Author: TechFlow

Recently, the ETH/SOL exchange rate has fallen to a new low, and ETH has been widely FUDed. This is not the first time this scenario has played out. In August this year, ETH also faced widespread ridicule, and the "E down, S up" slogan gradually became louder. The similarity between this time and the last time is not only the ETH being ridiculed, but also the $Vista that surged under a wave of FUD.

Yes, the mainnet's light, $VISTA, which single-handedly revived the mainnet market in early September, has risen again, and this time the price has directly broken through the previous high, reaching a market cap of nearly $70 million, with a weekly high of over 700%.

$VISTA is the token of the new Ethereum-based DEX Ethervista. Based on various innovations, the biggest selling point of Ethervista when it launched in September was "a Uniswap that can provide dividends to users". For a detailed introduction to Ethervista, see the article: $VISTA, the dark horse, is the savior of Ethereum DeFi or a flash in the pan?

However, the MEME hype has been continuous, and ETH has gradually weakened, and the market has also gradually lost interest in Ethervista. For a long time, the price performance of $Vista has been rather sluggish, with a market cap hovering around $5 million. On October 28, Ethervista announced the official launch of its own "Pump.fun" - "Etherfun", a MEME Pump-type application on the mainnet. Considering the price trend, this may be the main reason driving the rise of $VISTA.

Ethervista+Pump.fun = Etherfun?

The benefits of creating a Pump-type application are self-evident, with Pump.fun earning hundreds of millions of dollars a day being the best example.

So, what are the differences between the innovative Ethervista's Etherfun and Pump.fun? We have summarized the key points from the official documentation:

Lower token launch threshold

Etherfun has optimized the Bonding Curve launch settings, where tokens only need to reach a target value of $4,000 (about 1.5 $ETH) for the platform to automatically establish a liquidity pool on Ethervista, compared to Pump.fun's target value of $12,000.

Low creation cost and high purchase incentives

Etherfun has made adjustments to address the high gas fees on the ETH network. The initial cost for creators is close to zero ($1-2), while the gas fees are shifted to the first and last buyers, who are also compensated accordingly: the first and last buyers each receive a 2% (about 0.03 $ETH) reward from the pool.

Liquidity management

In terms of liquidity management, Etherfun has introduced a permanent lock-up mechanism, where the liquidity after the project is completed will be locked on the Ethervista platform. The trading profits are distributed proportionally to the creators and liquidity providers (creators and LPs each receive about $5 in profits per trade), which is different from Pump.fun's regular liquidity management approach.

Ecosystem integration

Etherfun is deeply integrated with the Ethervista ecosystem, and a portion of the LP fees are used to repurchase and burn $VISTA tokens.

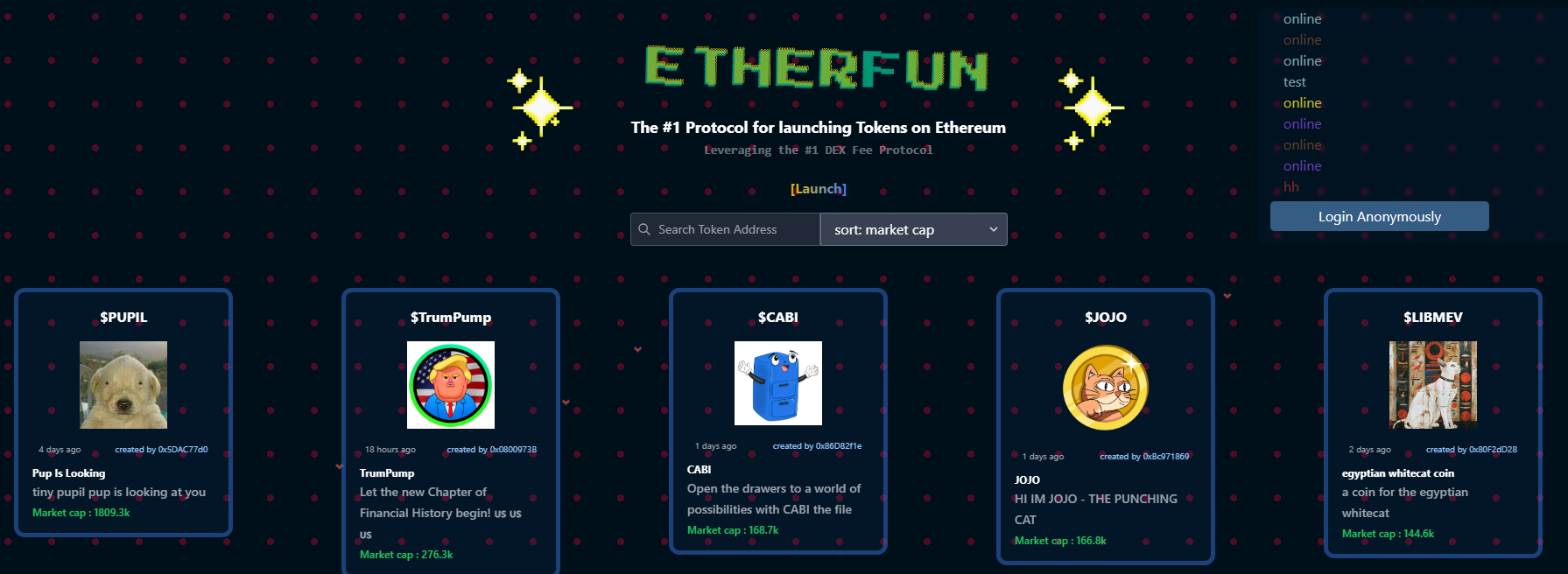

Etherfun has launched, what to play now?

Currently, Etherfun has been launched, and from the market cap performance, it may still be in the early stage, with certain risks involved. Here are two projects ranked by market cap that Ethervista has officially interacted with as a reference.

Note: MEME token prices are highly volatile and carry high risks. Investors should fully assess the risks and participate cautiously. This article only shares information based on market trends, and the author and platform do not guarantee the completeness and accuracy of the content, nor provide any investment advice.

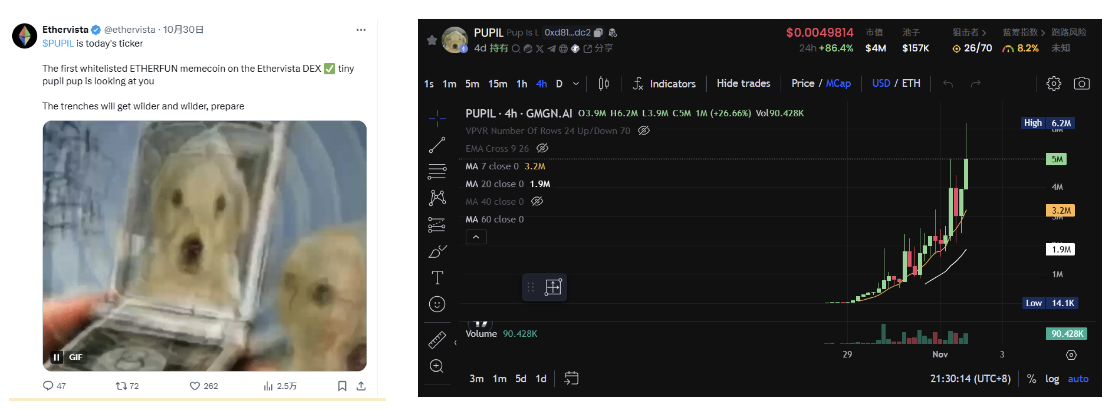

$PUPIL: Etherfun's first MEME

Contract address:

0xd81e97027c21366ead8e37428b3c033e95a7adc2

24H trading volume: $460,000

Current market cap: $5 million

Highest market cap: $6.2 million

$PUPIL is the first Ticker launched by Etherfun, with official promotion on Twitter. As $VISTA has been rising, $PUPIL has reached a peak market cap of $6.2 million.

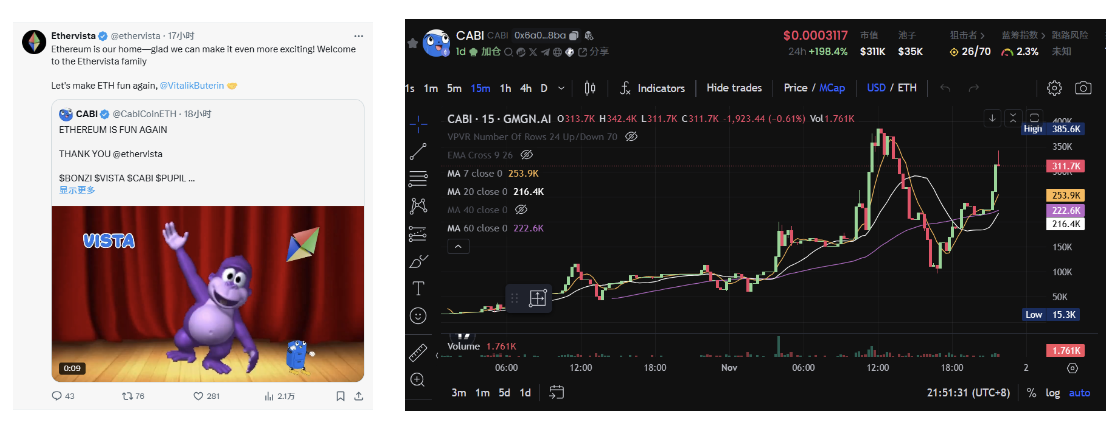

$CABI

Contract address:

0x6A064c1B4A0432c5d7Df441759E4E256F21af8BA

24H trading volume: $100,000

Current market cap: $300,000

Highest market cap: $385,000

Etherfun's original MEME, actively interacting with projects like $BONZI in the Vista ecosystem, with official retweets and interactions.

Summary: The ecosystem is still in the early stage, it may be a value trap or a low-cap trap

As of the time of writing, the price of $VISTA has approached $70, but although the coin price has skyrocketed, the Etherfun, which is the focus of this ecosystem update, seems to have low enthusiasm. Except for the leader, the market caps and trading volumes of various tokens are all performing averagely. Even the official needs to "shill" them.

It may be that the market has not yet recovered from the Solana craze, or that the quality of the Etherfun project itself is not sufficient to attract a large influx of attention. In any case, as a young platform, Etherfun still needs time to verify the reliability and security of its mechanisms. Although it has shown many innovative advantages in theoretical design, its actual operational effectiveness and long-term development potential remain to be tested by the market. Investors are advised to maintain rational judgment and reasonably assess the risk-reward ratio when participating.