The Federal Reserve "mouthpiece", Wall Street Journal reporter Nick Timiraos wrote an article on the Federal Reserve's interest rate decision in November, compiled by

MarsBit as follows:

The Federal Reserve on Thursday decided to cut interest rates by 25 basis points, but released more uncertainty about the pace of further rate cuts, as the Fed continues to try to prevent the sharp rate hikes of the past two and a half years from dragging down the economy.

In the post-meeting press conference, Federal Reserve Chairman Powell said the election would not have any impact on the Fed's near-term policy decisions. He also reiterated that he plans to remain at the Fed until his four-year term as chairman expires in May 2026.

When asked whether he believes the president can dismiss him or other senior officials from their positions before the end of their terms,

Powell unusually gave a concise response reiterating his consistent view: "The law doesn't permit that."

Additionally, an advisor to President-elect Trump stated that he will not seek to change the Fed's top leadership.

Thursday's rate decision was another rate cut following the initial 25 basis point cut in September, bringing the federal funds benchmark rate to between 4.5%-4.75%. All 12 Fed voters supported the rate cut.

Officials said these measures were necessary because they are more confident that the inflation rate will return to the central bank's target, and they believe that

even with the latest rate cut, interest rates are still high enough to restrain economic activity.

This move was widely anticipated. After the announcement, the S&P 500 and Nasdaq Composite indexes maintained their upward trend, ultimately reaching new all-time highs.

Trump's victory this week could reshape the economic outlook, with a Republican majority in Congress on both sides of Capitol Hill set to bring about sweeping changes in areas like taxes, spending, immigration and trade. Economists are divided on whether this policy mix will promote or undermine economic growth and push up prices. The shift in the outlook in turn raises questions on Wall Street about whether the Fed will alter its earlier expectations - of steadily lowering rates over the next one to two years.

Powell said it is too early to say how the policies of the next administration will reshape the economic outlook, "We don't guess, we don't speculate, we don't assume" what policies will be enacted.

Since the Fed's rate cut in September, longer-term bond yields have risen significantly, meaning higher borrowing costs for mortgages or car loans. The rise in yields has largely been due to better economic data reducing investors' concerns about a recession, which could have prompted larger rate cuts. But some analysts believe

the bond market's sharp sell-off may also reflect some investors' concerns about higher deficits or inflation under a second Trump administration.

In any case,

the market has produced an unusual outcome: borrowing costs have risen after the Fed cut rates. According to data from Freddie Mac, the average 30-year mortgage rate has jumped from 6.1% in mid-September to 6.8% this week.

Over a similar timeframe, investors in the interest rate futures market have

steadily reduced their expectations for the extent of rate cuts by the Fed over the next year or so. Citigroup says they now expect the Fed to lower rates to around 3.6% by 2026, compared to an estimate of 2.8% in September.

Officials are trying to pull rates back to a more "normal" or "neutral" level - one that neither stimulates nor restrains economic growth, but they don't know what the normal rate is. Policies that promote economic activity or inflation will lead officials to conclude: they should maintain a moderately restrictive rate stance.

This means they will keep rates slightly above normal or neutral levels.

Before the 2008-09 financial crisis, many believed the neutral rate might be around 4%, but after the crisis, with the recovery extremely slow, economists and Fed officials believe the neutral rate may be closer to 2%. The September rate projections showed most officials expect they may lower rates to around 3.5% next year if the economy grows steadily and inflation continues to cool.

According to the Fed's preferred index, the inflation rate was 2.1% in September, up slightly from a year earlier. The so-called core inflation rate, which excludes volatile food and energy prices, was 2.7%. The Fed's long-term target is 2% inflation.

With officials uncertain about the location of the neutral rate, they may be guided by the economic performance in the coming months. If inflation continues to slow and labor demand appears weak, officials may conclude that continuing to cut rates along the path they envisioned in September is reasonable.

Officials "are trying to make a choice between two risks, one of acting too quickly and potentially undermining the progress we've made on inflation, and the other of acting too slowly and allowing the labor market to become too tight," Powell said.

If inflation progress stalls, or if a booming financial market raises concerns about inflation running above target, officials may be more reluctant to continue the steady pace of rate cuts at successive meetings.

The most immediate focus is whether the Fed will cut rates again at its meeting next month in December. In September, 19 participants were roughly evenly split on whether there would be one or two more rate cuts this year, with 9 seeing no more than one cut, either in November or December, and 10 expecting two cuts.

KPMG chief U.S. economist Diane Swonk said, "There's a lot to learn between now and the December meeting. They can't throw the door wide open, but they can't slam it shut either."

Powell said slowing the pace of rate cuts is "something we're just starting to think about," "as we get closer to what looks to be a neutral or a neutral level, it may be appropriate to slow the pace of our easing."

Deutsche Bank chief U.S. economist Matthew Luzzetti said that even before the election results, recent data suggested another rate cut would be a delicate balance, as inflation appears likely to be slightly above officials' forecasts, while the unemployment rate has recently declined. He said the election outcome, which has lifted the stock market to new highs, also boosts the prospects for strong economic growth, rising inflation and labor market improvement,

increasing the chances the Fed will forgo a cut next month.

Luzzetti said, "From a risk management perspective, those are pretty compelling reasons to skip a cut."

Glenn Hubbard, an economist at Columbia University who served as a senior advisor to President George W. Bush, said given the recent economic strength, Fed officials may have preferred a 25 basis point cut in September rather than 50 basis points.

Hubbard said that if the pace of the return to the Fed's inflation target slows, and if the neutral rate is higher, "you really don't have a lot of room to cut." "I don't think you're going to see a lot of cutting."

Bitcoin continues to break new highs

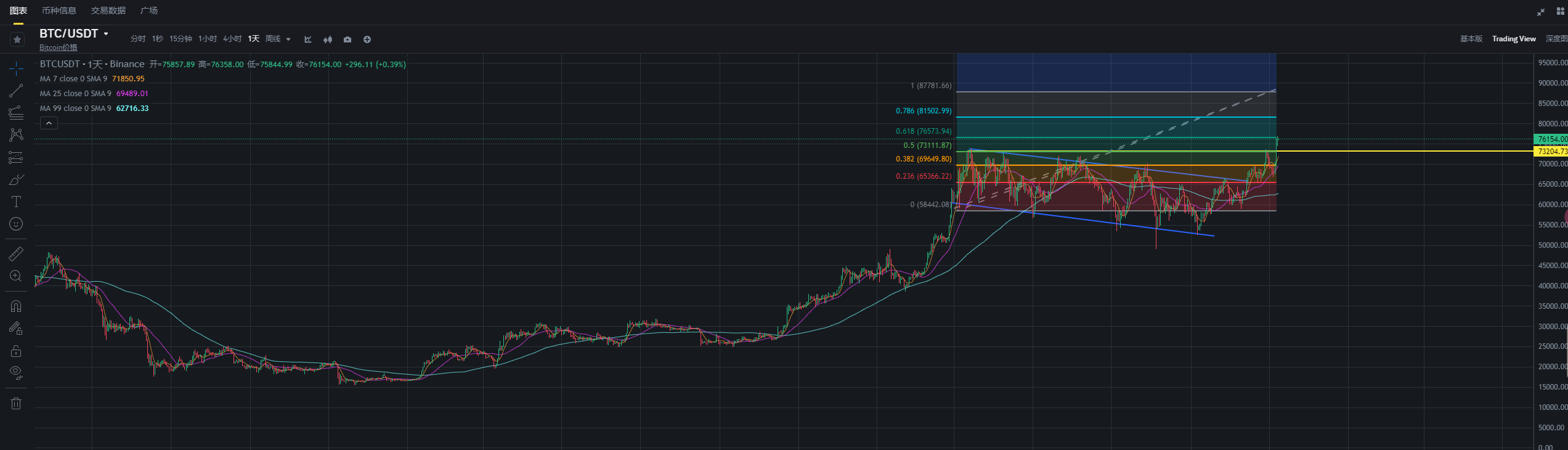

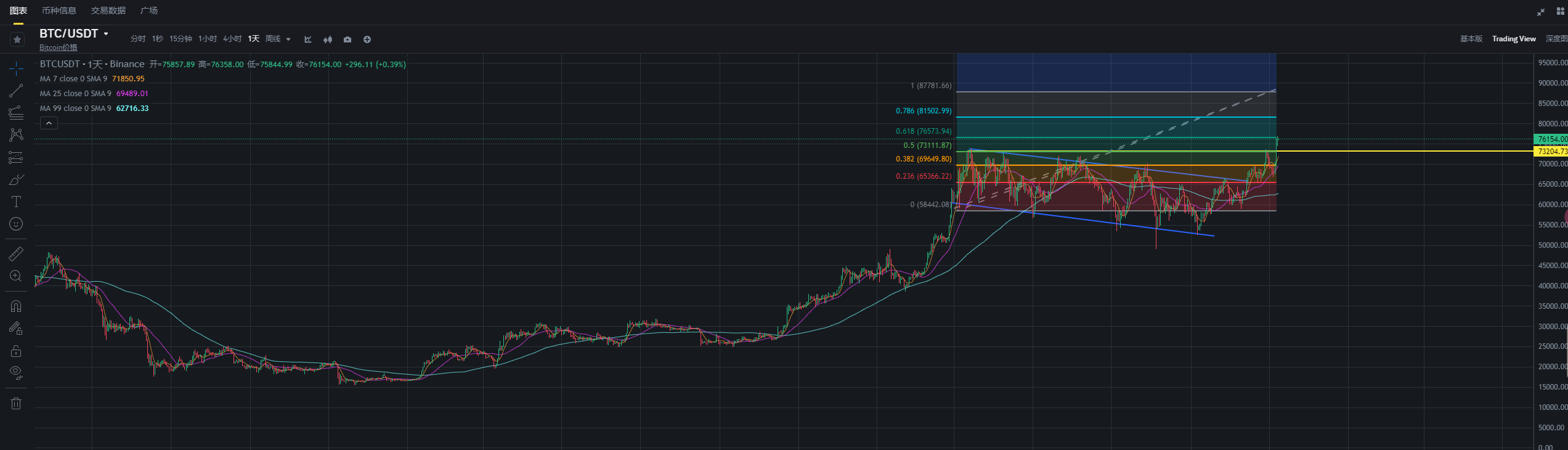

Bitcoin broke through $76,800 in the early hours of the morning, setting a new all-time high.

Strong inflows into spot Bitcoin ETFs, Bitcoin breaking out of a 7-month downtrend into a price discovery phase, and the Republican red wave's success in Congress, the Senate and the executive branch, have prompted multiple institutional investors to increase their Bitcoin allocations.

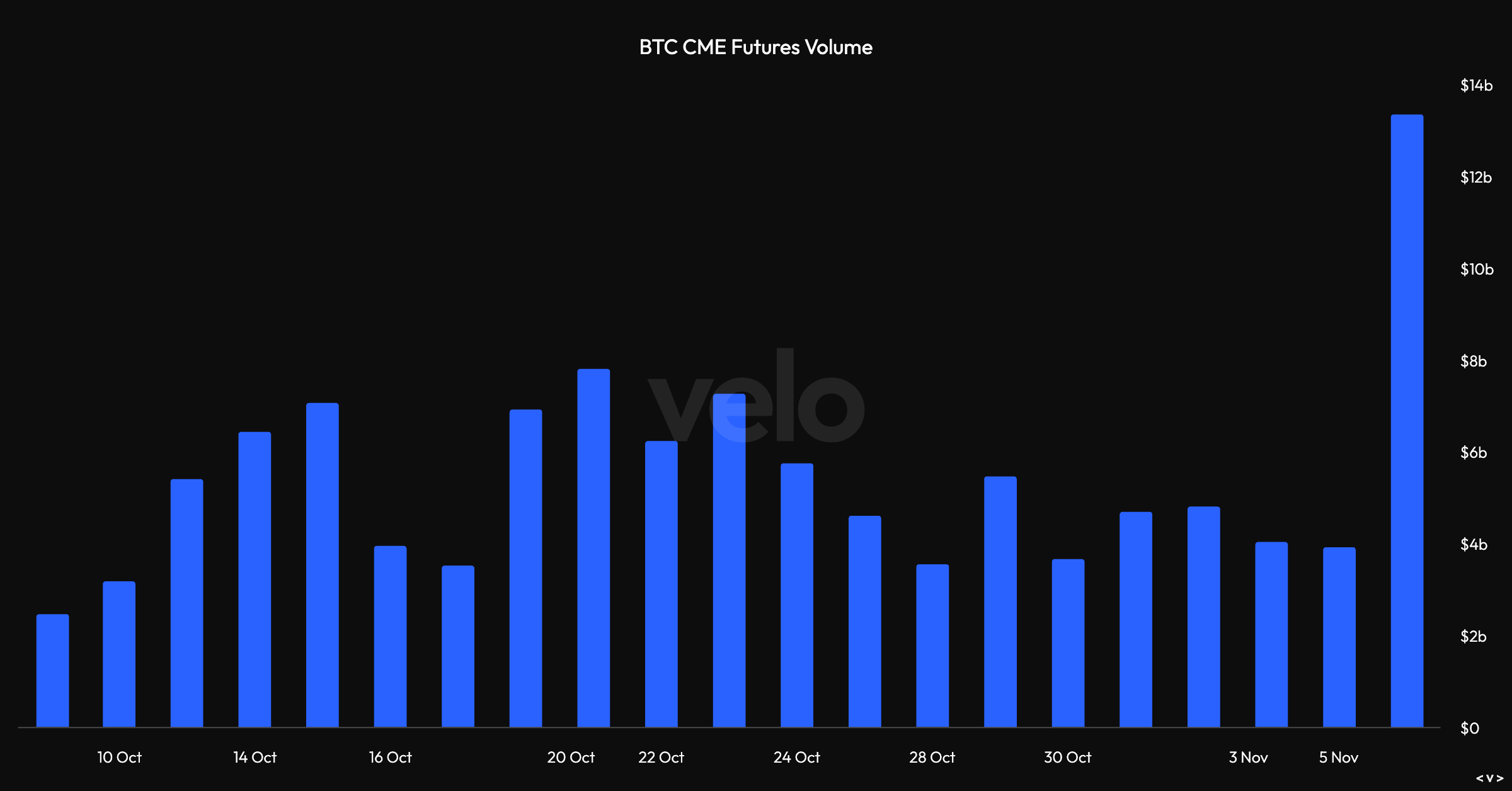

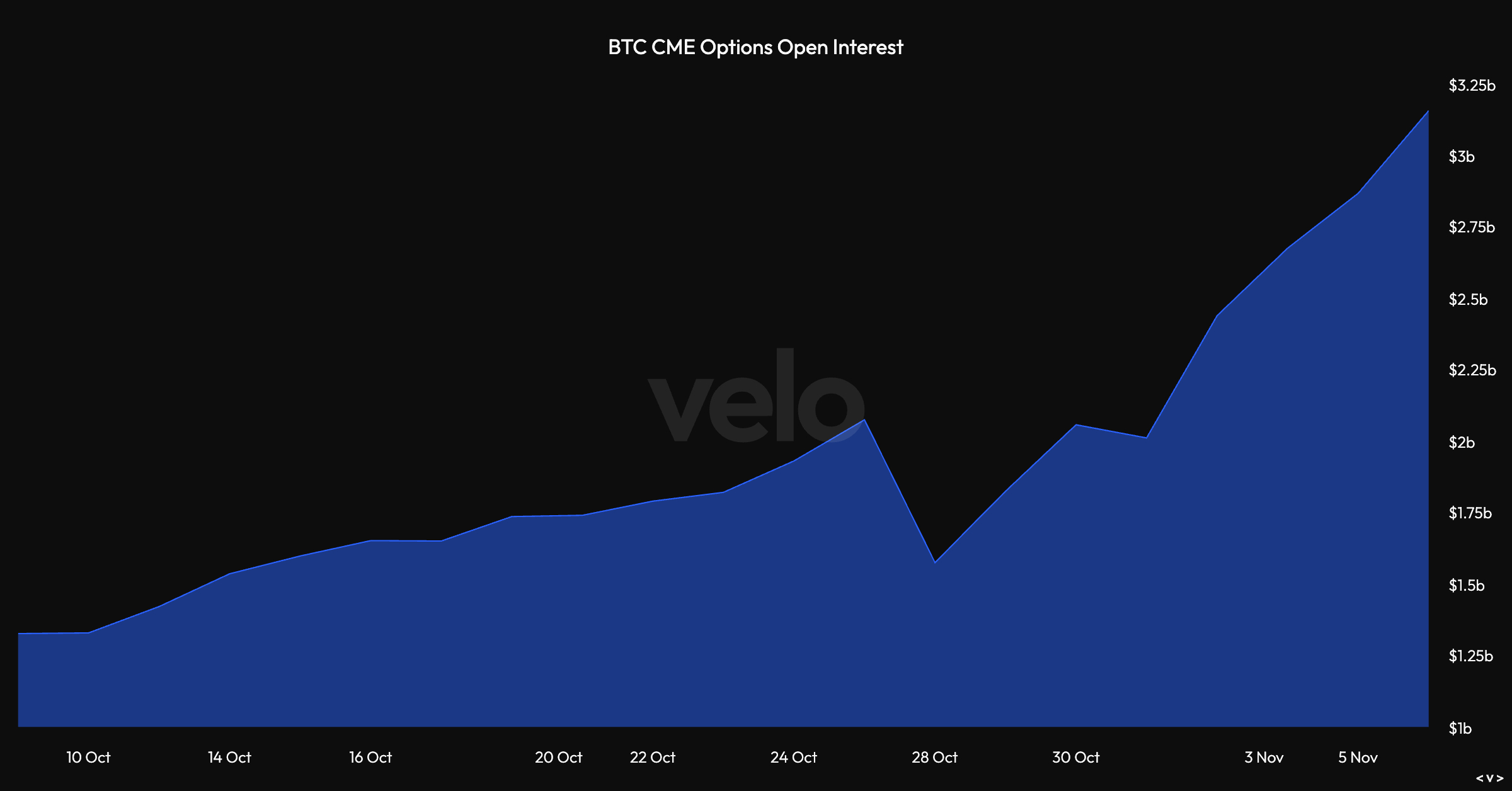

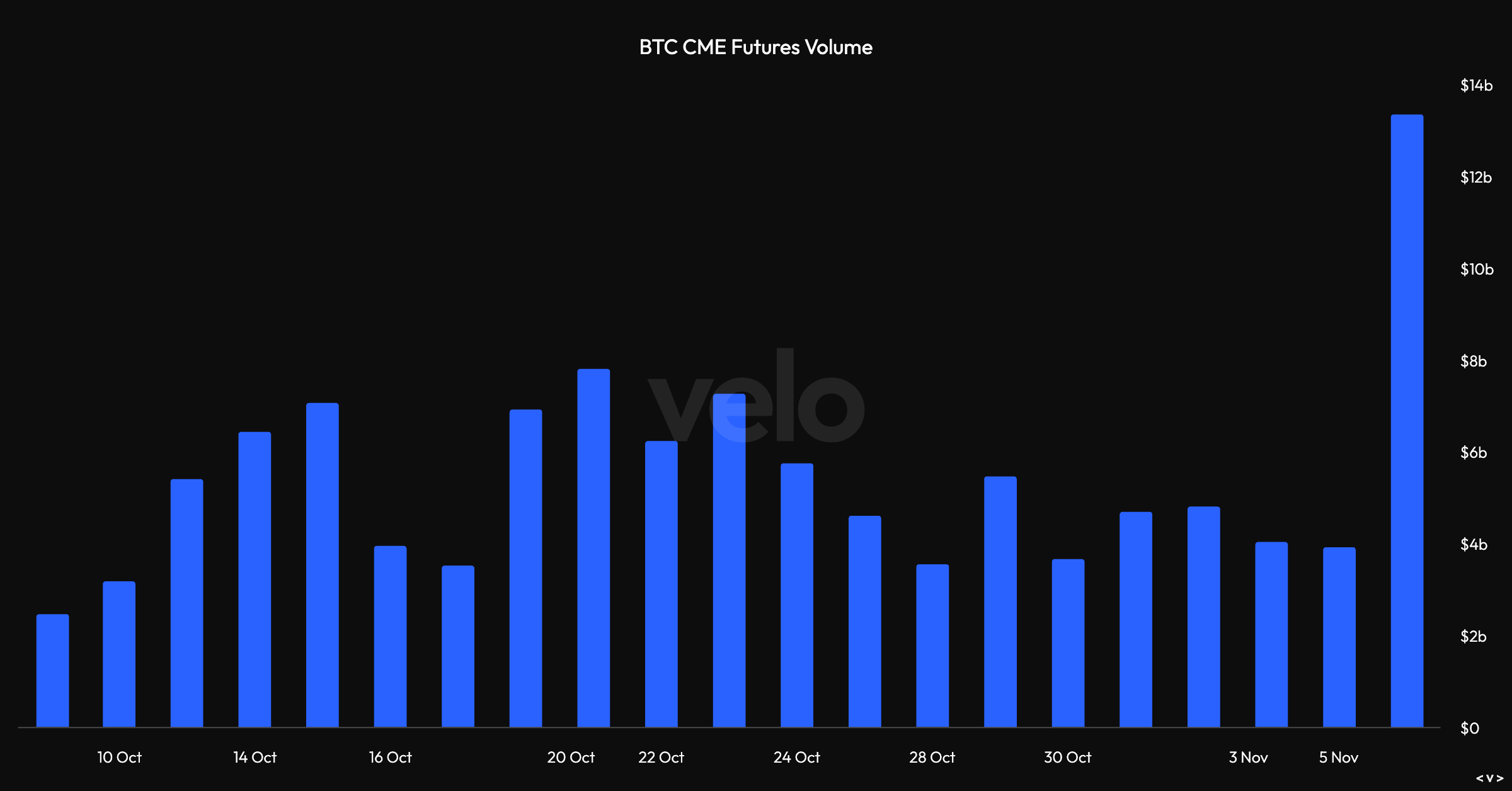

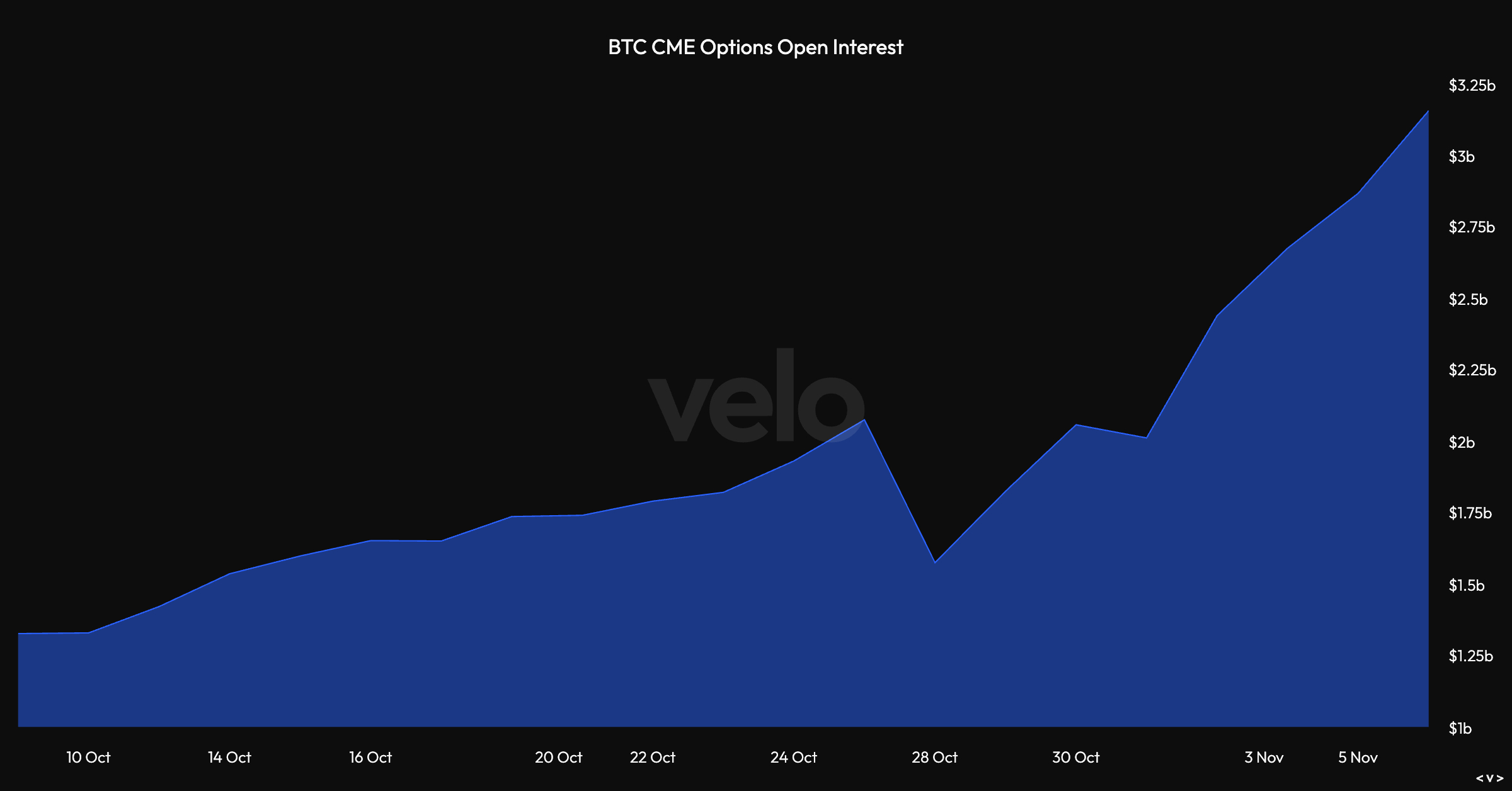

On November 6, CME BTC futures trading volume reached a record high of $13.15 billion, and the same day CME's notional open interest reached 15,255 BTC.

It is clear that institutional investors are preparing for further upside at the Chicago Mercantile Exchange (CME), as evidenced by the $1.1 billion increase in open interest contracts on November 6.

From a technical analysis perspective, the Fibonacci extension tool currently forecasts the uptrend to continue towards the $88,000 area. The overall order structure with a 2.5% depth shows a batch of sell orders in the $78,000 range, followed by what appears to be shorts up to $83,000. However, in the context of generally bullish expectations, this liquidity pocket is likely to be pulled up to the short-squeeze level.

SOL Poised to Hit New All-Time High

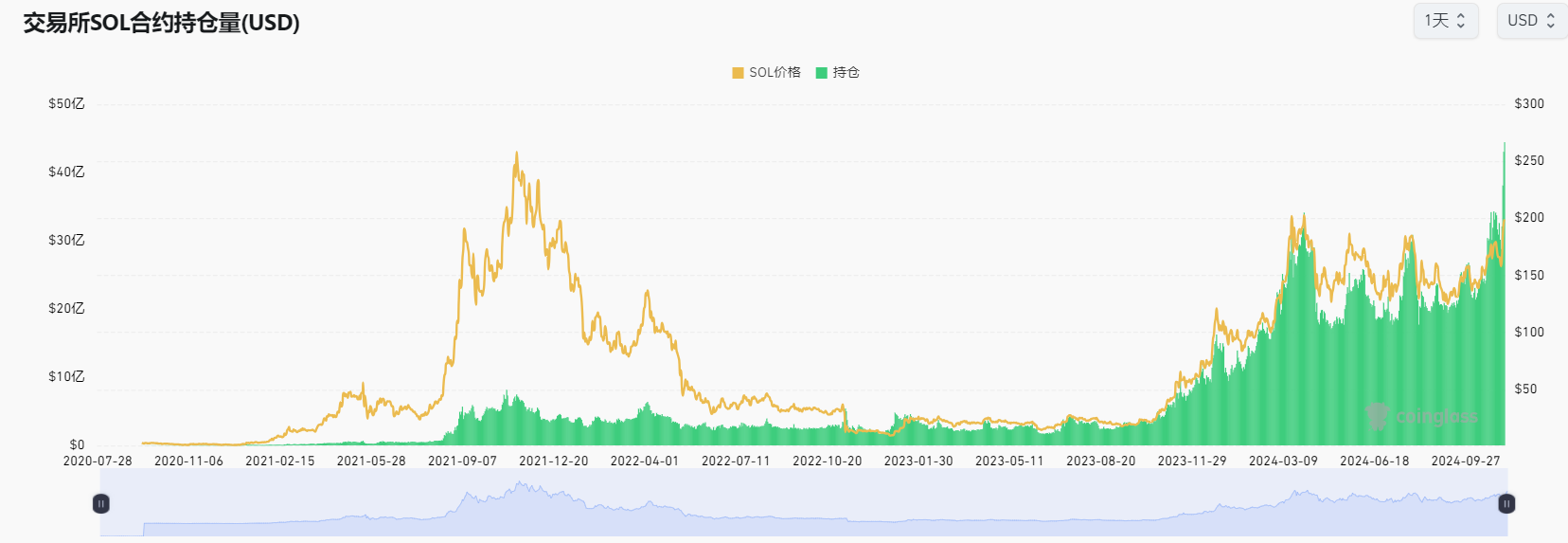

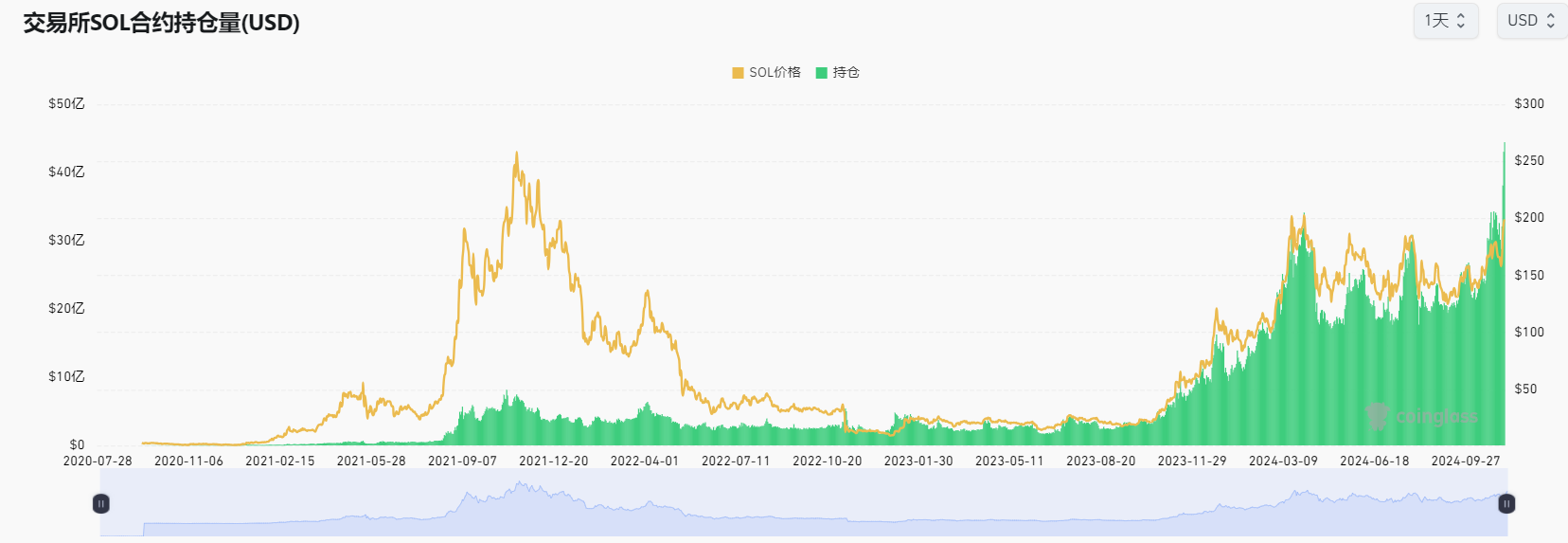

As of the time of writing, SOL is trading at $199, up 7% in the past 24 hours. According to technical indicators, SOL is expected to reach $248 and then break through $276 to set a new all-time high.

The rise in SOL demand is accompanied by a surge in leveraged positions, with the total open interest in Solana futures reaching an all-time high on November 8. Although the risk of forced liquidations is higher during SOL price pullbacks, the derivatives data still suggests further upside potential.

On November 8, the open interest in SOL futures surged to 21.89 million SOL, up 11% from the previous week, reaching a new high in notional value of $4.3 billion. This reflects strong adoption of SOL derivatives, indicating growing institutional interest, but also brings potential risks.

Robust On-Chain Metrics Support Continued SOL Price Appreciation

Memecoins have been the primary driver behind SOL's rise to $194, but some key factors have been overlooked, such as Solana's Total Value Locked (TVL), which reached $6.82 billion on November 8, up 22% from the previous month. Significant growth has been observed in areas such as liquidity staking, perpetual futures, leverage, and lending, as well as sectors beyond memecoins.

As long as the on-chain metrics remain strong and the SOL derivatives do not show signs of excessive fear or greed, Solana's competitive advantages (providing fast and relatively low-cost transactions) will continue to provide "free marketing" and attract a large user base, especially with Bitcoin's new all-time high.

Overall, there are no signs of weakness, indicating that the SOL price is poised for further appreciation.