Preface

Since 2024, the TON (The Open Network) ecosystem has attracted widespread market attention. Relying on Telegram's huge user base, coupled with the issuance and supply of USDT stablecoin and the continuous support of Binance, the TON ecosystem infrastructure and projects have grown rapidly. Projects such as Notcoin and Catizen have emerged as dark horses, and the entire ecosystem has shown a "rapid development" trend.

However, in August this year, Telegram founder Durov was arrested in France, which seems to have cast a shadow over the entire public chain. The price drop has made the problems more exposed: a relatively single ecosystem, a user group lacking payment ability, and occasional network downtime. These external criticisms seem to be proclaiming that TON is just a fleeting phenomenon and will eventually fade into obscurity.

Perhaps things are not that bad. In TON, I see a familiar shadow, at that time and now: in 2022, the FTX collapse, Solana was also deeply involved. Due to a series of operations by SBF, the degree of interpenetration between FTX, Alameda and Solana is second only to the symbiotic relationship between Terra and LUNA. Even many people believe that SBF is the founder of Solana.

The FTX explosion was like announcing to the world the collapse of the patron behind Solana. When the wall falls, everyone pushes it, and the SOL price has fallen 96% from its previous high, and the TVL has also fallen nearly 98% from its historical high. The single-digit SOL plus the surging FUD have left the community only with despair. However, in less than two years, SOL has risen rapidly again, with a market value of over 100 billion US dollars, surpassing the Vanguard Group, becoming the third largest public chain after Bitcoin and Ethereum, and the fourth largest in the crypto market.

Does TON have a chance to replicate Solana's path to ascension? Let's take a closer look.

Solana's Path to Revival

1. Continuous technological iteration

Solana experienced three major network failures and several performance declines in 2022, and also had one failure in 2023. These outages were mainly caused by consensus issues. Although low transaction fees are beneficial to users, they also make it easier to send large numbers of transactions or conduct denial-of-service (DDoS) attacks.

When proposing a block, validators receive information packets (contained in the block), independently verify their correctness, and confirm each other to reach consensus. However, when the validators are slow to process the information packets, the consensus information may be lost.

A chain with a strong DeFi ecosystem needs to guarantee 100% uptime, so Solana needs a more robust client infrastructure. The main reason for Solana network stoppages is the lack of congestion control and network processing latency. Several network upgrades have improved the validators' abnormal handling of transaction surges and achieved better congestion control.

2. Low transaction fees and ample liquidity

Solana's transaction fees are extremely low, which attracts on-chain capital to engage in high-risk "money-making" behaviors. High-frequency trading often means that users are mainly concerned about one thing: transaction fees, and even put security in a secondary position. This ultra-low transaction fee has made Solana the preferred choice for on-chain speculators.

Tether and Circle have both issued their own stablecoins on Solana. For a public chain, the existence of stablecoins makes the DeFi ecosystem easier to develop, attracting users to use these financial applications, which in turn motivates developers to create more applications, thereby starting the flywheel of economic growth.

3. Innovative project parties

Public chains that can quickly issue assets at low cost are often able to rise rapidly. In 2017, Ethereum rose due to the emergence of ICOs, in 2019 Binance Chain rose due to IDOs, and in 2023 Solana rose again due to memecoins. On the basis of low cost and high efficiency, Solana has become a popular platform for rapid asset issuance.

On this basis, the key is to have creative and "playful" project parties, because excellent products are the first line of attraction for users. Solana has several native star projects such as StepN and MagicEden, and the innovative genes of the entire ecosystem are obviously stronger. When the meme coin season arrived, Solana quickly gave birth to phenomenon-level projects like pump.fun, which can quickly organize transactions, seamlessly switch between internal and external markets, and are particularly suitable for capital speculation, effectively activating on-chain liquidity.

4. Growth flywheel

With a stable and high-speed network, low transaction costs, eye-catching star projects, and sufficient liquidity and traffic in place, the elements of the growth flywheel are already in place. Accompanied by the rotation of the track sectors, the AI, Depin, and SocialFi fields have exploded, and Solana's high TPS, low fees, and complete infrastructure continue to meet the needs of developers to build high-performance applications. New phenomenon-level products are constantly emerging on Solana, new resources are continuously flowing in, the competitiveness of the public chain is improving and reflected in the price, the significant rise attracts new users, and new users attract more developers, and thus the growth flywheel begins to spin rapidly.

TON Fundamental Analysis

Compared to the three key factors and one flywheel for SOL's recovery, TON's fundamentals are no less impressive.

In terms of technical architecture, TON has demonstrated three groundbreaking innovative technologies that together build a highly scalable, efficient and secure blockchain ecosystem. These three key technologies are Infinite Sharding, Instant Hypercube Routing, and Self-Healing Vertical Blockchains.

- Infinite Sharding: The core of this technology lies in its dynamism and extremely high scalability. It allows the network to flexibly adjust the number of shards according to real-time needs, supporting up to 2^60 working chains at most. This means that the TON network can automatically optimize its structure based on changes in transaction volume and network load, always maintaining optimal performance. This dynamic sharding capability lays a solid technical foundation for future large-scale application scenarios.

- Instant Hypercube Routing: This innovative mechanism greatly improves the efficiency of cross-shard communication. By adopting complex mathematical models and algorithms, Instant Hypercube Routing can achieve near-instant information transmission and processing between massive shards. This not only significantly reduces network latency, but also creates favorable conditions for cross-chain interaction and complex smart contract execution, laying the foundation for the interoperability of the TON ecosystem.

- Self-Healing Vertical Blockchains: The unique feature of this technology is its ability to correct invalid blocks without causing forks, thereby maintaining the consistency and stability of the system. This self-healing capability greatly enhances the network's robustness and reduces the risk of network interruptions caused by block errors. At the same time, it also simplifies the network maintenance process, improving the overall system's reliability and security.

The synergistic effect of these three core technologies has enabled TON to achieve significant technological breakthroughs in the blockchain field. The Infinite Sharding technology provides the network with unprecedented scalability, solving the scalability bottleneck faced by traditional blockchains. Instant Hypercube Routing ensures low latency cross-chain interaction even in a highly sharded environment, which is crucial for building complex decentralized applications. The Self-Healing Vertical Blockchain mechanism further enhances the system's stability and reliability, providing users and developers with a secure and efficient blockchain environment.

In addition, TON's gas fees are extremely low. Based on the current gas fee pricing, it only costs $0.5 in gas fees to perform 6-8 transactions on the TON chain. In some cases, TON even subsidizes transactions, achieving 0 gas interactions. TON also supports the use of USDT and Notcoin to pay gas fees, these innovations undoubtedly solve practical pain points from the user's perspective, demonstrating sincerity.

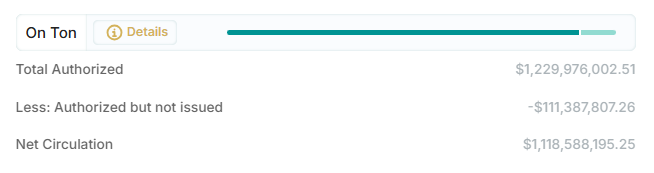

In terms of liquidity, in April this year, TON reached a cooperation with Tether, and USDT was officially introduced into the ecosystem. As of November 13, the authorized issuance volume of USDT on the TON chain has increased to about $1.23 billion, compared to the $1.89 billion issuance volume of USDT on Solana, TON has already caught up in terms of stablecoin liquidity.

The TON ecosystem has also shown a brilliant performance. The phenomenal mini-game Notcoin has become one of the hottest and most user-active channels on Telegram since its launch on January 1, 2024. The community enthusiasm is extremely high, with over 30 million participants and a peak daily active user count exceeding 5 million. The meme project $DOGS has successfully airdropped tokens to 17 million users. The most astonishing fact is that the mini-game Hamster Kombat has amassed over 250 million users in just 3 months, a record-breaking number in the web3 world.

Looking at this, TON has a high-speed network, low gas fees, ample stablecoin liquidity, mischievous project teams, and even hundreds of millions of users. So why has the growth flywheel stalled?

The Absence of DeFi Ecosystem

According to ton.app, the TON ecosystem currently has 1,113 Apps, covering tracks such as liquidity staking, DEX, DeFi, SocialFi, and games.

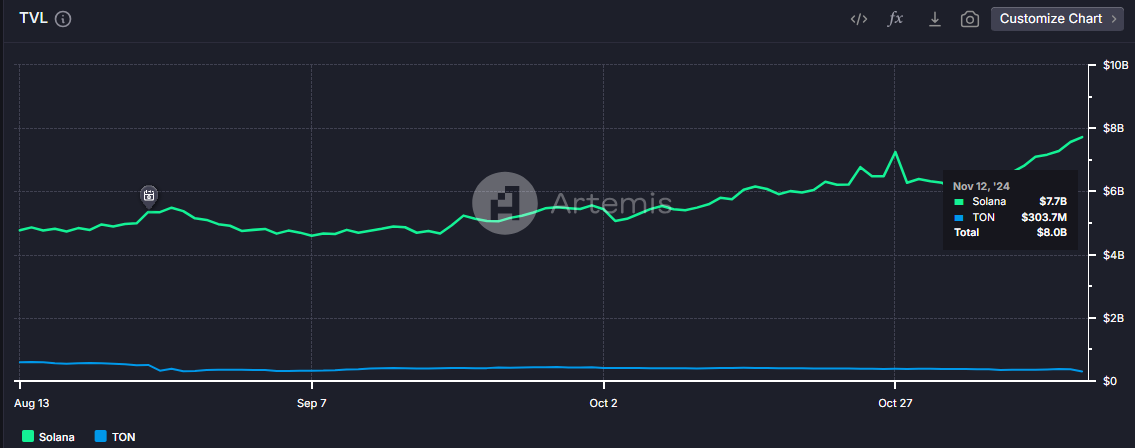

However, a notable phenomenon is that over half of the projects in the TON ecosystem are Telegram mini-games, indicating a certain degree of unbalanced development. According to Artemis data, TON's current daily active addresses are 840,000, while Solana's are 6.1 million, a difference of nearly 8 times. More notably, the gap in their total value locked (TVL) across the chain is even greater: TON's is $300 million, while Solana's reaches $7.7 billion, a 25-fold difference.

This huge gap stems from the lack of DeFi in the TON ecosystem, which may be the biggest factor affecting its development.

A unique feature of the TON blockchain is that the calls between smart contracts are asynchronous rather than atomic. This means that when a smart contract calls a method of another contract, the call will not be executed immediately, but will be processed in a future block after the transaction ends. Although TON's network architecture's infinite sharding technology brings an extremely high ceiling in scalability, its asynchronous nature significantly increases the difficulty for developers to build DeFi applications. Additionally, TON's virtual machine (TVM) is not compatible with the Ethereum virtual machine (EVM), and the official tools and documentation are incomplete, leading to a significantly higher development difficulty for the TON chain. It is estimated that it typically takes three EVM developers to complete the workload of one TON developer, with a longer development cycle and more challenges. In the fast-paced blockchain environment where time is measured in seconds, this situation may lead many TON chain developers to be unwilling to deeply develop products in the long term.

The limited development of DeFi has resulted in a public chain with a DEX that is difficult to use and almost no lending services, which is hard to attract on-chain users in the current meme coin boom environment. It is worth noting that a large portion of the users attracted by TON's mini-games are not traditional Web3 users.

The crypto-native users that TON is missing are precisely the most influential, viral, and cohesive group within the industry. Data shows that over 95% of the transactions of the top-ranking meme coins on TON, such as Notcoin, Dogs, and Hamster, occur on centralized exchanges (CEXs). This creates a contrast: the Telegram platform is bustling, while the TON chain appears quiet.

Drawing on the experience of the pioneer of asynchronous network architecture, ICP, the DeFi ecosystem on asynchronous network public chains is likely to remain in a depressed state during bull and bear markets. Will TON be stuck in this situation?

Crypto WeChat is the Ultimate Form

Although TON lacks the inclusive effect of DeFi and crypto-native users, it has not positioned itself as a traditional high-performance public chain. TON's differentiated strategy is to lead the mass adoption of cryptocurrencies and become the "crypto WeChat".

Justin, the Growth Director of the TON Foundation, once said: "If we define the past development of the crypto field as 'Web3', then TON is more like 'Web2.5'. It borrows from the more mature practices of Web2 in large-scale applications, providing a convenient user experience, while avoiding the problems of Web2 such as user privacy, ownership, and unequal profit distribution. Imagine if the WeChat mini-program 'Waterdrop Fundraising' was decentralized, using such a crowdfunding platform within a social software, it might be more attractive to donors."

The rapid establishment of TON has quickly positioned Telegram as one of the largest gateways for Web2 users to enter Web3. This makes Telegram's approximately 900 million monthly active users the largest "Web2.5 user" pool and a primary distribution channel for almost all major cryptocurrency markets.

This is also the reason why Binance is frantically listing TON ecosystem tokens. For exchanges, these tokens are key to attracting new users and driving business growth. Telegram's influence spans the globe, especially in Africa, the Middle East, and parts of South Asia - the "Third World" regions where credit cards are not yet widespread, and residents have not yet widely adopted crypto payments or credit card payments. As these regions gradually embrace Web3 and crypto payments, they will bring a massive influx of new users to the exchanges.

This model is similar to the "Play to Earn" craze led by projects like Axie and guilds like YGG in the previous bull market, which brought a large number of new users to Web3 in Southeast Asia. For the entire industry, the track itself, and even project market capitalization, the ability to attract Web2 users on a large scale is undoubtedly a highly positive development.

The mass adoption of cryptocurrencies is currently mainly limited by the entry threshold. In fact, many traditional users do not care about the degree of decentralization, they just come to use the product, not to join the consensus. This is something that many crypto purists find difficult to understand: if you don't care about decentralization, why use cryptocurrencies? But this is not a black-and-white issue. Web2 and Web3 are now like two parallel Layer1s, and they need a bridge between them, which we might call Web2.5.

Take Telegram's @wallet application as an example, it is a custodial wallet. In the past, we would say: "Not your keys, not your coins". But now the market realizes that this approach can indeed allow traditional users to access cryptocurrencies at a very low learning cost. Sacrificing some decentralization features in exchange for a lower industry entry barrier, this is Web2.5. This is also the most direct path for cryptocurrencies to achieve mass adoption: first, use this channel to bring a massive number of users into the crypto "yard", and then, through more detailed education, guide those interested into the truly decentralized "house".

Among the public chains committed to developing the mass adoption of cryptocurrencies, TON is currently the most outstanding, which is its core competitiveness.

What will the future be like?

After understanding TON's core competitiveness, we can see that TON's path to rise, though certainly different from Solana, is still promising. However, on this path of ascent, TON needs to solve at least two key issues:

1. Ecosystem Content Optimization

The early TON ecosystem's mini-games mainly relied on viral marketing similar to "Pinduoduo's One-Knife" to achieve rapid growth. However, as similar products are repeatedly launched, the new user acquisition effect will gradually weaken, and exchanges may also reduce the frequency of token listings. Therefore, the focus will shift to user retention rate and lifetime value (LTV). Compared to user acquisition, these two key indicators for sustainable development are more dependent on quality content, rather than just viral dissemination. These indicators will drive the team to implement meaningful routine operations to achieve long-term sustainable development.

2. Selling Pressure from Ancient Whales

Due to special historical reasons, the token distribution of TON is extremely uneven: the top 100 addresses hold 92% of the supply, and research shows that at least 85.8% of the token supply is concentrated in the hands of a few possibly interconnected miner groups. In February 2023, TON VOTE passed a "TON Token Economic Model Optimization Proposal" to temporarily freeze inactive mining wallets for 48 months - these wallets have never been activated and have no withdrawal records. However, February 2025 is fast approaching, and TON urgently needs new proposals to control this potential selling pressure.

Looking to the future, as the network gradually develops, development tools are optimized, and users are widely adopted, whether the "Web2.5" model created by the combination of TON and Telegram can drive a price surge in the next bull market remains to be seen.