Author: Revc, Jinse Finance

The price of Bitcoin has risen to around $97,000 today, officially sounding the charge to hit $100,000. This historic moment not only symbolizes the rise of the crypto economy, but also poses a profound challenge to the traditional financial system. The following text analyzes its historical evolution, driving factors, global impact, and the policy interaction between the Trump administration and the crypto industry, and looks forward to the future of crypto.

1. From Geek Experiment to Global Financial Asset: The Rise of Bitcoin

Bitcoin was born against the backdrop of the 2008 financial crisis, and Satoshi Nakamoto left "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" in the Genesis Block, expressing dissatisfaction with the traditional financial system. From the two-pizza transaction in 2010 to the $69,000 high point in 2021, the development of Bitcoin has clearly shown the following stages:

Startup stage: The early geek circle and niche investors provided a living space for Bitcoin, and its main use was limited to experimental currency.

Mainstream signs emerging: In 2017, the price of Bitcoin broke through $10,000, triggering more widespread market and media attention.

Institutionalization process: After 2020, the active participation of traditional financial institutions has significantly enhanced the legitimacy and market position of Bitcoin.

Now, Bitcoin has grown from a decentralized currency experiment into a global financial asset with a market capitalization of over $1 trillion.

"That Pizza's price is still rising"

2. Key Factors Driving Bitcoin to Break Through $100,000

(1) Economic and Geopolitical Environment

Inflation Hedge: The Federal Reserve's long-term quantitative easing policy has led to a global liquidity glut, and Bitcoin has become an ideal tool to hedge against inflation due to its fixed supply.

De-dollarization Wave: In the context of escalating geopolitical conflicts, the international community is seeking to break away from the dominance of the US dollar, and Bitcoin has become a potential alternative settlement tool.

(2) Technological Upgrades and Ecosystem Improvements

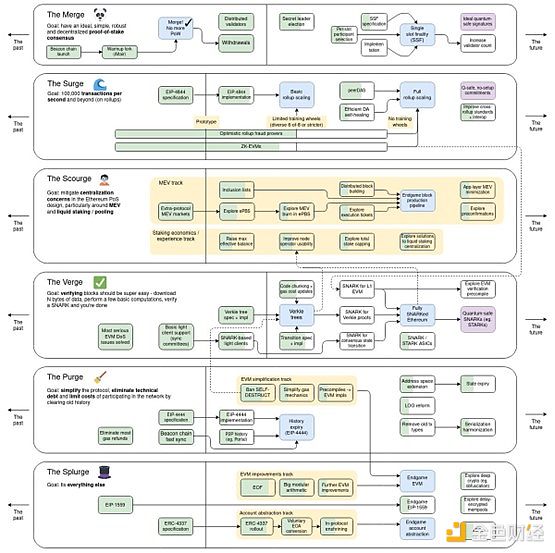

Technological Innovation: Upgrades such as the Lightning Network and Taproot have significantly improved transaction efficiency, privacy, and scalability, enhancing the feasibility of actual payment scenarios.

Ecosystem Maturity: The gradual improvement of the infrastructure has significantly reduced the user threshold, driving the transformation of Bitcoin from an investment asset to a financial tool.

(3) Institutional Investment and Mainstream Adoption

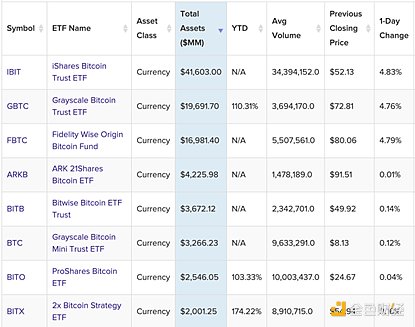

ETF Driving Capital Inflow: The approval of spot Bitcoin ETFs has provided a compliant channel for traditional investors, attracting a large amount of capital into the market.

Corporate Accelerated Acceptance: The support of companies like Tesla and PayPal has further expanded the payment scenarios of Bitcoin, gradually integrating it into mainstream economic activities.

3. Policy Impacts of the Federal Reserve and the Trump Administration

(1) The Double-edged Sword of Monetary Policy

Driven by Loose Policy: Quantitative easing has increased market liquidity, promoting the development of innovative assets, but also leading to asset bubbles and widening wealth gaps.

Adjusted by Tightening: Tightening measures may temporarily suppress the Bitcoin market, but they also help stabilize the economic environment in the long run.

(2) Potential Crypto Policies of the Trump Administration

Regulatory Environment Changes: Trump plans to replace the SEC leadership, potentially nominating candidates who support crypto assets, creating a more friendly environment for the market.

National Reserve Proposal: If the US establishes a strategic Bitcoin reserve, it will significantly enhance its status as a financial asset.

Policy Advisory Mechanism: Establishing a "Bitcoin and Cryptocurrency Presidential Advisory Council" to promote industry development at the policy level.

(3) Corporate and Individual Influence

Elon Musk's Support: Musk's continued promotion may accelerate the adoption of Bitcoin in the payment and consumption fields.

Coinbase's Policy Advocacy: Through active political lobbying, the crypto industry is gaining more mainstream policy support.

4. The Economic and Financial Significance of Bitcoin

(1) Reshaping the Global Financial Market

Innovation in Asset Allocation: Institutional investors will include Bitcoin in their asset portfolios, alongside gold and real estate.

Liquidity and Market Diversification: As the Bitcoin market matures, global liquidity will increase significantly, providing investors with more risk diversification options.

Technology Spillover Effect: Driving the application of blockchain technology in DeFi, Web3, and payment network transformation.

(2) Implications for National Economies

New Reserve Asset Option: Emerging economies with high inflation and foreign exchange shortages may follow El Salvador's example and include Bitcoin in their reserves.

Cross-border Payment Revolution: Bitcoin as a low-cost, high-efficiency payment tool has unique advantages in international trade and personal remittances.

5. The Future Path of Bitcoin

(1) Technological and Market Prospects

Value Potential: Scarcity and institutional demand may drive further price increases for Bitcoin.

Sustainability and Privacy Optimization: Optimizing energy consumption, enhancing privacy, and improving resistance to quantum computing will be the focus of future technological development.

(2) Regulatory and Geopolitical Risks

The Duality of Compliance: Reasonable regulation can promote market confidence, but excessive intervention may stifle innovation and push activities into the gray market.

International Policy Competition: Policy differences between countries will lead to competition in the blockchain technology field, while also driving global cooperation.

Summary

As Bitcoin charges towards $100,000, it marks a profound transformation in the global economic and financial system. Driven by technology, policy, and market forces, Bitcoin is poised to become an important part of the future financial ecosystem and continue to lead the wave of decentralization revolution.