At 3:15 am Beijing time on February 19, the price of Bitcoin suddenly plummeted to $93,300, hitting a new low in nearly two weeks. Although it later rebounded and rose to $95,400, the magnitude of this volatility was shocking and had a huge impact on the market.

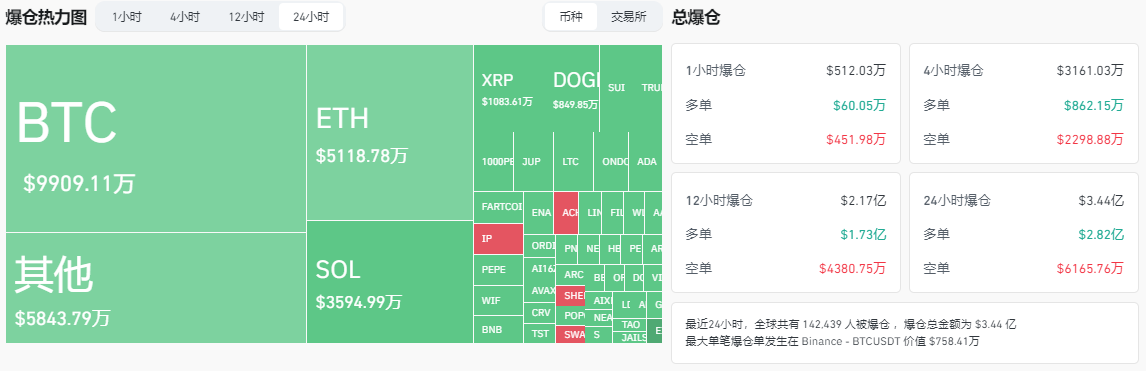

The violent fluctuations over 14 hours have plunged the derivatives market into a bloodbath. According to data from Coinglass, in the past 24 hours, 142,439 investors globally have been liquidated, with a total liquidation amount of $344 million. The violent market fluctuations have triggered panic among investors and also exposed the fragility of the cryptocurrency market.

Differentiated Performance of Core Assets

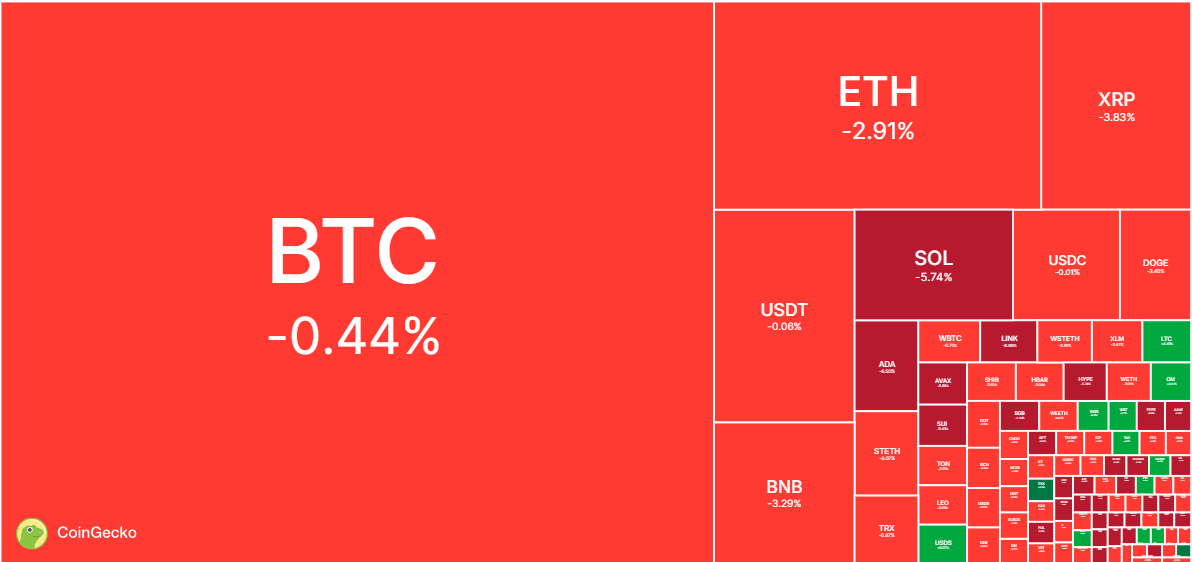

The cryptocurrency index shows that the market has presented a significant layering phenomenon in this round of adjustment:

BTC: Although it has experienced a 3.2% weekly decline, it is still above the 120-day moving average (around $93,000).

ETH: It touched the key psychological support of $2,600 (down 9.1% from the weekly high), and is currently rebounding to $2,660, with 30-day volatility expanding to 47%.

Altcoins in Collapse: Solana (SOL) plummeted 20%, hitting a low of $160, and is currently trading at $169, having lost all its gains since January 13. Doge fell to $0.24, and XRP is struggling to hold support around $2.47.

LIBRA Incident Affects Market Sentiment

The uncertainty of the macroeconomic environment continues to affect the cryptocurrency market, and the "scam" incident of the LIBRA meme coin has further exacerbated this gloomy sentiment.

QCP Capital's cryptocurrency options trading department pointed out in its market analysis: "Due to the weak performance of ETH and other Altcoins, Bitcoin's dominance has risen to 60%, the highest level in four years. The recent LIBRA scandal involving Argentine President Javier Milei has also undermined confidence in Altcoins and meme coins."

In addition, since the Federal Reserve paused its hawkish interest rate policy in January, the upside space for Bitcoin has been limited. Fed Governor Patrick Harker has recently maintained a hawkish stance, stating that he will continue to stabilize interest rates until inflation is brought under control. This bearish sentiment has kept Bitcoin prices below $100,000 for the past two weeks, but Bitcoin's market dominance (BTC.D) has risen above 60%, further suppressing the rebound of Altcoins.

Analyst Jamie Coutts believes that before Bitcoin can potentially rebound, the market may experience another round of upside.

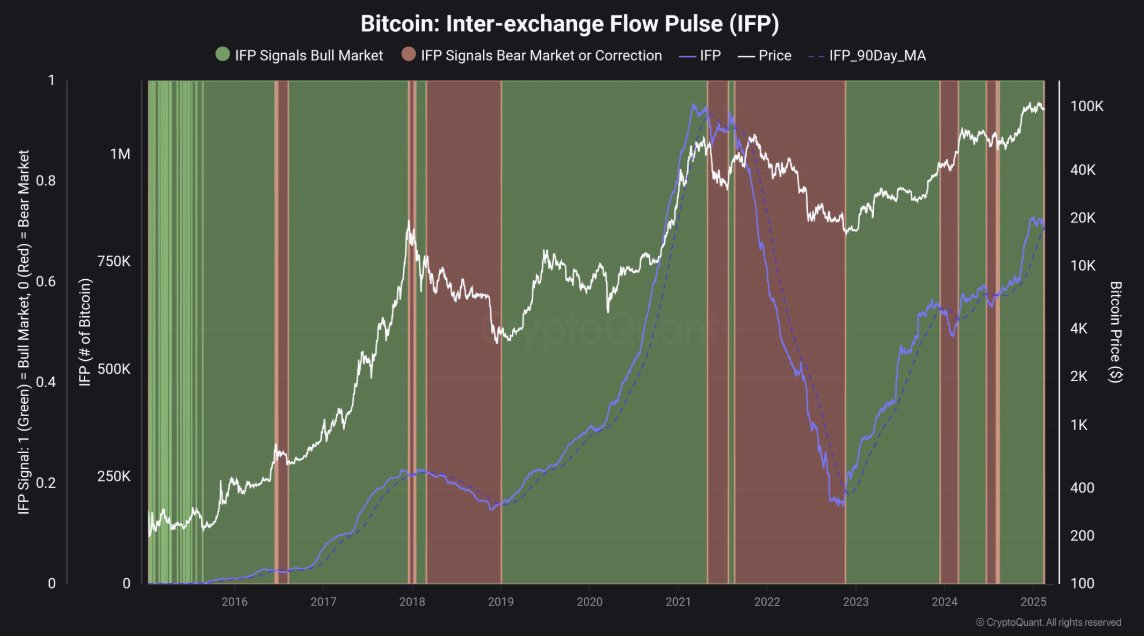

Bitcoin's Cross-Exchange Flow Pulse Turns Bearish

Bitcoin's cross-exchange flow pulse chart. Source: CryptoQuant

According to on-chain analyst Maartunn's analysis, Bitcoin's cross-exchange flow pulse (IFP) has turned negative, indicating a decline in potential investors' risk appetite. The IFP indicator measures the flow of Bitcoin between the spot and derivatives markets. Historical data shows that when the market is bullish and investor sentiment is high, more Bitcoin will be transferred from the spot to the derivatives market. When the market is weak, Bitcoin will flow out of the futures market and into the spot exchanges, indicating investors' expectations of a price decline.

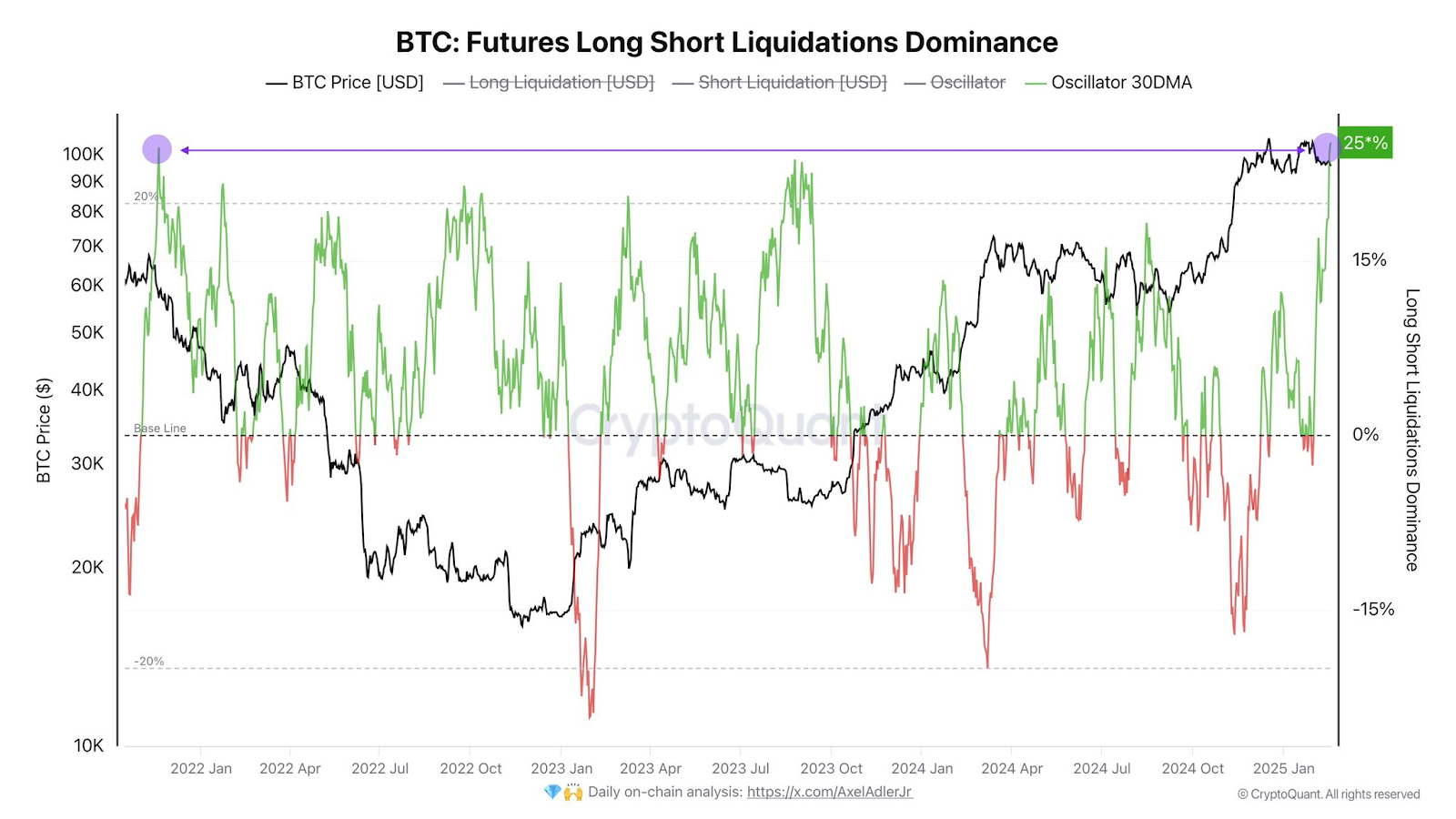

On February 16, the IFP indicator turned negative for the first time since the third quarter of 2024, suggesting that market sentiment may be changing. Bitcoin researcher Axel Adler Jr. also pointed out that the liquidation of long positions in Bitcoin futures has reached the highest level in two years.This is similar to the situation in January 2022, when the liquidation of long positions signaled the beginning of a bear market.

Bitcoin futures long-short liquidation dominance chart. Source: X.com

However, Adler stated that the market has responded to the pressure, indicating that buyers remain active during the adjustment period, "buying the dip", which has limited the extent of Bitcoin's downside.

Nevertheless, for the bulls, the situation is not entirely out of control, as Adler added,

"Currently, the market has responded adequately to this pressure, which actually indicates strong demand during the adjustment period. Buyers are actively 'buying the dip', limiting the depth of Bitcoin's decline."

The Worst-Case Scenario for Bitcoin is a Drop to Around $80,000

Since February 3, BTC has been consolidating in the range of $95,000 to $99,000, with the $95,000 support level being tested five times in the past two weeks. The persistent testing of the support level may weaken the effectiveness of this range, increasing the risk of a break below the support. Therefore, Bitcoin may record its first close below $95,000 in the upcoming trading sessions.

If the support level is breached, the price may further explore the range between $91,130 and $88,909. If the market becomes more bearish, the price could retrace to the $81,699 to $85,160 range, which was the price range during the early "Trump rally" rebound period for Bitcoin.

The daily gap on the CME still lies between $77,000 and $80,000, which could be the worst-case scenario for Bitcoin, implying that the Bitcoin price may further decline by 15%.