On February 24th, despite reports that Bybit acquired $740 million worth of ETH from the open market, the Ethereum price still fell by 5%. Some traders expected the price to rebound after the hacking incident on February 21st, believing that Bybit's purchases to make up for the losses would drive up the price. However, this expectation was not realized.

Bybit CEO Ben Zhou stated that this transaction was deliberately disguised as a legitimate transaction, but it contained malicious source code that modified the wallet's smart contract logic to steal funds. Historically, Lazarus - reportedly the North Korea-backed hacker group behind this attack - is not in a hurry to liquidate the stolen assets, as these wallets are typically closely monitored and blacklisted by most centralized platforms.

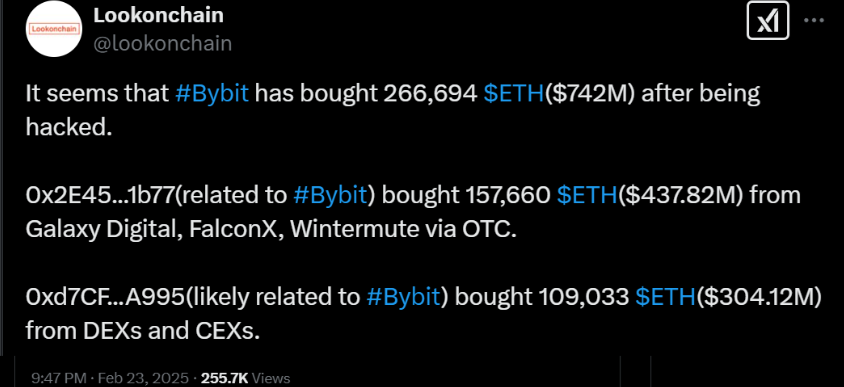

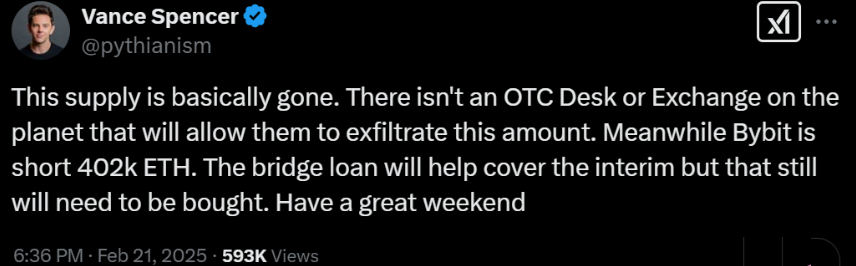

Regardless of the hackers' intentions for the stolen ETH, analysts point out that significant buy-side pressure is inevitable, as no over-the-counter (OTC) platform or exchange has sufficient liquidity to absorb such a large quantity. Theoretically, the top 10 exchanges' ETH order book depth totals around 2%, or approximately $52 million, making a $7 billion market purchase a challenge.

Vance Spencer, co-founder of crypto venture capital firm Framework Ventures, noted that the bridge loan provided to Bybit is temporary, meaning that ultimately over 400,000 ETH will need to be purchased on the open market. Lewi, a contributor at Perennial Labs, expressed a similar view, predicting a potential short squeeze that could drive up the Ethereum price.

Data shows Ethereum traders have closed their leveraged positions

From February 21st to 23rd, the Ethereum price rose by 6.7%, briefly retesting the $2,850 resistance level. However, the entire $190 gain was erased on February 24th, with ETH falling to $2,650. Notably, this decline coincided with reports that Bybit had recovered over 50% of the stolen Ethereum and accelerated the drop after confirming that the positions had been fully closed.

The poor performance of Ethereum may be due to traders who had expected Bybit to actively purchase ETH in the open market being forced to unwind their positions after realizing this assumption was incorrect.

On February 24th, Ethereum futures open interest decreased to 8.52 million ETH, down from 8.82 million ETH the previous day. This data suggests that while the forced liquidations were relatively small (at $34 million), traders still unwound their leveraged positions. This is in line with expectations, as a 6.7% price movement would require 15x leverage to fully clear the margin.

The Bybit hack event highlights the risks of Ethereum's multi-sig setup

The Bybit hack event itself has triggered a significant shift in investor sentiment within the Ethereum ecosystem, highlighting the risks of using the Ethereum Virtual Machine (EVM) for complex multi-sig setups. This incident underscores the issues of high complexity and lack of robust defense mechanisms compared to simple hardware wallets, revealing that even institutions managing billions of dollars in assets are vulnerable to such failures.

Another concern for Ethereum holders is that the adjusted local staking yield is only 2.4%, especially considering the ETH supply growth has reached a 0.6% inflation rate. In comparison, Solana's SOL has an adjusted local staking yield of 4%. Previously, analysts were optimistic about the potential inclusion of staking functionality in a U.S. spot Ethereum exchange-traded fund (ETF), but this proposal is currently under review by the U.S. Securities and Exchange Commission (SEC).

Ultimately, the decline in Ethereum's price is not only due to the Bybit hack event but also the over-optimism of leveraged traders and expectations around the potential inclusion of staking functionality in a U.S. spot ETF.