Author: The Kobeissi Letter

Compiled by: TechFlow

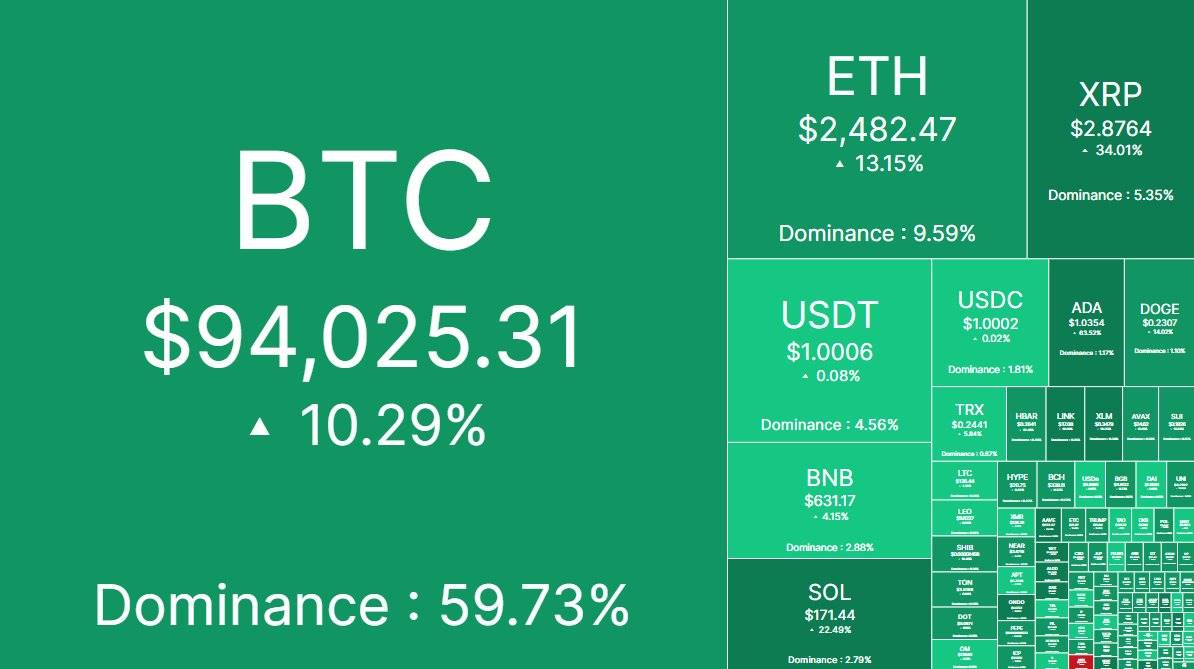

President Trump announces the US Strategic Crypto Reserve, Bitcoin price breaks $94,000.

President Trump has officially announced a major plan - the establishment of a "US Strategic Crypto Reserve" and stated that he will strive to make the US the global leader in cryptocurrencies. This news quickly triggered a strong market reaction, with the total cryptocurrency market capitalization increasing by more than $300 billion in just 3 hours.

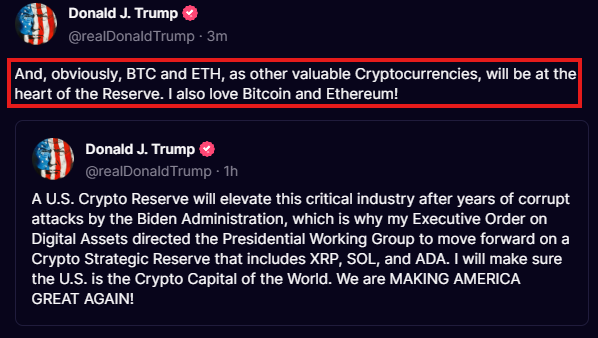

In a statement released at 10:24 am ET on February 3, 2025, Trump said the US will consolidate its leading position in the global cryptocurrency field through the "Crypto Strategic Reserve". However, this initial statement only mentioned Ripple ($XRP), Solana ($SOL) and Cardano ($ADA).

This news has driven a significant increase in the prices of the related tokens. Cardano ($ADA) surged 64% in a short period of time, while Ripple ($XRP) and Solana ($SOL) rose 30% and 21% respectively.

However, investors noted that BTC and ETH were not included in the initial reserve announcement, which has led to market speculation and discussion.

In fact, as early as January 16, the New York Post had reported that President Trump planned to propose the establishment of an "America First" crypto reserve, focusing on supporting digital currencies created in the US, such as Solana, USD Coin and Ripple.

But at 12:11 pm ET, Trump updated his statement, clearly stating:

"Clearly, Bitcoin and Ethereum, as other valuable cryptocurrencies, will be a core part of the reserve."

A few days before this supplementary statement was released, Trump's son Eric Trump had suggested "buying the dip" on social media, hinting at an optimistic attitude towards the recent cryptocurrency price correction.

Since the announcement, the Bitcoin price has rebounded quickly, currently breaking through $94,000, up nearly 20% from the recent low.

Since 3:00 pm ET last Friday, the Bitcoin price has soared from $78,200 to over $94,000. This not only marks Bitcoin's complete exit from the bear market territory, but also means it is only about 16% away from its all-time high.

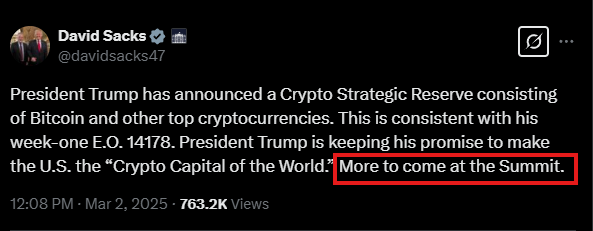

Trump's crypto affairs representative @DavidSacks said more details will be revealed at the crypto summit.

President Trump will host the first cryptocurrency summit at the White House on March 7th. This historic meeting has attracted widespread attention, and there are rumors that the strategic reserve list may be expanded to include more cryptocurrencies.

Furthermore, this strategic reserve plan may pave the way for the US to migrate all government spending to blockchain technology.

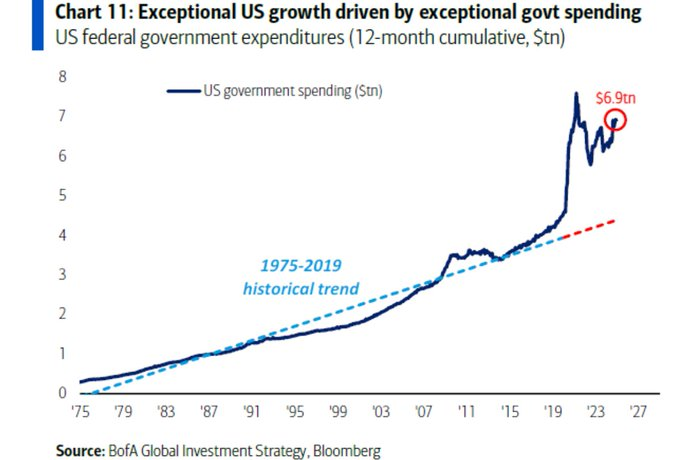

A month ago, Elon Musk had proposed a similar suggestion, and if this idea is adopted, the $6.9 trillion in annual US government spending could be recorded on a decentralized ledger.

Compared to traditional systems, blockchain technology is expected to significantly reduce audit costs, saving billions of dollars in expenses each year.

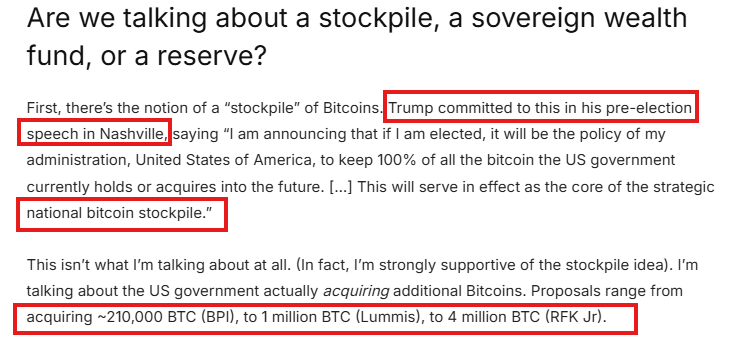

However, a noteworthy question is, why did the strategic reserve initially focus only on Bitcoin, and then gradually expand to more cryptocurrencies?

During Trump's campaign, there was a proposal for the US to purchase 2.2 million to 4 million BTC. But the expansion of the reserve scope has not provided a clear policy explanation, which has led to market speculation.

So far, we can see the following major developments:

The US Securities and Exchange Commission (SEC) is supportive of cryptocurrencies;

The Trump administration has clearly expressed support for cryptocurrencies;

Announced the establishment of a crypto strategic reserve;

The SEC has withdrawn several lawsuits against cryptocurrencies;

Trump has launched a memecoin;

The SEC has stated that memecoins are not securities.

It can be said that this is the most supportive US government for cryptocurrencies to date.

It is worth mentioning that last Friday, the Nasdaq 100 index rose 2% in the last 3 hours before the close, with almost no obvious positive news at the time. This inevitably makes people wonder if someone had advance knowledge of the crypto reserve news?

We expect that when the futures market opens, technology stocks may see a significant gap up driven by the crypto reserve news.

Looking ahead, the cryptocurrency market will continue to search for the next major catalyst. With many of Trump's campaign promises already digested by the market, the market is entering uncharted territory.

Will Bitcoin set a new all-time high this month? Let's wait and see.