Pi Network (PI) has experienced a sharp sell-off, dropping over 61% in the past 30 days. Despite a recent partnership with Telegram Crypto Wallet, PI is struggling to regain momentum as most technical indicators remain bearish.

BBTrend has been negative for 12 consecutive days, and RSI has slightly recovered from oversold levels but remains below the neutral 50. As the downtrend remains firmly established and important support levels approach, PI's next move will depend on whether buyers can intervene and reverse the current trajectory.

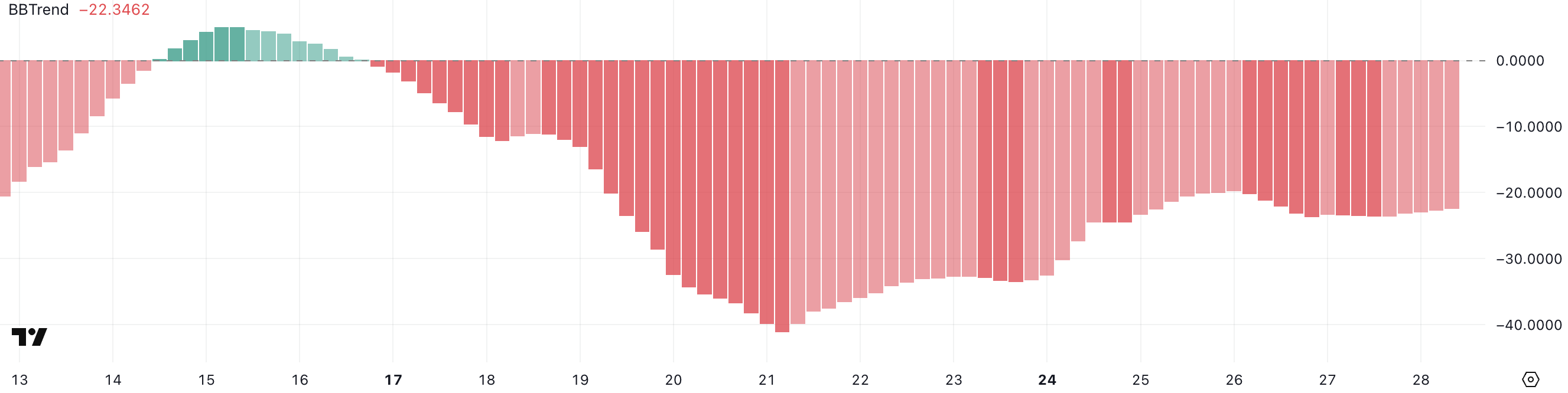

PI BBTrend, Declining for 12 Consecutive Days

Pi Network (PI) continues to face selling pressure while the BBTrend indicator remains deeply in negative territory at -22.34.

This has not translated into sustained upward momentum, despite recent headlines about Telegram Crypto Wallet integrating Pi Network.

BBTrend recorded its recent low of -41 on March 21st and has been showing bearish signals for 12 consecutive days since March 16th. This prolonged weakness emphasizes the ongoing struggle of buyers to regain market control.

BBTrend, or Bollinger Bands Trend, is a momentum-based indicator measuring trend strength and direction. Positive BBTrend values indicate upward momentum, while negative values represent bearish sentiment. The further from zero, the stronger the trend.

With PI's BBTrend positioned at -22.34, the market remains under strong bearish influence, potentially slightly easing from the extreme lows of recent decline.

Unless this trend soon transitions to positive territory, PI's price could face continued pressure. Despite recent integration news, buyers will maintain a cautious stance.

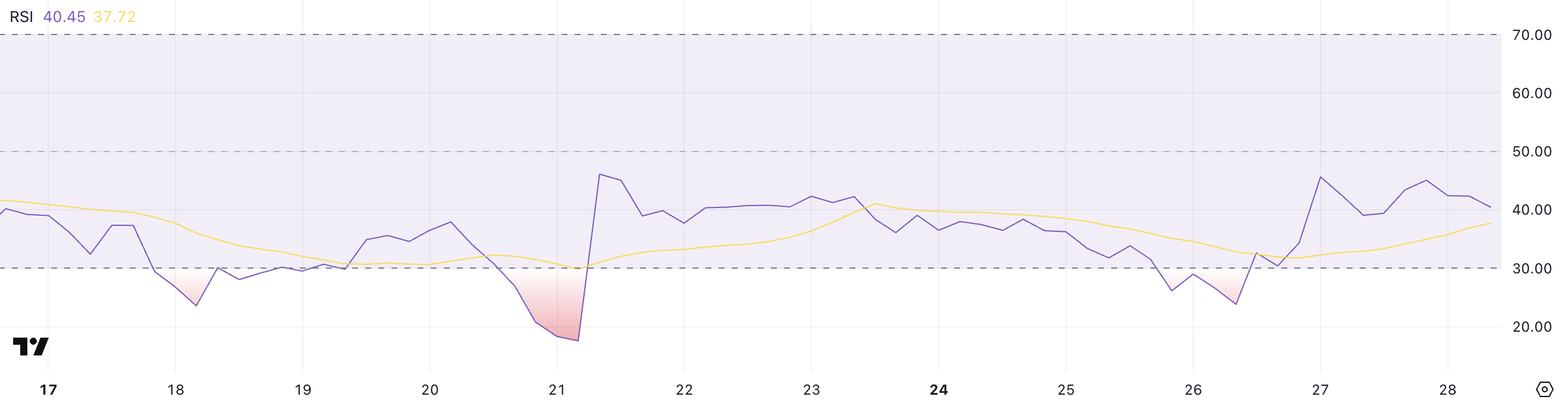

Pi Network RSI Recovers from Oversold, Lacks Bullish Momentum

Pi Network is showing initial signs of momentum recovery, with the Relative Strength Index (RSI) rising from 23.8 to 40.45 two days ago.

This rebound suggests a decrease in oversold pressure, but PI's RSI has failed to cross the neutral 50 in the past two weeks, emphasizing continued weakness in bullish conviction.

Despite slight gains, the market has not yet demonstrated sufficient strength to meaningfully shift sentiment in favor of buyers. This cautious rise could lead to a breakout or continued correction.

RSI, or Relative Strength Index, is a momentum oscillator measuring price movement speed and change. Ranging from 0 to 100, values above 70 indicate overbought conditions, while values below 30 suggest an asset is oversold.

With PI's RSI currently at 40.45, it remains in a neutral to bearish zone. No longer extremely oversold, strong buying pressure remains lacking.

A clear trend reversal likely requires the RSI to exceed 50, which has not occurred in the past two weeks. Therefore, the current movement is closer to a potential bottom attempt rather than a confirmed transition.

Will PI Continue to Correct?

PI price is currently trading within an established downtrend indicated by EMA (Exponential Moving Average) alignment, with short-term EMA firmly positioned below long-term EMA.

This setup reflects continued selling pressure, and if correction persists, PI might revisit the key support level of $0.718, with potential to drop to $0.62 if that support fails to hold.

However, RSI's recent signs of life suggest a short-term rebound might occur, providing hope for recovery.

If upward momentum builds, PI could challenge the $1.05 resistance in the short term. Breaking that level could shift sentiment, and if the uptrend strengthens, it might open doors to further increases to $1.23 and potentially even $1.79.