- Stablecoin has become an indispensable part of mainstream finance, however many banks only focus on the basic concept.

- Below are some important aspects of stablecoin that banks need to clearly understand.

Stablecoin, from a small concept in the cryptocurrency ecosystem, has now affirmed its position as an important factor in the global financial discourse.

In fact, some analysts believe these stable Tokens could become formidable competitors to the USD. According to TinTucBitcoin, there are two key factors supporting this hypothesis.

First, the expanded use of stablecoin for cross-border transactions, especially in payments for essential commodities like crude oil and agricultural products.

Second, and most importantly, the increasingly international trend, especially in G20 economies, towards developing a non-USD or decentralized alternative.

As a result, stablecoin – notably Tether [USDT] – has reached a market capitalization of $144.30 billion, affirming its leading position in the developing digital financial field.

Understanding Stablecoin Beyond Speculation

Fundamentally, stablecoin is designed to maintain a 1:1 ratio with assets like the USD. Unlike risky assets, stablecoin demonstrates a negative correlation with broader market dynamics.

Simply put, the increase of stablecoin signals capital reallocation away from volatile assets, indicating a search for liquidation. Within this framework, stablecoin operates as a risk reduction tool.

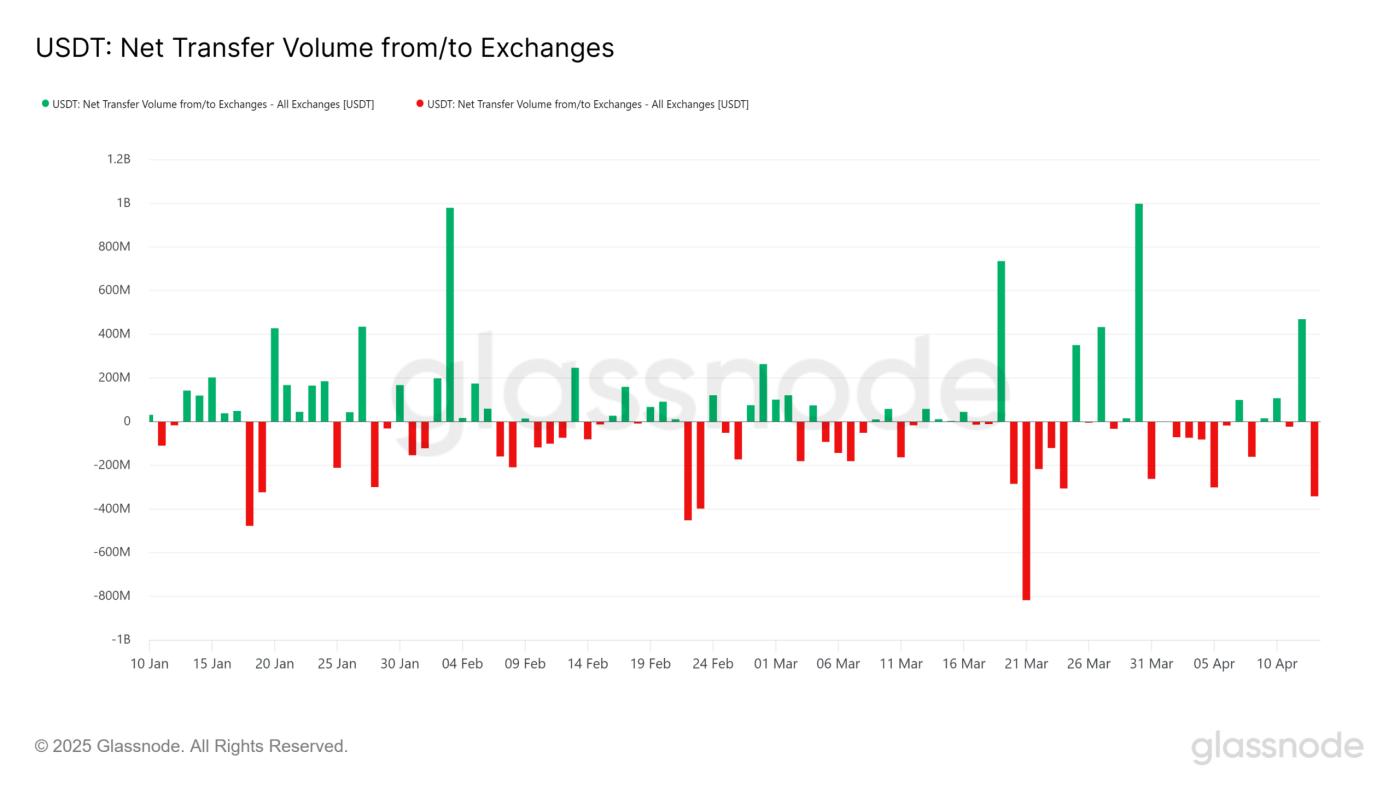

For example, during the period of 20-24 March, the net flow chart of USDT shows red-bodied candles reflecting high accumulation.

This period coincides with Bitcoin [BTC] moving parabolically to a local peak of $88K, followed by a strong correction down to $81K.

Source: glassnode

Therefore, their inherent stability makes them less speculative than other risky assets. However, many banks still misunderstand the strategic role of these stable Tokens — often seeing them simply as representatives of fiat currency.

As the financial landscape evolves and decentralization becomes increasingly structurally significant, here are some important aspects of stablecoin that banks need to know.

Important Facts Banks Need to Understand

Clear oversight is crucial for any asset type, but stablecoin faces a dispersed regulatory context.

For example, in the United States, the jurisdictional ambiguity between SEC and CFTC creates confusion. In contrast, the EU is moving towards standardization with its MiCA framework.

Meanwhile, Asia presents a mixed picture. This global difference complicates cross-border operations. In fact, as countries deploy their Central Bank Digital Currency (CBDC) pilots, stablecoin may face stricter regulations in the future.

But it doesn't stop there. Even in money transfer services, which require cross-border payments, banks need to address regulatory barriers to maximize this use case.

In summary, stablecoin provides significant use cases in the banking sector, enhancing transparency and decentralization.

However, for their potential to be fully realized, banks must establish strict regulatory oversight, simplify cross-border payments, and change their perspective – viewing stablecoin not as speculative opponents, but as the future of mainstream finance.