Author: Token Dispatch, Thejaswini MA

Compiled by: Block unicorn

Preface

Compiled by: Block unicorn

Preface

One tweet. 69 minutes. $17 million. And then there was chaos. What happened next to the official Base account opened up the entire crypto community to questions about “content coins,” insider trading, and the accountability of major platforms.

Three mysterious wallets somehow knew exactly when to buy and made $666,000 in profits, while thousands of retail traders suffered heavy losses.

Base claims this is just a harmless experiment in “on-chain culture” — but on-chain evidence reveals a more complicated truth. Is this a new frontier for creator monetization, or a pump and dump with a new name?

In today’s deep dive, we’ll dissect crypto’s most controversial “non-token-token” launch from every angle.

Events

On a perfectly ordinary Wednesday afternoon, Base — Coinbase’s Ethereum layer-two network — posted a seemingly innocuous tweet: “Base is open to everyone.”

What happened next is a perfect example of etiquette still evolving in the cryptocurrency space, where the line between experimentation and irresponsibility remains frustratingly blurred.

60 seconds after the initial tweet, Base attached a link to a Zora post in a comment that contained the exact same content as the tweet. For those who don’t know, Zora is an “on-chain social protocol” that automatically turns any content posted on its network into tradable tokens. Post something clever and people can buy and sell your clever tokens.

Base’s leadership likely saw this as a harmless experiment in “on-chain culture.” The crypto community saw something else entirely: a $17 million memecoin that appeared out of thin air and carried the name of one of the most recognizable brands in crypto.

This is where the story gets interesting—and complicated.

The market reacted as you would expect when a major layer 2 network “launches” a token:

- Market value surged from 0 to $17 million in just 69 minutes

- It then plummeted by nearly 90% (to less than $2 million)

- It recovered in the next few hours, peaking at $20 million.

- As of this writing, it is stable at around $8 million to $10 million

To an outside observer, it looked like a classic pump and dump. To Base, it was an object lesson in the law of unintended consequences.

For the thousands of retail traders who bought at the high, it was an expensive educational lesson in the difference between “content coins” and “meme coins” — a distinction that meant nothing to the people who had just lost money.

Base founder Jesse Pollack tweeted.

Anatomy of a Controversy

What makes this incident particularly noteworthy is not just the price fluctuations, but what on-chain sleuths subsequently discovered.

Blockchain analysis platform Lookonchain shows that three wallets bought a large amount of the token before the official announcement of Base, and then sold it at the high point, making a total profit of about $666,000. These wallets hold a total of 47% of the token supply.

Meanwhile, Base, as a content creator, received 10 million tokens (1% of the total supply) and made about $81,000 from transaction fees. Although Base promised never to sell these tokens, it didn’t look good.

So we see three wallets:

- Somehow knew to buy before the public announcement

- Holds nearly half of the supply

- Sold at the high, profit over $666,000

The community was very upset with the mess.

So even though Base claims they never sold their 1% allocation, they still profited from the frenzy they sparked through transaction fees.

The timing of those pre-purchases raises serious questions about whether anyone knew about Base's postings in advance.

Of course, maybe three random wallets just happened to buy a large amount of this particular token before it was promoted by one of the biggest brands in crypto. Maybe I can win the lottery tomorrow.

If the “Base is open to everyone” event wasn’t confusing enough, Base launched a second token on the same day: “Base @ FarCon 2025.”

The token, also created on Zora, was created to promote Base’s appearance at FarCon, the annual conference of decentralized social media platform Farcaster.

FarCon also experienced a decline like its “brother”.

Play word games

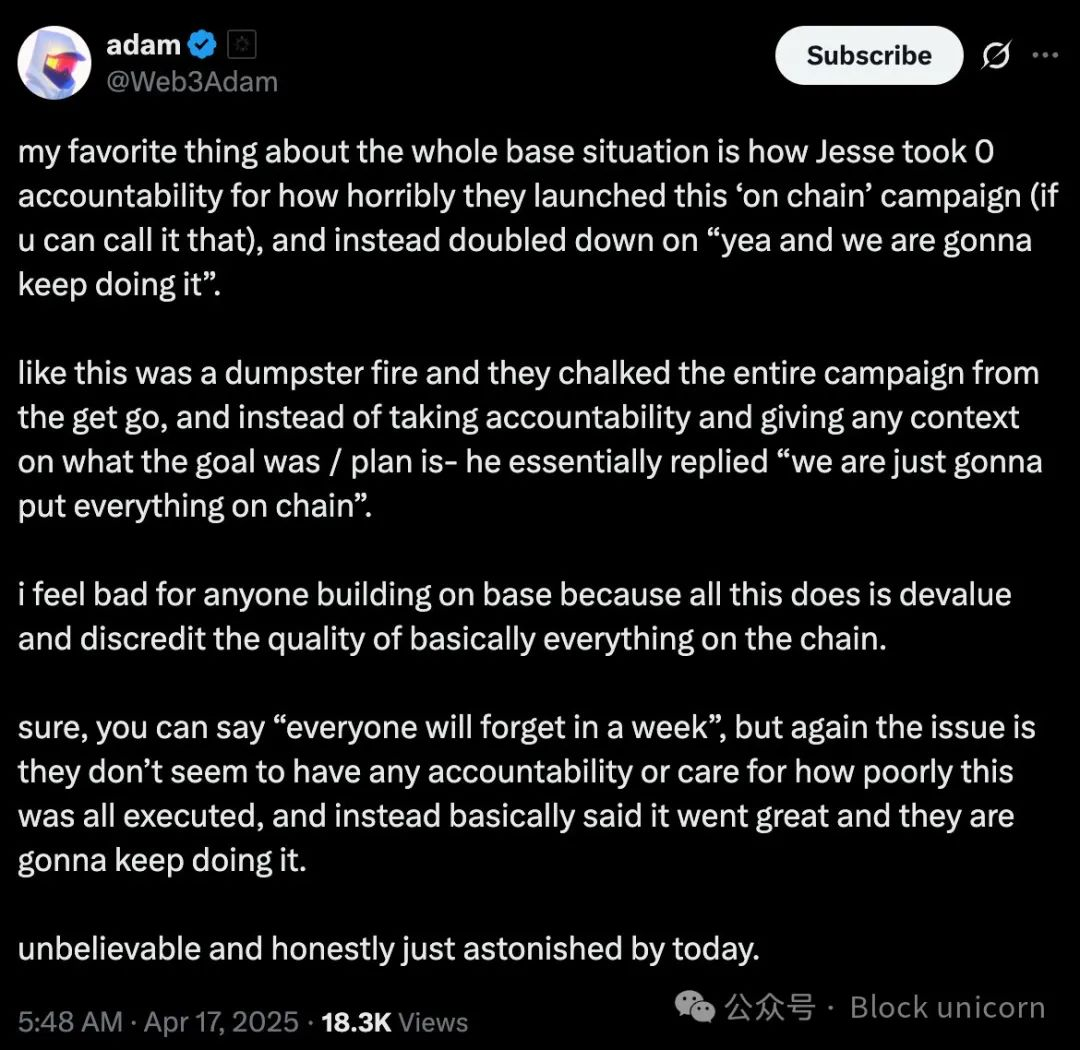

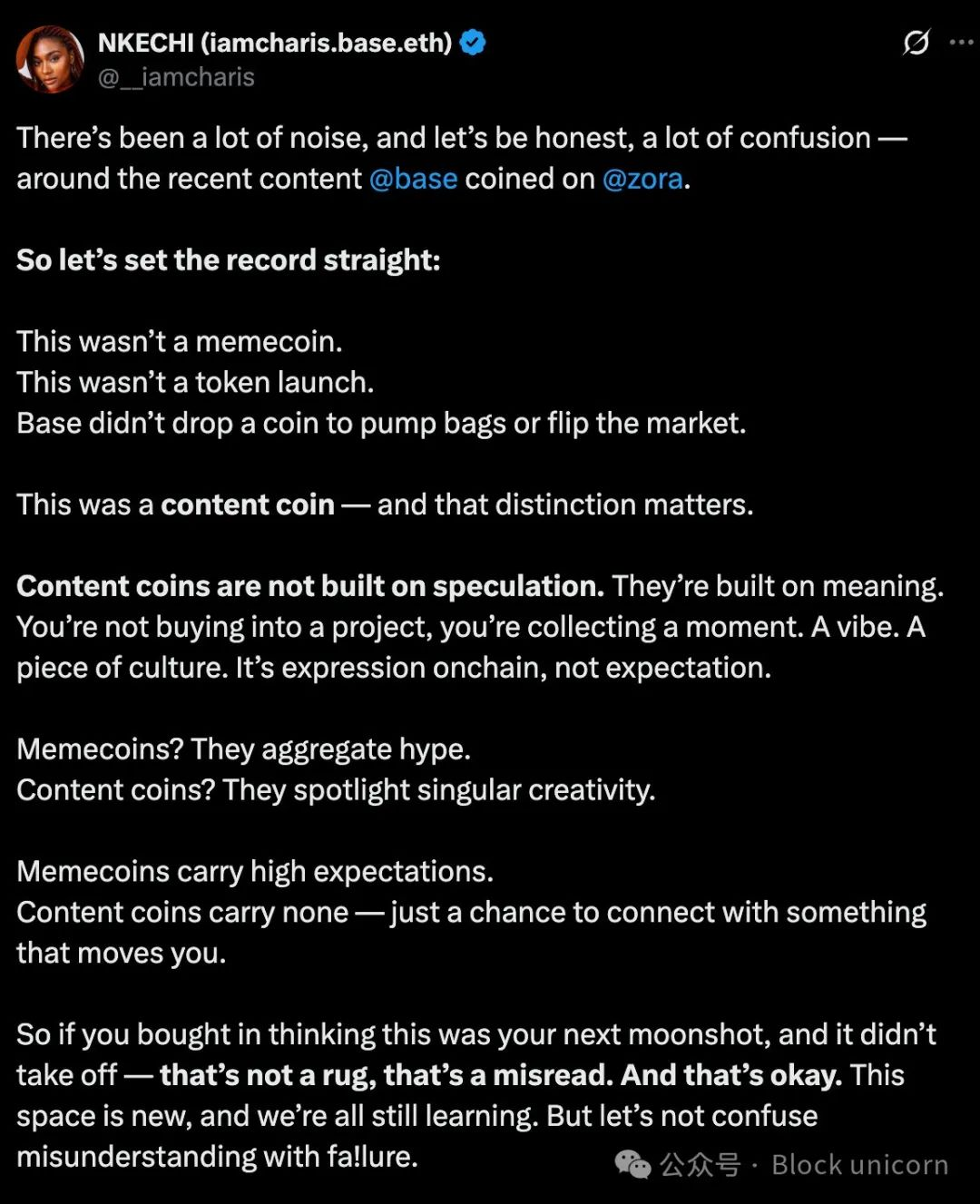

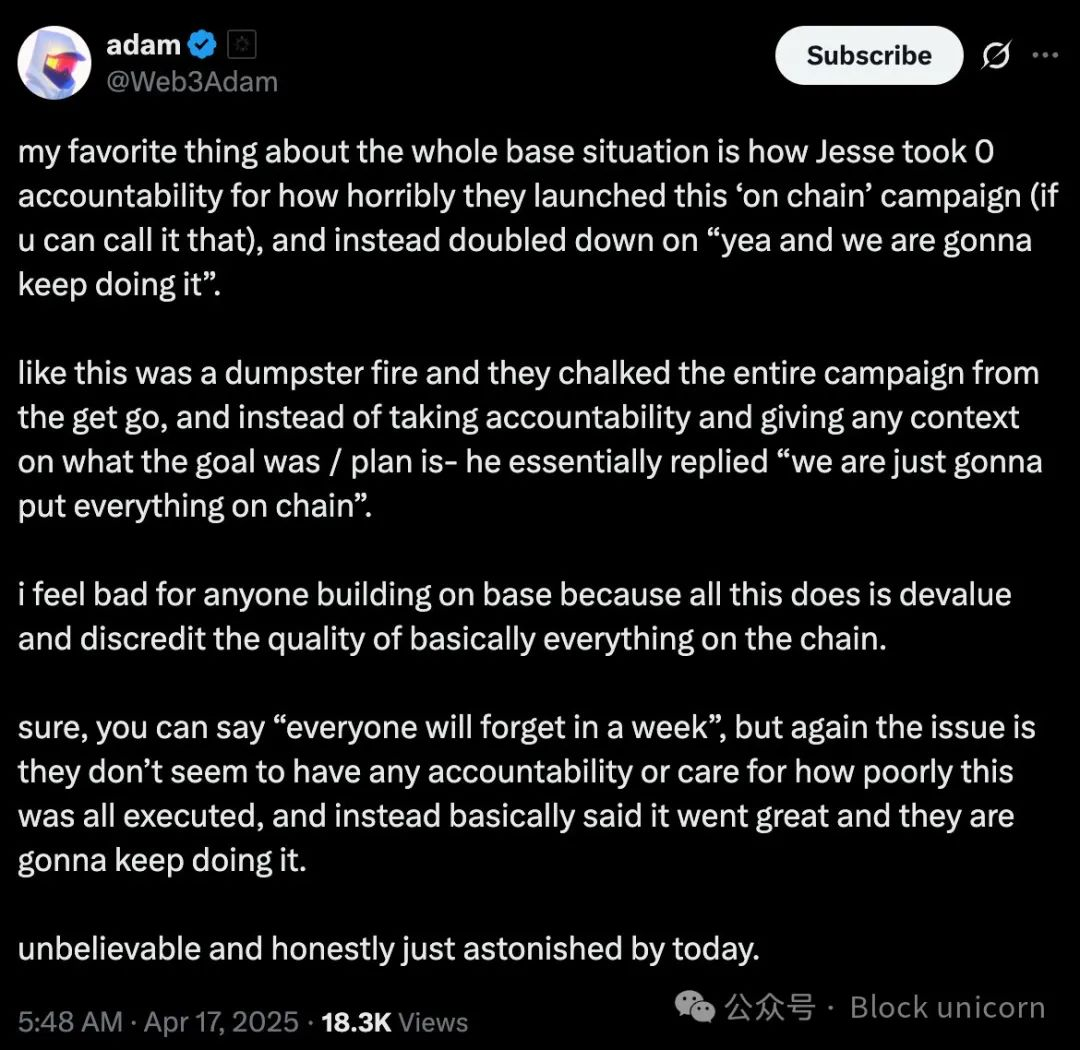

In the face of criticism, Base and its backers have adopted a defense reminiscent of Mark Zuckerberg’s insistence that Facebook is not a media company: “This is not a meme coin, this is a content coin.”

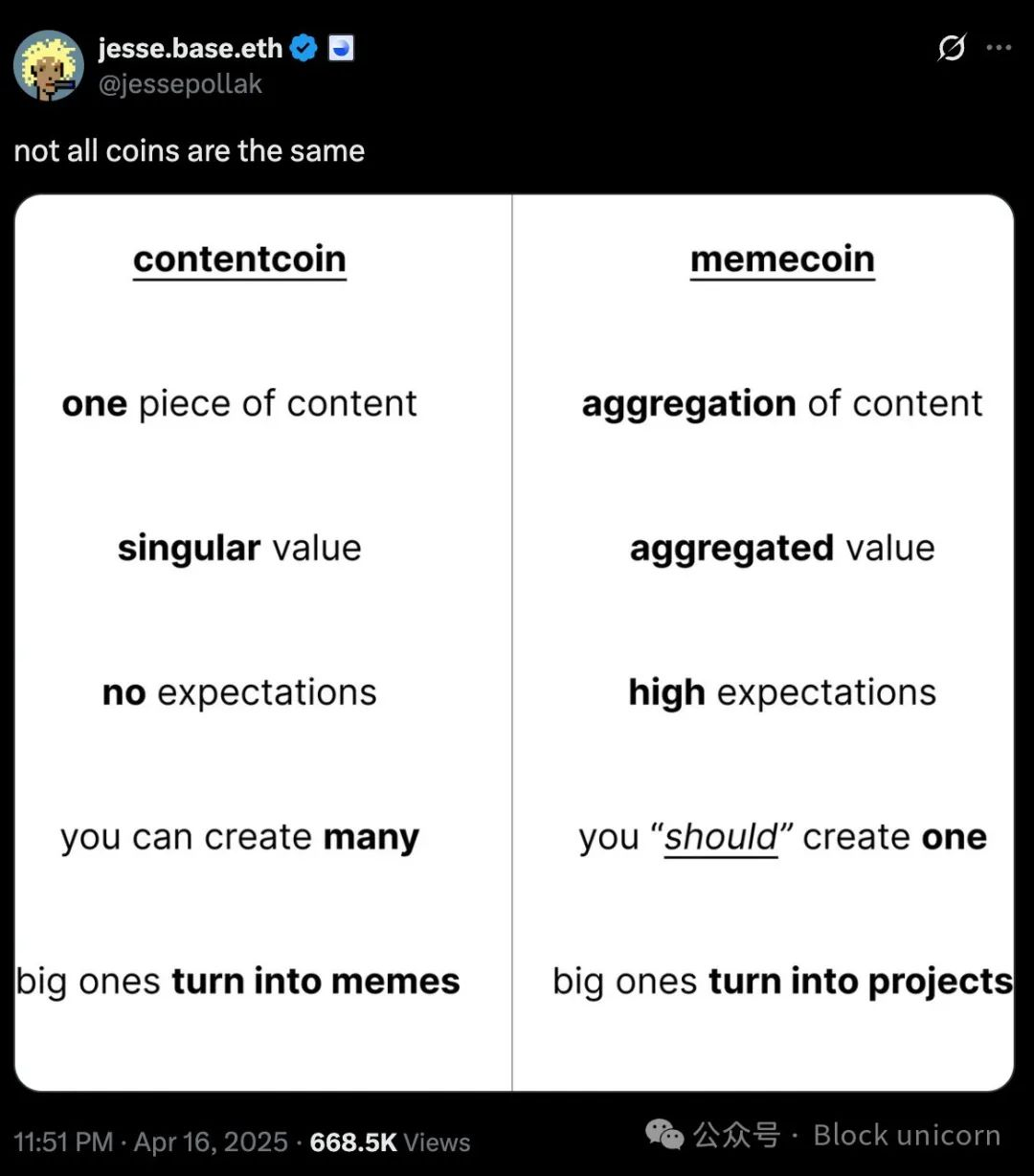

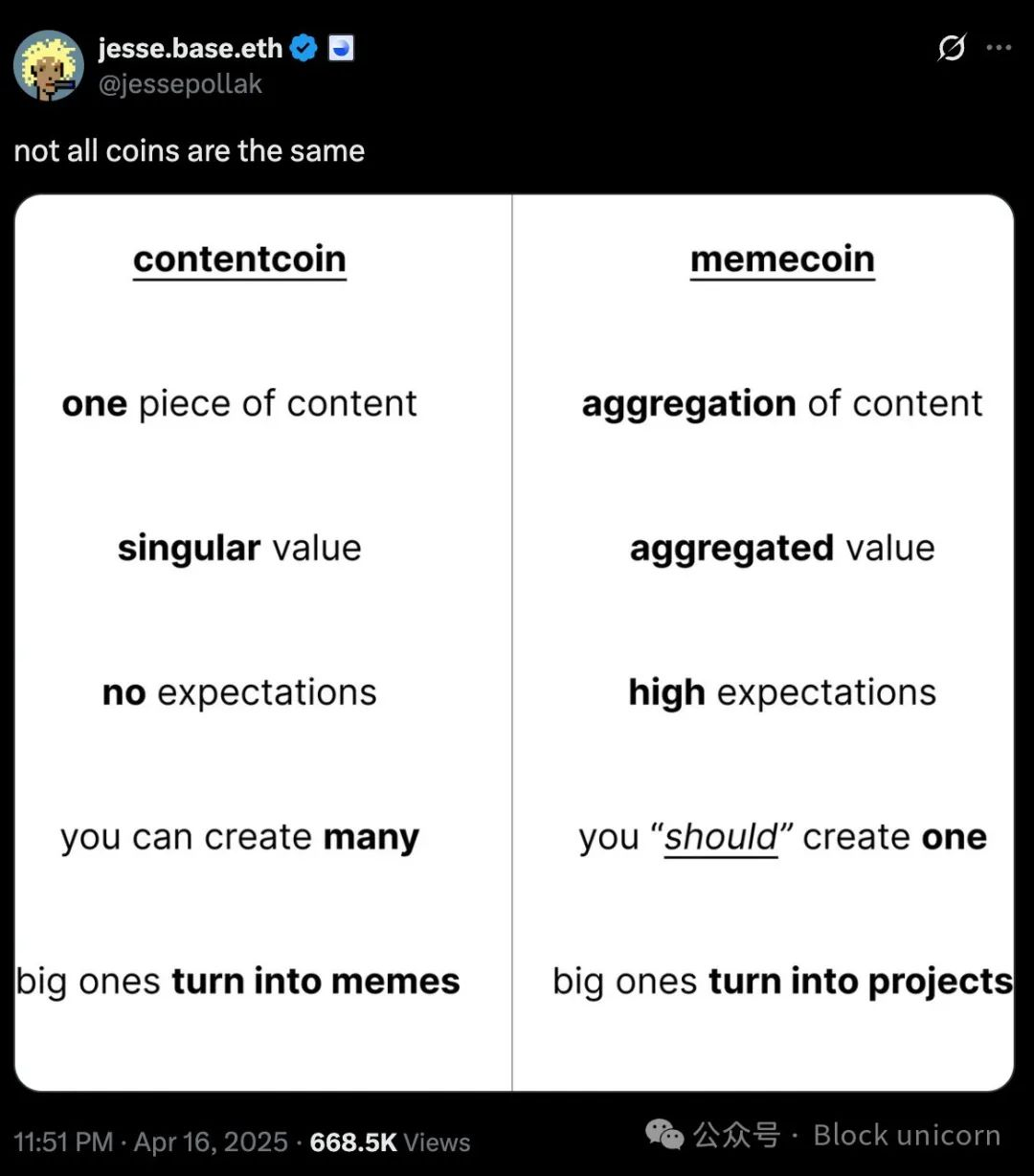

Jesse Pollak, founder of Base, offers this distinction: content coins represent “single content” with “single value” and “no expectations,” in contrast to meme coins that aggregate content and carry high expectations.

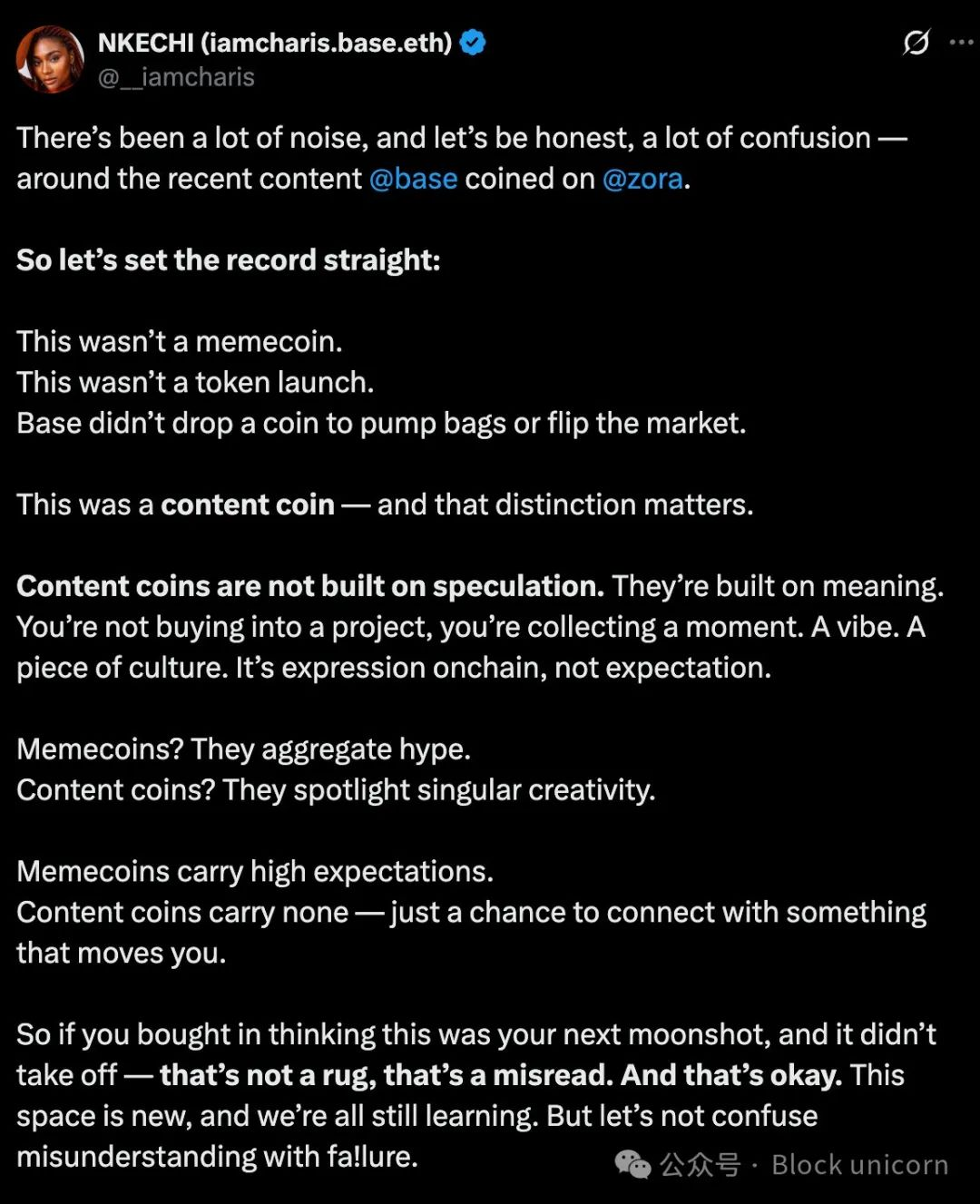

Another Base developer, Charis, was more direct: “This is not a meme coin. This is not even a token launch. Base did not launch a token to pump and dump or hype the market. This is a content coin — this distinction is important.”

The reaction from most cryptocurrency traders was nothing short of eye-rolling.

Content Coins vs. Meme Coins: What’s the Difference?

Let’s dissect the “content coin” vs. “meme coin” debate, because it’s at the heart of Base’s defense.

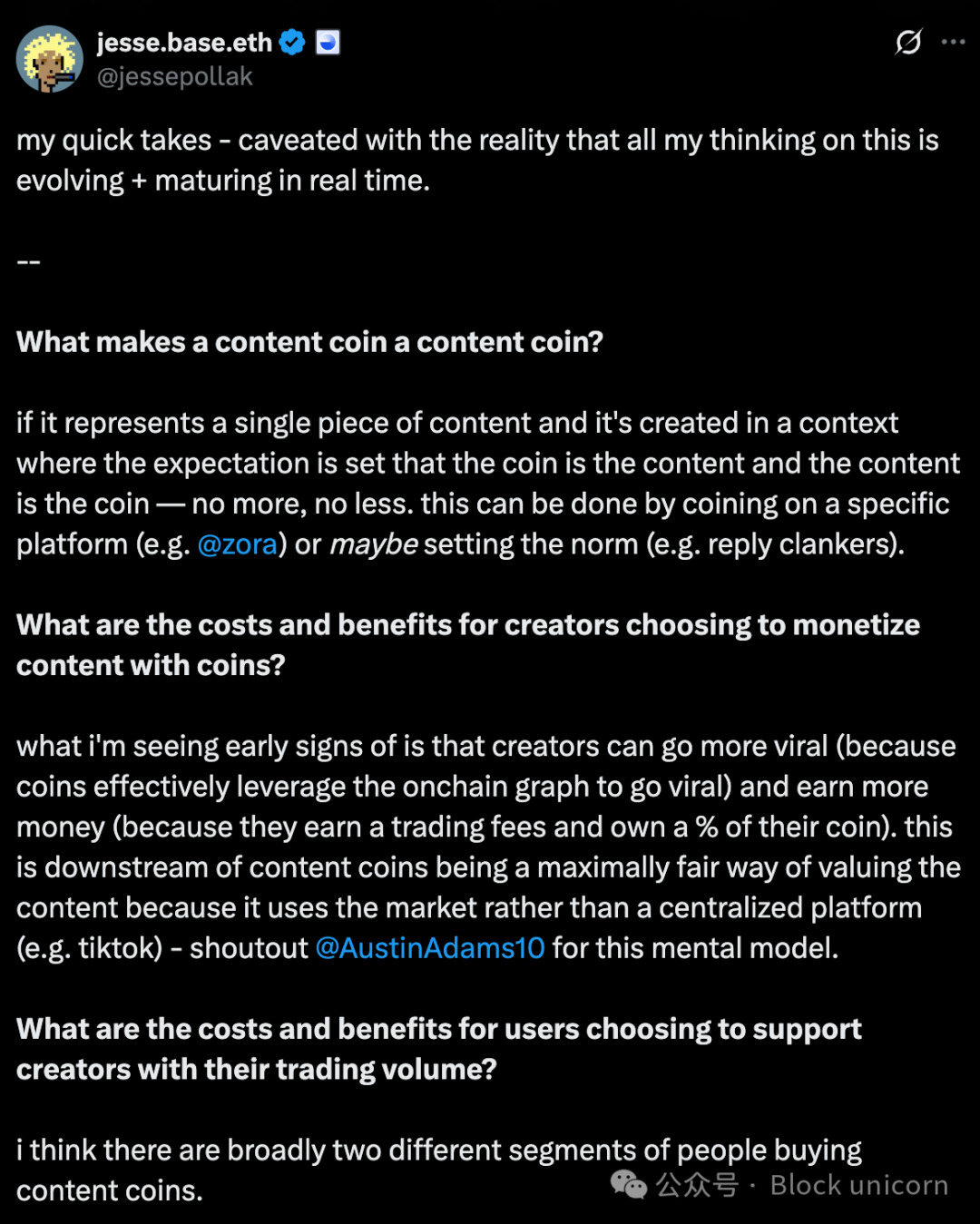

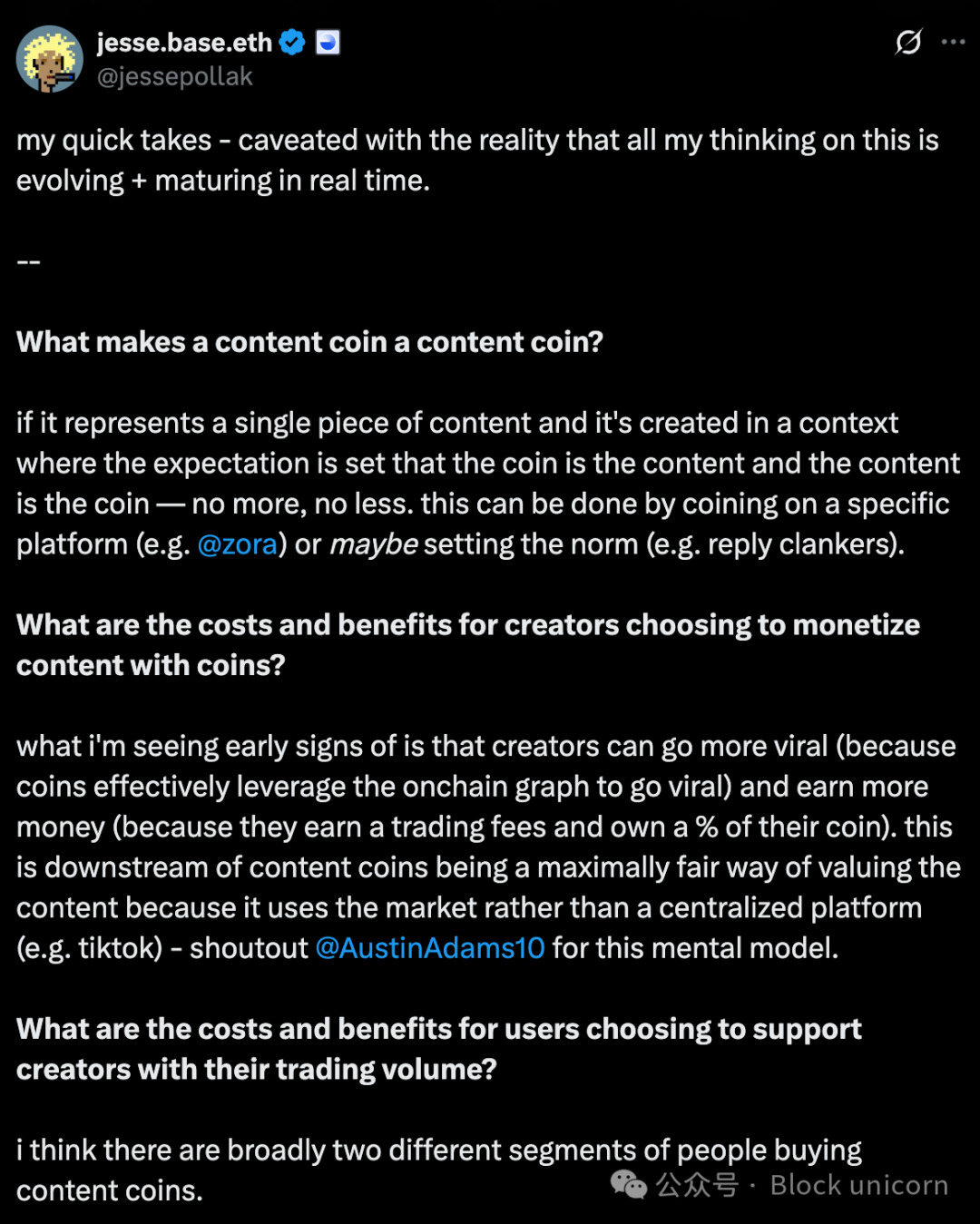

Jesse Pollak said a content coin is defined as “if it represents a single piece of content and is created in a context where the expectation is that the coin is the content and the content is the coin — no more, no less.”

He believes that content coins can help creators become famous, and clear financialization is not necessarily a bad thing.

Jacob Horne, co-founder of Zora, wrote in February that content coins can solve the contradiction between free information and high production costs. In his vision, content coins create open markets that reward creators, distributors, and consumers while keeping information free to access.

In theory, this sounds good. But in practice, the “Base Open to All” token incident looks a lot like a pump and dump:

- Tokens launched with implicit endorsement from big brands

- Price surge

- Early buyers (who mysteriously knew in advance) sold

- Later buyers suffered heavy losses

- Afterwards, everyone argued about the word game

Zora's post retweeted an anonymous user, Larp von Trier, who succinctly summarized it: "Solana newbies had no idea how Zora worked, so they got hammered."

Our View

The Base Open to All incident reveals a critical gap in how we think about responsibility in crypto. Traditional finance has clear lines of accountability — if an investment promoted by a bank fails, there are consequences. In crypto, these lines are fuzzy at best.

When Base tweeted a link to create a token, the market value soared to $17 million and then plummeted 90%. Who was responsible? Base for posting the link? Zora for automatically tokenizing the post? Traders who didn’t understand what they were buying? Or wallets that jumped on the announcement?

Frustratingly, the answer seems to be "it's complicated".

This ambiguity is both crypto’s greatest strength and its most enduring weakness. The field has grown rapidly because the barriers to experimentation are extremely low. But that same freedom has also created an environment where messy events like “content coins” have occurred frequently.

The mere association with Base/Coinbase is enough to cause millions of dollars to pour into a token with no utility, no roadmap, and no future.

This isn’t unique to Base — we’ve seen similar phenomena involving tokens allegedly associated with Solana, Bitcoin, and just about every other major crypto project.

With this influence comes responsibility. Base’s core mission — “building a global on-chain economy that fosters innovation, creativity, and freedom” — is commendable. Their technical innovation is impressive. Their growth numbers (900,000 daily active addresses, $2.4 billion in total locked value) show reasonable potential for growth.

That makes this memecoin misstep particularly puzzling. Base doesn’t need to chase short-term wins or social media hype. They’re building something that will have real long-term significance.

The “content coin” defense rings particularly hollow considering that Base just released an ambitious Q2 roadmap that outlines impressive technical innovations like Flashblocks (which cuts block times to 200 milliseconds), Base Appchains (third-layer chains for specific applications), and enhanced privacy features.

The contrast between Base’s serious technical ambitions and this seemingly frivolous attempt to tokenize social posts is hard to ignore.

The line between innovation and irresponsibility may be blurry, but successfully navigating that line can be the difference between truly transformative projects and interesting but ultimately failed experiments.

In crypto, as in life, good intentions are not enough to solve problems. “Base is open to everyone” is a nice slogan — but only if “everyone” includes retail traders who don’t understand the difference between meme coins and content coins and who shouldn’t become collateral damage in the “on-chain culture” experiment.