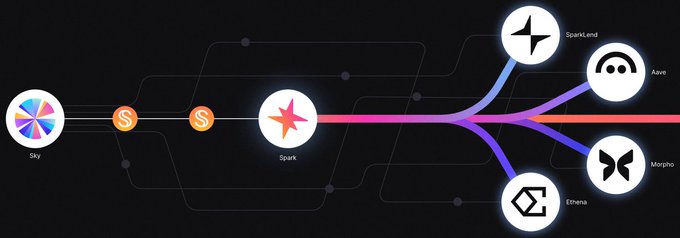

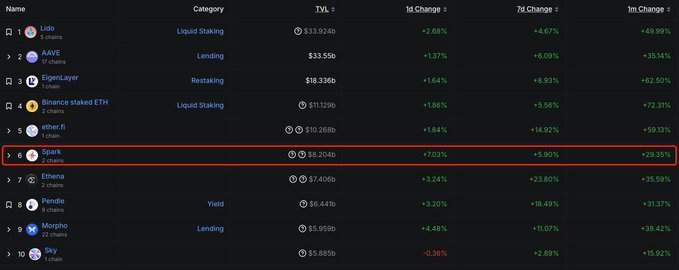

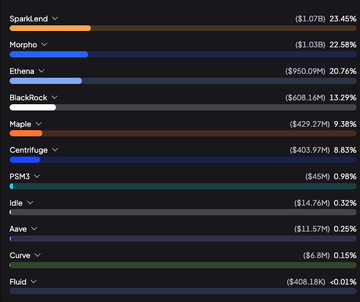

Today, I deposited 10 WU into the recently 6x "meme coin" Spark to try its financial effect, so I'm writing a tweet to discuss it. Interestingly, right after the tweet I previously shared about "Stablecoins Not Allowed to Earn Interest", @timzz_sleep reached out to me for an Alpha Call and shared Spark, a platform specifically for stablecoin interest, and then it entered a surge mode the next day 🤣 This tweet will detail the origin of Spark and its position in the MakerDAO and the entire on-chain stablecoin ecosystem. Spark is also a project with aesthetic appeal, and I will continue to follow and share related content. Many may not know that @sparkdotfi is a sub-project of MakerDAO, so before discussing Spark, I need to explain the ultimate plan proposed by MakerDAO (now renamed Sky @SkyEcosystem) three years ago. At that time, the founder @RuneKek published a five-phase roadmap for MakerDAO's future in the community, with the original link as follows: forum.sky.money/t/the-5-phases...… In this plan, the short-term goal is to increase the Dai stablecoin supply to over 10 billion within three years. The first step is to rebrand and unify, renaming Dai and MKR to new stablecoin and governance token names. So now Dai is renamed to USDS, and MKR will be renamed to SKY in September. Currently, USDS+Dai totals 9.2 billion, so the three-year 10 billion goal is only about one-tenth complete, with a long way to go. The second step is closely related to Spark's birth, where MakerDAO will launch six sub-DAOs, each with a specific task and its own governance model, simplifying MakerDAO's overall governance and workload. In this sub-DAO plan, the most important aspect is that MakerDAO itself will no longer directly handle business, acting only as a central bank. Sub-DAOs can borrow stablecoins from the Maker protocol at very low rates and then deliver them to other third-party DeFi protocols to generate revenue. Since sub-DAOs bear all maintenance costs and credit risks, they can charge third parties rates higher than their borrowing rates, thus earning the spread. Spark is the first sub-DAO born in the second step of this roadmap. You can understand MakerDAO as a central bank, with Spark being its first and currently only commercial bank. The remaining three steps involve introducing AI, enhancing governance, and launching a new chain, which I won't elaborate on here. Currently, this roadmap has been implemented to the second step, with Spark being its core. Because MakerDAO has massive stablecoin reserves, Spark plays two core roles in the MakerDAO ecosystem and even the entire on-chain world: 1. For stablecoin holders, helping them find safer and more sustainable high yields. 2. For DeFi and other protocols, helping them inject liquidity without relying on third-party capital. Liquidity! Liquidity! Liquidity! Everyone is tired of hearing this word, but whoever controls liquidity controls the upstream water release valve. So MakerDAO is the reservoir storing water, and Spark is the canal channeling water. Currently, Spark ranks sixth in TVL among all DeFi protocols, having injected 4.6 billion USD in liquidity and generated 200 million USD in income. The following chart shows the distribution of funds, with the first being Spark's own lending, the second and third being the two hottest new DeFi projects Morpho and Ethena in this cycle, and the fourth, yes, is BlackRock. This is the background and achievements of Spark's birth. If stablecoins are the biggest narrative in recent years, then helping users solve stablecoin yield sources and helping protocols inject stablecoin liquidity are the most important businesses in this cycle, which is exactly what Spark is doing. Welcome to use my referral link to enter Spark for deposits ❤️ app.spark.fi/points/2FRXDE

This article is machine translated

Show original

陈剑Jason

@jason_chen998

07-20

尽管稳定币发行商拥有恐怖的净利润率和以国债为主非常稳定的收入来源,但不论是之前欧洲的《加密资产市场法规》,还是现在走到最前沿美国的《GENIUS法案》,都禁止稳定币发行商向持有人支付任何形式的利息,看起来像是国家强制让发行商暴富不能与民分利,实际上这种限制则是对当前以银行为代表的传统金

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share