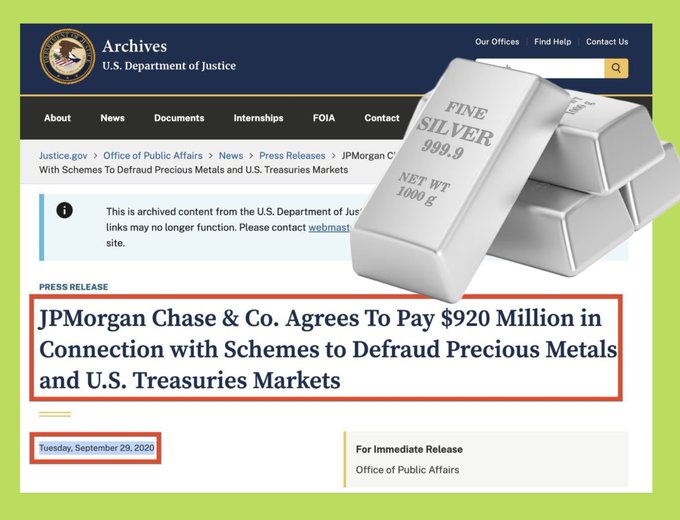

🤔 How is the price of silver being "suppressed": when paper silver dominates physical silver 🥈 On December 29, 2025, the price of silver plummeted by -15.75% in just 24 hours, wiping out nearly $600 billion in market Capital . At first glance, many thought this was just a sharp correction. But a closer look at the structure of the silver market reveals a very familiar pattern. Silver actually exists in two parallel markets. One is paper silver traded on COMEX through futures and Derivative Futures Contract . The other is physical silver bought and sold in the real world. On COMEX, the price of silver is only around $70–73 per ounce, but in the physical market, the price is much higher: around $130 in Japan, $115 in the UAE, $110 in India, and $80–85 in Shanghai. A difference of $10 to $60 per ounce is unusual in a healthy market. The root cause lies in the excessive leverage of the paper silver market. It is estimated that one ounce of physical silver is "backed" by over 400 ounces of paper silver. This allows the price to be manipulated through the sale of paper contracts, even when physical silver is scarce. When the price of silver rises too quickly due to real demand, the market often reacts by tightening margin requirements on futures contracts. Increased margin requirements force leveraged traders to either sell or deposit more money, leading to forced sell-offs and a price crash. This doesn't solve the problem of physical silver shortages; it only temporarily pushes prices down. History has proven this model. Between 2008 and 2016, JP Morgan traders were found to be manipulating the gold and silver markets using spoofing techniques. The case was proven in court, and by 2020, JP Morgan had to pay a fine of $920 million. This shows that the precious metals market was once controlled through the paper market. Currently, there is no conclusive evidence that JP Morgan or any specific bank is manipulating silver. However, the reality is that the paper positions of large institutions remain very large, with leverage even higher than in 2011, while physical silver inventories are lower. This makes the entire system fragile. Looking back at history, every major bull cycle in silver has followed the same pattern: real demand pushes prices up → paper leverage swells → margin calls become tight → forced liquidation → prices are pushed down. What is happening now is almost a replica of previous cycles. And the familiar outcome is usually this: large institutions make billions of dollars, while small retail investors have to hold onto their positions for years, waiting for the market to reflect the true value of the silver. Chia to Bull Theory, an analysis channel with 72,000 followers on X.

This article is machine translated

Show original

Upside GM

@gm_upside

01-01

🥈 Bạc giảm mạnh sau khi lập đỉnh: Lịch sử thường nói gì?

Bạc vừa giảm khoảng 9% trong ngày, ngay sau khi lập đỉnh cao nhất lịch sử vào cuối tuần trước - một nhịp điều chỉnh mạnh nhưng không hề hiếm gặp.

Dữ liệu trong hình cho thấy, trong 6 lần x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share