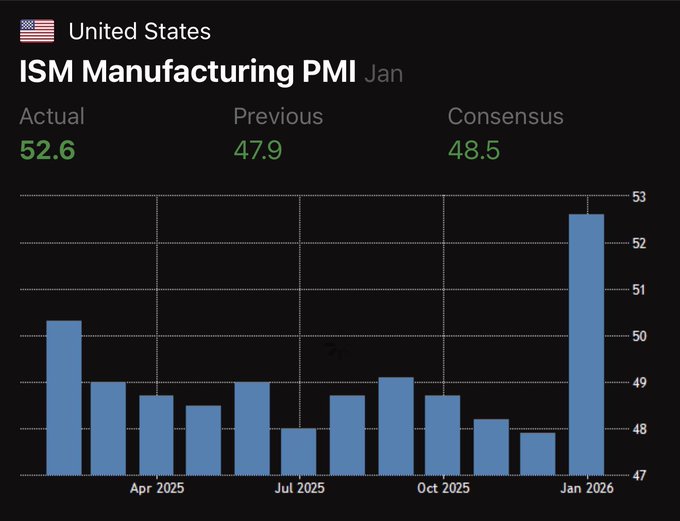

While ISM data is only correlated with the crypto bull market, not causally related, it's still worth a look: First, let's understand what the ISM Index (Purchasing Managers' Index) is. It's a monthly report released by the Institute for Supply Management (ISM) to measure the health of the US manufacturing sector. Simply put, it's like a "barometer of factory owners' sentiment": an index above 50 indicates expansion and good business; below 50 indicates contraction and difficulties; and equal to 50 means flat. Past major cryptocurrency bull markets (such as those in 2013, 2017, and 2021, when prices skyrocketed) all occurred when the US ISM manufacturing index exceeded 50. Currently, this index has just jumped to 52.6, the largest increase since 2021. Previously, it mostly hovered below 50, only occasionally surfacing. Jesse believes this signals that cryptocurrencies are about to take off.

This article is machine translated

Show original

Jesse Eckel

@Jesseeckel

02-02

Every single crypto bull run ever (2013, 2017 and 2021) happened when the ISM moved up above 50.

Today we hit 52.6.

This entire cycle since 2021 we’ve been below 50 with only tiny blips above the surface.

This is by far the largest move up we’ve had this cycle.

Run it hot.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content