BlackRock's Bitcoin ETF hits record $10 billion in trading volume; have institutions given up? Photo: CryptoSlate

BlackRock's Bitcoin ETF hits record $10 billion in trading volume; have institutions given up? Photo: CryptoSlate

The wave of sell-offs swept through Bitcoin ETFs.

BlackRock 's Bitcoin spot ETF is becoming the focal point of the sell-off in the cryptocurrency market. Record volume, coupled with plummeting prices and soaring demand for hedging, reveals a phase of institutional investor surrender.

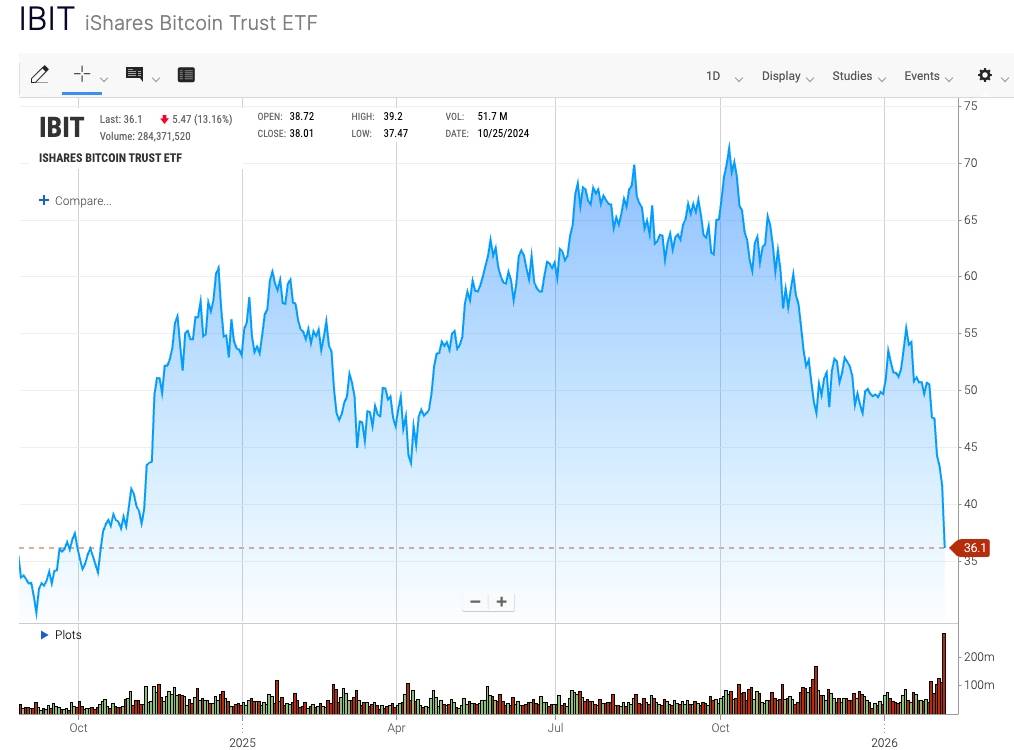

In this morning's trading session, the iShares Bitcoin Trust (IBIT) recorded over 284 million shares changing hands, according to Nasdaq data, equivalent to a notional value exceeding $10 billion. This figure is 169% higher than the previous record of 169.21 million shares set on November 21 last year.

At the same time, the price of IBIT fell 13% to below $35, its lowest level since October 11, 2024. YTD, the fund has lost 27% of its value, after peaking at $71.82 in early October. This development reflects the widespread weakness in the cryptocurrency market, as Bitcoin plummeted to $60,000 in the same session , wiping out hundreds of billions of dollars in market Capital in just a few weeks, marking one of the worst trading days in history, second only to the FTX scandal in 2022 .

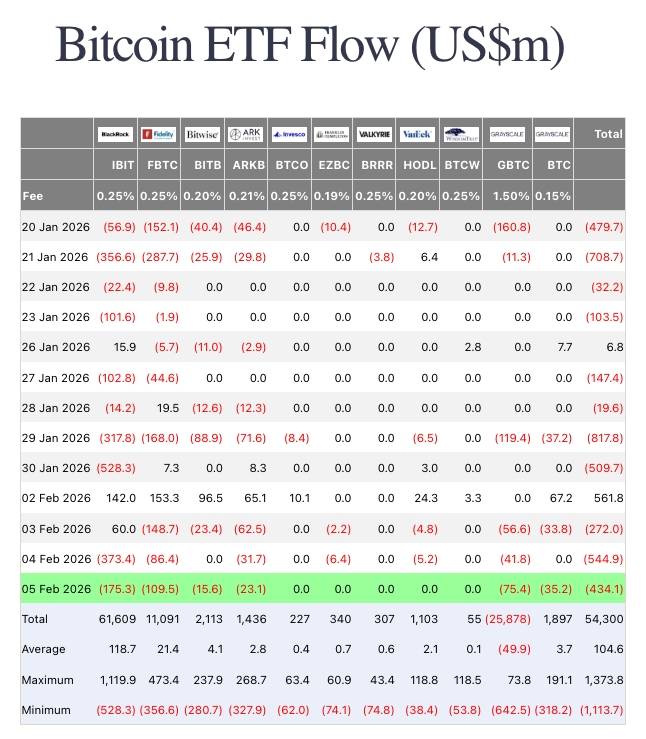

Selling pressure was also evident in the Capital flow. In this session alone, IBIT experienced net outflows of $175.33 million, accounting for approximately 40% of the total outflow of $434.11 million across 11 Bitcoin spot ETFs. Prior to this, Bitcoin ETFs in the US had recorded several consecutive Capital sessions, reflecting a reversal in institutional capital flows after a period of strong investment in managed products last year.

Statistics on cash flow of Bitcoin ETFs in the US. Source: Farside Investors (February 6, 2026)

IBIT is currently the world's largest listed Bitcoin fund, holding physical Bitcoin and designed to closely reflect the spot price of the largest cryptocurrency by market capitalization. This product was once XEM the preferred approach for financial institutions seeking to invest in cryptocurrencies through custodial trading and traditional exchange-based transactions. However, the current downturn shows that even the most cautious investors are under pressure.

Signs of "surrender" are spreading.

In technical market analysis, the combination of record volume and sharp price drops is often XEM as a signal of the capitulation phase – when long-term investors accept losses and sell at any price. This is often the extreme sell-off of a bear market, initiating a prolonged and volatile Dip process.

IBIT's options market in the same session also reinforced this scenario. According to data from MarketChameleon, long-term put options – a hedge against downside risk – traded at a premium of more than 25 basis points over call Call Option , the largest spread ever recorded for this fund. A strong bias toward put options typically reflects extreme fear, as investors prioritize Capital preservation over betting on a potential recovery.

The broader market landscape is also putting increasing pressure. Recent reports indicate that many businesses that previously held Bitcoin as a treasury asset are facing significant price drops, forcing them to reassess their financial strategies. Simultaneously, global capital is shifting away from risky assets towards cash and bonds, as expectations of sustained high interest rates continue to dominate investor sentiment.

There's no guarantee we've hit Dip.

Although current signals are characteristic of a peak sell-off, analysts warn that this does not mean the market has Dip . History shows that after a capitulation phase, the market usually experiences a prolonged period of consolidation with narrow trading ranges and a high degree of caution, rather than an immediate, strong rebound.

Previous Bitcoin price downturns suggest that bottoming Dip can take months, while ETF Capital — Capital expected to be a stabilizing anchor for the market—are now showing clear cyclical patterns.

With the increasing involvement of large financial institutions through ETFs and Derivative, current volatility not only reflects the sentiment of individual investors but also shows how traditional markets are revaluing Bitcoin in a tighter macroeconomic environment. If the Capital pressure continues, this correction could be prolonged, making the current phase one of the biggest challenges for the cryptocurrency market since previous downturns.

Coin68 compilation