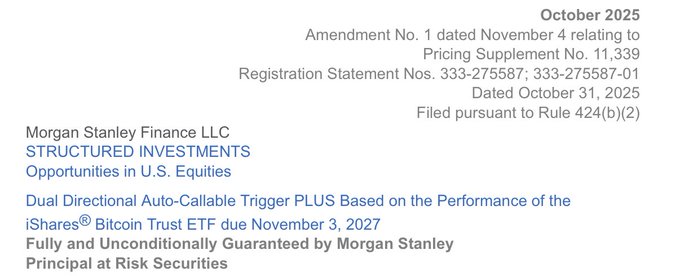

Arthur believes the recent plunge in Bitcoin, especially the repeated breaches of key support levels, was not due to retail investor panic, but rather to large banks on Wall Street hedging their Bitcoin investment products. These products offer some loss protection for investors, such as breaking even on slight dips. However, once Bitcoin falls below key cost levels, such as 75%, banks are forced to frantically sell Bitcoin to hedge the risk, resulting in a death spiral that drives the price even lower. This recent sell-off is likely a violent sell-off triggered by the breach of key support levels. If this is the cause, the short-term violent sell-off appears to have subsided, with key support levels breached and most shares sold. However, under this large-scale hedging mechanism by banks, long-term risks still exist.

This article is machine translated

Show original

Arthur Hayes

@CryptoHayes

$BTC dump probably due to dealer hedging off the back of $IBIT structured products. I will be compiling a complete list of all issued notes by the banks to better understand trigger points that could cause rapid price rises and falls. As the game changes, u must as well.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share