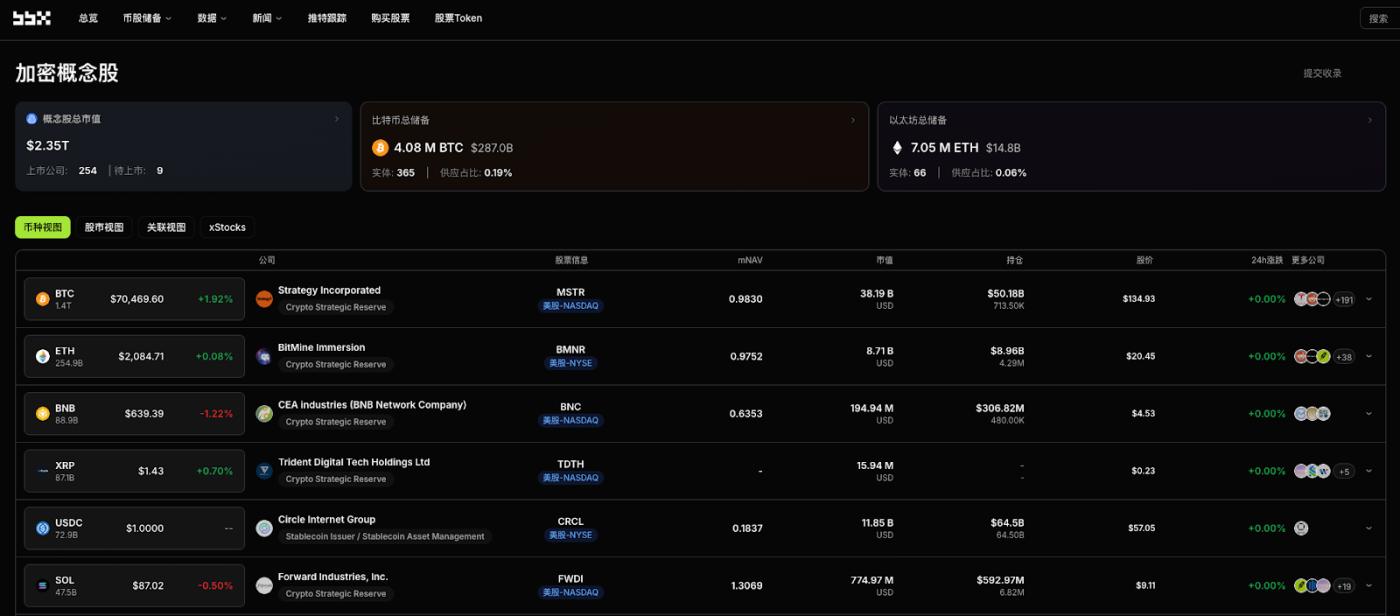

According to ME News, on February 9th (UTC+8), BBX Crypto Concept Stock Information reported that global listed companies exhibited a dual evolution of "large-scale competition" and "structural deleveraging" against the backdrop of increased volatility in crypto assets last week. Despite a deep price pullback in the market due to the "February cold snap," leading holding giants continued to accumulate shares using equity instruments, while mid-sized companies optimized their financial quality through asset consolidation.

Core Giants and Treasury Expansion Dynamics

Strategy (NASDAQ: $MSTR) released its fiscal year 2025 report last week. The announcement showed that as of February 1, 2026, its total Bitcoin holdings reached 713,502 coins , with an additional 41,002 coins raised through its ATM (market price issuance) program in January alone. This week (the week ending February 1), the company purchased another 855 Bitcoins. Currently, Strategy controls approximately 3.4% of the total Bitcoin supply, and its "21/21 Plan" still has approximately $20.3 billion in Common Stock ATM quota to be released, demonstrating its continued accumulation as the world's largest corporate holder.

Metaplanet (TSE: 3350) confirmed that it will complete a private placement and warrant exercise payment of approximately US$137 million on February 13. The company stated that despite recent market volatility leading to a pullback in book profits, it will adhere to "earnings per BTC" as its core metric and plans to use 14 billion yen of the proceeds from this offering specifically to continue increasing its Bitcoin holdings, aiming to become the first non-mining entity in Asia to hold over 50,000 Bitcoins.

Mergers & Acquisitions Integration and Debt Optimization Dynamics

Strive Enterprises (NASDAQ: $ASST) officially completed its all-stock acquisition of Semler Scientific (NASDAQ: $SMLR) this week. The announcement disclosed that the combined company holds a total of 12,797.9 bitcoins, officially surpassing Tesla to become the 11th largest corporate holder globally. Strive announced plans to use operating cash flow and SATA preferred stock proceeds over the next 12 months to prioritize repaying $100 million in convertible bonds and $20 million in Coinbase mortgage loans from the former Semler, aiming to achieve 100% uncollateralized treasury holdings.

Genius Group (NYSE American: $GNS) released an earnings update disclosing that it sold 96 bitcoins at an average price of approximately $73,238 between late January and early February, raising approximately $7 million to repay bitcoin-secured loans. As of February 6, the company still held 84.15 BTC, and its debt decreased from $8.5 million to $3.3 million. The company stated that through this "dynamic rebalancing" strategy, it successfully reduced its financial leverage while maintaining its core holdings.

Dynamics of Multi-Asset and Defensive Allocation

DeFi Development Corp (NASDAQ: $DFDV) released its January review report. As the world's first publicly traded company with Solana as its core reserve, it currently holds approximately 2.22 million SOL (equivalent to 0.0743 SOL/share). This week, the company announced a treasury yield partnership with Hylo and Solstice YieldVault, generating native interest by staking its SOL holdings, transforming its treasury from a static reserve into a self-sustaining liquidity engine.

Thumzup Media (NASDAQ: $TZUP) sent a letter to shareholders last week confirming that its board of directors has authorized expanding its treasury allocation to include multiple tokens beyond Bitcoin, including ETH, SOL, XRP, DOGE, and LTC. With Donald Trump Jr. as a significant shareholder, Thumzup plans to use its recent $50 million fundraising to establish a multi-asset portfolio and expand its business into crypto mining.

LQR House (NASDAQ: YHC) and Cosmos Health (NASDAQ: $COSM) also disclosed their respective treasury progress. LQR House's board of directors has approved the purchase of up to $1 million worth of Bitcoin as reserve assets; while Cosmos Health has increased its total Ethereum holdings to over $2 million through a $300 million digital asset facility.

Market perspective

Last week's market dynamics reflected three deep trends: First, "uncollateralized" has become a new industry standard: Giants like Strive are using equity financing to divest collateralized loans, aiming to ensure absolute portfolio security during extreme volatility. Second, "full asset coverage" is emerging: Thumzup's authorization of multiple currencies signifies that corporate allocation has expanded from a single "digital gold (BTC)" to "ecosystem governance rights (SOL, XRP, etc.)." Third, "valuation inversion" has triggered restructuring expectations: Companies like Hyperscale Data, whose crypto reserve value far exceeds their market capitalization, are attracting institutions like Ark Invest to aggressively buy related assets like BitMine during periods of volatility. (Source: ME)