This article is machine translated

Show original

Although I often criticize @okx and @star_okx, it's always based on facts.

Looking at the statements from both sides regarding the 517BTC incident, here are a few key points:

1/ Was it market manipulation?

The user opened a $450 million long position in 2018. Given the market depth and trading volume at the time, this position was bound to cause problems.

This exposed a bug in the contract risk control system at the time. The user shouldn't have been allowed to open such a large position in the first place, and freezing the position after triggering the alert was reasonable.

The user opened with 20x leverage, and was liquidated with less than 5% volatility. The claim that "the position would have been reduced automatically if it hadn't been frozen" is, in my opinion, unfounded.

While the user may not have had the subjective intention to manipulate the market, high leverage and excessively high position size are conventionally considered manipulation risks, ultimately leading to liquidation and systemic risk.

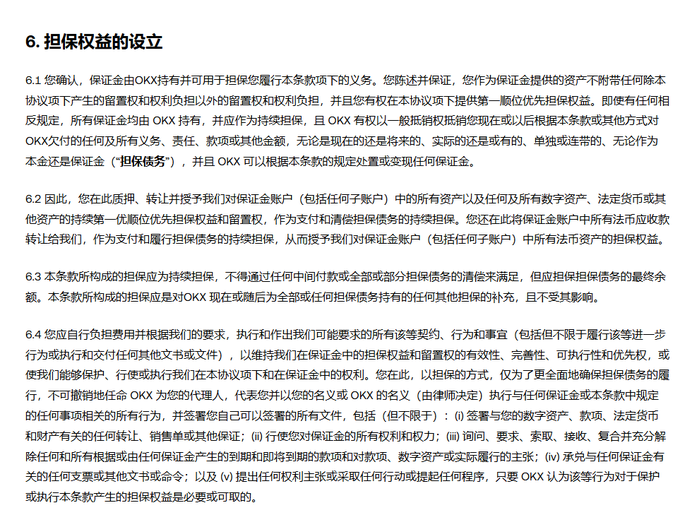

OKX User Agreement Clause 6.2 mentions the ability to close, restrict, and roll back trades. This clause is definitely written in a way that benefits OKX. The clause itself may be controversial, but it does act within its scope.

2/ Was freezing 517BTC reasonable?

According to the announcement, the massive contract losses at the time were due to margin calls. OKX provided 2500 BTC to cover the losses, and also deducted some user profits through social compensation, plus froze 517 BTC belonging to the affected users.

Therefore, the estimated losses from the margin calls are at least 4000 BTC.

As for the spot balance, the user agreement states that "all sub-accounts/wallets are generally considered as the same user's overall assets. If a contract generates a large negative balance, the platform has the right to deduct from across accounts."

This is similar to freezing assets; the terms are controversial, but they were indeed implemented according to the terms.

In summary, OKX's contract risk control had serious problems at the time. It didn't limit the size of user positions or leverage, only having a small insurance fund and social compensation (BitMex had already used ADL at the time). After causing significant system losses, OKX compensated for some of the losses, recovered some from profitable users, and then froze 517 BTC belonging to the users who suffered margin calls.

The terms are somewhat unreasonable, but they are all normal procedures based on the user agreement. There's basically no solution; the only recourse is through legal channels.

Logic of deducting from spot account

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share