Australia's CBA: "Weak nonfarm payrolls expected, US dollar under pressure."

The Fed may cut interest rates further if the labor market cools and inflation eases.

The coin market is also sensitive… A weak dollar fuels Bitcoin's upward momentum.

Asian currencies trade sideways ahead of U.S. jobs data

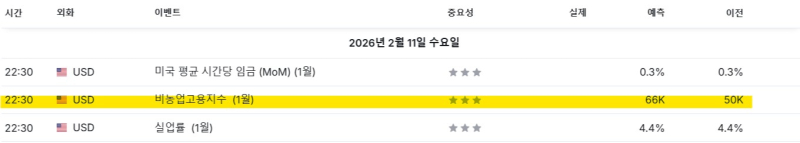

In Asian foreign exchange markets today, major currencies fluctuated within a flat range against the US dollar. This was due to investors maintaining a wait-and-see stance ahead of the US nonfarm payrolls report, scheduled for release at 10:30 PM on the 11th.

The nonfarm payrolls index is a key indicator of the U.S. employment situation and serves as a crucial clue in determining the direction of the Federal Reserve's (Fed) monetary policy. Weak employment is interpreted as a sign of an economic slowdown, increasing expectations of a Fed rate cut. Conversely, strong employment suggests a rate freeze or rate hike.

The market expects the jobs report to be released today to fall short of market expectations, which would further weaken the dollar.

"Weak employment figures expected… dollar pressure expected."

"We expect the non-farm payrolls figure to be below market expectations, which will put pressure on the US dollar," Commonwealth Bank of Australia (CBA) foreign exchange and economist Carol Kong said in a report released today.

He analyzed that "if the U.S. labor market cools further and inflation pressures ease, the Fed is likely to cut interest rates twice more this year."

The market currently expects the Fed to cut interest rates one or two times this year. However, some speculate that if employment data proves significantly weaker than expected, the timing of the rate cut could be brought forward or the cut could be larger.

A weak dollar fuels upward momentum for coin prices.

A weaker dollar is likely to have a positive impact on the coin market. Typically, a weaker dollar leads to a decline in Tether dominance (USDT.D) due to a decline in preference for stablecoins, which in turn tends to increase the relative value of virtual assets like Bitcoin.

Furthermore, expectations of a Fed rate cut lead to increased liquidity, stimulating a preference for risky assets. Lower interest rates diminish the appeal of safe-haven bonds, and investors tend to shift funds to riskier assets like stocks and cryptocurrencies.

Indeed, Bitcoin experienced a significant surge when expectations of a Fed rate cut in 2023-2024 grew. In 2024, Bitcoin reached a record high, fueled by the Fed's rate cut and the approval of a Bitcoin spot ETF.

Domestic investors are also sensitive

Domestic coin investors are also paying close attention to today's U.S. employment data release. If the scenario of a weak employment report, a weak dollar, and a rise in Bitcoin becomes a reality, it could create short-term upward momentum.

However, experts advised that "the employment indicator alone does not determine the market direction," and that "inflation indicators, comments from Fed officials, and geopolitical risks must be comprehensively considered."

Joohoon Choi joohoon@blockstreet.co.kr