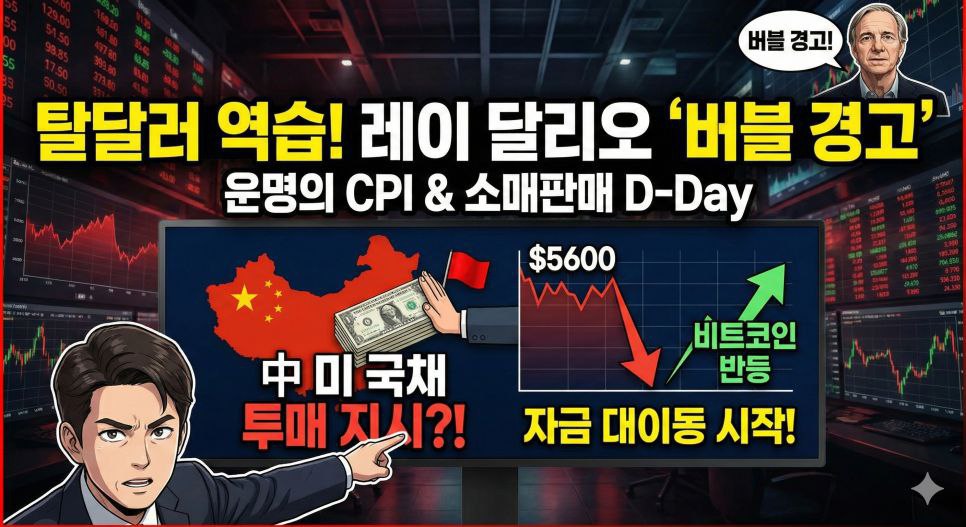

📕Hobby Life Research Written by "SB" 📌Key Issues of the Moment ✔️Ahead of the retail sales and CPI, two key indicators in the US, consumer inflation expectations fell significantly to 3.1%, falling short of previous estimates. ✔️A senior White House advisor noted that a shrinking US labor force and rising productivity could indicate a future employment slowdown, but also cautioned that concerns about AI are overblown. ✔️Fed Governor Miran stated that inflation and dollar concerns due to tariffs are overblown. ✔️However, reports emerged that China has unofficially ordered the sale of US Treasury bonds. ✔️The US dollar index is currently at 96.879, having reversed about half of its gains since the start of interest rate hikes. ✔️The dollar is weakening as China and other countries begin to move away from the dollar. However, we believe that dollar weakness will be limited until a substantial interest rate cut occurs. ✔️However, the dollar may strengthen following the CPI release this week (Friday, February 13th) and the non-farm payrolls index (Wednesday, February 11th), which is not good for risky assets. ✔️Nevertheless, gold, which had surged approximately 30% since early January, has reversed course and is currently fluctuating around $5,000, indicating that the rapid rally in assets has somewhat subsided. ✔️Bitcoin and Ethereum spot ETFs, which had consistently seen net outflows, returned to net inflows as of the February 9th trading day, suggesting a short-term bottom. ✔️Ray Dalio warned that the Federal Reserve is overstimulating the economy, creating a bubble, suggesting that we have entered a risky phase unlike any in the past. ✔️The US market, which had been seeing a shift in funds from growth stocks to value and consumer stocks, has rebounded after reversing excessive losses, but the Nasdaq index remains below its 60-day moving average. ⚖️ Summary The downward trend in consumer inflation expectations signals a slowdown in inflation, but also a signal of recessionary concerns. Personally, I believe the CPI, whether it's lower or higher, won't have a significant impact. (It's likely to remain flat.) However, if retail sales aren't strong, this could be bad news for risky assets. Funds are shifting from "highly rising assets to less-higher assets." #International

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content