Not long ago, Vitalik Buterin, co-founder of Ethereum, predicted three areas of opportunity in 2023 in an interview with David Hoffman, co-founder of Bankless, namely wallets, anti-inflation stable coins, and Ethereum-based website login services (SIWE) .

Recently, many well-known people and institutions in the industry have released reports, reviewing the encryption winter of the past year and providing an outlook for 2023. What new trends or potential track codes are there that deserve attention?

01

SIWE: One Ethereum address to log in all web applications

Among them, compared with the two old-fashioned topics of stable currency and wallet, SIWE (Sign-In with Ethereum) is a relatively new technology-oriented concept in the perception of many people.

As a login standard jointly formulated by the digital identity authentication company Spruce, the Ethereum Foundation, ENS , etc. in October 2021, SIWE is actually a set of technical specifications for logging in to third-party web applications through Ethereum accounts, enabling users to log in to third-party web applications through Ethereum accounts and ENS profiles control their digital identities instead of relying on traditional middlemen.

In short, SIWE aims to reduce the difficulty of connecting Web2 applications or DApps to the Ethereum account system . We must know that the Web3 world lacks real and sustainable incremental users. This is a recognized pain point and a long-standing problem. Therefore, the key to being able to tell your own multi-billion growth story well through the circle-breaking effect.

And SIWE can help to do a good job of "incremental entry" - it allows the application to give users a different experience from traditional Web3 applications on the login page. It not only supports the login method of Web3 wallets such as MetaMask, but also supports mobile phone numbers. , email, Google account, Apple account, Facebook and other traditional Web2 login methods.

This means that more Web2 users outside the circle can directly enter Web3 games with Web2 login methods (email, Google account, etc.) and enjoy a smooth login experience without having to understand, create and back up themselves from scratch A set of private key system and account identity system.

In addition, although SIWE can reduce the connection threshold between a wider range of Web applications and Web3 users, it does not mean that it is as simple as simply integrating encrypted wallet logins into traditional Web applications.

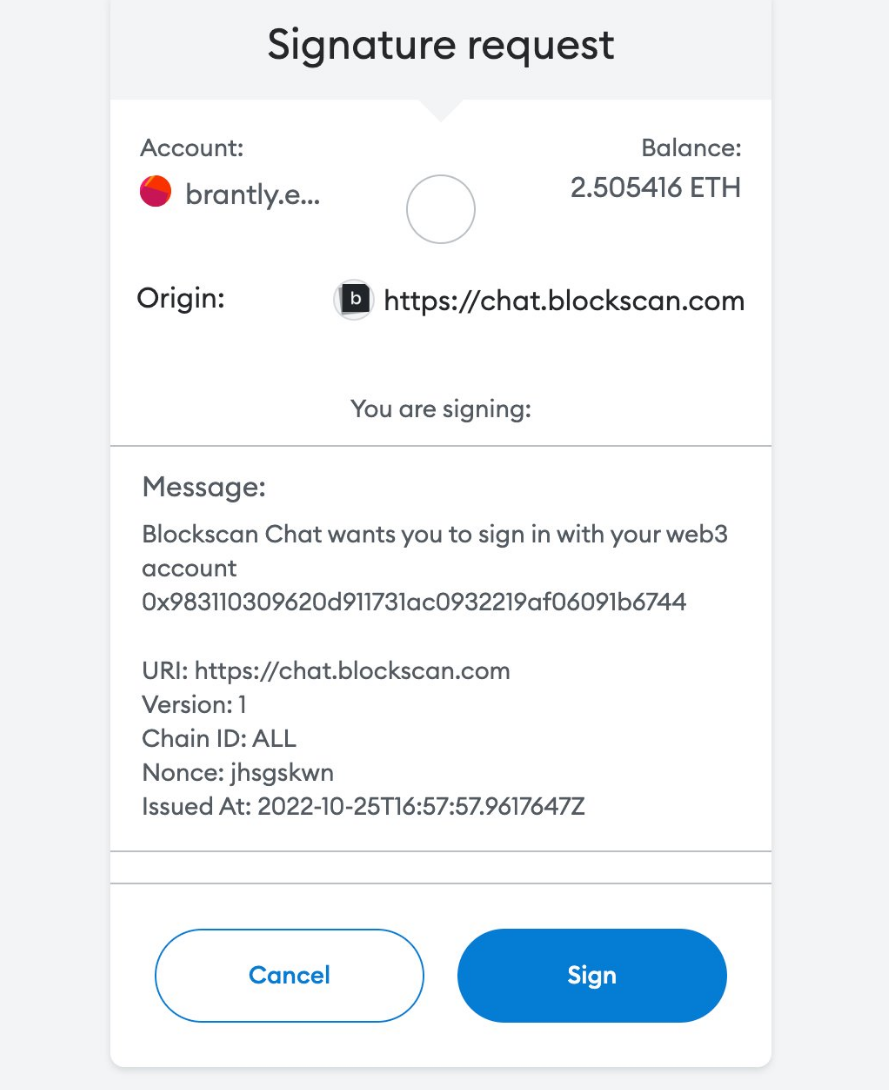

According to the previous introduction by Brantly Millegan, compared to directly using the MetaMask wallet "Connect" to connect to the wallet, SIWE has an additional step of signing messages with the wallet:

This step is also the core of SIWE, by signing a message, the user can prove that there is a corresponding private key (not revealing what it is), and then the server can use it to match the user with other users in the system.

That is to say, the private key basically acts as the user's password to log in to the corresponding server, "securely log in to all web applications through the same private key", which is also the key vision of SIWE to provide Web3 users with account ownership and data ownership. No wonder Vitalik It will pay special attention to its imagination in 2023.

02

Can stablecoins and wallets "sprout from old trees"?

In 2022, the collapse of Terra in May brought a huge impact on the stable competition track, especially the algorithmic stablecoin, which profoundly affected the evolution of its internal and external structure; then the FTX crisis in November intensified users' distrust of CEX, The outflow of market funds to the chain has become a new trend, and the importance and attention of wallets have become increasingly prominent.

- The "Elephant in the Room" Stablecoin

Specifically, in the stablecoin track, although DeFi, NFT, and DAO have successively occupied the center stage of cryptocurrencies in the past few years, stablecoins, as the "elephant in the room", have been growing steadily and become the largest in the crypto industry. , one of the fastest growing tracks.

According to CoinGecko data, as of January 11, the total market value of stablecoins exceeded US$137.8 billion, a significant decline from the US$180 billion at the beginning of 2022, but initially major players such as USDT, USDC and DAI still dominated.

At the same time, although UST is out, there are still competitors trying to FEI, FRAX and other protocols have their own unique designs and adopt different distribution strategies.

Therefore, the risk and fierce competition of the stablecoin track in the encryption industry are very high , but the potential market size is in the trillions of dollars, especially USDT has already taken a step out of the circle, and it is used in many interesting applications such as the World Cup. All scenarios appear as optional new payment options, and it is worth paying attention to in 2023.

The anti-inflation stablecoin mentioned by Vitalik should benefit more from the background of the global inflation in 2022. It refers to the category of stablecoin that is anchored to the CPI for flexible adjustment. Previously, AMPL and other similar products have been practiced.

- Wallets: An old topic with a new twist

In terms of wallets, whether it is the increasingly popular MPC or the social wallet based on smart contracts, they are actually old topics that are constantly radiating new ideas.

Among them, the core idea of MPC is to disperse control rights to achieve the purpose of dispersing risks or improving disaster preparedness, effectively avoiding security issues such as single point of failure. In the context of the industry black swan in 2022, which will continue to lead to the intensification of the trend of decentralization, MPC is very popular. Favored by institutions and project parties, it is expected to continue to be popular in 2023 and gradually become the industry standard.

As for the social wallet based on smart contracts, the previous " It is more worrying than the huge loss in the plunge, and the encrypted assets are lost in vain. Can the social recovery wallet come in handy?" As explained in the article, its core idea is that each participant has some influence on the ability to accept or reject transactions, but no one can unilaterally move funds.

In addition, it is not only safe enough to meet the needs of wallet recovery, asset inheritance, etc., but more importantly, it is user-friendly and simple enough. For the encryption market where a large number of users enter the market, it may well be a possible breakthrough point for traffic entry in 2023.

03

Other crypto outlooks for 2023

In addition to Vitalik's 2023 crypto outlook, there are some other high-profile predictions.

For example, recently, more and more KOLs have begun to mention the so-called "GameFi beyond the bull-bear cycle" . Messari said that he is first bullish and then bearish on Web3 games, and this field may be overhyped.

In addition, including the familiar zero-knowledge proof and zkEVM, a16z, Pantera Capital, NewOrder, etc. are all very optimistic in their 2023 forecast reports. Now in the context of the depressed sentiment in the encryption market, zero-knowledge proof, especially zkEVM, will be used in the entire encryption in the future. The role played by ecology is particularly important, and it is expected to be one of the most concerned topics in 2023.

Pantera Capital is also more optimistic about the Tokenization of real-world assets that MakerDAO and others have been promoting, and believes that by 2023, more real-world assets will be mapped to the blockchain, and these assets may have more interesting applications, such as There may also be an increase in real estate, startups focused on bringing traditional financial institutions into the crypto space in a regulatory-compliant manner.

In general, history always has the same rhyme, and the concentration of forecasts and outlooks of various companies basically tends to be the same, and most of them are deterministic tracks that everyone is already familiar with-zero-knowledge proof, GameFi, Tokenization of real world assets, stable currency and CBDC.

But looking back at history, we will find that the projects that can really detonate the industry and bring disruptive impact are often uncertain innovations, just like the Uniswap AMM mechanism at the beginning of this round of bull-bear cycle, it is difficult to get a more consistent prediction in the early stage .

However, history can be used as a mirror. Things like SIWE, zero-knowledge proofs, wallets, etc. that can be predicted or forecasted are generally deterministic tracks, which provide the underlying growth soil for uncertain innovations such as Uniswap, and can also help We can better see the essence, just like UST, which is short-lived.

There is nothing new in the encrypted world, and all predictions and prospects can find corresponding dark lines in past events.