Written by: SAM ANDREW

Compilation: TechFlow TechFlow

Ethereum has the characteristics of a productive asset that generates profits that go to token holders. But is it considered a productive asset like a stock? Does Ethereum's valuation multiple affect the price of ETH?

A valuation multiple is a heuristic for estimating the value of an asset. Google trades at 30 times earnings. Nvidia trades at 230 times earnings. If Google's current profitability lasts for 30 years, it will take 30 years to recoup its investment in Google. If Google's earnings grow, fewer years will be needed. Relative to Nvidia, Google's valuation is low. Price valuation, eg the difference between 30x and 230x, is not the only driver of return on investment, but it is an important one. Expensive assets like Nvidia have high growth expectations built into their current valuation multiples. If they fail to meet these high expectations, prices will plummet.

Similar valuation multiples can also be applied to cryptocurrencies. Market cap divided by total fees is a cryptocurrency's valuation multiple. Market capitalization represents the market's current perception of an asset's value. Fees are the gross revenue generated by the protocol. A blockchain's revenue is similar to the profits it distributes across the network. Therefore, blockchain revenue and earnings multiples are the same.

What is Ethereum's valuation multiple?

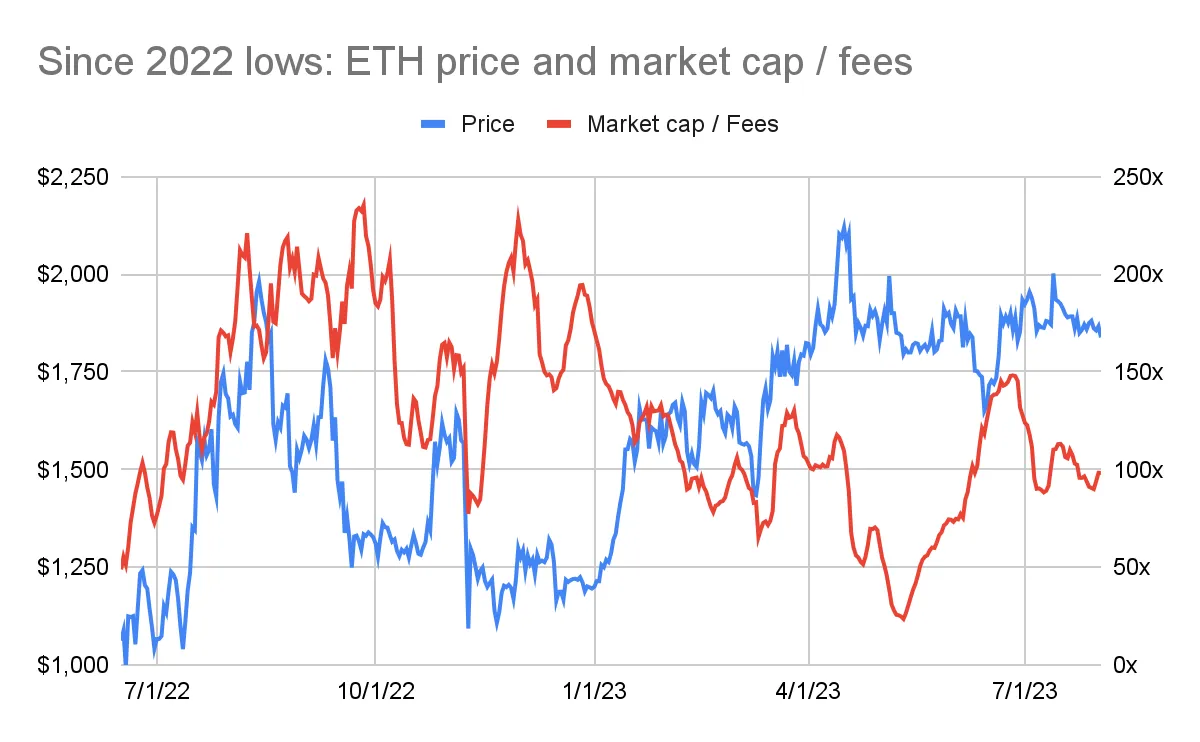

Ethereum is currently trading at 100 times its seven-day annualized fee valuation. Since summer 2022, Ethereum's fee multiple has fluctuated between 25x and 235x (see chart below: ETH price and market cap/fees since 2022 lows).

unexpected relationship

The chart above shows the inverse relationship between Ethereum price and valuation multiples. The best time to buy Ethereum is at the end of 2022, when the price of Ethereum is around $1200. However, at exactly that time, Ethereum’s valuation multiple was even higher, reaching 200x fees . By the spring of 2023, the price of Ethereum is close to $2000, but its fee multiple drops to 50-100 times.

The inverse relationship between price and valuation multiples was unexpected. Typically, an asset is more valuable as an investment when its valuation multiple is lower. Multiples are typically lower until an asset hits an inflection point. The market realizes that assets are undervalued. Prices started to rise and so did valuation multiples.

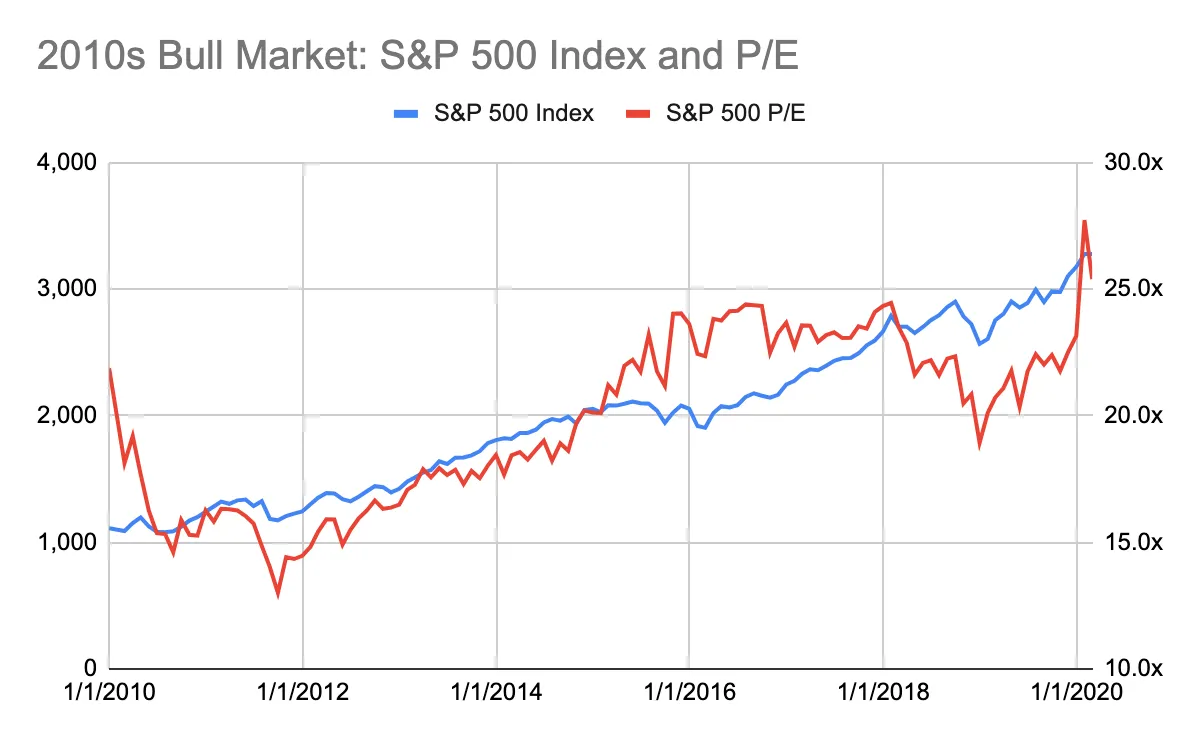

The chart below (2010s Bull Market: S&P 500 and P/E Ratio) illustrates the general relationship between price and multiples. It describes the bull market in the U.S. stock market in the 2010s before the outbreak of the new crown epidemic. At the start of the decade, the S&P 500 traded at about 15 times earnings. The S&P 500 has averaged 18 times earnings since 1928 and 26 times since 2000. The inflection point came in 2011, when the U.S. emerged from the global financial crisis with interest rates near record lows. Since then, the price and multiple have started to rise steadily.

So, what can we infer from Ethereum’s multiples?

Do Ethereum's multiples indicate whether ETH is "cheap" or "expensive"?

How does "cheap" or "expensive" translate into ETH's price performance? Is this an indicator of a good buying opportunity like the stock market?

These questions can be answered by analyzing historical data.

Over the past five years, the price of ETH has risen from $10 to over $4,000. This 400x price move makes it difficult to see the relationship in one chart. Instead, we can highlight different periods to illustrate trends.

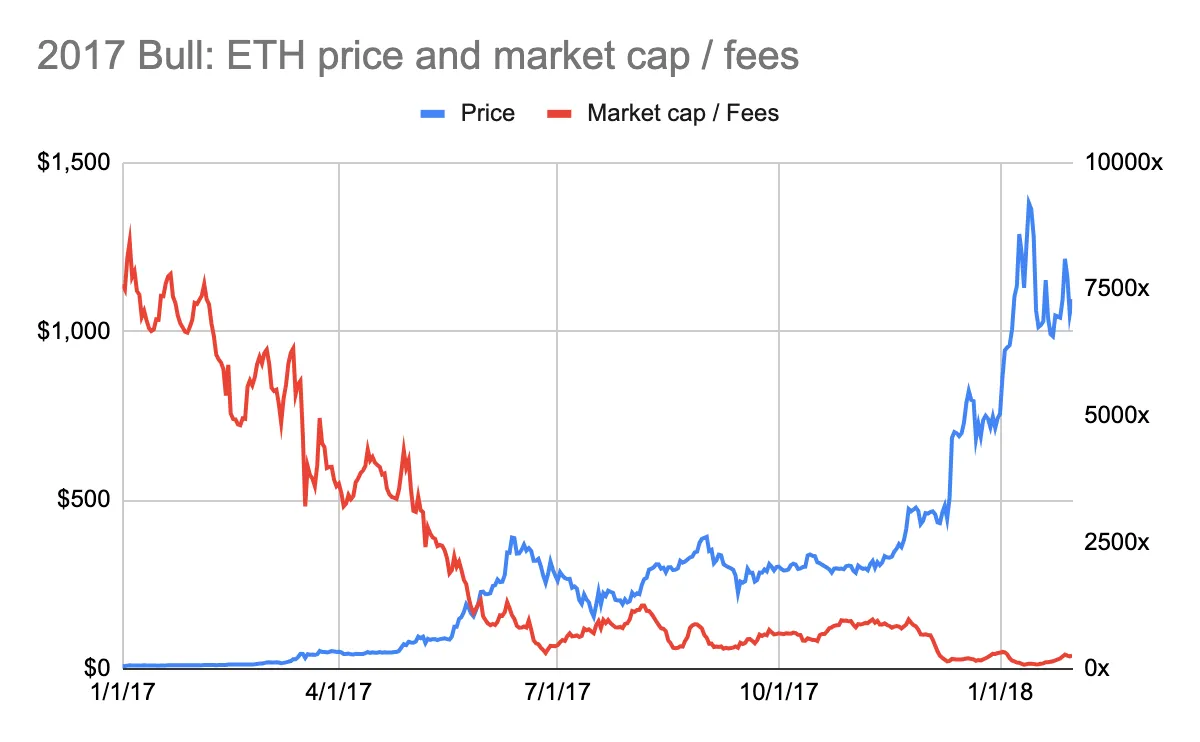

The 2017 bull market highlighted the inverse relationship between multiples and prices. In early 2017, Ethereum's multiple hit a staggering 7,700x fees (see chart below: 2017 Bull Run: ETH Price and Market Cap/Fees). However, from a price movement standpoint, that was a great time to buy Ethereum at around $10. Subsequently, the price of Ethereum increased by 10 times, and the multiple dropped to 100 times.

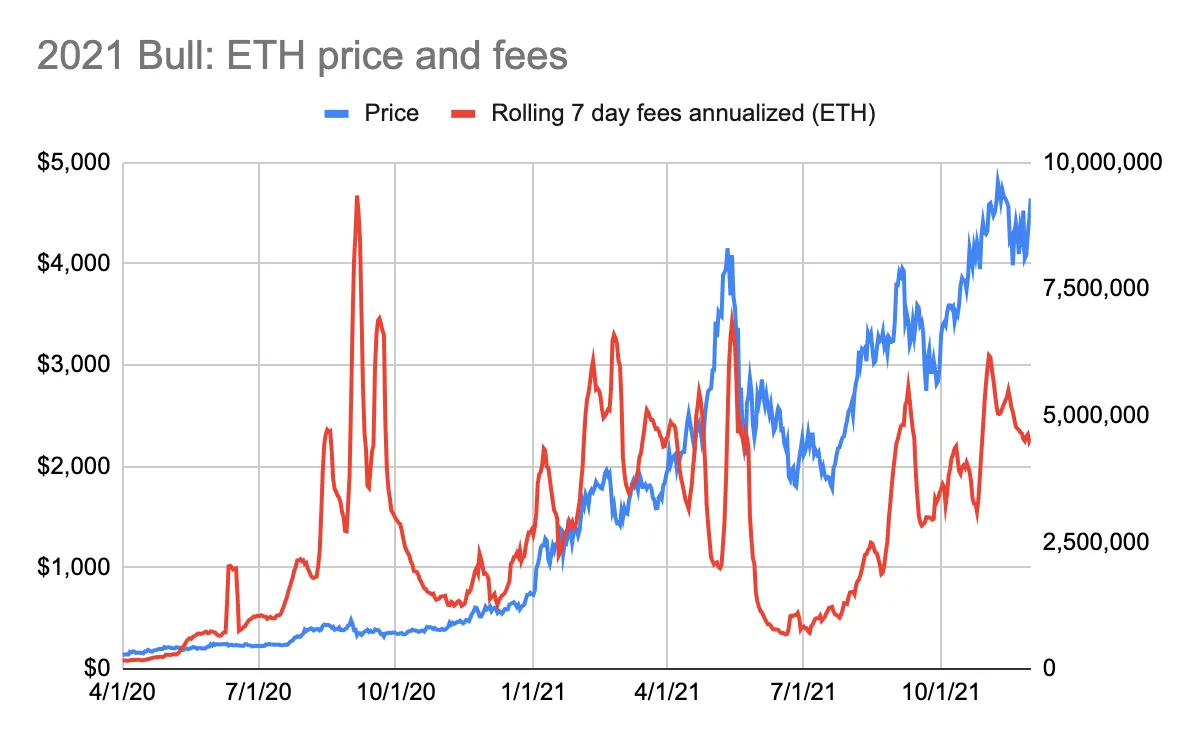

The 2021 bull market is showing the same trend. Buying Ethereum at around $200 in early 2020, when the Ethereum multiple hit 650x fees (see chart below: 2021 Bull Run: ETH Price and Market Cap/Fees). The price of Ethereum increased by 24x while its fee multiple compressed to 22x.

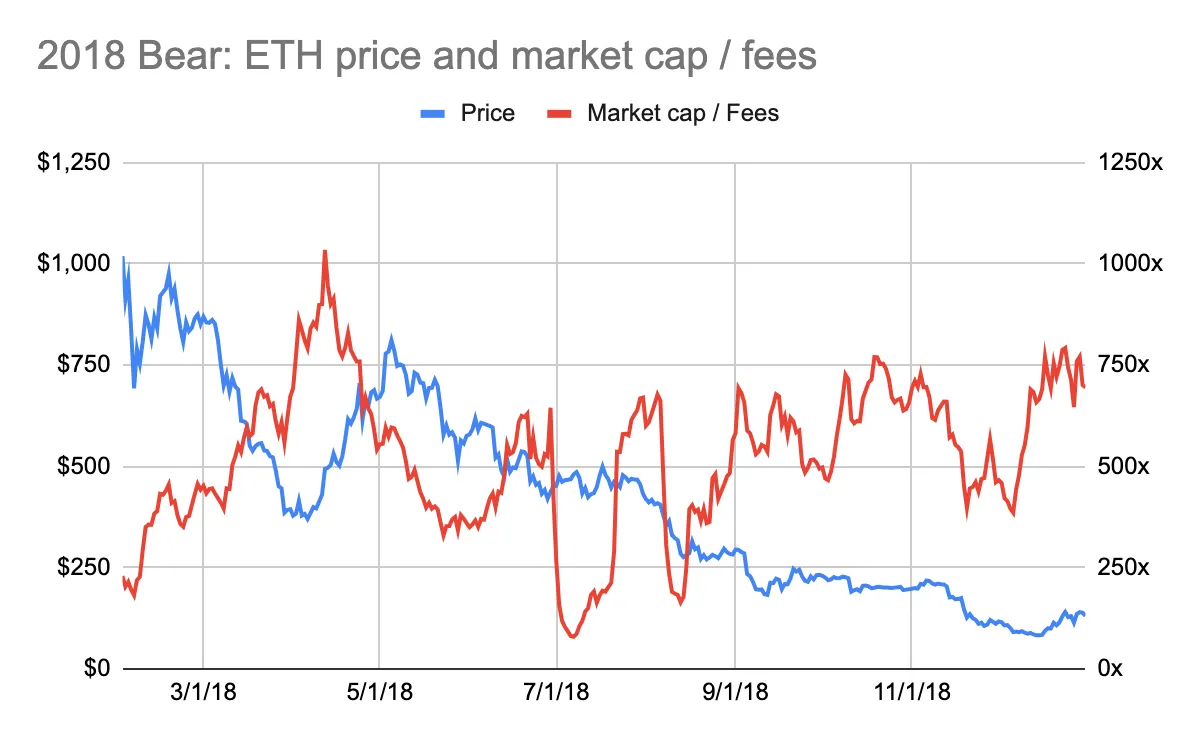

The bear market in Ethereum also exhibited the same inverse relationship. In early 2018, the price of Ethereum peaked near $1000, and at the same time the multiple of Ethereum dropped to 200x fees (see chart below: 2018 Bear Market: ETH Price and Market Cap/Fees). And just a few months ago, Ethereum's multiple was over 3000x fees (see chart above: 2017 Bull Run: ETH Price and Market Cap/Fees). This suggests that it is a good time to sell Ethereum at that time.

Likewise, in late 2021, the price of Ethereum hit an all-time high of over $4,000 while Ethereum's multiple dropped to 25x fees (see chart below: 2022 Bear Market: ETH Price and Market Cap/Fees). This suggests that it is a good time to sell Ethereum at that time.

multiple conclusions

ETH price and multiple are inversely proportional. History has shown that it is best to buy when ETH is trading at its peak P/E and sell at its trough. Buy when ETH is trading at its highest valuation multiple, and sell when it is trading at its lowest valuation.

This conclusion is indeed counterintuitive.

This is different from how productive assets such as stocks are traded.

How to explain this special relationship?

This counterintuitive conclusion can be explained by the following:

The market is forward-looking.

The value of Ethereum is not based on multiples of fees.

1. The market is forward-looking

Whether it is stocks, commodities or cryptocurrency markets, it is forward-looking. Prices reflect expectations about the future, not what has already happened. Think of it this way: A company's value is based on its future cash flows.

The market cap/fee multiple reflects Ethereum's fees at a particular point in time. The cost data used to calculate the multiple is the sum of the past seven days' costs multiplied by 52 weeks. It does not reflect the future fee potential of Ethereum. This cost data is not a forward-looking indicator.

Analyzing historical data confirms the forward-looking nature of the Ethereum market. During the 2017 bull run, the price of Ethereum rose before Ethereum fees (denominated in ETH) rose (see chart below: 2017 Bull Run: ETH Price and Fees). Note that prices did not drop as fast as fees in early 2018.

In the 2021 bull market, a similar but weaker trend emerged. As of May 2021, the price started to rise before the corresponding fee increase (see chart below: 2021 Bull Run: ETH Price and Fees). However, during the summer of 2010, fees nearly tripled without a corresponding change in the price of Ethereum. Furthermore, in early 2021, the increase in fees triggered a rise in the price of Ethereum. This reversal of sequence can be explained by the new crown epidemic. In the summer of 2020, people were locked in their homes. DeFi applications are exploding, and users are spending more on Ethereum fees as a result. However, the investment community is not paying attention to cryptocurrencies.

ETH price volatility in anticipation of Ethereum fee growth is most pronounced in bull markets. This relationship is neither disproved nor confirmed when ETH price is falling or trading sideways.

2. ETH is not valued on a multiple of fees

The market may not value Ethereum on a fee multiple. If the market does this, the ETH price and fee multiple should move somewhat in sync. The logic should be that a lower P/E ratio tends to imply a more attractive entry price, not the other way around.

Ethereum’s fee multiple fluctuates wildly and tends towards high valuation multiples. Since 2016, Ethereum has traded between 10x and 8,800x its fees. Since 2021, this range has compressed to 20x to 235x. Valuation multiples are still relatively high.

Ethereum has the characteristics of a productive asset, a commodity, and a store of value asset. Valuations for productive assets are based on multiples of earnings. Commodities and store-of-value assets are not. The difficulty in interpreting ETH's valuation as a fee multiple may indicate that ETH is viewed more as a store of value asset than a productive one.

However, there is a problem here...

If ETH is not viewed as a productive asset, why would the price fluctuate in anticipation of fee growth?

Prices are not supposed to fluctuate. After all, if ETH is a store of value asset, then an increase in Ethereum fees should not have much impact on its valuation.

But fees do have an impact on price.

How big is this effect?

Hard to say. ETH price is affected by several variables, including macro factors, regulation, and competition. It is impossible to determine which variable has the greatest impact on price.

In the world of cryptocurrencies, and Ethereum in particular, fundamentals such as fees matter. Fundamentals determine the health and prospects of a network. For layer 1 blockchains, fundamentals can only play a role in valuing the network. The value of the blockchain is largely reflected in its monetary attributes, that is, its ability to serve as a store of value and value transfer, and its ability to secure the network. Protocols and applications built on layer 1 blockchains rely more on their attributes as productive assets.

Therefore, you cannot derive the price of ETH by trading multiples. Ethereum's "cheap" or "expensive" multiples don't tell much. But ethereum's metric, its fees, drives price swings.