Original|Odaily Odaily

Author: Azuma

In September 2022, the decentralized asset custody protocol Safe (formerly Gnosis Safe) opened airdrop applications for SAFE tokens to approximately 43,000 eligible users. However, since SAFE has remained non-transferable since the beginning of TGE, users who received the airdrop have not been able to use their SAFE for trading or cashing out so far.

More than 500 days later, as the SafeDAO community voted to approve the proposal to "activate the SAFE transfer function" in the middle of this month, Safe officials have confirmed that SAFE will officially activate the transfer function today (April 23), which also means that the token will soon "remove its shackles" and enter normal circulation.

As the circulation of SAFE approaches, several leading exchanges including OKX and Bybit have announced that they will launch SAFE as soon as possible, which also gives airdrop benefit users and the entire Safe community more room for imagination.

This morning, Safe community governance member @Daniel published a long article on X, which detailed some historical information about Safe product positioning, economic model, and circulation status. Next, this article will use this as a basis to extract and explain the key information, hoping to help everyone prepare for SAFE.

Project History and Financing Status

Safe’s predecessor was called Gnosis Safe. The project was originally just a multi-signature tool for Gnosis team users to manage IC0 funds, but later the team decided to promote this internal tool as a public service.

With the development of the project itself and the iteration of industry narratives (especially the rise of the concept of account abstraction), Safe is no longer a simple multi-signature tool, but has transformed into a modular smart contract account infrastructure. It hopes to gradually replace the current mainstream EoA accounts through default smart contract accounts, laying the foundation for the further popularization of cryptocurrencies.

Safe has only one round of public financing history. In July 2022, Safe announced the completion of a $100 million strategic financing, led by 1kx, with participation from Tiger Global, A&T Capital, Blockchain Capital, Digital Currency Group, IOSG Ventures, Greenfield One, Rockaway Blockchain Fund, ParaFi, Lightspeed, Polymorphic Capital, Superscrypt and 50 other strategic partners and industry experts.

According to The Block's report at the time, Safe's valuation during this round of financing was US$1.25 billion, which means that SAFE's investor quota accounted for 8%, an amount that also coincides with the token economic model later disclosed by Safe.

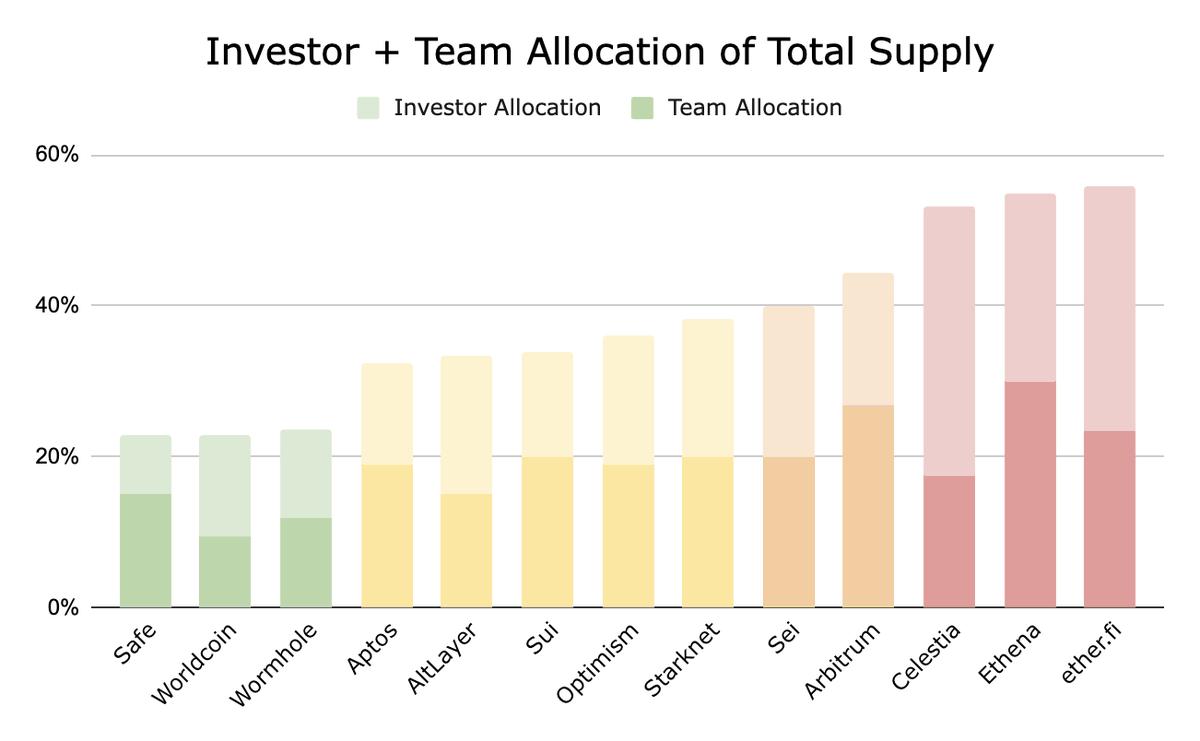

Odaily Note: Comparison of team quotas and institutional quotas of SAFE and some other mainstream tokens.

Safe Ecosystem Scale

According to Safe’s official disclosure, some key data of the current Safe ecosystem are as follows:

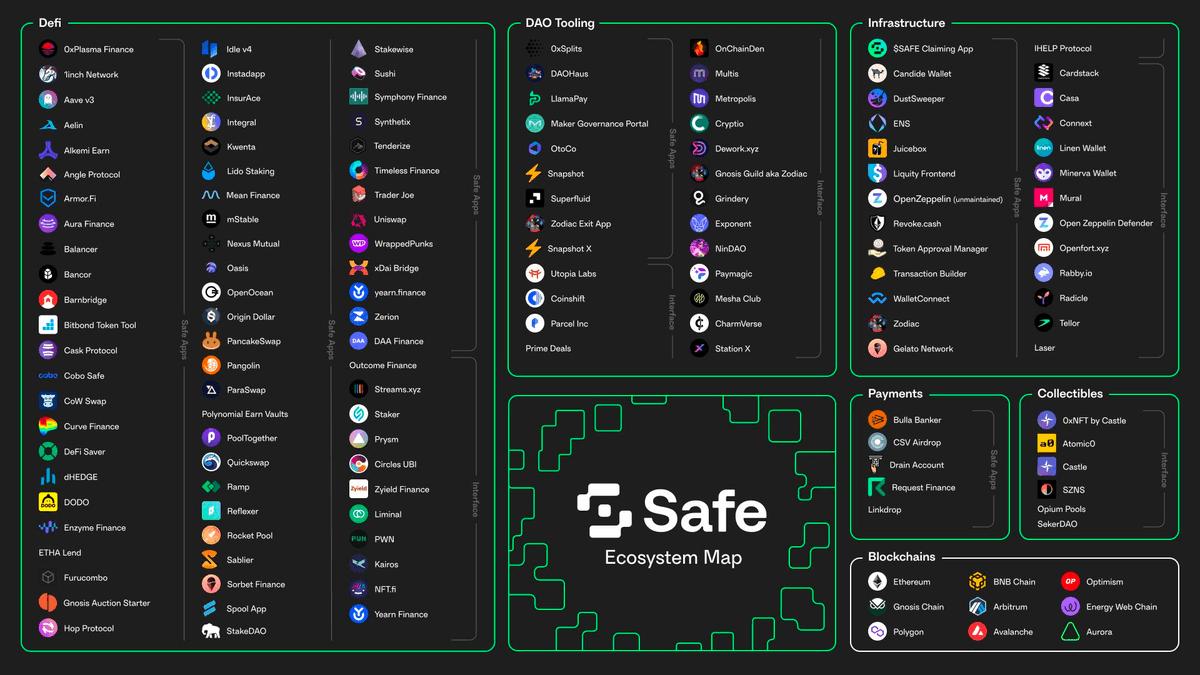

The number of networks supported has reached 14, mainly covering the Ethereum network and the pan-EVM ecosystem;

The number of integrated projects exceeds 190. The main services include helping DAO with treasury management and helping various DeFi, NFT, and institutions with fund custody;

More than 8 million smart contract accounts have been deployed;

More than 46 million transactions processed;

Total funds under custody exceed $100 billion…

In addition to the basic data, what is more potentially influential is that Safe has always been favored by some of the top players in the industry.

Worldcoin, another major project created by OpenAI CEO Sam Altman, has used Safe by default to deploy smart contract accounts for its users; Ethereum co-founder Vitalik is also a loyal supporter of Safe, holding 240,000 ETH through the Safe smart contract account, which is almost his total ETH holdings; Bybit also has two hot wallets that use Safe's smart contract account.

Token Economic Model

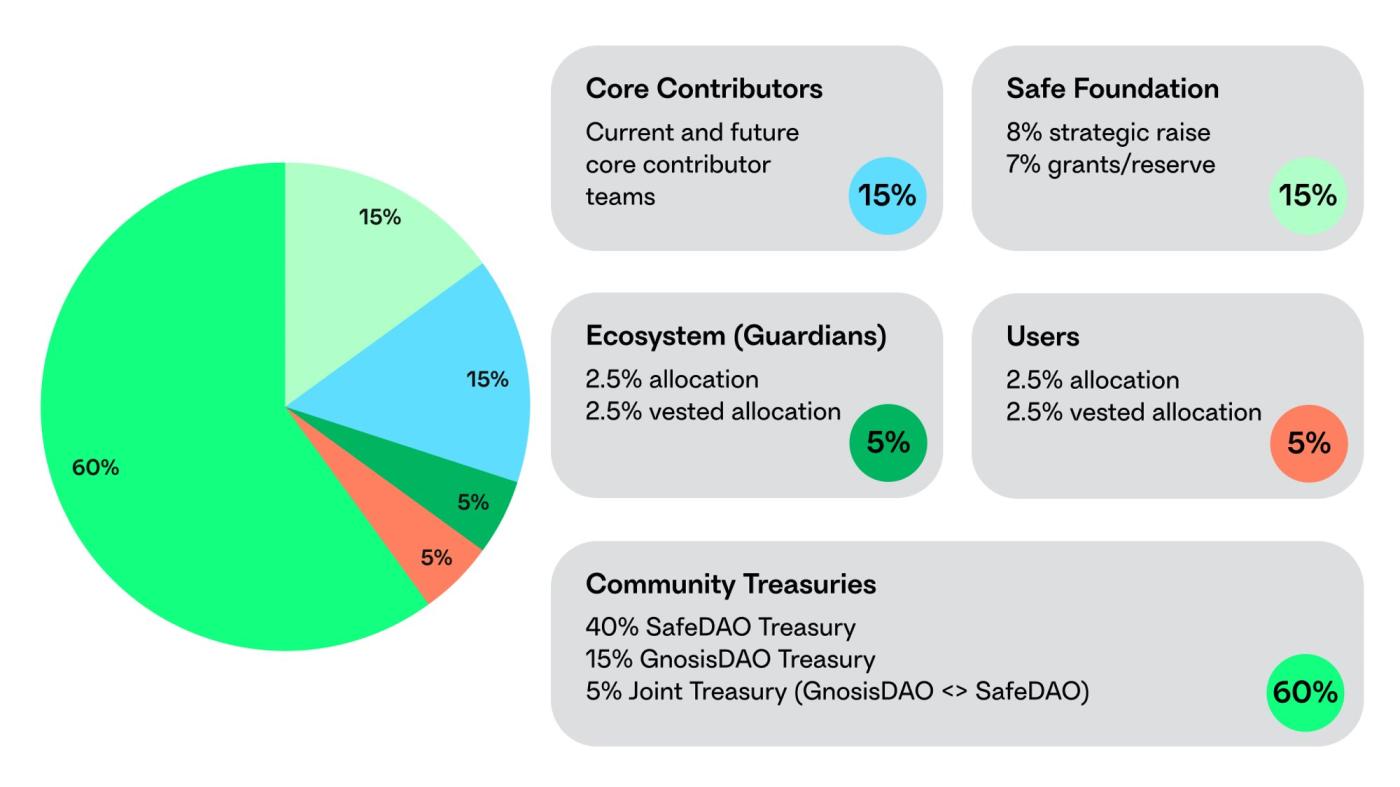

According to the token economic model information disclosed by Safe, the total supply of SAFE is 1 billion, and the specific distribution information is as follows:

15% allocated to core contributors;

The foundation allocates 15% (including 8% investor share);

5% for the ecosystem;

2.5% allocated to users;

60% is allocated to the community treasury.

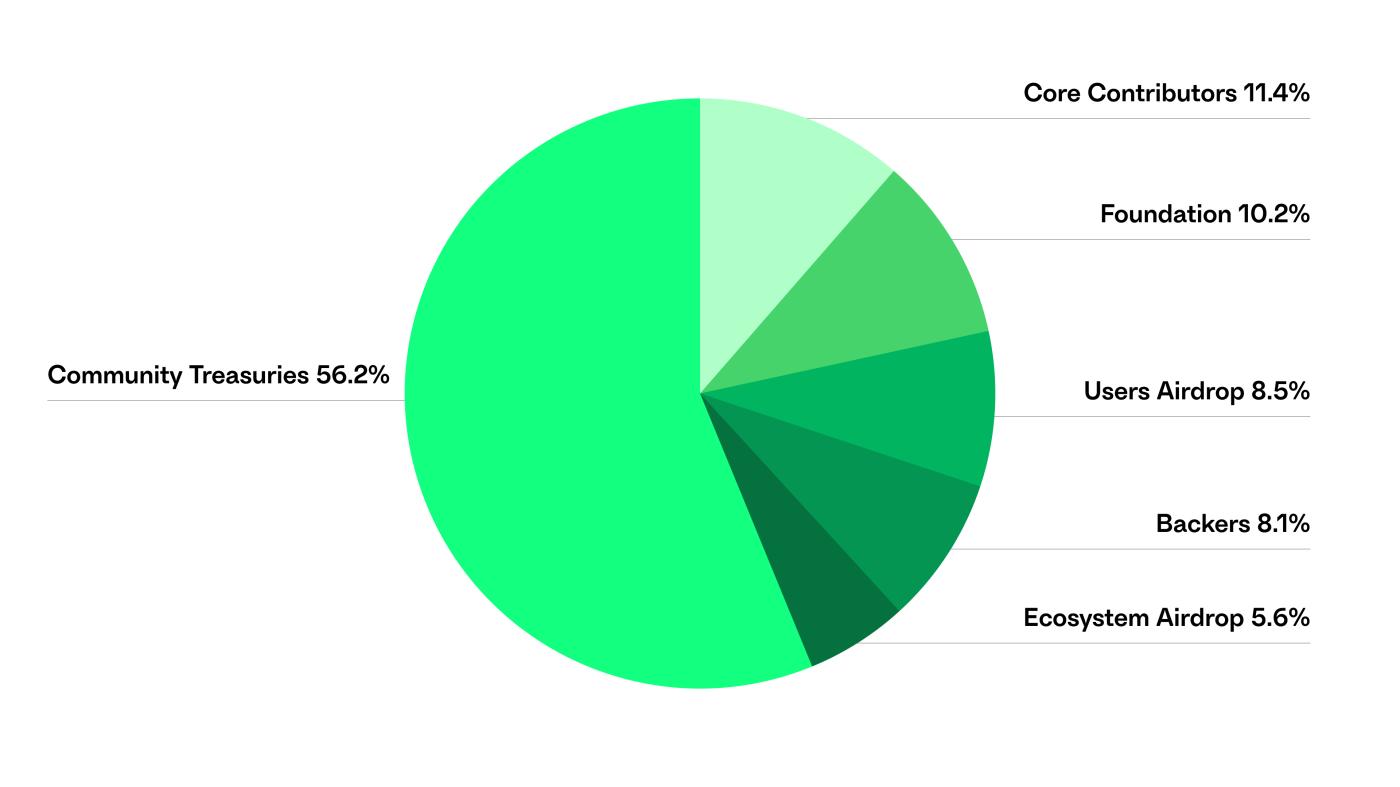

In addition, the theoretical initial supply of SAFE is about 427 million. Excluding the share belonging to the community treasury, the initial circulation supply of non-treasury is about 143.4 million. The specific distribution is as follows:

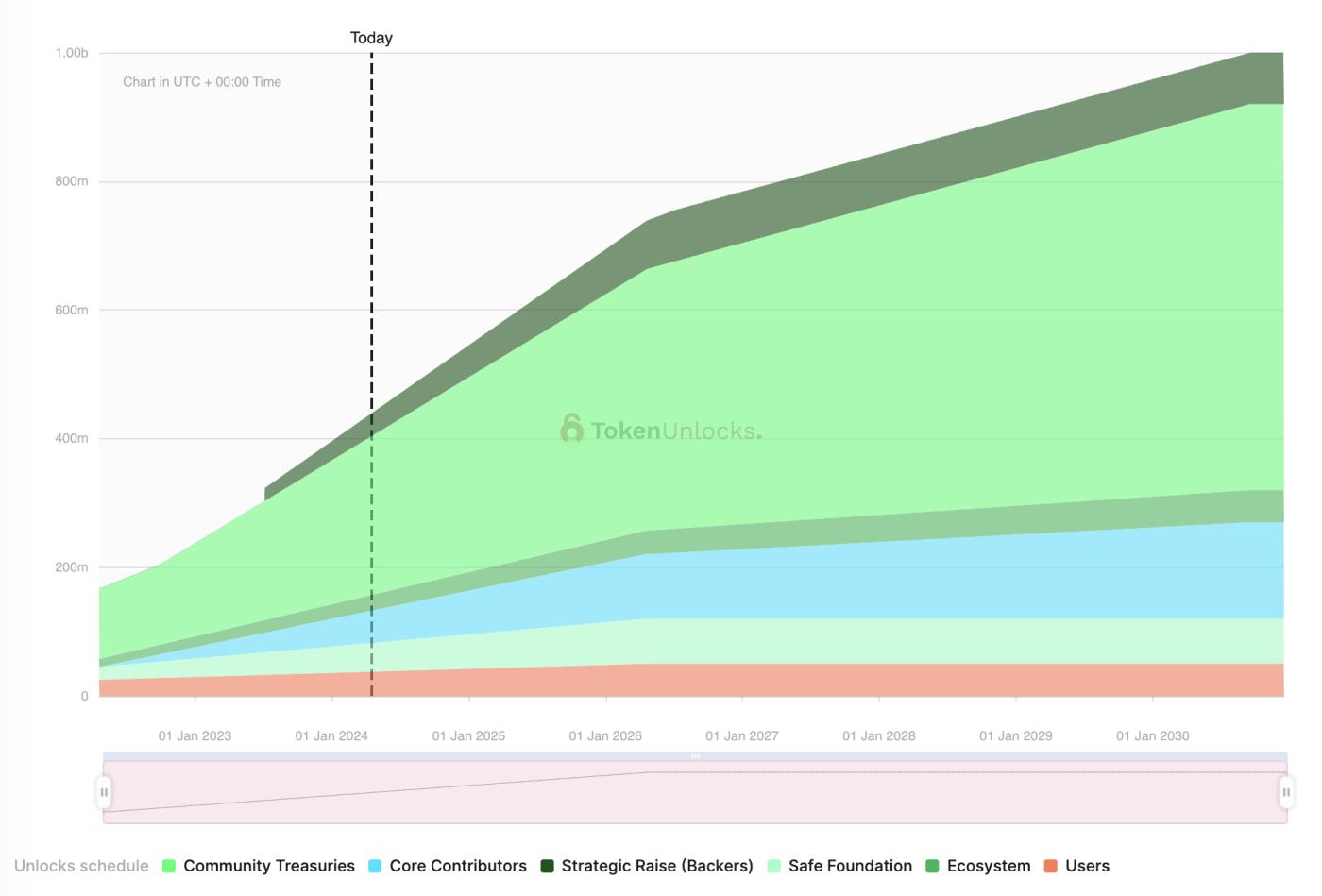

The detailed token unlocking progress can be seen in the figure below.

However, as a pioneering project in the emerging track of smart contract account infrastructure, and as early as 2022, SAFE's own circulation and status are relatively special, so it is difficult for us to find similar projects with which to compare valuations.

However, considering that most of the recent new projects have good FDV performance, and Safe's own fundamentals and track imagination are both excellent, we will be rationally optimistic about SAFE's opening performance.