Original title: Why create Reya Network

Author: Reya Network

Compiled by: Heilsman, ChainCatcher

This article is excerpted from the Reya Network official documentation.

Why create Reya Network?

Reya Network is not another general purpose L2, nor is it another hype narrative with no real substance. Instead, we solve real problems in DeFi scaling that cannot be solved by general design. As a DeFi OG team, we know what these problems are. Most importantly, we have found ways to solve them.

The most important limitation to DeFi expansion is the massive liquidity fragmentation that has emerged, with each new exchange built on a universal Rollup competing for a limited supply of liquidity. This leads to shallower markets across all exchanges, harming the interests of traders and market participants. Universal designs also inherit problems such as front-running and harmful MEV, and have performance limitations due to the inability to execute in parallel.

Reya Network changes the way we think about scaling. We believe that networks do not need to be general-purpose, but can be optimized for a single use case. By focusing on a single use case, we are not limited to technical improvements, but also focus on financial logic and liquidity. Therefore, Reya Network focuses on DeFi transactions and optimizes for the three pillars of liquidity, capital efficiency, and performance.

The three pillars of Reya Network

Reya Network liberates the DeFi application layer by creating an autonomous, professional and optimized infrastructure, addressing the following 3 core pillars:

fluidity

The capital invested in Reya Network is effectively used to support transactions through a novel passive liquidity pool mechanism. This design creates instant shared liquidity for all exchanges operating within the Reya ecosystem, enhances market depth, lowers market entry barriers, and enhances users' trading experience.

But the benefits of liquidity don’t stop there. By incorporating financial logic into the network design, Reya acts as a clearing protocol across exchanges. This eliminates liquidity fragmentation and allows liquidity to be organized as a network between exchanges.

As market makers can freely share liquidity between exchanges, the growth of the ecosystem strengthens the potential trading conditions on each exchange. In this way, we create the flywheel of “interoperable liquidity” for the first time in DeFi.

Capital efficiency

The margin logic is embedded into the Reya Network itself, which means that users have a single margin account that can be used across multiple exchanges. In many ways, this creates the first decentralized clearing house .

Reya Network’s margin engine logic is the most advanced in the cryptocurrency space, providing traders with up to 3.5x capital efficiency improvements and LPs with up to 6x capital efficiency improvements. Any exchange on the Reya Network will automatically inherit this logic as long as it runs on the network.

Performance

Performance improvements are critical, so we made Reya Network lightning fast. With a block time of 100 milliseconds and a throughput of up to 30,000 transactions per second, Reya Network is one of the fastest EVM rollups.

Additionally, transactions are executed on a "first-in, first-out" (FIFO) basis with zero gas fees, eliminating front-running and harmful MEV. This functionality is built using the Arbitrum Orbit technology stack. More optimizations will be made over time, including continued migration of application-specific logic into the network design itself.

The importance of performance cannot be underestimated - currently DeFi accounts for less than 5% of all cryptocurrency volume, in part because it cannot compete with the high performance and strong user experience of CeFi venues. However, when performance improvements are combined with modularity and the integration of underlying financial logic, why can't we finally capture CeFi volume and bring it on-chain for the first time? This will not only bring huge transaction volume to DeFi, but will also greatly improve transparency, robustness and composability for all traders who join our DeFi ecosystem.

The team behind Reya

Reya Labs, the creator of Reya Network, is run by a team of DeFi OGs that have launched multiple successful startups in the past, including Voltz Protocol, which grew to over $30 billion in notional volume in just 12 months.

We’ve received backing from some of the biggest names in the industry and raised nearly $10 million from VCs like Framework, Coinbase, and Wintermute.

route map

Reya Network is a revolution that happens in stages.

As a liquidity network, the first logical step is to launch the network with an inflow of liquidity. This is why first on our roadmap is the Liquidity Generation Event (LGE) scheduled for April .

After LGE, we will prove the concept of the Reya Network by deploying a fully functional permanent DEX, Reya Exchange. Reya Exchange will be the first exchange on the network and will also serve as a tool to attract more liquidity and traders, creating a strong network effect for subsequent exchanges.

Subsequently, Reya Network will be opened to other exchanges and eventually become the foundation for the survival of the new generation of DeFi.

Liquidity Generation Activities

Liquidity Generation Event (LGE) is when Reya Network bootstraps liquidity before trading begins. Since liquidity is critical to trading, our goal is to attract as much liquidity as possible.

The earliest LP will get an XP boost.

For example:

The earliest LPs to deposit into the pool receive a 10x return. This means that instead of accumulating (for example) 50% annualized XP, they receive 500% annualized XP on the capital deposited during this period.

LPs who deposit into the pool later may get 2x.

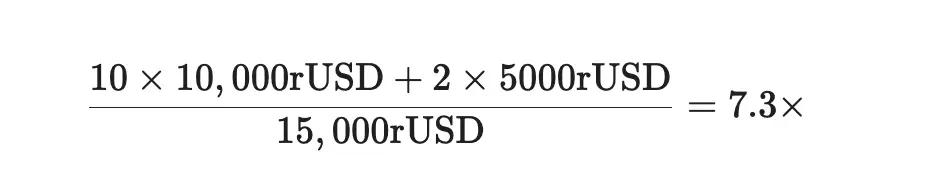

If multiple deposits have different boosts, the final boost will be calculated as a capital weighted average. For example, if you deposit 10,000 rUSD with a 10x boost and 5,000 rUSD with a 2x boost, your final boost will be calculated as follows:

LPs will continue to utilize the capital deposited during the LGE until they exit. When you withdraw, you will lose the multiplier on the withdrawal amount (but keep the deposited amount).

- The mechanism is simple, you only need to stake assets to participate in LGE. The assets available for the phase are USDC from the Ethereum mainnet or USDC from supported L2.e. Other assets will be introduced later.

- Funds on the Reya Network are non-custodial and can be withdrawn at any time. A withdrawal button on the dApp will be coming soon to improve the user experience, but in the meantime, you can withdraw funds directly from the Reya Network smart contract. However, if you withdraw funds, you will permanently lose the XP boost that comes with withdrawing funds.

- The LGE starts at noon UTC on April 22 and will run until noon UTC on May 6. The Reya Perp DEX will then go live at noon UTC on May 7, which means trading will begin.

EVM compatible wallets can be used to connect to the LGE page. Funds can be deposited from Ethereum Mainnet, Arbitrum One, Polygon PoS and Optimism Mainnet.

- Related event link: https://reya.network/lge