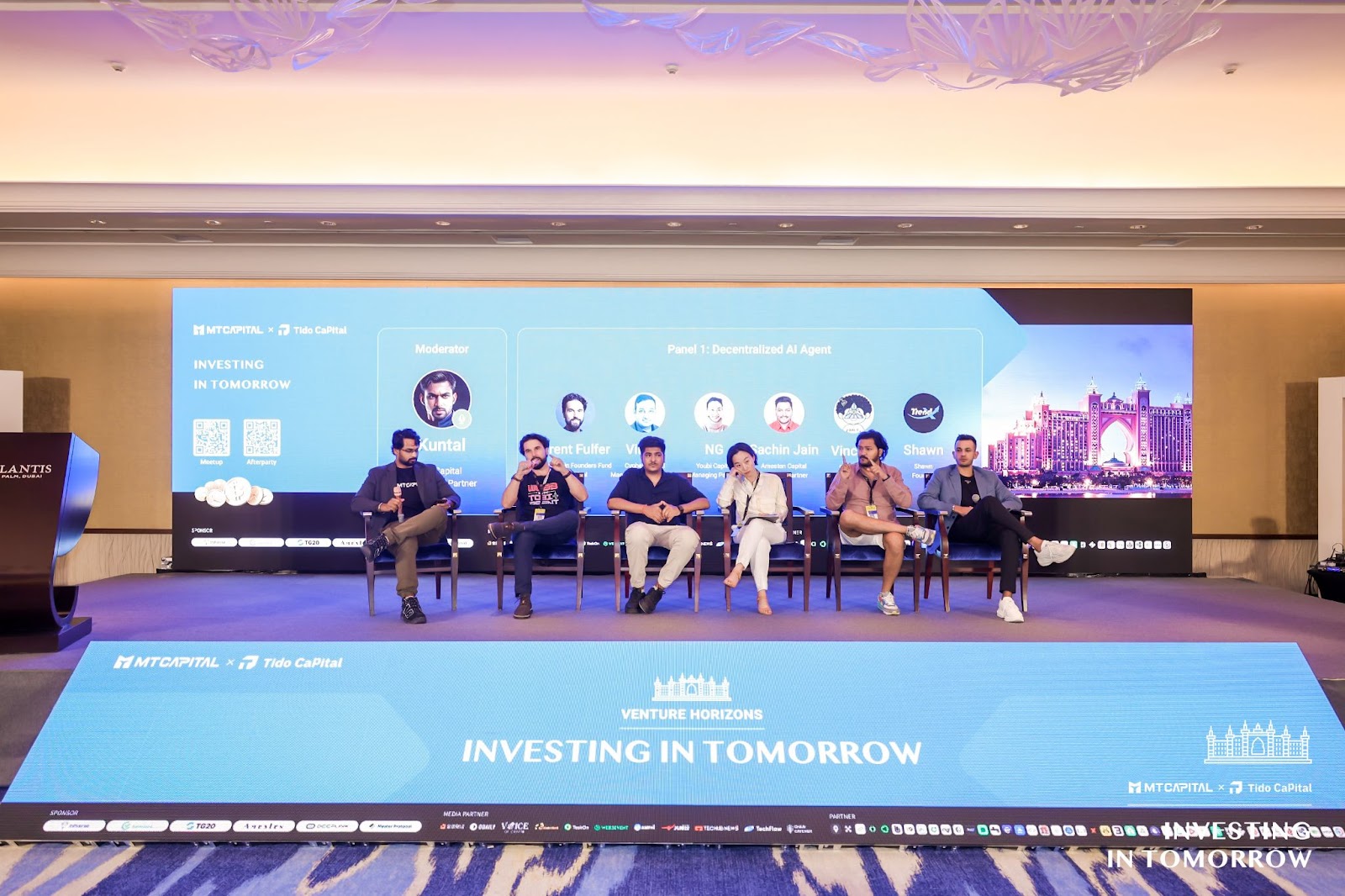

The “Token 2049 Venture Horizons: Investing in Tomorrow” event, hosted by MT Capital (Momentum Capital) and Tido Capital, successfully concluded on April 16 at the Atlantis Hotel in Dubai.

During the conference, numerous industry leaders and top investment experts engaged in in-depth discussions on new trends in the crypto market following the Bitcoin halving. Topics included the integration of AI and Web3, decentralized AI computing networks, and the future development of the BTC ecosystem. The aim was to provide participants with profound insights into future trends in the crypto market, exploring how technological innovation impacts the industry and how it drives the large-scale adoption of Web3.

Noa, founder of MT Capital (Momentum Capital), and Ian, partner, each delivered speeches, sharing MT Capital's vision and future investment strategy.

1. Why is the fund named Momentum Capital?

Noa: In physics, "momentum" represents a measure of an object's motion, reflecting the combined effect of velocity and mass. Similarly, in the investment field, momentum symbolizes our rapid response to market dynamics and the force driving projects forward. By grasping the right market trends, we can achieve steady growth even amidst volatility. The abbreviation MT Capital is also for ease of remembering.

2. Why choose to launch a new fund during the 2023 bear market?

The reason for launching the fund during a bear market is to ensure that, once the storm has passed, we can truly support entrepreneurs with substance, experience, and potential. From an investor's perspective, a bear market offers the opportunity to enter the market at a lower cost, allowing us to carefully select projects with genuine potential that will stand out when the market recovers. Looking ahead, I have full confidence in Momentum Capital and the projects we support. We will be committed to investing in companies and projects that solve real-world problems through innovation and bring positive impact to society. As technology matures and the market further develops, we will leverage the power of capital to make even greater contributions to the crypto space.

Ian stated: "MTCapital is committed to capitalizing on rapid market changes to ensure the continued growth and returns of crypto investments. MT's investment strategy leverages the dynamic developments of the crypto market to optimize investment performance. Our first fund has $50 million in assets under management (AUM), covering both primary and secondary investments."

Last year, in 2023, I met with Noa, and we agreed on the need to create a strong, pragmatic, and international fund to prepare for the new market cycle. Therefore, I left the investment team at a top cryptocurrency exchange where I had served for over two years and joined MT Capital. As the market has seen, Bitcoin's first halving occurred at such a turning point, and now, on the eve of the next halving, a cyclical shift in the market is taking shape.

MT Capital's mission is to translate this vision into real value. Noa and I both have over six years of experience in crypto investing, with portfolios spanning five regions including the US, Hong Kong, India, and Singapore. Our focus areas include native innovation, decentralized applications (DApps), gaming, and the integration of AI and DePin. We will create value for investors by driving innovative and practical projects and leveraging the rapid growth of the capital markets.

3. MT Capital's Investment Strategy & Focus on AI + Web3 Sectors in 2024

With the rapid development of blockchain technology and AI, their integration is seen as a key driver for unlocking a new generation of digital and economic innovation. By combining AI's data processing capabilities with blockchain's transparency and security, new application scenarios and business models are rapidly emerging. Decentralized data collaboration and sharing mechanisms not only optimize data acquisition and use but also enhance user privacy protection, providing richer and more diverse data resources for AI model training. As technology advances, the combination of AI and blockchain is also driving the utilization of decentralized computing resources, which not only lowers the barrier to entry but also improves the overall performance and reliability of the system. In short, the combination of AI and Web 3 heralds a more efficient, transparent, and decentralized future, which will greatly promote innovation and economic benefits across various industries.

Currently, MT is preparing for increased capital inflows in a booming market. From an investment perspective: First, it will focus on projects with original innovation, aiming for high alpha returns. Second, DApps and games, which help users migrate traffic to Web3. Third, Web3 technologies combined with AI, hoping to solve existing AI problems, such as providing more choices and strengthening data privacy protection. Fourth, vertical sectors like DePin, which helps achieve better interaction between real-world users and Web3.

At the end of last year, MT invested in: Sidequest, a community focused on Web 3.0 and game discovery, which has now entered the Binance MVB and is currently in the MVP stage; and Catizen, which I am very optimistic about, which gained 2 million users on Telegram within a month, with over 400,000 daily active users. Another investment was bitSmiley, the largest native stablecoin protocol on BTC, supporting numerous BTC L2 cryptocurrencies.

Furthermore, Ian believes that Bitcoin ETFs are driving traditional capital into the crypto market. This process is expected to last for about six months, thus there is still an opportunity to attract significant traditional capital. Secondly, the Bitcoin halving will increase mining costs, from the current approximately $40,000 in electricity to $100,000. Therefore, a price of $100,000 per Bitcoin seems like a very likely future trend. Next, Bitcoin's dominance in the market is expected to increase rapidly in each cycle, especially during the middle boom phase, with the top 100 cryptocurrencies seeing more investment opportunities.

Finally, the global regulatory environment is becoming increasingly favorable towards cryptocurrencies. We have seen numerous approvals for Bitcoin-related ETFs and payment services in Hong Kong, Singapore, and the United States, indicating a long-term positive outlook for the upcoming Web3 environment.

Below is a wealth of valuable insights shared by the guests. Due to character limitations, only a portion of the key points expressed by the guests during the roundtable discussion are included:

Brent Fulfer, Blockchain Founders Fund Principal

Brent Fulfer: The potential and practical applications of combining AI and Web 3 technologies in the non-traditional application area of pet identification and passport services. I believe that by combining blockchain and AI, we can achieve data transparency and verifiability while optimizing service efficiency and user experience. This technological integration can not only create huge commercial value in the pet market but also meet the market's high demand for personalized and customized services. I believe that the combination of Web 3 and AI has enormous potential in opening up new markets and innovating business models, while also empowering traditional applications.

Vineet, Cypher Capital Managing Partner & CEO

Vineet: I see AI playing a crucial role in smart contract applications, especially in how it can be used to extract and process data from the network to support automated decision-making within smart contracts, such as automatic hedging and adjusting the loan-to-value (LTV) ratio. In this way, AI can not only improve the execution efficiency of smart contracts but also enhance the decision-making capabilities and responsiveness of the entire system.

Our investments are focused on simplifying the integration of AI with smart contracts, thereby reducing the need for multiple audits and accelerating the time-to-market. These projects significantly improve the efficiency of transaction and contract management by integrating multiple functionalities into the smart layer, enabling smart contracts to leverage AI to analyze data and automate complex operations.

In addition, I believe that privacy protocols and their importance for improving physical infrastructure access for retail users, as well as the potential applications of AI in optimizing Web 3 infrastructure, are crucial.

NG, Youbi Capital Managing Partner

NG: Let me talk about the strategies for combining AI with Web 3 technologies and their potential impact, especially in data processing, computing power, and algorithm development. I divide this combination of technologies into two main categories: Web3+AI and AI+Web3. In the Web3+AI context, AI is used as an enhancement tool, primarily aimed at improving product performance and user interface, making it more efficient and user-friendly. In the AI+Web3 framework, however, AI is not merely an auxiliary tool, but exists as a core product, demonstrating its central role and dominant position in product development.

Implementing AI applications in the Web 3 environment, such as processing and labeling data in a decentralized manner, not only improves data quality and usability but also enhances the overall transparency and trustworthiness of the system. For example, using Web 3 technologies for data labeling allows for the collection and verification of data in a decentralized environment, which can then be used to train and improve traditional Web 2 AI models.

Furthermore, the development of decentralized computing resources, such as the GPU market, allows AI systems to perform large-scale data processing and complex computational tasks. This decentralization of computing resources not only improves resource utilization but also lowers the entry barrier for AI projects, promoting broader innovation and participation.

Sachin Jain, Amesten Capital Founding Partner

Sachin Jain: I believe that with the proliferation of digital counterfeits and fake content, combining AI-powered predictive and generative models with the decentralized and transparent nature of Web 3 can significantly enhance the verification of the authenticity of digital content. Several projects I've invested in that leverage deep learning and blockchain technology to enter the prediction markets and DeFi space have demonstrated the potential of AI in financial prediction and decision support. This combination of technologies can not only address real-world security challenges but also drive innovation in financial products, such as supporting complex financial decisions through precise data analysis.

Furthermore, the combination of AI and Web 3 is crucial for improving the accuracy of digital identity verification and online security, highlighting the strategic significance of the integration of AI and Web 3 technologies. This combination provides strong technical support and broad application prospects for processing complex data, providing reliable security verification, and driving innovative solutions.

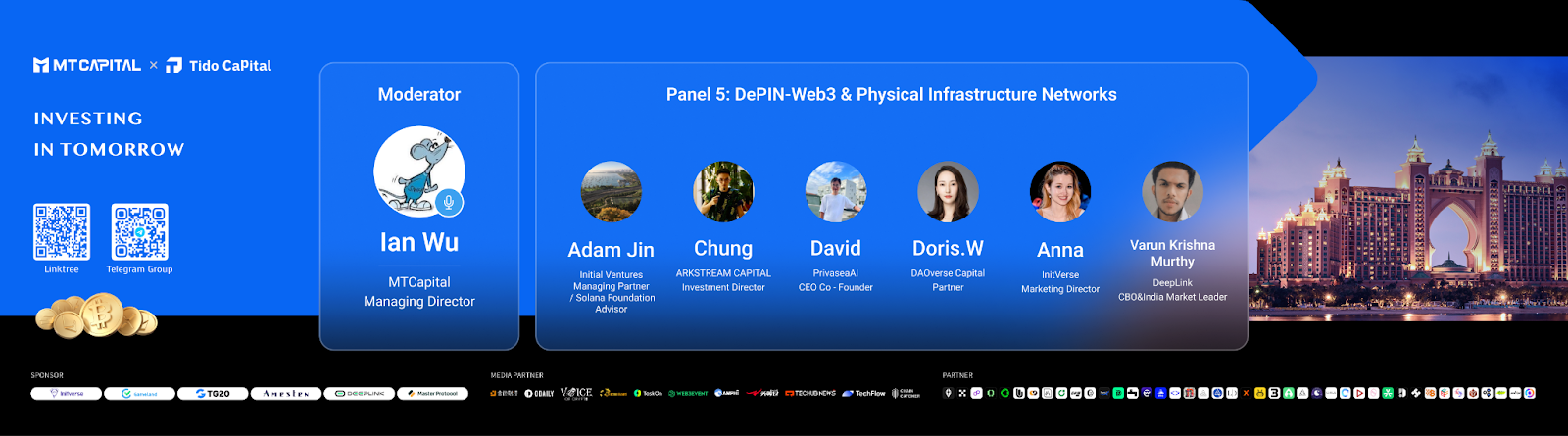

Roundtable 2: Decentralized AI computing power is also a current trend in AI + Web3

Mohit Pandit, IOSG Director

Mohit believes that the primary challenge to the widespread deployment of AI applications is acquiring high-performance computing resources (such as GPUs and CPUs) and large amounts of data, both of which are indispensable elements for AI model training. The high cost and difficulty in obtaining high-performance computing resources in the current market, especially against the backdrop of a global chip shortage, makes solving this problem through innovative technologies and business models an urgent issue.

By leveraging cryptocurrencies as a coordination mechanism, decentralized network platforms aggregate distributed computing resources. This model not only fully utilizes idle computing resources but also regulates supply and demand through market mechanisms, reducing costs. For example, expensive chips that have been purchased but not fully utilized can be more effectively shared with users who require significant computing power.

Without sufficient data, AI models cannot be effectively trained. Therefore, I support establishing a decentralized data aggregation platform that allows individuals and organizations to contribute their data. This not only solves the data scarcity problem but also encourages more data providers to participate through token incentive mechanisms, thereby forming a continuously growing and self-improving data ecosystem.

This decentralized computing and data aggregation model based on blockchain and cryptocurrency technology can not only solve the obstacles to computing and data acquisition in the expansion of AI, but also promote the democratization of AI technology, enabling more researchers and developers to enter this field at a lower cost and accelerating the innovation and application of AI technology.

Xinwei, MT Capital Head of Research

Xinwei: I believe that traditional centralized AI and computing platforms have many limitations, especially in terms of data protection and computing resource allocation. Centralized platforms often treat user data as a tool for profit rather than as an object of protection, which not only threatens user privacy but also limits the potential value of the data. In response, decentralized AI, by utilizing blockchain technology, can democratize data and computing resources, thereby protecting user data from misuse while increasing data transparency and credibility.

Another challenge of decentralized systems lies in parallel computing and resource scheduling. In traditional Web 2.0 environments, complex task scheduling and resource management can be achieved using mature technologies such as Docker and Kubernetes. However, in decentralized Web 3.0 environments, these tasks become much more difficult. This is primarily because decentralized networks lack a central authority to effectively coordinate resources, thus requiring new algorithms and protocols to ensure the efficient allocation and execution of computational tasks.

Furthermore, I believe the issues of data transmission and synchronization are also crucial, especially in efficiently handling large amounts of data within decentralized networks. I recommend advocating for data compression techniques to reduce the amount of data transmitted between nodes, thereby accelerating processing and reducing costs. This not only helps improve the performance of decentralized networks but is also key to enabling large-scale AI applications.

Scalability is a crucial aspect of decentralized AI, particularly in scaling network processing capacity while maintaining network consistency. This requires innovative consensus mechanisms and smart contract designs to achieve effective resource management and rationalize incentive mechanisms, ensuring the network can operate continuously and efficiently.

Darren, Bing Ventures Investment Director

Darren: In the current development of AI technology, how can we promote technological progress and widespread application by expanding computing networks? I believe vertical and horizontal scaling are very important, specifically the core elements and implementation methods of each scaling approach.

First, vertical scaling involves enhancing the depth of technology, including developing more efficient processing hardware and optimizing algorithms to make AI training and execution more efficient. This scaling not only focuses on improving hardware performance, such as developing better GPUs or dedicated AI chips, but also includes software optimization, such as algorithm improvements and system architecture upgrades. Through vertical scaling, the processing power of individual nodes can be increased, thereby accelerating the training process of AI models and improving response speed.

Secondly, the purpose of horizontal scaling is to expand the overall capacity of the system by increasing the number of nodes in the network, especially by introducing more data providers and computing resource participants. Decentralized AI networks rely heavily on a broad network of participants to provide the necessary computing and data resources. For example, attracting more retail computing power participants and small data centers through incentive mechanisms can effectively utilize idle computing resources and enhance the overall computing power of the network. This approach not only improves the network's redundancy and resilience but also enhances the generalization ability and accuracy of AI models through diverse data inputs.

Decentralized AI networks face challenges in implementing these scaling strategies, including effectively managing and scheduling distributed resources, and ensuring data security and processing efficiency. I believe that the application of decentralized technologies can address these issues by enhancing transparency and trust among participants. Meanwhile, emerging blockchain technologies, such as smart contracts and consensus algorithms, offer innovative solutions to these challenges.

Finally, from an investment perspective, when selecting AI and blockchain projects for capital injection, it is essential to consider their technological maturity, market potential, and team background. Through precise project selection and strategic investment, the development of decentralized AI networks can be promoted, driving the entire industry forward.

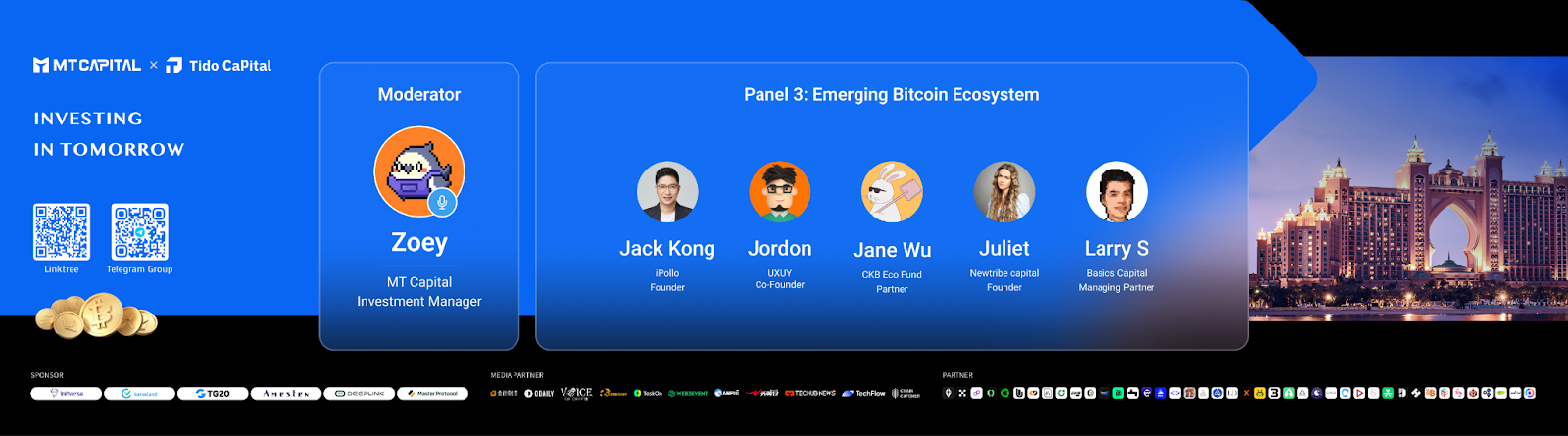

Roundtable 3: Besides AI, the development of the BTC ecosystem is also a hot topic in both primary and secondary markets. Especially around the time of the halving, new asset protocols within the BTC ecosystem have emerged frequently. How will the BTC ecosystem evolve going forward?

Jack Kong, iPollo Founder

Jack Kong: I believe the Bitcoin ecosystem has long-term investment value. The development of blockchain technology over the past fifteen years has proven Bitcoin's effectiveness in token issuance and transaction processing. These achievements provide a solid foundation for Bitcoin's continued growth and market stability.

Furthermore, emerging protocols on Bitcoin, such as BRC20 and the upcoming Runes protocol, are crucial. These protocols bring significant technological advantages to the Bitcoin ecosystem by optimizing the token issuance process. Compared to Ethereum's ERC20 protocol, a notable advantage of these new protocols is their independence from smart contracts, thereby reducing the need for security audits and potential security risks. This simplified issuance mechanism not only improves efficiency but also enhances the overall security of the system.

Through protocols like BRC20 and Runes, the Bitcoin network will be able to support more types of assets and transaction methods, which will greatly expand its application and influence in the global financial ecosystem. I predict that these improvements will propel Bitcoin to a more leading position in the global blockchain field, attracting more investors and developers to participate.

Jordan, Co-founder of UXUY

Jordan: I believe the future development of cross-chain DEX aggregators and Layer 2 solutions within the Bitcoin ecosystem is crucial. The BRC20 standard and the Runes protocol are vital to the Bitcoin ecosystem; these emerging standards and protocols offer new opportunities for asset issuance and trading, particularly in terms of improved security and efficiency. These innovations are key drivers of future growth for the Bitcoin ecosystem.

I am very optimistic about the future development of the Bitcoin ecosystem, especially in the areas of asset issuance and cross-chain transactions. I believe that with technological advancements and the maturation of the ecosystem, Bitcoin will be able to unlock more potential applications, thereby attracting more users and developers to participate in this ever-expanding network.

Jane Wu, CKB Eco Fund Partner

Jane Wu: I believe the CKB Eco Fund plays an important role in driving innovation in the Bitcoin ecosystem, especially in its work on asset insurance and Layer 2 solutions.

First, asset issuance protocols within the Bitcoin ecosystem are undergoing rapid development and evolution, particularly with the introduction of new protocols such as BRC20 and RGB++. These protocols are designed to enhance Bitcoin's functionality by optimizing the UTXO model, allowing for more efficient issuance and management of assets on the Bitcoin chain. For example, the RGB++ protocol provides the ability to implement asset insurance on Bitcoin Layer 1, leveraging Bitcoin's security and stability in a way that fully utilizes Bitcoin's inherent security and stability.

UTXO Stack, as a Layer 2 solution, leverages Bitcoin's infrastructure to provide fast, low-cost transaction processing capabilities. This solution represents a significant innovation for applications requiring high throughput and low transaction fees. Furthermore, CKB, as a client-side verification mechanism, provides additional flexibility and scalability for asset issuance and trading on Bitcoin.

I believe that while a variety of asset issuance protocols have emerged in the market, this has also prompted developers and investors to more carefully evaluate the advantages and applicable scenarios of each protocol. In the coming years, the market will see several major protocols stand out and become leaders.

Larry S, Basics Capital Managing Partner

Larry S: My primary focus is on venture capital in the Bitcoin ecosystem and the potential development of Layer 1 protocols.

First, Bitcoin's security and potential market leadership as a Layer 1 protocol are beyond question. The security of Bitcoin's underlying protocol is the most mature and reliable of all blockchain technologies, providing a solid foundation for upper-layer applications and innovation. Therefore, any expansion or enhancement of Bitcoin Layer 1 will directly benefit from its inherent security features, giving Bitcoin-based projects a unique competitive advantage.

I am optimistic about the long-term growth potential of AI and advanced projects within the current Bitcoin ecosystem, particularly their potential for further innovation and application within the Bitcoin infrastructure. As technology advances and the market matures, Bitcoin is becoming more than just a monetary system; it's a vast technological and financial ecosystem providing a platform for various innovations.

Finally, emerging Layer 2 solutions within the Bitcoin ecosystem are crucial and hold significant potential. While transaction processing speed and cost remain major challenges for Bitcoin, Layer 2 technologies, such as the Lightning Network and sidechains, can effectively improve processing speed and reduce costs. The development and application of these technologies will be key drivers of future growth in the Bitcoin ecosystem.

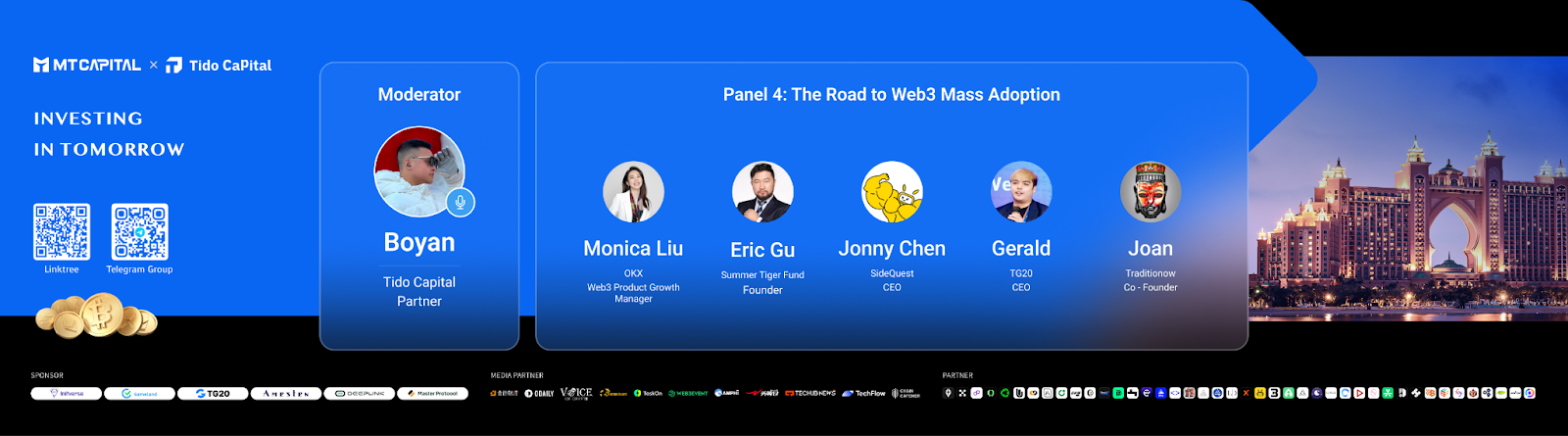

Roundtable 4: Web3 Mass Adoption is a topic that is receiving increasing attention and discussion. RWA, gaming, social networking—which applications in which sectors can bring mass adoption to Web3? And what is the future path for Web3 Mass Adoption?

Eric Gu, Summer Tiger Fund Founder

Eric Gu: I think there might be a problem-setting misunderstanding in the current discussion about Web3 adoption. We often talk about how to promote the adoption of technology protocols. For example, the TCP/IP protocol itself has never faced the question of "how to achieve mass adoption" because protocol-level adoption naturally spreads along with the expansion of the application layer. Therefore, I suggest that the focus should be shifted to specific applications built on top of Web3 or blockchain, which is key to driving widespread adoption of the technology.

Furthermore, in the Web3 field, the main challenge currently lies in infrastructure development, particularly the maturity of Layer 1 and Layer 2 solutions. We are still in the exploratory phase of the Layer 2 platform layer, and it is expected that the improvement of this infrastructure will be key to driving Web3 from a technological concept to the mainstream market within the next two to three years. By comparing the current Web3 infrastructure with the development of the traditional Internet, there are still shortcomings and room for improvement in existing technologies.

The strategy for promoting Web3 needs to focus on developing applications that can attract ordinary users, rather than simply focusing on protocol-level technical optimizations. In this way, we can more effectively promote the large-scale adoption of Web3 technologies and ultimately achieve their global popularization.

Adam Jin, Initial Ventures Managing Partner/ Solana Foundation Advisor

Adam: The transformative power of blockchain can significantly improve efficiency and user experience across various sectors. Key advantages of using blockchain in decentralized infrastructure include enhanced security, transparency, and the ability to execute transactions without intermediaries, which reduces costs and increases speed.

Furthermore, the integration of blockchain technology faces numerous challenges, particularly in terms of scalability and user adoption. Despite the significant benefits it offers, the technology still needs to overcome obstacles such as high energy consumption and complex implementation processes, which may hinder its mainstream acceptance.

Continuous improvements to blockchain protocols, such as layer-2 solutions and other technologies that enhance scalability, are crucial for enabling blockchains to handle higher transaction volumes while maintaining low cost and high speed. I believe this will make blockchain more accessible and applicable to a wider range of industries beyond finance, including healthcare, supply chain management, and even government services.

A regulatory framework that supports blockchain innovation and adoption is also crucial. Clear and supportive regulations are essential for fostering an environment in which blockchain technology can thrive and be securely integrated into existing economic and social systems.

I have a strong belief that blockchain will revolutionize the industry and that solving fundamental issues related to data security, transaction efficiency, and trust between parties will pave the way for a more interconnected and efficient global system.

In the interview, Gary shared his views on the currently popular meme scene.

Gary Yang, Eureka Meta Capital Founder

Gary: I think Meme coins transcend mere economic value, becoming a reflection of cryptocurrency culture and market dynamics. You can see that these coins attract people not only through humor and cultural phenomena, but also by showcasing the power of community and cultural resonance in the crypto market through their unique community building. For example, Dogecoin has built a fun and inclusive community with its Shiba Inu logo, and this community spirit is one of the key factors contributing to Meme coins' continued popularity.

From a market perspective, the performance of Meme coin largely reflects the emotional fluctuations of the crypto market. Its rapid price increases and decreases are often closely related to social media trends and celebrity comments, revealing the market's sentiment-driven nature. This phenomenon not only demonstrates the diversity of the crypto market and the broad acceptance among participants, but also highlights the potential bubbles and risks within the market.

Furthermore, to maintain its market position, Meme Coin requires strong community support and active media attention. Active community participation and loyalty, coupled with celebrity endorsements and sustained media coverage, have collectively driven Meme Coin's brand awareness and investment enthusiasm. In addition, Meme Coin's development necessitates continuous innovation and adaptation to new market demands. For example, by integrating new technologies such as DeFi and NFTs, it can provide community members with new use cases and value-added services, thereby maintaining its relevance and attractiveness in a highly competitive market.

Due to character limitations, the above is a selection of speeches from some of the guests. Thank you again to all the guests who attended!

The list includes: iPollo founder Jack Kong; OKX Ventures investor Benson; Foresight Ventures co-founder WhiteForest; Blockchain Founders Fund head Brent Fulfer; Hack VC partner Chichi; Cypher Capital managing partner and CEO Vineet; Access Capital founder Pablo Solano; Initial Ventures founder and Solana Foundation advisor Adam; Generative Ventures partner Will Wang; C^2 Ventures founder and managing partner Ciara Sun; IOSG head Mohit Pandit; EVG partner Jerome; CKB Ecosystem Fund head Baiyu; Eureka Group founder Garry Yang; Youbi Capital managing partner NG; AC Capital partner Vincent; Basics Capital managing partner Larry S; ArkStream Capital investment head Chung; Antalpha Ventures head Circle; MT Capital managing partner Kuntal; Kay Capital founder Kay; Newtribe Capital founder Juliet; Summer Tiger Fund founder Eric Gu; Amesten Capital founding partner Sachin Jain; and CoinW global president Sonia. Shaw, Stephen Cheung (Partner at WAGMi Ventures), Darren (Investment Director at Bing Ventures), Vandescent (Vice President at Edge Ventures), Sun Shuo (Founder of UXLink), Jordan (Co-founder of UXUY), and many other prominent figures from Web3.

About the organizer

MT Capital (Momentum Capital) is a global investment firm managed by a team of experienced investors, dedicated to investing in diverse and multicultural Web3 innovation projects across borders. Its portfolio covers the United States, Hong Kong, Dubai, and Singapore. Its main investment areas include:

1) Mass adoption: Decentralized social platforms, games, applications, and depin are key drivers of the spread of Web3 technologies to a wide range of users;

2) Crypto-native Infrastructure: Focuses on investing in public blockchains, protocols, and other infrastructure that support and enhance the ecosystem, as well as native DeFi solutions. In addition, the fund has a professional secondary trading team.

MT not only provides funding but also boasts a professional post-investment support team. Utilizing rigorous traditional VC mindset, MT helps companies grow by empowering them with resources, offering comprehensive support from market strategy to strategic planning. MT also assists projects in adjusting and optimizing their ecosystems and plays a key role in project interaction and traffic distribution.

The fund focuses on the Indian and Turkish markets, having already invested tens of millions of US dollars, demonstrating its commitment to long-term growth. MT, with its rigorous fund management and high-standard service, strives to be a powerful fund with a strategic perspective during the growth phase, aiming to continuously identify and support promising projects under various market conditions.

Official website: https://mt.capital/

Twitter: https://twitter.com/mtcap_crypto

Medium:

https://medium.com/@MTCapital_US

MT Capital would like to thank Tido Capital, the co-organizer of this event, as well as the more than 30 top VC representatives and outstanding project representatives. The success of this event would not have been possible without everyone's active participation and the support of the guests.

Thanks to our media partner: Jinse Finance

Special thanks to the event sponsors: InitVerse, Gameland, TG20, Amesten, DeepLink, and Master Protocol.