Author: David C Source: bankless Translation: Shan Ouba, Jinse Finance

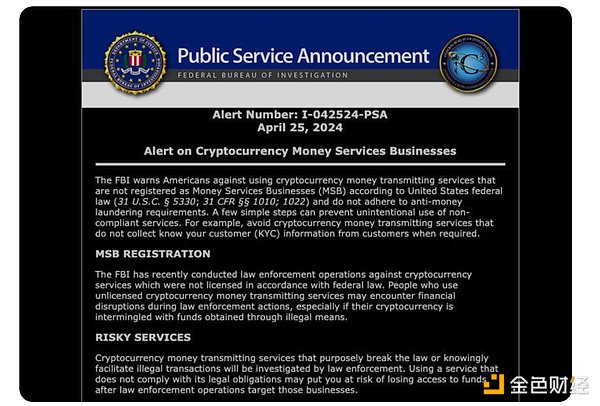

1. SEC and FBI attack cryptocurrencies

This week, controversy has arisen over the way the U.S. government has intervened in the cryptocurrency industry.

The U.S. Securities and Exchange Commission (SEC) has taken legal action against Ethereum as a security, and Consensys filed a lawsuit this week to fight back against the SEC’s regulatory overreach. Previously, Consensys disclosed that they had received a Wells Notice from the SEC, claiming that MetaMask was operating as an unregistered securities exchange.

It all seemed to come together this week, with the Federal Bureau of Investigation (FBI) also issuing a warning urging Americans to only use cryptocurrency services that are registered as money services businesses (MSBs) under federal law — which does not include self-custody services.

The U.S. government appears to be stepping up its regulatory efforts on cryptocurrencies and privacy lately, with even courts calling its actions in cryptocurrency cases an “abuse of power.”

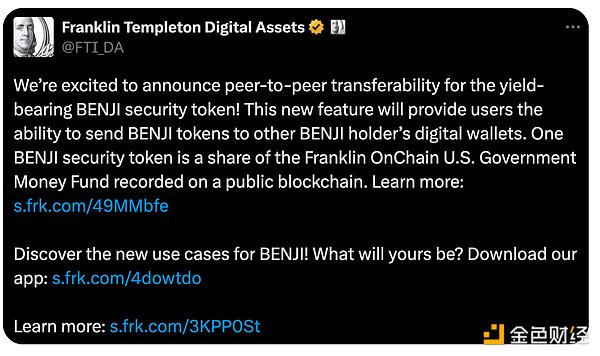

2. Franklin Templeton’s On-Chain Fund

Franklin Templeton, the fund known for its laser eyes and WIF hat on Twitter, announced the launch of its OnChain Money Market Fund on Thursday. The $380 million Franklin OnChain U.S. Government Money Fund is now live on the Stellar and Polygon blockchains, with its BENJI token representing a direct claim on government securities, cash, and repurchase agreements.

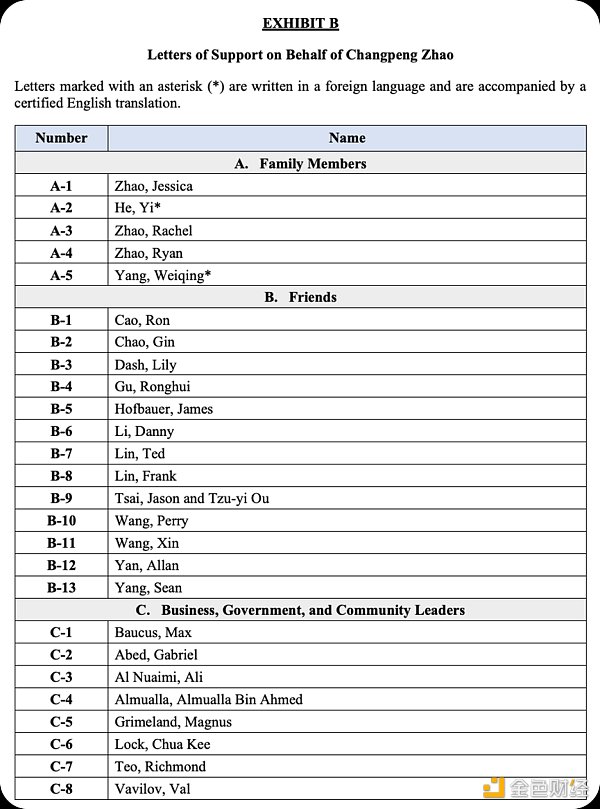

3. The Ministry of Justice wants CZ to serve 3 years in prison

The legal woes of former Binance CEO CZ continue to escalate as the U.S. Department of Justice pushes for a three-year prison sentence over allegations of sanctions violations and anti-money laundering failures at the exchange. While CZ’s defense claims ignorance of the specific transactions flagged, prosecutors argue that his negligence led to major compliance failures for which he must be held accountable. In response, CZ issued a heartfelt letter of apology and expressed his commitment to correcting Binance’s compliance deficiencies. Additionally, 161 letters from family, friends, and influential figures (such as the former U.S. ambassador to China and members of the United Arab Emirates’ ruling family) supported his request for a reduced sentence.

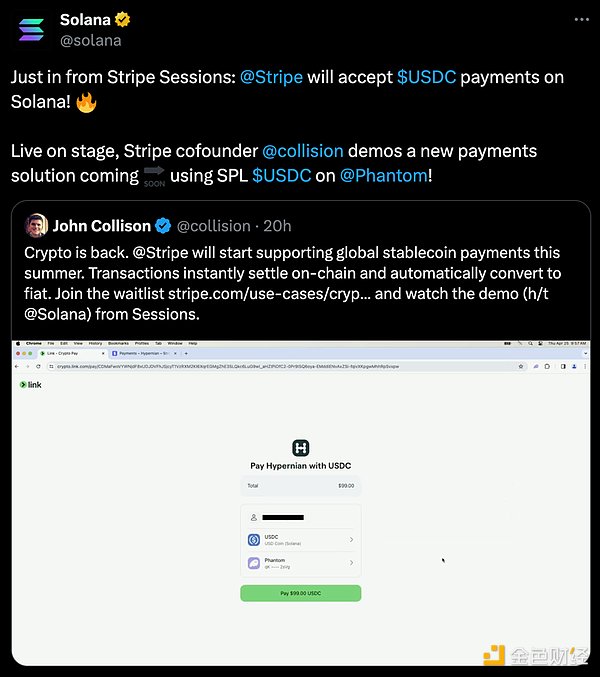

4. Stripe announces the upcoming launch of USDC payments

This week, fintech giant Stripe announced its re-entry into the crypto payments space, showcasing upcoming support for USDC on Solana, Ethereum, and Polygon. Stripe aims to position cryptocurrencies as a viable medium of exchange (Solana, *ahem*) by increasing transaction speeds and reducing costs, underscoring its belief in the maturing infrastructure of cryptocurrencies and their potential to simplify online payments. The move marks a significant endorsement of the role of stablecoins as a bridge between tradfi and cryptocurrencies.

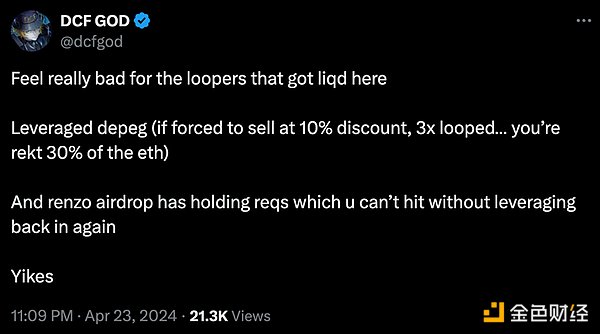

5️. Renzo’s ezETH token is seriously decoupled

In a dramatic turn of events, Renzo’s ezETH token experienced a dramatic 80% decoupling from its intended ETH parity, highlighting the fragility of the Liquidity Rehypothecation Token (LRT). It occurred shortly after Renzo announced an upcoming airdrop, which appeared to destabilize investor confidence, causing the token to plummet and resulting in a liquidity crunch. Although prices have largely recovered since then, the decoupling highlights the inherent risks of the nascent, rehypothecation ecosystem, which in some cases is highly leveraged.