Source: Account X " Understandable sol @DtDt666 "

Another blockbuster in the SOL ecosystem is released. Following JUP/JTO/RAY, the blockbuster http://IO.net is here. It is also a new project of Binance. Today we make a price forecast based on investment research:

1. Price prediction

Price prediction for $IO.

Initial total supply: 500,000,000 IO

Maximum token supply: 800,000,000 IO

Initial circulation: 95,000,000 IO (19% of the total initial token supply)

Total mining volume: 20,000,000 IO (4% of the total initial token supply)

Halving mechanism:

2024-2025: 6,000,000 $IO tokens will be released each year during these two years.

2026-2027: Starting in 2026, the annual release is halved to 3,000,000 $IO tokens.

2028-2029: The release amount continues to halve, with 1,500,000 $IO tokens released each year.

Optimistic scenario: If the market reacts positively, $IO may open above $4.8 and have a chance to reach $12 or even higher.

Conservative scenario: In a relatively stable market environment, the price of $IO may fluctuate between $4-7.5.

Currently, the trading price of $IO in the OTC market is close to $5. From my personal perspective, I can buy some spot for 3-5U.

The emergence of io fills the gap in the field of decentralized computing and provides users with a novel and promising computing method. Although the market has given io a high valuation of $1 billion, its products have not yet been tested by the market, and there are technical uncertainties and supply and demand matching challenges.

If it can quickly meet market demand and avoid major risks and technical problems in operation, http://io.net will have the potential to become the most eye-catching project product in the Web3 field.

As a project with the triple halo of AI+DePIN+Solana ecology, let us wait and see how the market value of IO,NET will perform after its launch.

IO price query on AEVO: https://app.aevo.xyz/perpetual/io

2. Strong narrative

In this year's globalization trend, AI and DePIN can be said to be a perfect match. DePIN will attract a lot of computing power. If DePIN can integrate supply chain cloud services such as GPU, or mobilize hardware equipment across the network to build an infrastructure network, then there will be great demand in large model training, distributed machine learning, data storage verification mining, distributed reasoning and other directions.

GPU is the lifeblood of AI. As AI innovation continues to advance, Nvidia's market value surpasses Apple, which makes us realize that GPU will become one of the most valuable assets in the world. Therefore, AI+DePIN will take over the previous round of DeFi Summer and become the main line of value in this round of bull market.

io,net is a Solana-based DePIN protocol that aims to solve the coordination problem of GPU resources (currently Amazon's. Similar to how DeFi eliminates middlemen and pools liquidity, io,net solves inefficiencies in the GPU market by providing a solution that incentivizes participants to cooperate.

io,net is not only a model of technological innovation, but also a representative of the application of blockchain in solving real-world problems. The project team is committed to pushing boundaries and bringing more possibilities to the Web3 world.

In layman's terms: it integrates idle GPUs and creates a shared GPU computing platform. Relying on the Solana blockchain, it provides a decentralized and permissionless global collaboration, verification, and payment platform to share the idle GPU computing power in hardware clusters such as data centers, crypto mining farms, gaming computers, and high-performance workstations.

There are three main groups within the IO ecosystem:

GPU Renters (also known as Users)

For example, machine learning engineers looking to purchase GPU computing power on the IOG network can use $IO to deploy GPU clusters, cloud gaming instances, and build Unreal Engine 5 (and similar) pixel streaming applications.

GPU owner (also known as vendor)

For example, independent data centers, crypto mining farms, and professional miners are looking to make their underutilized GPU computing power available on the IOG Network.

IO Coin Holders (also known as the Community)

Participate in providing cryptoeconomic security and incentives to coordinate mutual benefits and penalties between parties to promote the growth and adoption of the network.

3. Core issues

2.1 What problems does the project solve and what value does it create?

Specifically, io solves the following practical problems:

Limited availability of GPUs: Obtaining hardware resources through traditional cloud services may take weeks to wait, and popular GPU models are often out of stock. http://io.net provides a decentralized physical infrastructure network (DePIN) by integrating underutilized GPU resources from independent data centers, crypto miners, and other hardware networks (such as Filecoin, Render, etc.), allowing engineers to access distributed cloud clusters at a lower cost.

Poor selection: When using traditional cloud services, users have very limited choices in terms of GPU hardware, location, security level, latency, etc. io.net, through its DePIN, provides an accessible, customizable, cost-effective, and easy-to-implement system that enables users to choose the corresponding computing resources according to their needs.

High cost: The cost of acquiring high-performance GPUs is extremely high, and projects may need to spend hundreds of thousands of dollars per month for training and inference. http://io.net reduces this overhead by aggregating GPU resources from different sources to provide computing power at a lower cost.

In addition, io focuses on four core capabilities to further optimize AI/ML workflows:

Batch Inference and Model Serving: By exporting the trained model’s architecture and weights to shared object storage, you can parallelize inference on batches of incoming data.

Parallel training: Leverage distributed computing libraries to coordinate and batch training jobs for parallelization using data and model parallelism across many distributed devices.

Parallel hyperparameter tuning: Hyperparameter tuning experiments are inherently parallel, and io.net leverages distributed computing libraries for advanced hyperparameter tuning to checkpoint best results, optimize scheduling, and simply specify search patterns.

Reinforcement Learning: iO uses an open source reinforcement learning library that supports production-level highly distributed RL workloads and provides a simple set of APIs.

Through these solutions, io aims to provide AI/ML engineers with a powerful, flexible, and cost-effective computing resource platform to support their R&D and innovation activities.

2.2 Is the project’s technology feasible?

Whether it is the application technology of blockchain or the resource integration and call of computing power, it is a feasible technology. However, there are still some technical challenges to overcome, such as ensuring the stability of the network, handling fault tolerance, data security and privacy protection, etc. Further verification is needed, but this part is not an insurmountable technology. For early and mid-term projects, you don’t need to worry too much.

2.3 Is the project CX-feasible?

The io,net project originated from the Solana Hackathon, and many investment institutions, such as Multicoin and Okx, participated in it, so it has a certain innate traffic type;

ArkStream Capital recently successfully completed its Series A investment in IO,Net. This round of financing was led by Hack VC, with participation from more than 20 well-known overseas and domestic VCs and angel investors, with a total financing amount of US$30 million.

io,net focuses on Depin, GPU, large models, AI, and Solana, so the prospects are still promising.

3. We can deduce the market value range of IO and NET in two ways:

1. Market-to-sales ratio, i.e. market value/revenue ratio;

2. Market value/number of network chips ratio.

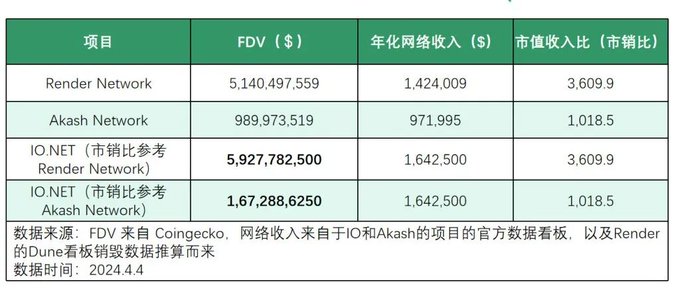

Let’s first look at the valuation deduction based on the price-to-sales ratio:

From the perspective of price-to-sales ratio, Akash can be used as the lower limit of IO's valuation range, while Render can be used as a high-end pricing reference for valuation, with an FDV range of US$1.67 billion to US$5.93 billion.

But considering that the IO project is newer, the narrative is hotter, the early circulating market value is smaller, and the current supply-side scale is larger, there is a high possibility that its FDV will exceed Render.

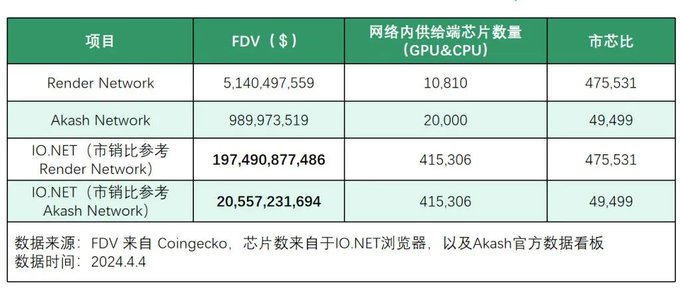

Let’s look at another angle to compare valuations, namely the “market-to-core ratio”.

In the context of a market where demand for AI computing power exceeds supply, the most important factor in a distributed AI computing network is the scale of the GPU supply side. Therefore, we can use the "market-to-chip ratio" to make a horizontal comparison, using the "ratio of the total market value of the project to the number of chips in the network" to deduce the possible valuation range of http://IO.NET as a market value reference.

If we use the price-to-core ratio to estimate the market value range of IO, IO uses the price-to-core ratio of Render Network as the upper limit and Akash Network as the lower limit, and its FDV range is 20.6 billion to 197.5 billion US dollars.

And we also need to take into account that the current huge number of IO chips online is stimulated by airdrop expectations and incentive activities. The actual number of online chips on the supply side still needs to be observed after the project is officially launched.

Therefore, in general, valuation calculations based on the price-to-sales ratio may be more relevant.