After Federal Reserve Chairman Jerome Powell made it clear that the time has come to cut interest rates, the market expected that the Federal Reserve would gradually cut interest rates starting in September. U.S. Treasury bond prices rose for the fourth consecutive month in August, setting the longest consecutive rise in three years. Yields have fallen four times in a row. The US 10-year Treasury bond yield fell 0.197% to 3.910% in August, and the 2-year yield fell 0.411% to 3.926%.

It is worth noting that bond yields have rebounded this week, indicating that the market has reduced expectations for a significant interest rate cut by the Federal Reserve.

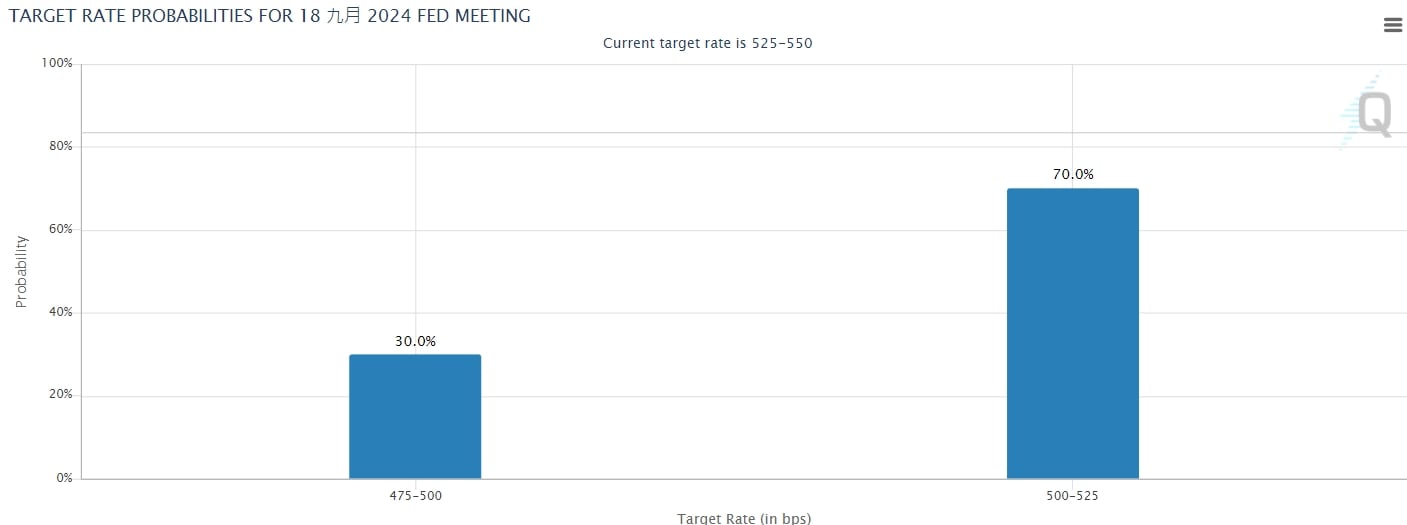

The annual growth rate of the U.S. personal consumption expenditures (PCE) price index remained at 2.5% in July, the same as in June. In addition, the number of corporate layoffs remained moderate, and the annual GDP growth rate in the second quarter was revised upward from 2.8% to 3%. The market has lowered its expectations for a sharp interest rate cut by the Federal Reserve in September. FedWatch shows that the market expects a 70% chance of a 1-digit rate cut by the Federal Reserve in September, while the probability of a two-digit rate cut has dropped to 30% from 36% a week ago.

Since 2022, the 10-year and 2-year U.S. Treasury yield curves have continued to invert, reflecting market concerns about an economic recession. As Powell announced that the time has come for policy adjustments, the 2-year U.S. Treasury yield has fallen by more than 10 The 1-year U.S. Treasury yield and the interest rate gap between the two have narrowed rapidly. Although the inversion of the yield curve to positive has always been a reliable recession signal, many indicators currently show that economic conditions may not be as weak as expected, so labor market data has become key.

The U.S. August non-farm payrolls report, which will be released on September 6, has attracted market attention. Jia Wei, head of global bond and interest rate strategy at ING Financial Markets, said that unless the labor market weakens sharply, for example, the number of new jobs is far lower than expected, and The unemployment rate continues to rise, otherwise the Federal Reserve will not cut interest rates by 2% next month.

Bank of America warns markets of overreacting to rate cuts

It is worth noting that the Bank of America strategist team recently warned that the recent rise in U.S. government bonds has been too large, and there are four major factors that may cause yields to stop falling and rebound, especially long-term yields. The 30-year yield has dropped from the low level at the end of April. The peak of 4.82% dropped sharply to 4.05%, but the trend may reverse in the future.

The top four factors listed by Bank of America are as follows:

- Seasonality: September is typically one of the busiest months for corporate bond issuance, with $180 billion worth of new U.S. Treasuries set to flood the market.

- Geopolitical factors: Energy prices may rise, such as natural gas prices in Europe.

- Current status of investment positions: The 30-year U.S. Treasury bond has turned from oversold in the first quarter to overbought now, and fund managers have recently begun to net increase their holdings of long-term bonds for the first time since March.

- The market is too optimistic about the extent of interest rate cuts: The current U.S. bond prices reflect that the market expects an interest rate cut of 200 basis points, and the market expectations are too optimistic.

Citigroup estimates the price will drop by 5% by the end of the year

However, Citi economist Robert Sockinsaid in a recent interview with Yahoo Finance that with the unemployment rate rising, the Federal Reserve may cut interest rates by more than market expectations. It is expected that the Federal Reserve will cut interest rates by 1.25% (5 yards) before the end of the year:

Our U.S. team expects the Fed to cut interest rates by 2 yards at the beginning and another 2 yards later, and estimates that it will actually cut interest rates by 5 yards this year.

Robert Sockin explained that the bank’s forecasts are based on the evolution of the labor market and rising unemployment:

The question remains how much the unemployment rate has risen. So from a risk management perspective, this could lead to the Fed being more aggressive in its initial moves, especially if they believe the risk of a sharp economic slowdown is high.

The U.S. unemployment rate unexpectedly rose from 4.1% in June to 4.3% in July. Although the number of people applying for unemployment benefits has declined in recent weeks, the magnitude is not significant. Robert Sockin believes that if the unemployment data continues to be poor, the Federal Reserve will It’s hard not to take more radical action.