Bitcoin and Ethereum exchange-traded funds (ETFs) saw their highest inflows in recent weeks in the session that ended Friday, September 27, amid ongoing discussions about a recovery in the cryptocurrency markets.

September has historically been Bitcoin's worst performing month, and the market is expecting better prospects as October approaches.

Crypto ETFs see highest multi-week inflows

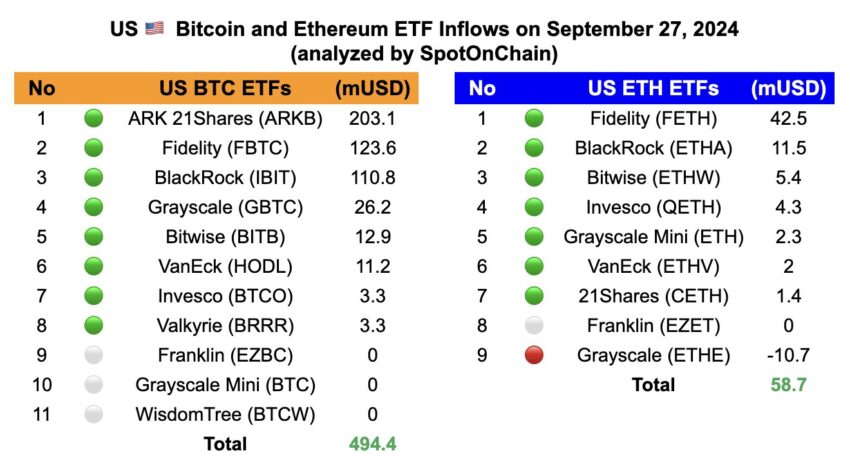

Cryptocurrency investors bought 7,526 Bitcoin (BTC) and 22,310 Ethereum (ETH) on Friday, recording net inflows of $494.4 million and $58.7 million into Bitcoin and Ethereum ETFs, respectively.

Spotonchain, an on-chain insights provider, said in a report that these inflows brought total weekly inflows up to the levels seen a few weeks ago. In terms of weekly inflows, the Bitcoin (BTC) ETF recorded a net inflow of $1.11 billion, while the Ethereum (ETH) ETF recorded a net inflow of $84.6 million.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

Data from asset manager Farside Investors also supports the report, with BlackRock’s IBIT ETF seeing significant net inflows every day except Monday, while Fidelity’s Bitcoin spot ETF, FBTC, also saw positive inflows of $24.9 million.

Since its debut in the U.S. market in January 2024, spot Bitcoin ETFs have attracted significant interest from institutional investors, offering them the opportunity to include Bitcoin directly in their portfolios while bypassing the difficulties of direct purchase and safe custody.

As BeInCrypto reported, over 1,000 institutional investors participated in just two 13F filing periods , highlighting the overwhelmingly positive response from the market to a BTC ETF.

Meanwhile, in the ETH ETF market , all issuers are struggling, with financial products continuing to underperform. Nevertheless, it is not easy for both markets to attract positive inflows .

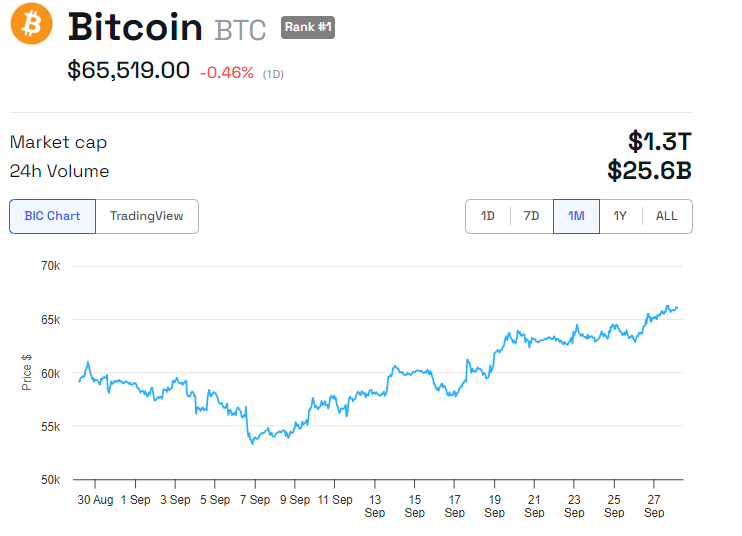

This comes as investors continue to bet on a recovery in the cryptocurrency market, with Bitcoin holding above $65,500.

Bitcoin price strength is closely tied to broader economic indicators that suggest increased liquidity, which often works in favor of Bitcoin. For example, China is considering financial support for its citizens amid economic hardship . Likewise, the U.S. Federal Reserve recently cut interest rates , which is often positive for risky assets.

Several economists, including macro researcher Julien Vittel, have commented on the increase in liquidity.

“Liquidity is picking up again, and Bitcoin, which is very sensitive to changes in liquidity conditions, has the potential to move explosively as new liquidity enters the system. The macro environment is changing. A major liquidity wave is on the horizon, and when it arrives, Bitcoin looks set for a strong upside in Q4,” Bittel said .

Likewise, the Global Money Index (GMI) shows increased liquidity. This indicator measures the amount of money in circulation between consumers and banks.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

An increase in GMI suggests that there is more money in circulation and ready to be spent, which could lead to increased Bitcoin purchases.