This week’s roundup highlights increased regulation and innovation in the crypto space in Asia and MENA. Dubai regulators are implementing new cryptocurrency marketing rules, which will take effect on October 1, 2024. Meanwhile, in South Korea, Worldcoin was fined 830 million won for violating data privacy laws by collecting sensitive biometric data.

As regulators across the region step up their oversight, the cryptocurrency industry is going through a period of change that is reshaping its future.

Dubai introduces strict guidelines for cryptocurrency promotion and marketing activities

From 1 October 2024, companies promoting virtual assets in Dubai will have to comply with new marketing regulations introduced by the Virtual Assets Regulatory Authority (VARA). According to the guidelines , cryptocurrency advertisements must include a prominent disclaimer highlighting the risks of investing. The disclaimer must clearly state that virtual assets may lose all or part of their value and are subject to significant volatility.

In addition to the new disclaimer requirement, VARA also introduced fines for non-compliance. Companies that violate the marketing guidelines can be fined up to AED 10 million (approximately $2.7 million).

Read more: How Regulations Affect Crypto Marketing? The Complete Guide

The size of the fine depends on the severity of the violation. If a company repeatedly violates the regulations, the fine may increase.

Additionally, Virtual Asset Service Providers (VASPs) are now required to obtain VARA approval when offering incentives related to virtual assets. This ensures that promotional materials do not obscure the risks that investors may face.

This regulatory update is part of Dubai’s ongoing efforts to strike a balance between cryptocurrency innovation and consumer protection. As the region establishes itself as a global hub for blockchain and digital assets, the new rules aim to protect retail and institutional investors from misleading promotional content.

Worldcoin fined 800 million won for violating personal information protection laws

South Korea’s Personal Information Protection Commission (PIPC) has fined WorldCoin and its developer, Tools for Humanity (TFH), 1.14 billion won ($830,000) for violating the country’s data protection laws.

The fine stems from the fact that Worldcoin collected sensitive biometric data, including iris scans, from Korean users without their consent . Furthermore, the data was transferred to Germany without notifying the users. This act further violated South Korea’s data privacy laws.

PIPC ordered Worldcoin to take corrective action, including obtaining explicit user consent for sensitive data collection. The agency also called for improved transparency in data storage and use. Furthermore, the company must introduce an effective data deletion mechanism for users who wish to withdraw from Worldcoin services.

Hong Kong e-HKD+, RWA and digital currency research

The Hong Kong Monetary Authority (HKMA) has recently launched the second phase of its digital currency project , now rebranded as Project e-HKD+. This phase aims to explore more advanced use cases for the digital currency, including wider applications in retail and corporate environments.

Project e-HKD+ brings together 11 companies to conduct real-world trials of tokenized asset settlement, programmable payments and offline transactions. This pilot program is important in assessing the benefits and feasibility of implementing digital currencies within the broader economy.

The results of Phase 2 will help shape the future design and regulatory framework for digital currencies in Hong Kong. The authorities plan to publish key learnings by the end of 2025.

Eddie Yu, chief executive of the HKMA, stressed that the scheme was essential to position Hong Kong at the forefront of financial technology.

“The e-HKD pilot programme has provided a valuable opportunity for the HKMA to work with the industry to explore how digital currencies can add unique value to the general public. The HKMA will continue to adopt a use-case-driven approach in its exploration of digital currencies and looks forward to working closely with industry players in Phase 2 to co-create a range of innovative use cases,” Yew said .

The authorities also plan to establish an e-HKD Industry Forum, which will serve as a collaborative platform for industry leaders to discuss the wider adoption of digital currencies.

Indonesia's largest bank launches blockchain-based pilot project

Bank Rakyat Indonesia (BRI), Indonesia’s largest state-owned bank, is launching a blockchain-based pilot project to improve transparency and security in financial transactions . Announced during the Indonesia Blockchain Conference (IBC), the project aims to streamline supply chains and secure business transactions for BRI’s vast customer base of 82 million people.

Nithia Rahmi, BRI’s Head of Digital Banking Development, stressed that the initiative is part of the bank’s broader commitment to embracing Web3 technologies. Rahmi explained that the project will improve BRI’s digital infrastructure and position the bank as a leader in blockchain adoption in the Indonesian financial sector.

As blockchain technology gains traction in Southeast Asia, the BRI movement is aligned with a regional trend of integrating decentralized technologies into traditional banking systems. Banks’ adoption of blockchain is expected to set a precedent for other institutions seeking to innovate and improve financial processes.

Singapore Court Gives WazirX 4 Months to Deal with Hacking Case

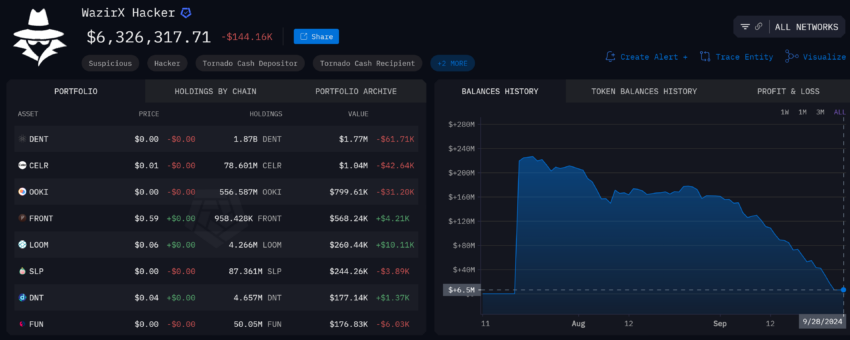

On September 26, the Singapore High Court granted Zettai Pte Ltd, the parent company of Indian cryptocurrency exchange WazirX, a four-month reprieve . The decision followed the platform’s $230 million hack in July.

This grace period will allow WazirX to restructure its debt and settle users’ outstanding cryptocurrency balances. Initially, a six-month grace period was requested, but the court decided to grant a four-month grace period, taking into account the automatic 30-day grace period that started with the initial application.

Nischal Shetty, Director of Zettai and Founder of WazirX, expressed his gratitude for the court’s decision. He described it as an important step towards recovery and resolution. Shetty also emphasized that this grace period is necessary to develop a fair and creditor-approved reorganization plan that maximizes the chances of recovery for affected users.

As part of the court’s terms, WazirX has pledged full transparency. The exchange will disclose wallet addresses, provide financial data, and address user concerns raised during the legal process. Additionally, voting on the restructuring plan will be overseen by independent parties to ensure fairness.

Read more: Cryptocurrency Project Security: Early Threat Detection Guide

In parallel with these legal proceedings, blockchain data from Arkham Intelligence revealed that the hackers had almost completely laundered the stolen assets. Of the $230 million, only $6 million of the cryptocurrency was not laundered. The hackers moved most of the funds through the cryptocurrency mixer Tornado Cash.