Author: James Hunt, The Block; Compiled by Wuzhu, Jinse Finance

As we enter the first full week of 2025, analysts at research and brokerage firm Bernstein have made 10 predictions for the coming year, as cryptocurrencies enter what they describe as the "Infinite Era".

The Infinite Era is "a prolonged period characterized by continuous evolution and widespread adoption, where cryptocurrencies are no longer controversial - just part of the financial system being built for the new intelligent age," the analysts, led by Gautam Chhugani, wrote in a report to clients on Monday. "Don't expect a boom-bust cycle," he said. "Cryptocurrencies are now firmly on the radar of enterprises, banks, and institutions, embedded in the foundations of our financial system."

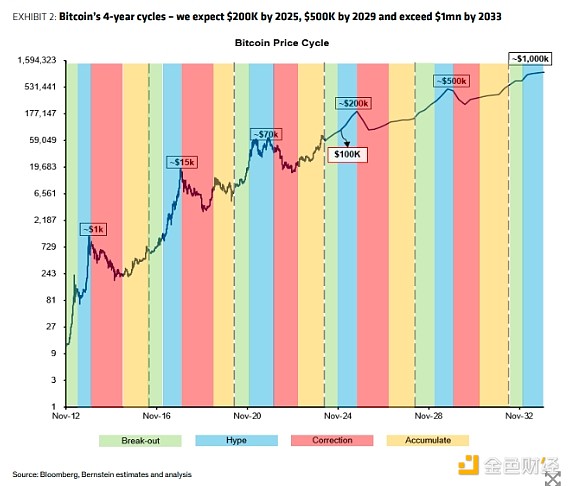

Following former President Donald Trump's strategic Bitcoin reserve campaign pledge, the analysts reiterated their price target for Bitcoin, which they expect to reach $200,000 by the end of 2025.

While the analysts are uncertain whether nations will make actual purchases a legislative priority this year, they do expect corporate capital adoption to continue growing, with inflows projected to exceed $50 billion by 2025, up from $24 billion last year. The analysts said MicroStrategy is likely to lead demand again, followed by Bitcoin miners expanding their capital plans and small-to-medium-sized companies hoping to emulate the Michael Saylor model.

They also predict that a U.S. spot Bitcoin ETF will attract over $70 billion in net inflows - double the $35 billion in 2024 - driven primarily by accelerated institutional adoption by hedge funds, banks, and wealth advisors, with holdings surging to 40% from just 22% in Q3 2022. Additionally, the analysts expect the Bitcoin ETF whitelist process to continue, with leading national commercial banks and private banking platforms maintaining a presence, and the momentum for Bitcoin and Ethereum ETFs to persist, with a Solana ETF potentially emerging before year-end.

"A U.S. announcement of a national Bitcoin reserve will trigger a global sovereign state race to buy Bitcoin. Our $200,000 Bitcoin price target does not consider government demand - only institutional and corporate demand," Chhugani said. "As corporate treasuries and Bitcoin ETFs become a significant component of Bitcoin ownership, we expect Bitcoin ownership to become more entrenched. Therefore, if Bitcoin spends more time below $100,000, it will transfer from traders/sellers to long-term holders like MicroStrategy and Bitcoin ETF holders."

On Bitcoin, the analysts said miners "must" continue shifting capacity to AI to create value. In 2024, there will be a significant divergence in performance between AI-diversified companies and "pure" Bitcoin miners. The analysts noted that AI-diversified companies like Core Scientific and TeraWulf gained 308% and 136% respectively this year, while Riot Platforms and CleanSpark lost 34% and 17%. They expect this trend to continue as "AI is transforming the Bitcoin mining business model, making it more sustainable and less cyclical, bringing a broader institutional investor base."

Continuing the AI theme, Bernstein analysts expect the integration of AI and crypto to deepen this year, with the convergence of AI and crypto driving innovation across multiple fronts. Key developments include decentralized AI blockchains for computation, storage, and reasoning, as well as "human-proof" identity verification services, AI-integrated crypto wallets, and tokenized AI agents.

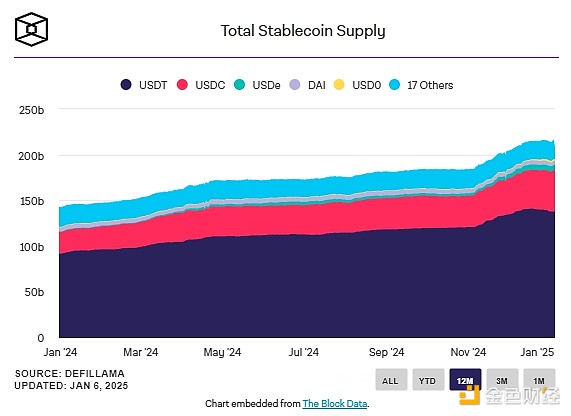

Stablecoin Market to Reach $500 Billion, SEC to Withdraw Crypto Cases

Bernstein analysts expect the industry to see "unprecedented" regulatory tailwinds this year as crypto-friendly governments take office, including potential legislation on stablecoins and digital asset market structure, as well as further clarification on the definition of "crypto securities."

"Stablecoin legislation will be seen as a priority. Stablecoins further strengthen the dollar through buying Treasuries and online distribution of digital dollars," Chhugani said. "Digital asset market structure provides legal clarity and licensing for exchanges, brokers/dealers, including the legal status of non-custodial DeFi protocols, carving them out of broker/dealer status. Finally, constraining the definition of crypto securities and allowing the CFTC to oversee more digital assets beyond a small subset of digital asset securities."

Such U.S. legislation could drive significant growth in the global stablecoin market, with analysts forecasting that the global stablecoin market will exceed $500 billion by 2025, more than double the 55% growth to over $200 billion in 2024, as its applications extend beyond the crypto industry, particularly in global cross-border B2B payments and remittance solutions.

Additionally, the analysts expect that a more crypto-friendly U.S. Securities and Exchange Commission will withdraw or resolve existing cases against crypto companies and allow more private crypto companies to go public, with IPOs becoming a further positive catalyst for the market. They also anticipate that crypto exchanges and platforms like Robinhood will achieve stock market tokenization, enabling a 24/7 liquid stock market trading based on blockchain technology, with banks and asset managers also launching more crypto-related products.

Finally, Chhugani said that despite its poor performance last year, Ethereum is poised to become the next "institutional darling" by 2025. The analysts noted that Ethereum has 28% staked, 3% absorbed by ETFs, and 7.5% locked in smart contracts, and its limited supply and utility as a fee payment and collateral asset for Layer 1 and Layer 2 chains make it attractive to traditional investors seeking intrinsic value.