The person who built a business empire around cryptocurrency. Three predictions, three industries with far-reaching impacts.

Written by: Thejaswini M A

Translated by: Saoirse, Foresight News

"We are in the early stages of a disruptive technology that has the potential to bring major changes to the world, just like the internet."

Jeremy Allaire has accurately predicted the future three times. The first time was in 1990, when most people had never heard the word "internet", he had already insight into the transformative potential of the World Wide Web. This insight gave birth to ColdFusion software, earning him millions.

The second time was in 2002, when he predicted that anyone would be able to distribute video content globally without relying on television networks. This vision gave rise to Brightcove, bringing him hundreds of millions in revenue.

The third time was in 2013, when he realized that cryptocurrency could become the cornerstone of an entirely new financial system. This bet may forever change the way money works.

At 54, Allaire has been building invisible infrastructure supporting the digital world for thirty years. The USDC stablecoin he created processes trillions of dollars in transactions annually and has become a bridge between traditional finance and the crypto economy.

But for someone whose profession is to see what others cannot, Allaire's steps in building the future have never stopped.

[The rest of the translation follows the same approach, maintaining the original structure and translating all text except for names and specific technical terms.]In 2012, Brightcove went public with a valuation of $290 million, with Jeremy holding a 7.1% stake.

He successfully created a market that allowed thousands of creators to reach global audiences without begging television networks, film companies, or media executives. However, when Brightcove conquered the online video field, he stepped down as CEO in 2013 and became chairman.

Why leave when everything was going well? This was already the second time. But Jeremy's gaze was already fixed on the next turn.

Monetary Revolution

In 2013, Jeremy Allaire once again stared at the computer screen, just like 23 years ago in his dorm room in Minnesota.

This time, he was studying something called Bitcoin.

The 2008 financial crisis made him begin to question everything about traditional banking. Lehman Brothers went bankrupt, Bear Stearns disappeared, and the global financial system nearly collapsed, making Jeremy wonder if there was a better way.

When he first encountered Bitcoin, the feeling was familiar, almost déjà vu. "I had exactly the same feeling about digital currency, especially Bitcoin," he told Fortune magazine, "We are in the early stages of a disruptive technology that could bring major changes to the world, just like the internet."

He saw a so-called "universal monetary circulation system, just like the HTTP protocol is the basis for information transmission on the internet".

In October 2013, Jeremy co-founded Circle with Sean Neville.

Their vision was to help create the world's first global currency based on open platforms and standards like Bitcoin.

Accel Partners and other well-known venture capitalists immediately joined. Everyone felt that this was not an incremental improvement to existing financial services.

Jeremy wanted to create a programmable currency that could settle payments almost instantly at a cost just a fraction of traditional wire transfers. They were not trying to improve existing financial services, but to create an entirely new category that could operate globally without relying on correspondent banking relationships that make international transfers slow and expensive.

But Circle's early attempts at consumer-facing Bitcoin applications and trading platforms were not very successful. The breakthrough came only when Jeremy realized that the problem was not with the technology, but with volatility.

The Birth of USDC in 2018

Through collaboration with Centre Consortium and Coinbase, Circle launched USD Coin (USDC). This is a stablecoin backed by actual US dollar reserves, with each USDC token exactly worth $1.

Now, enterprises could enjoy the benefits of cryptocurrency, including instant global transfers, 24/7 availability, and programmable smart contracts, without experiencing Bitcoin's extreme price volatility.

Jeremy's chosen regulatory path was full of risks. Unlike many crypto companies operating in gray areas, Circle directly collaborated with financial regulators to ensure USDC met the highest standards of transparency and compliance.

This decision sometimes put Circle at a competitive disadvantage: other stablecoin issuers could move faster because they were less concerned with compliance. But Jeremy was playing a longer game.

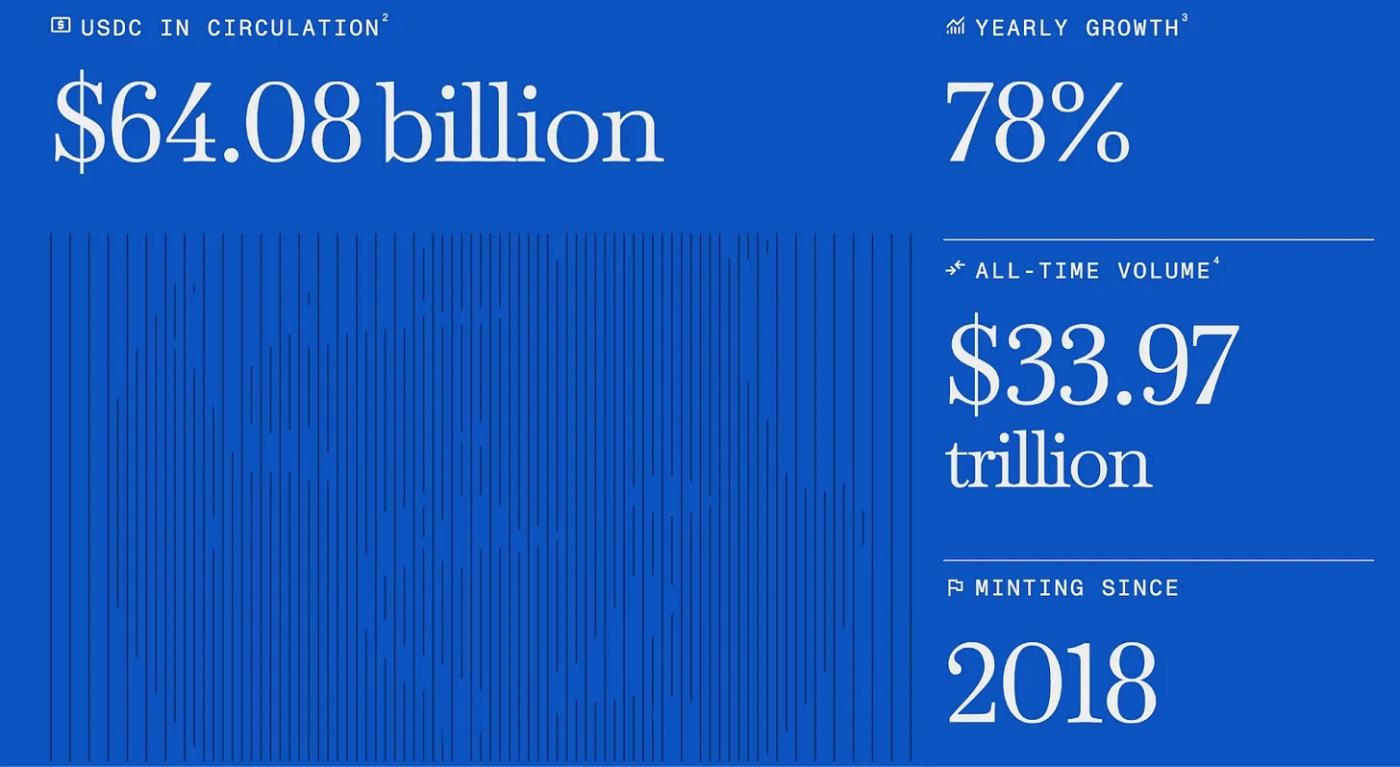

By 2025, USDC had become the second-largest stablecoin by market cap, with a circulation of over $64 billion. Enterprises used it for international payments, developers built financial applications on top of it, and individuals used it for instant cross-border remittances.

Jeremy's success came after overcoming what industry observers called an "almost impossible distribution challenge". Unlike Tether (which gained widespread use through early cooperation with Asian crypto exchanges), Circle had to build a distribution network from scratch.

Circle's strategy was to establish a strategic partnership with Coinbase: Circle would pay 50% of its net interest income to Coinbase in exchange for distribution rights in its network.

Was it expensive? Yes. Was it effective? Undoubtedly.

USDC became the primary alternative to Tether in the Western market.

Crisis Test

March 10, 2023, Dubai. This was supposed to be the weekend of Jeremy's son's 13th birthday.

At 2 AM local time, the phone started ringing.

Silicon Valley Bank was facing collapse, and Circle had $3.3 billion in USDC reserves stored in this bank.

Within hours, USDC de-pegged, dropping to $0.87. Traders were in panic; the stablecoin Jeremy had spent five years building seemed like it might become almost worthless overnight.

Jeremy assembled a virtual war room on Google Meet, working with the East Coast team across an 8-hour time difference. His son's birthday party was forgotten; this was about protecting the funds of millions who trusted Circle.

Option A: Immediately transfer funds to other banks.

Option B: Rely on FDIC deposit insurance to cover any losses.

Option C: Negotiate with companies willing to purchase Circle's Silicon Valley Bank assets at a discount.

Under the watch of the entire crypto world, Jeremy made a personal commitment: if Silicon Valley Bank's deposits could not be recovered, Circle would "cover the entire funding gap".

This crisis tested all the foundations of Jeremy's reputation: transparency, accountability, and the determination to do the right thing in difficult times.

Circle published a detailed blog post explaining exactly what happened and the steps they were taking to protect customer assets.

Three days later, federal regulators guaranteed Silicon Valley Bank's deposits.

USDC re-pegged to the dollar, and the crisis ended.

Jeremy proved that Circle could withstand serious external shocks while maintaining customer trust. His chosen approach of collaborating with regulators rather than confronting them was rewarded at the most critical moment.

Throughout Circle's development, Jeremy positioned himself as the most prominent "clear regulatory framework advocate" in the cryptocurrency field. Many crypto entrepreneurs disagreed with this, preferring to minimize regulation. But Jeremy testified to Congress, participated in regulatory working groups, and collaborated with global policymakers to shape the cryptocurrency regulatory framework.

In 2024, Circle became the first major global stablecoin issuer to comply with the EU's Markets in Crypto-Assets Regulation.

The strategy worked.

Jeremy then decided to take Circle public.

The path to going public was not smooth. A first attempt through SPAC merger in 2021 was not approved by the SEC. However, Jeremy persevered.

In July 2025, Circle successfully went public on the New York Stock Exchange.

The IPO documents showed a company with substantial revenue, clear compliance, and massive business scale. Circle's public debut was valued at over $4.6 billion. Jeremy's decade-long bet on stablecoins had yielded an astonishing return.

Today, Circle trades with the stock ticker CRCL, with a market cap exceeding $40 billion. Since its July IPO, the stock price has risen over 430%, making it one of the most successful public market debuts in crypto history.

Jeremy believes stablecoins are approaching their "iPhone moment": when technology becomes practical and user-friendly, enabling mass adoption.

Genius Moment

On July 18, 2025, President Donald Trump signed a bill that validated Jeremy Allaire's efforts over the past decade. The GENIUS Act became the first comprehensive stablecoin regulation in the United States. Jeremy's strategy of advocating compliance positioned USDC perfectly.

The GENIUS Act did three things Jeremy had long advocated: first, confirming that stablecoins are not securities, eliminating regulatory uncertainty plaguing the industry; second, requiring stablecoins to be fully backed by safe assets like Treasury bonds, addressing reserve transparency issues; third, bringing stablecoin issuers into the same compliance framework as traditional banks.

Jeremy spent years building infrastructure, and now governments are rushing to adapt to an inevitable world of programmable money.

This prophet who saw the potential of the network in 1990, foresaw video democratization in 2002, and insight into the crypto revolution in 2013, has just witnessed his third prediction redefining money itself.

In an industry obsessed with "acting quickly and breaking conventions," he proved that the most transformative changes often stem from patience, persistence, and the wisdom of perceiving what others overlook.

Three predictions, three industries left with profound impacts. If his past record is any indication, even more significant changes lie ahead.