"This is just the first step towards 1 billion Gas and beyond." —— Ethereum Foundation, August 6, 2025

In a blog post about protocol progress by the Ethereum Foundation, this sentence was quietly placed in the paragraph summary. The event it describes - the increase of the Ethereum mainnet Gas Limit to 45 million - did not trigger market hysteria, nor did it create much buzz in the crypto community.

This was not an oversight. While the industry's attention was generally drawn to dazzling Layer 2 projects and airdrop wealth effects, a more fundamental evolution concerning Ethereum's future was quietly taking place.

This adjustment was not a simple technical fine-tuning. It was more like a strategic move after a long-term game, representing the latest response from Ethereum's core developers to the classic challenge of "L1 scaling".

To understand the deeper meaning of this move, we must first deconstruct its core - what exactly is the Gas Limit?

What Exactly is the Gas Limit?

Imagine Ethereum as a "world computer" composed of countless computers globally. To make this computer work for you - whether transferring an account or running a complex smart contract - you need to pay a "fuel fee". This fuel is called gas.

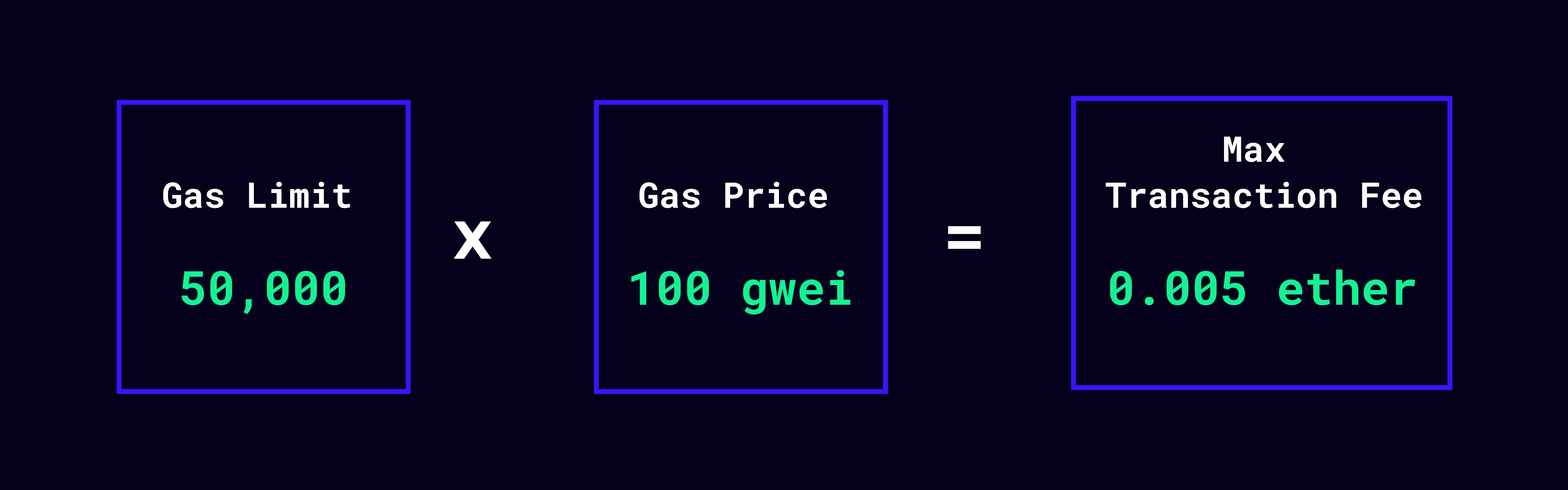

- Gas: The "Measurement" of Computation Every operation you perform on Ethereum, from a simple addition to a complex transaction, has a fixed gas consumption, just like electrical appliances have a fixed power rating. The more complex the operation, the more gas it consumes. Gas itself is not money; it's just a unit measuring how many computational resources your operation requires.

- Gas Price: The "Unit Price" of Fuel The price of gas is how much ETH you're willing to pay for each unit of gas. This is entirely determined by market supply and demand. When the network is congested and many people want to trade, you'll need to offer a higher "unit price" to encourage validators to prioritize your transaction, just like surge pricing during peak hours.

- Gas Limit: The "Fuse" of Safety There are two types of "Limit" here, and understanding their difference is crucial:

Transaction Gas Limit: This is the consumption limit you set for a single transaction. For example, setting a limit of 21,000 gas for a transfer means you're only willing to pay for up to 21,000 gas. This is an important safety valve that prevents your transaction from getting stuck in an infinite loop due to smart contract code errors, potentially draining all your ETH.

Block Gas Limit: This is the core of our discussion. It defines the ceiling of total gas consumption for all transactions within a block (a collection of transactions).

We can use a more vivid analogy to understand this: If each transaction is seen as a package, the computational complexity determines its "weight" (gas consumption). Then, the block gas limit is the total load capacity of the truck (block) carrying these packages.

Raising the block gas limit from 30 million to 45 million is like increasing the truck's maximum load from 30 tons to 45 tons. This means that in the same transport batch (about 12 seconds per Ethereum block), this truck can carry more or heavier packages. The ultimate result is an improvement in the network's transport efficiency (transaction processing capacity).

This total load limit is crucial. It ensures the truck won't "break down" from infinite overloading, guaranteeing that each block can be processed and broadcast to the entire network within the specified time, thus maintaining the stability and synchronization of the entire logistics system (Ethereum network).

Now, let's return to a deeper question: In an era already equipped with various "air transport" and "high-speed rail" (Layer 2) solutions, why still bother to increase the truck's (L1) load capacity?

L1's "Obsession": Why Strengthen the "Supreme Court" in the L2 Era?

For a long time, discussions about Ethereum scaling were almost synonymous with "Layer 2".

From Optimistic Rollups to ZK-Rollups, industry elites seemed to have reached a consensus: move complex computations and massive transactions to L2 execution, while L1 (mainnet) only needs to play the role of a "data availability layer" and "final settlement layer", maintaining its extreme security and decentralization.

In this narrative, attempting to directly expand L1 was once viewed as a "thankless" and somewhat "heretical" idea. Because every "scaling" of L1 might increase node hardware burden, raising concerns about "centralization" risks.

A more core strategic question then arose: Given L2's wildfire-like momentum, why still be obsessed with strengthening L1?

On this, Vitalik Buterin's discourse clearly outlined L1's ultimate role: the "Supreme Court" and final security arbitrator for all L2s.

He plainly stated that a more powerful and cheaper L1 is the foundation for the healthy development of the entire L2 ecosystem. This is not empty talk, but based on two extremely specific scenarios:

- Lifeline of Resistance to Censorship. If an L2 operator (sequencer) acts maliciously and refuses to process your transaction, your last resort is to "force package" the transaction into L1. If L1's capacity is low and fees are high, this lifeline will become economically unfeasible. A higher capacity L1 ensures all L2 users have an economically viable "appeal" channel.

- Collective "Escape Pod" of Safety. When an L2 project faces technical failure or malicious attack, users need to be able to safely and quickly withdraw assets to L1. A higher capacity L1 can more calmly handle such sudden massive "bank runs", preventing the spread of systemic risks and guaranteeing user asset safety.

Therefore, strengthening L1 is not about competing with L2, but about providing a more reliable "safety net" for L2. Each L1 enhancement is adding to the security ceiling and value ceiling of the entire Ethereum ecosystem.

What is the Basis for Scaling?

Similar to how startup companies need funding to expand, Ethereum's "capital" for increasing the Gas Limit is the performance of its underlying client software. The confidence to steadily increase the limit by 50% is not from luck, but from an carefully planned engineering victory.

The "Berlinterop" event mentioned in the Foundation's report was a series of test meetings aimed at "extreme stress testing" mainstream clients like Geth and Nethermind. Its core purpose was to optimize performance in "worst-case" scenarios.

"The security and stability of the Ethereum network is not determined by average load, but by its ability to withstand the impact of 'monster blocks' containing massive complex computations," explained a core developer in a community forum.

It was in these tests that client teams made significant progress in high computational cost cryptographic operations like BN256 pairing, removing some past performance bottlenecks. This gave developers enough confidence to support the validator community's bottom-up "Pump the Gas" movement.

One could say that the 45 million Gas Limit is a precise confirmation of the network's current processing capacity, built on solid engineering data.

Dancing on Thin Ice: The Art of Coexisting with "State Bloat"

Increasing the Gas Limit is undoubtedly a dance on thin ice. Beneath the ice lies the abyss of "State Bloat" and "Centralization".

A higher Gas Limit means faster state growth, continuously increasing the storage, bandwidth, and computational burden on validator nodes. If the cost of running nodes spirals out of control, it might squeeze out small, amateur node operators, undermining the network's decentralized foundation.

This is remarkably similar to a classic "Prisoner's Dilemma":

- If only a few nodes can keep up, the network will become centralized.

- If it stagnates for the sake of decentralization, the network will lose competitiveness.

- The only way out is: accelerate while reducing the burden for everyone.

Ethereum has chosen this third path. While improving capacity, it vigorously promotes a series of "burden-reducing" technologies, like a dancer maintaining balance with a prop while skating.

Balance Prop One: History Expiry This can be understood as a "disk cleanup" for the node's "operating system". Recently, all mainstream clients have deployed "partial history data expiry", removing old data from before the Ethereum merge. This measure has an immediate effect, directly saving 300-500GB of disk space for full nodes. This is a key step towards the more ambitious EIP-4444 proposal (allowing nodes to store only recent history), aimed at fundamentally controlling node storage costs.

Balance Prop Two: Block Access Lists (BALs) This technology, considered a core candidate for the "Glamsterdam" upgrade, can be understood as attaching a "directory of accounts to be accessed" to each block. With this "navigation map", clients can process multiple unrelated transactions in parallel, like expanding a single-lane highway to multiple lanes, greatly improving block processing efficiency. This directly offsets the computational pressure from increased Gas Limit, achieving "speed increase without burden".

Ultimate Imagination: From 100 Million Gas to "Beast Mode"

45 million is just the opening of this dance. Ethereum developers' gaze has long been fixed on a more distant end goal.

The key to that end goal is called the "zkEVM prover client".

It seeks to completely overturn the verification paradigm that has continued to this day:

- Current Mode: After a block is broadcast, each validation node needs to independently and completely re-execute every transaction in the block. This is a "trust, but verify" brutal aesthetic.

- Future Mode: After executing all transactions, the block proposer generates a tiny zero-knowledge proof (ZK-SNARK) that proves the calculation process is completely correct. After receiving the block, other validation nodes no longer need to repeat calculations thousands of times, only need to complete a lightweight proof verification.

From "repeated labor" to "verifying results", this will be a performance leap of orders of magnitude. At that time, the L1 computational bottleneck will be completely opened, and Gas Limit growth will no longer be linear fine-tuning, but may enter a true "Beast Mode", with potential comparable to centralized systems.

Price Ripples: How Scaling Stirs the Supply and Demand Balance of ETH?

The ultimate purpose of technological transformation is to enhance network utility, which will inevitably be reflected in its native asset ETH's economic model. The impact of L1 scaling on ETH price is a delicate supply and demand game.

From the demand side, this is a significant "gravity enhancement". The most direct effect of increasing Gas Limit is increasing block space supply, thereby reducing the cost users pay to compete for space (i.e., Gas Price). Lower transaction fees are the strongest catalyst for attracting new users and applications to the ecosystem. This will create a positive cycle: lower fees → more users trading and exploring DeFi and Non-Fungible Tokens → more developers deploying innovative applications → overall network utility and value improvement → thereby increasing the fundamental demand for ETH as a core asset (used for Gas payment, staking, DeFi collateral, etc.). This is like reducing highway tolls; although single-trip revenue decreases, it will attract multiple times the traffic, ultimately multiplying the economic value of the entire road.

From the supply side, the game is more complex, with its core in EIP-1559's burning mechanism. EIP-1559 stipulates that the fixed "base fee" in each transaction's gas fee will be destroyed, permanently removed from circulation. This is the cornerstone of ETH's "deflationary" narrative.

- Short-term Challenge: Increasing Gas Limit adds block space supply, which will temporarily reduce network congestion, causing the transaction's "base fee" to drop. This means less ETH is burned per transaction, potentially weakening ETH's deflationary rate in the short term.

- Long-term Bet: However, core developers are playing a larger game. They are betting on the "low margin, high volume" effect (or Jevons Paradox): although the fee and burning amount per transaction decreases, the overall network usability will greatly stimulate total transaction volume.

Ultimately, ETH's total burning amount depends on total transaction volume × average base fee per transaction. Developers believe that exponential growth in transaction volume will be sufficient to offset the decline in average base fee, thereby increasing ETH's total burning amount in the long term, further consolidating its "Ultra Sound Money" status.

Therefore, L1 scaling's impact on price is not simply a positive or negative. It is a profound transformation from "scarcity driven by congestion" to "value driven by utility". In the short term, it may challenge the deflationary narrative; but in the long term, it is building a broader, more solid demand foundation for ETH.