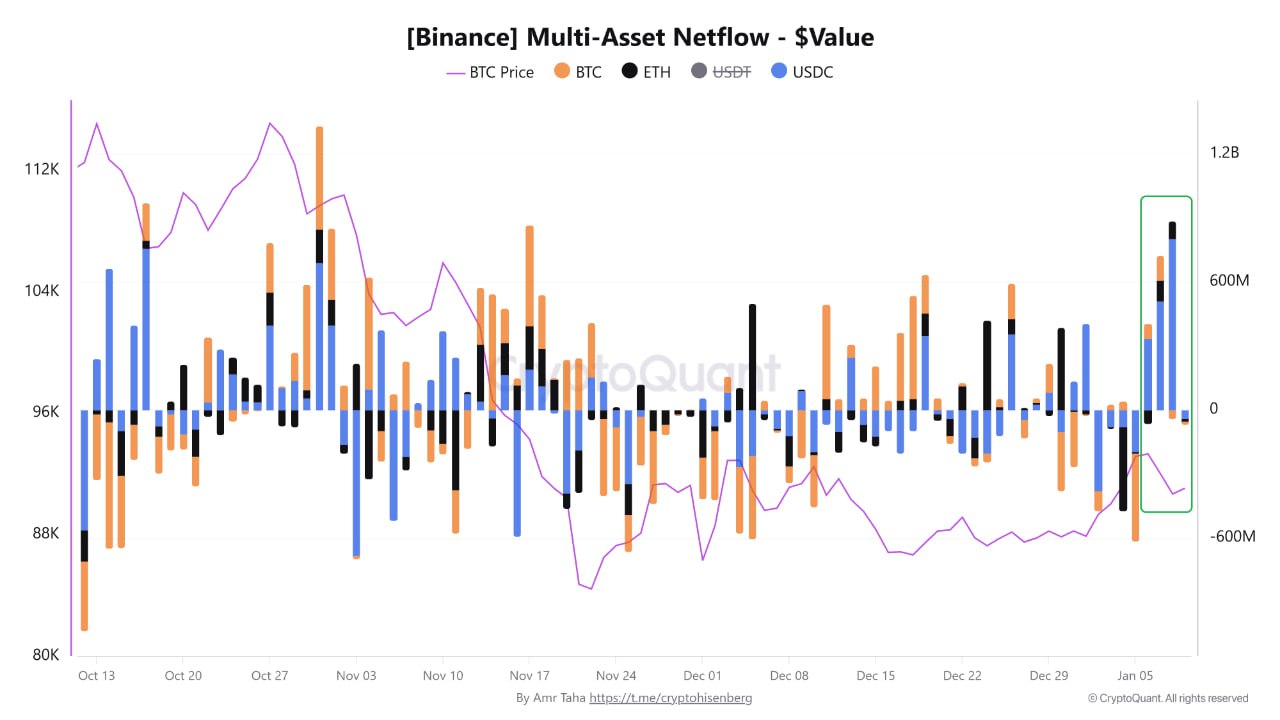

🔗 Original | Author Amr Taha 📈 View Chart “Binance Stablecoin Inflows Dominate, Signaling Strengthened Market Caution” Based on Binance's on-chain metrics today, the market is simultaneously displaying mixed signals. Binance's multi-asset net fund flow (in USD) shows the net amount of various assets flowing into and out of the exchange on a daily basis. Net inflows indicate that deposits exceed withdrawals, indicating capital moving into the exchange, while net outflows indicate capital leaving the exchange. A key observation recently has been the strong net inflows of USDC. On January 6th, net inflows reached approximately $300 million, on January 7th, approximately $500 million, and on January 8th, over $800 million. A similar trend was observed in mid-October, just before BTC fell from around $109,000 to below $85,000. While this doesn't necessarily indicate a sharp price drop, it can be interpreted as a signal that capital is waiting on exchanges, uncommitted. According to the Whale Screener indicator, the majority of funds flowing from whale wallets to exchanges in the spot market are concentrated in stablecoins. As of today, stablecoin deposit activity has increased significantly, with total deposits approaching $1 billion. This behavior is typically characteristic of the buy preparation phase. However, the stablecoin dominance indicator requires a more conservative interpretation. This indicator indicates the proportion of stablecoins in the overall cryptocurrency market. A rising dominance indicates selling pressure, while a falling dominance indicates a shift in funds toward riskier assets. Currently, stablecoin dominance remains above 9% and has yet to close below 9% on a daily basis. As long as this level persists, #BTC's upward momentum is likely to be limited. In summary, the increase in stablecoin holdings on spot exchanges can be interpreted positively as a waiting pool of funds for future purchases. However, the high level of stablecoin dominance suggests that capital has not yet fully shifted to risky assets. ✏️Summary in One Line The inflow of Binance stablecoins can be seen as waiting pool of funds for purchases, but as long as dominance remains high, #BTC's short-term upward momentum will be limited. [Sign up for a free CryptoQuant membership] Sign up using the link above to receive one month of free Advanced Plan access. Analyze market trends in-depth with on-chain data! ✖️ Official CryptoQuant X (🇰🇷Korean) ✈️ Official CryptoQuant Telegram (🇰🇷Korean)

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content