With the development of DeFi and NFT, DApp has taken a big step towards the successful implementation of blockchain on the consumer side, and the outline of Web3.0 is vaguely visible. However, in 2022, affected by changes in the overall market environment, the development of DApps has not shown the same breakthrough as in the previous two years, and is generally relatively stable. In addition to the M2E craze at the beginning of the year, there are also storage and social media DApps that have attracted much attention. However, these new changes are still in the process of accumulation and have not yet formed a force to promote qualitative changes in the industry.

The importance of DApp to the development of the industry is self-evident. In this article, PAData, a data news column of PANews, will review its development in the past year and analyze eight items including Ethereum, EOS, Tron, Solana, Avalanche, BNB Chain, Polygon, and Optimism. The current status of all 4464 DApps on the public chain will be analyzed, and the top 10 most active DApps among the five major DApp types including Games, DeFi, Marketplace, Collectibles, and Social & Media will also be analyzed. 50 DApps were analyzed, trying to comprehensively display DApps in 2022 from the intersection perspective of "public chain x type x user".

Content summary:

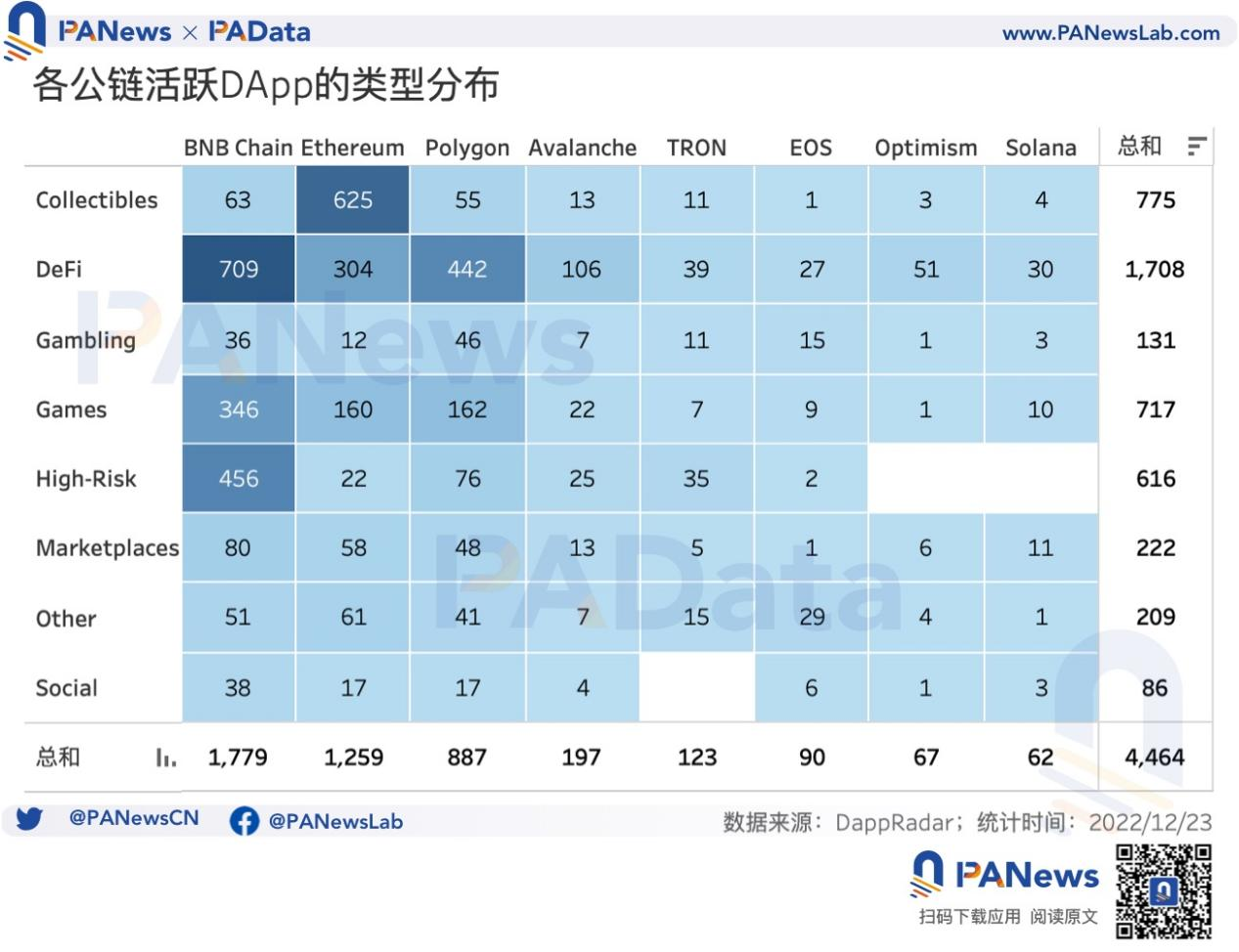

1) The DApps on BNB Chain and Ethereum are mainly composed of 3 types, and all types are fully covered, but the ecology on the other 6 public chains only consists of 1-2 types, and some types are missing. Collectibles on Ethereum have surpassed DeFi to become the dominant type, accounting for approximately 50% of the total.

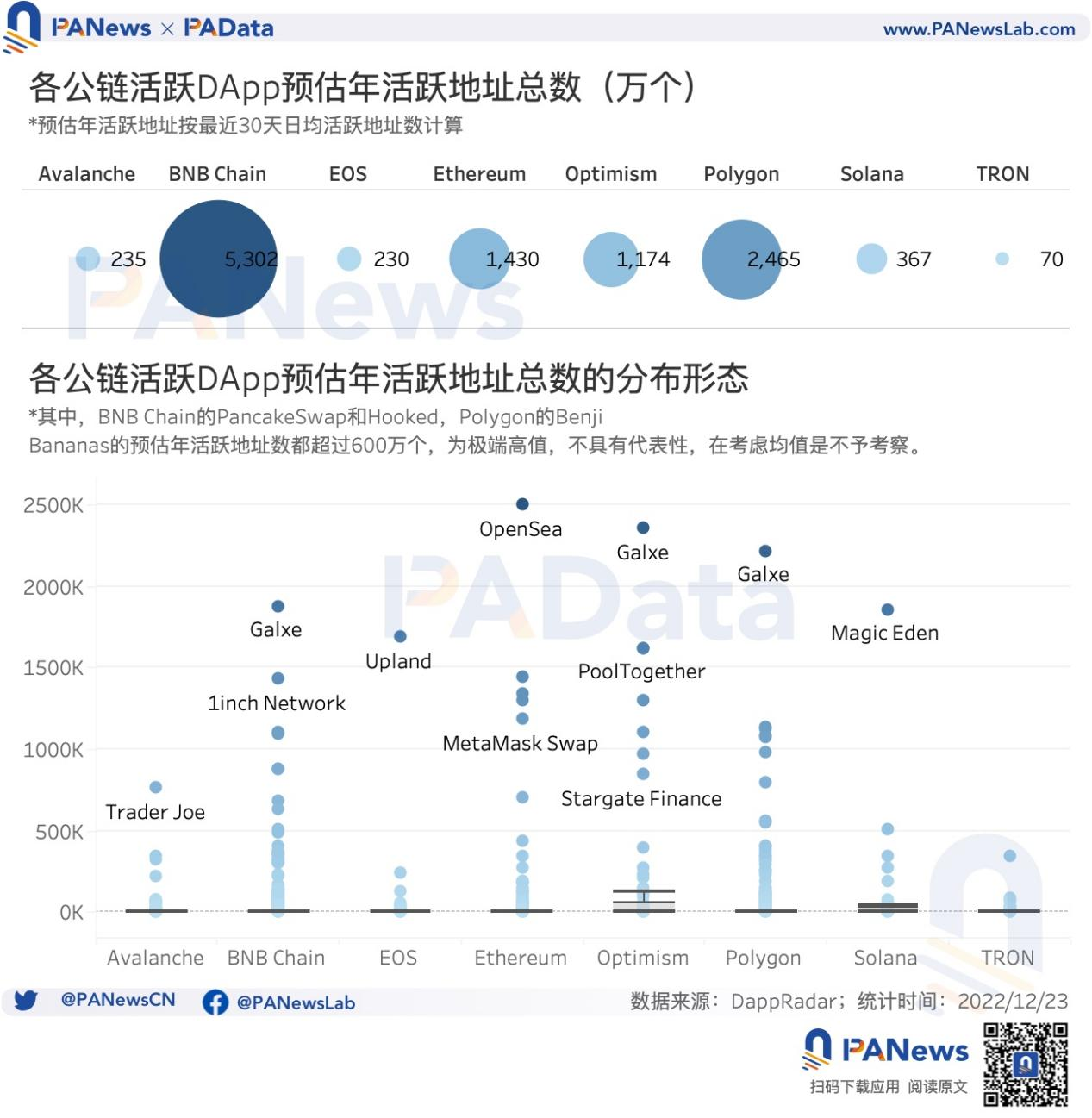

2) The number of active addresses for the whole year is estimated based on the average number of daily active addresses for each active DApp in the last 30 days. The estimated total number of annual active addresses for 4,464 active DApps across 8 public chains is approximately 113 million. Among them, BNB Chain has the most active users, followed by Polygon, Ethereum and Optimism.

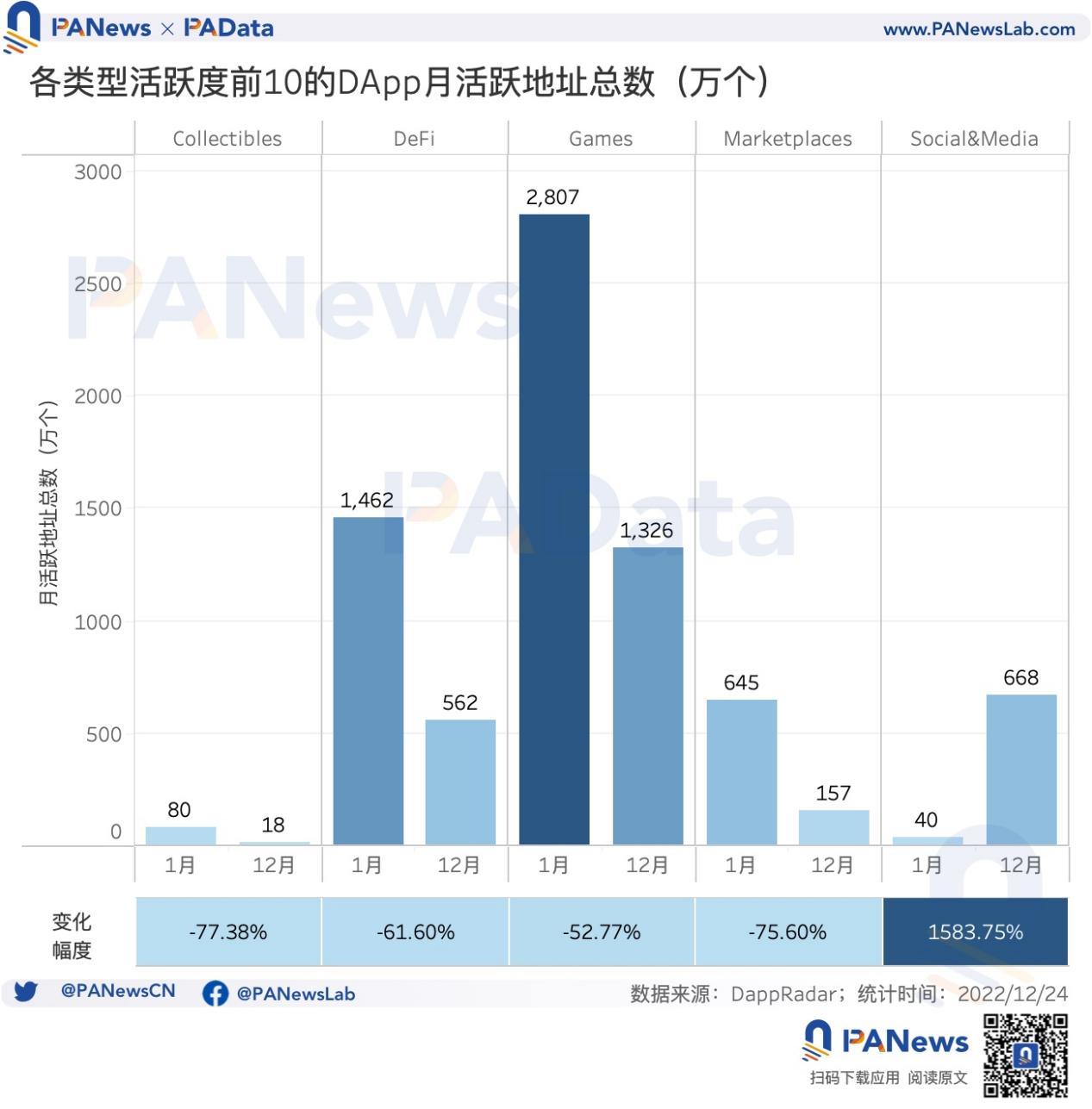

3) This year, only the active addresses of Social & Media’s top applications showed an upward trend, with the cumulative increase of active addresses from January to December reaching 1583.75%. The decline rate of DApps in the other four categories is between 50% and 80%.

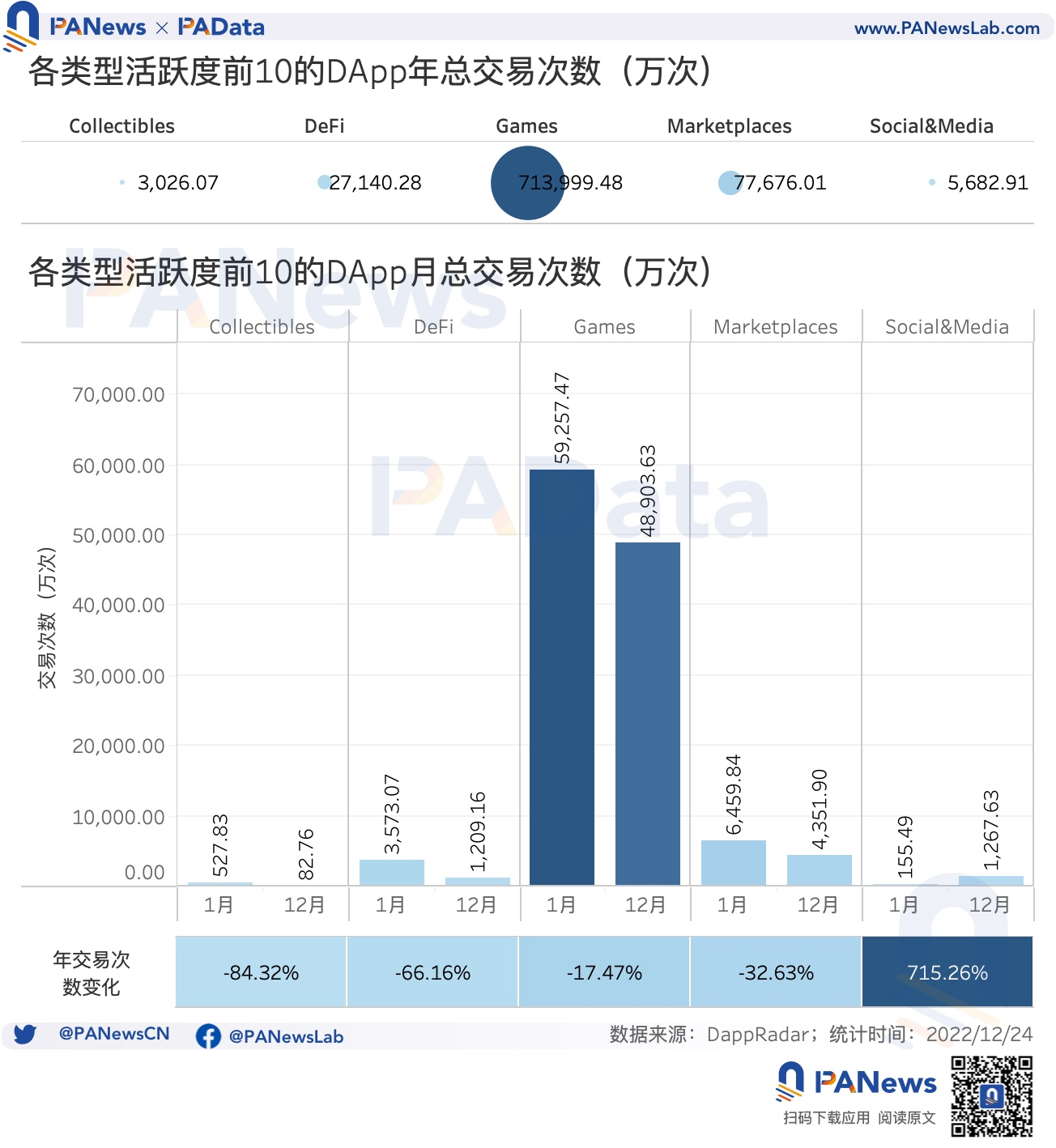

4) This year, only the number of transactions of Social & Media’s top applications is increasing, and the cumulative number of transactions from January to December increased by 715.26%. The other four categories all declined to varying degrees, among which Games dropped by 17.47%, which was a smaller decline.

5) The average monthly total revenue of the top 20 DApps is approximately US$152 million, and has shown a significant downward trend throughout the year. Total revenue in January was as high as US$515 million, but total revenue in December fell to US$24 million, a year-on-year decline of 95.34%. The average annual total revenue of 20 DApps is approximately US$83 million

There are 4,464 DApps with an estimated annual active address of 113 million. DeFi is no longer the dominant application type on Ethereum.

Major public chains have already regarded building a DApp ecosystem as their primary development strategy. According to DappRadar’s monitoring, currently, there are eight public chains with a large number of DApps and active addresses: Ethereum, EOS, Tron, Solana, Avalanche, BNB Chain, Polygon, and Optimism. PAData crawled these 8 public chains for DApps whose number of active addresses was not 0 in the last 30 days, and obtained a total of 4464 active DApps.

According to statistics, from the perspective of "public chain x type", BNB Chain has currently surpassed Ethereum to become the public chain with the largest number of active DApps, with a total of 1,779 observed. Among them, in terms of quantity, DeFi is the dominant type on BNB Chain, with a total of 709, accounting for about 40% of the total. Secondly, HighRisk (high risk) and Games are also the main types on BNB Chain, with 456 and 346 respectively, accounting for approximately 26% and 20% respectively.

Secondly, the number of active DApps on Ethereum also exceeded 1,000, reaching 1,259. Among them, Collectibles surpassed DeFi to become the dominant type, with a total of 625 observed, accounting for about 50% of the total. DeFi and Games have become the main types, with 304 and 160 respectively, accounting for approximately 24% and 13% respectively.

In general, the DApps on BNB Chain and Ethereum are mainly composed of 3 types, and all types are fully covered. However, the ecology on the other 6 public chains only consists of 1-2 types, and some types are missing. For example, Polygon ranks third in the number of active DApps. Among the 887 active DApps, there are 442 DeFi DApps, accounting for about 50%, and 162 Games, accounting for about 18%. Avalanche ranks fourth in the number of active DApps. 106 of the 197 active DApps are DeFi, accounting for about 54%. The number of active DApps on TRON, EOS, Optimism and Solana is small, and they are mainly DeFi.

From the perspective of "public chain Billions. Among them, BNB Chain has the most active users, followed by Polygon, Ethereum and Optimism. The estimated total annual active addresses of the 1,779 active DApps on BNB Chain is 53.02 million, which is much higher than the other seven public chains. Secondly, the estimated total number of annual active addresses of the 887 active DApps on Polygon is 24.65 million, and the estimated total number of annual active addresses of all active DApps on Ethereum and Optimism also exceeds 10 million. The remaining four public chains are affected by the small number of active DApps, and the estimated total number of annual active addresses is also small.

However, it should be pointed out that due to the overall downturn in market sentiment in the past 30 days, the number of active addresses has also decreased. Based on this, it is estimated that the number of active addresses throughout the year may be low. However, as a unified point of view, it does not affect the comparison of active addresses of various public chains.

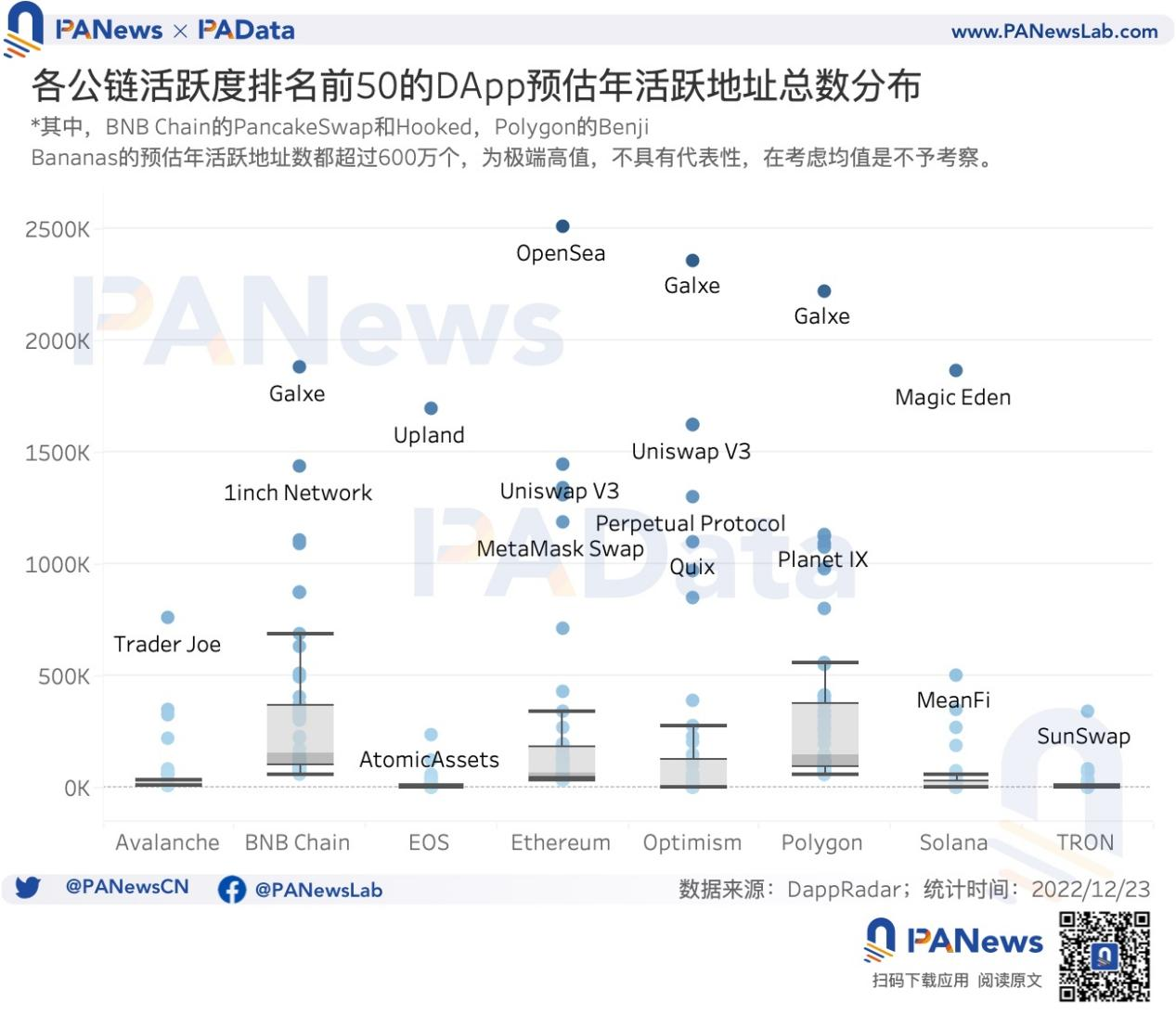

In order to eliminate the impact of the total number of active DApps on the observed number of active addresses of DApps on each public chain, PAData also calculated the average of the estimated annual active addresses of a single DApp on each public chain. After excluding extreme high values, the highest median estimated annual active addresses for a single DApp is Solana, with approximately 1,782, followed by Optimism, with approximately 1,387. The estimated median number of annual active addresses for a single DApp on other public chains is basically around 100-300.

From the morphological distribution, we can see that the estimated annual active address distribution of a single active DApp on each public chain is very discrete, and is generally greatly affected by long-tail DApps with low activity. In order to correct this effect, PAData focused on the estimated average annual active addresses of the DApps ranked among the top 50 active public chains (the top 50 average daily active addresses in the last 30 days) on this basis (excluding extreme values).

According to statistics, the top 50 most active DApps on BNB Chain and Polygon have the highest estimated median number of annual active addresses, about 155,100 and 143,600 respectively, followed by Ethereum, with the top 50 most active DApps estimated to have the highest median number of annual active addresses. The median annual active addresses are 65,900. Most of the estimated median annual active addresses for the top 50 most active DApps on other public chains are around 5,000-7,000.

There are 245 million annual active addresses in the top game category, and the number of active addresses and transactions in the social media category has increased significantly.

Different types of DApps show obvious differences in the size and behavior patterns of users. There are currently a large number of DApp types that have attracted much attention, mainly including Games, DeFi, Marketplace, Collectibles, Social & Media. Although there are many DApps in the High Risk (high risk) and Gambling (gambling) categories, these two categories have always been different. It is considered to be a key area for the future development of DApp and will not be further observed.

PAData selected the 10 active DApps with the highest number of active addresses in each category in the past 30 days as the analysis objects (hereinafter referred to as the top DApps), including SimpleFX in the DeFi category, Collect Trump Cards, Valhalla, Art Blocks Experimental and Collectibles in the Collectibles category. Although LaLiga Golazos and Blur in Marketplaces have a high number of active addresses in the last 30 days, the data collection period is less than 3 months, which is not conducive to observing the full-year data, so they will not be considered and will be ranked in order of activity until each type is selected. 10 or more. In addition, the focus here is on the differences in user scale and behavior patterns between different types of DApps. Therefore, although the selection of specific DApps has a certain degree of contingency, it does not affect the validity of the assumption that the performance of the head application is overall representative. .

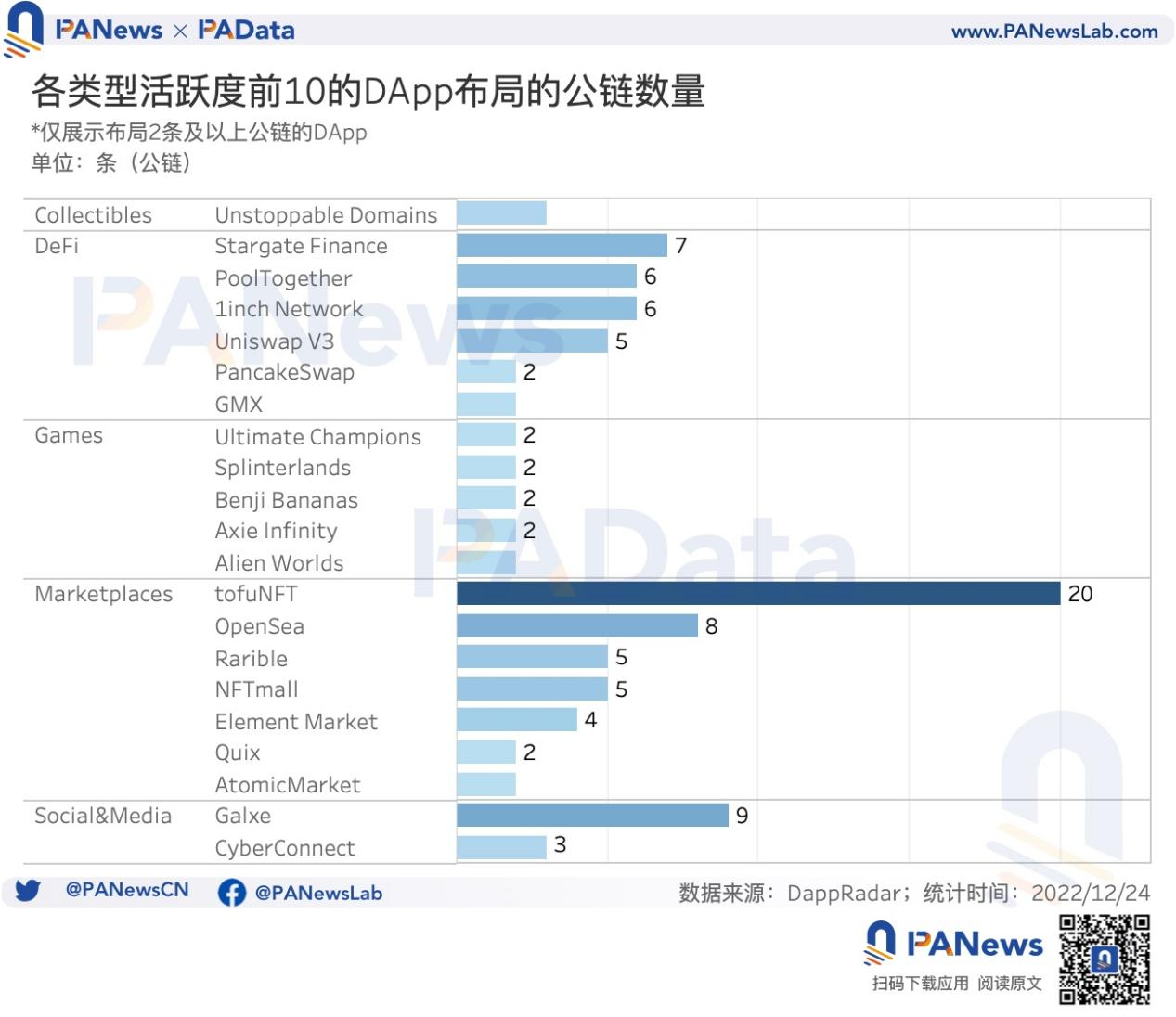

Judging from the multi-chain layout, there are 6-7 leading DApps in the Marketplaces and DeFi categories that have implemented a multi-chain layout with more than 2 public chains, and 4-5 of them have implemented a multi-chain layout with more than 5 public chains. Layout form. There are also 5 DApps in Games that have completed the multi-chain layout of 2 public chains, but only 1-2 of Collectibles and Social & Media have implemented multi-chain layouts without DApp. In general, the multi-chain layout of various DApps is the general trend, but there is room for further expansion of multi-chain layouts in many types, including Games. The increase in cross-chain liquidity is conducive to enhancing the usability of DApps.

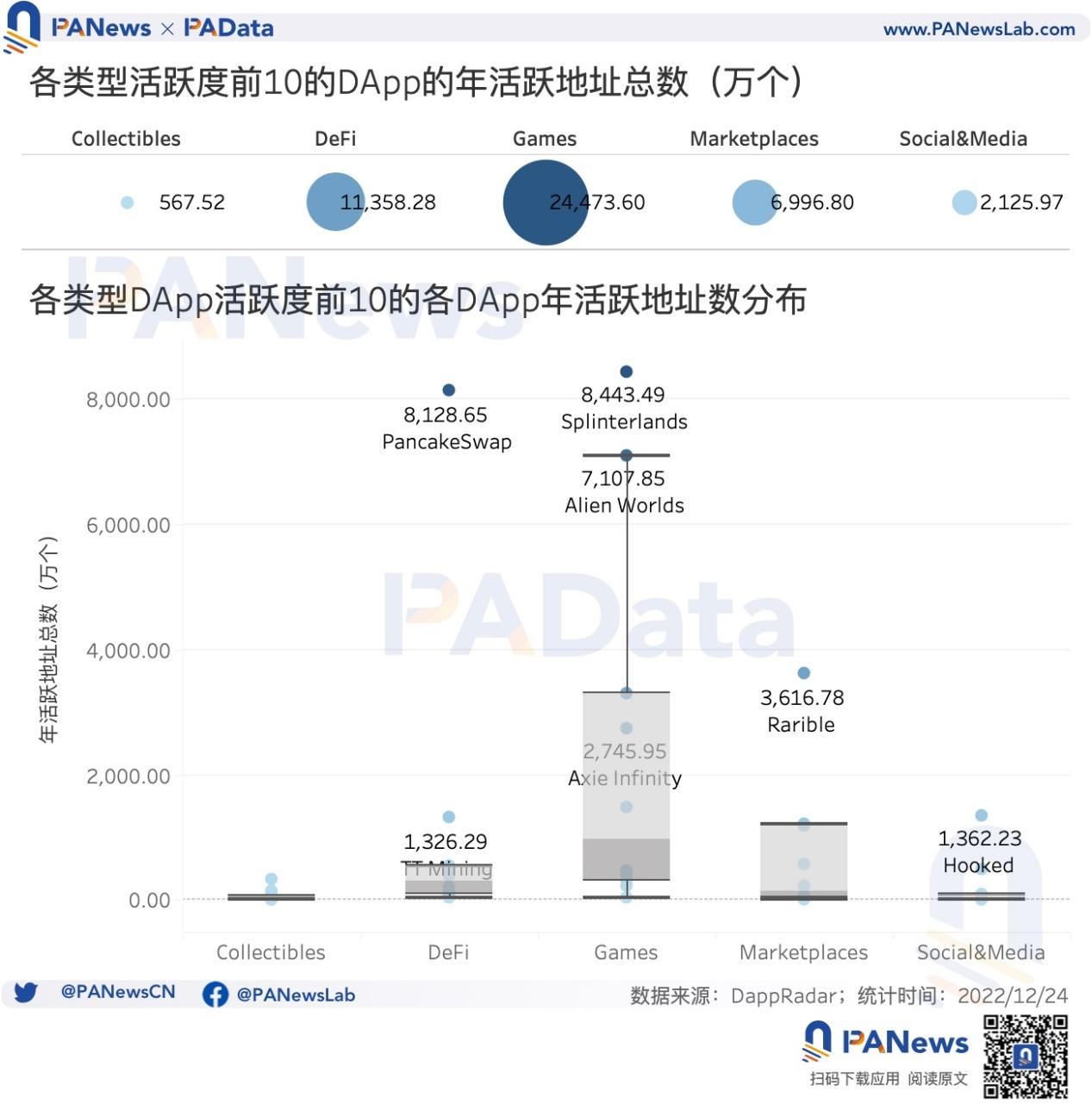

From the perspective of "type Among them, the total number of active addresses of Games’ leading DApp throughout the year was 245 million, the highest among all types. Followed by DeFi, the total number of active addresses of the top DApps throughout the year is 114 million. The lowest is Collectibles, with the total number of active addresses of the top DApps throughout the year only 5.67 million.

Moreover, there is not much difference in the active addresses of Collectibles head applications, and the distribution is relatively concentrated. The median number of annual active addresses of a single head DApp is only 81,300, and the maximum is only 3.2 million. Also having lower annual active addresses for a single top DApp is Social & Media, with a median of about 271,900. On the contrary, the annual active addresses of Games and DeFi top applications are much more, with the median reaching 9.7443 million and 2.9843 million respectively, and the maximum value exceeds 80 million. The characteristic of Marketplaces is that there is a huge difference between top applications. Therefore, although the maximum number of annual active places exceeds 36 million, the median number is only 1.4461 million.

In addition, judging from the changes in active addresses of header applications in each category, there is one point that deserves special attention. That is to say, only the active addresses of Social & Media’s top applications are on the rise this year, from a total of 400,000 active addresses in January to a total of 6.68 million active addresses in December, with the annual increase reaching 1583.75%. However, the active addresses of DApps in the other four categories have shown a downward trend throughout the year, with the cumulative decline in active addresses from January to December ranging from 50% to 80%.

In addition, the number of transactions and transaction amount are also aspects of user behavior patterns. Judging from the number of transactions, the total number of transactions for the 50 leading DApps in 5 major categories throughout the year was approximately 8.275 billion. Among them, Games’ top DApp has the highest total number of transactions throughout the year, approximately 7.14 billion, accounting for approximately 86% of the total. Followed by Marketplaces, the total number of transactions for the top DApps throughout the year was approximately 777 million. The total number of annual transactions for Collectibles and Social&Mediia’s leading DApps was relatively low, only 30.26 million and 56.82 million respectively. This is related to the characteristics of the application type itself. Games have ultra-high-frequency interaction characteristics, while Collectibles and Social & Media usually require interaction when minting NFT, and the interaction frequency is lower.

Judging from the changes in the number of transactions throughout the year, only Social & Media is growing. The total number of transactions in its top DApp increased from 1.5549 million in January to 12.6763 million in December, with the annual increase reaching 715.26%. The other four categories have declined to varying degrees. Among them, the total number of transactions of Games’ top DApp dropped by 17.47% from January to December, which is a smaller drop. During the same period, the total number of transactions of Collectibles dropped significantly, exceeding 84%. .

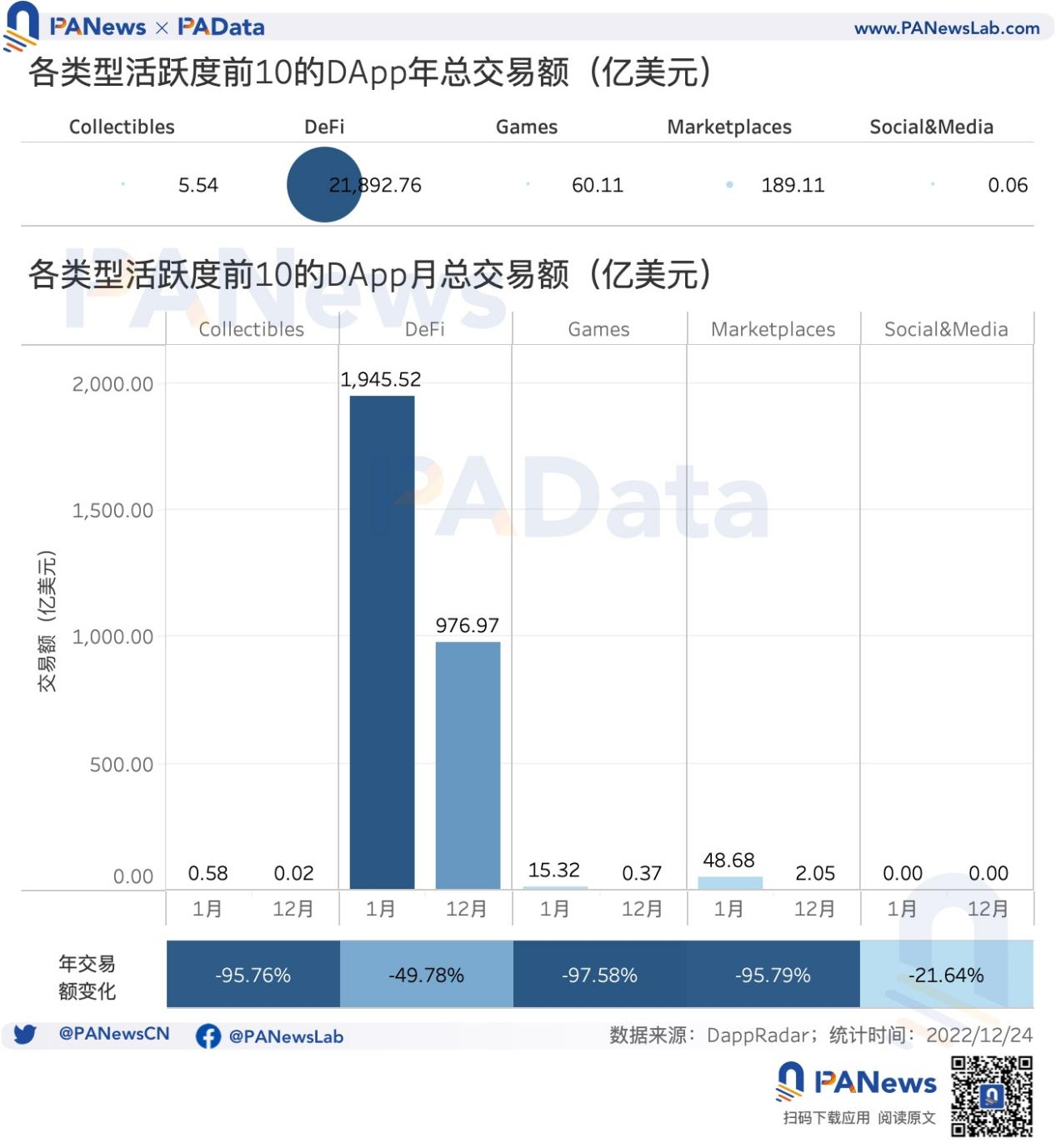

Judging from the transaction amount (the transaction amount that occurs when interacting with DApp contracts), the total transaction amount of 50 leading DApps in 5 major categories for the year is approximately 2.21 trillion US dollars. Among them, the total annual transaction volume of DeFi’s leading DApps is approximately 2.19 trillion, accounting for approximately 99% of the total. The transaction volume of other types of DApps is very small. The smallest of them, Social & Meida, has a total transaction volume of only about US$6 million as the leading DApp for the whole year.

Combined with the number of transactions, it can be seen that the user behavior characteristics of Games are obvious small-amount ultra-high-frequency interactions, DeFi is ultra-high-amount medium-frequency interactions, and Collectibles and Socia&Media are both ultra-small-amount ultra-low-frequency interactions.

Affected by the overall market environment, the total annual transaction volume of the five major categories of leading DApps has shown a significant downward trend. Among them, the total transaction volume of the three major categories of Collectibles, Games, and Marketplaces from January to December all fell by more than 95%. The lowest decline over the same period was Social & Media, which was about 20%.

The average monthly number of developers of top applications is 437, and the average monthly total revenue has dropped significantly to US$24 million.

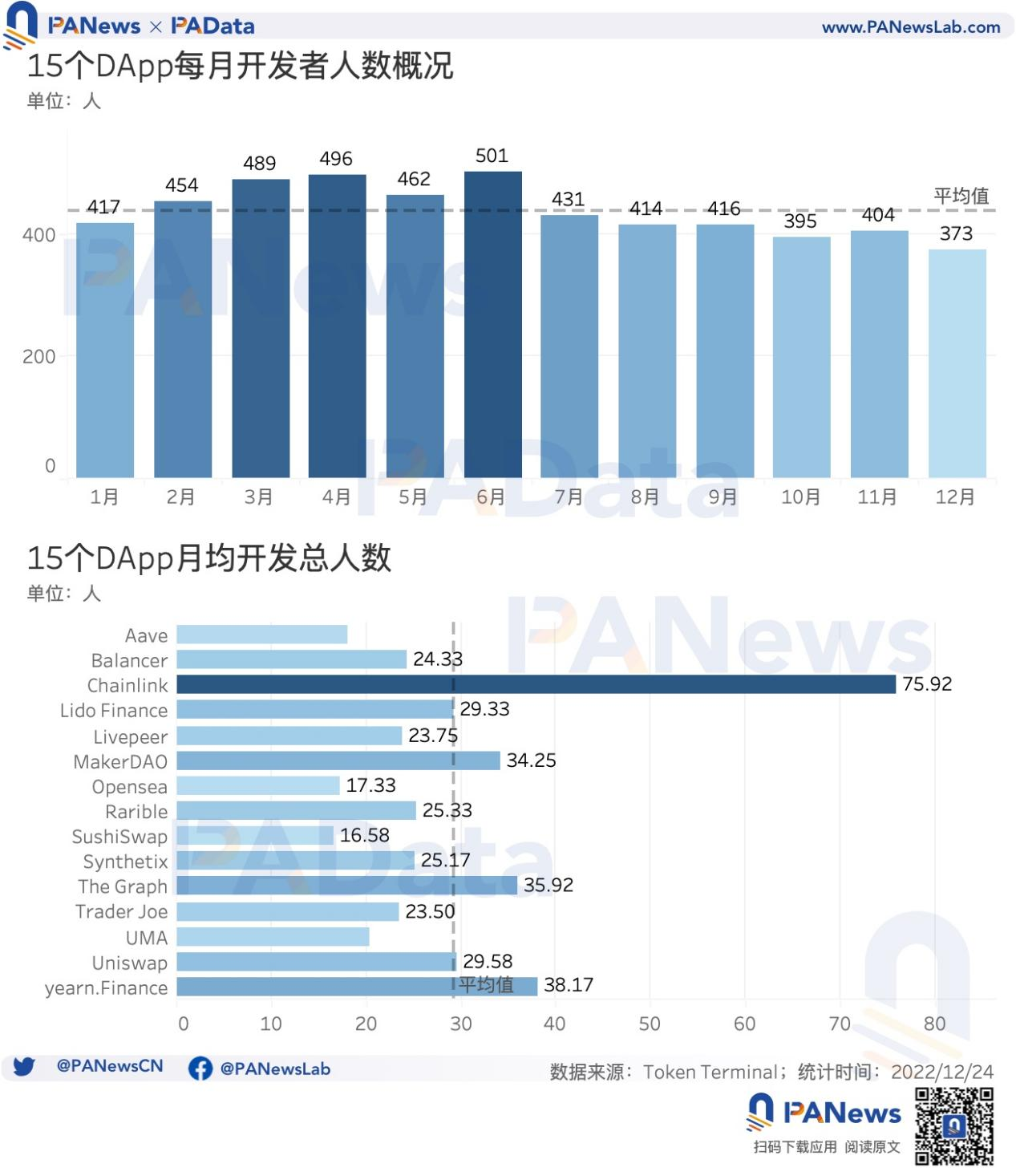

Finally, PAData also statistics on the development and revenue of top applications. According to TokenTerminal data, the 15 DApps with the largest number of developers include Chainlink, yearn.Finance, The Graph, MakerDAO, Uniswap, Lido Finance, Rarible, Synthetix, Balancer, Trader Joe, Livepeer, UMA, Aave, Opensea, and SushiSwap.

The average monthly total number of developers for the 15 DApps is approximately 437, and the total number of monthly developers in the first half of the year is higher than that in the second half of the year. In other words, the development activity in the first half of the year is higher than that in the second half of the year. Overall, development activity throughout the year showed a downward trend. Among them, March, April and June are the periods of high development activity throughout the year, with the total number of developers each month being more than 480. October and December are the periods of low development activity throughout the year, with the total number of developers each month being less than 400.

Looking at a single DApp, the average monthly number of people per DApp throughout the year is approximately 29. Among them, Chainlink has the highest number of developers, with an average monthly number of developers reaching 75. Secondly, MakerDAO, The Graph and yearn.Finance also have higher average monthly developers, all exceeding 30 people.

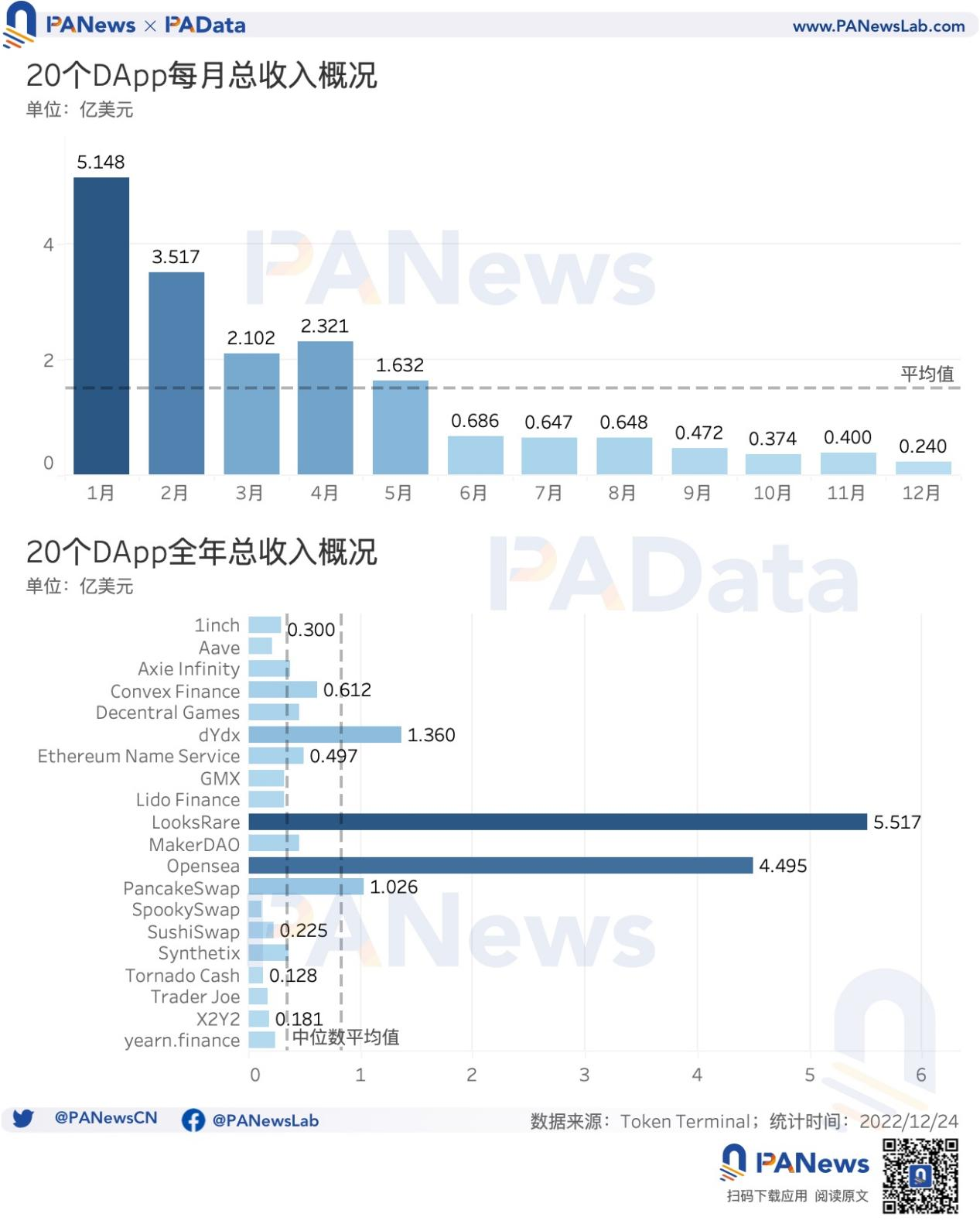

Also according to TokenTerminal data, the 20 DApps with higher cumulative total revenue (total handling fees received) include LooksRare, Opensea, dYdX, PancakeSwap, Convex Finance, Ethereum Name Service, MakerDAO, Decentral Games, Axie Infinity, Synthetix, GMX, Lido Finance, 1inch, yearn.finance, SushiSwap, Aave, Trader Joe, X2Y2, Tornado Cash, SpookySwap.

The average monthly total revenue of the 20 DApps is approximately US$152 million, and has shown a significant downward trend throughout the year. Total revenue in January was as high as US$515 million, but total revenue in December fell to US$24 million, a year-on-year decline of 95.34%. Since June, the total monthly revenue of 20 DApps has never exceeded US$70 million. It can be seen that DApp revenue is greatly affected by the fluctuation of the overall market environment.

Looking at individual DApps, LooksRare and Opensea, the two NFT trading markets, were the DApps with the highest total revenue throughout the year, reaching US$552 million and US$450 million respectively. But apart from that, the total annual revenue of other DApps is much lower. Only two DeFi DApps, dYdX and PancakeSwap, exceed US$100 million. The average annual total revenue of the 20 DApps is approximately US$83 million, but if the impact of extreme high values is excluded, the median is only US$35 million. Overall, the revenue performance of leading DApps is relatively good.