This series of articles will examine interesting companies or protocols, evaluate how they generate revenue, estimate their expenses and analyze their profits 📈.

Original: AAVE: DeFi Money Market Juggernaut 👻 (Pensive Pragmatism by Marco Manoppo)

Author: Marco Manoppo

Compilation: Dongxun, the way of DeFi

Personally, I'm fascinated by the culture of independent hackers, individual entrepreneurs, and self-starting companies that can generate huge profits for a core team at extremely high profit margins.

In contrast, cryptocurrency businesses and protocols tend to be rather ambiguous in terms of monetization models, focusing first on technology rather than business.

That's not necessarily a bad thing - but in the current macroeconomic and funding environment, crypto businesses need to refocus on one thing: "How do we make money?" 💰

Here are the main points for a quick summary:

- AAVE is the largest lending protocol with a TVL of $4.7 billion.

- Including token incentive emissions, AAVE is not profitable .

- AAVE 's coffers fell -88%, from a peak of $1.03 billion in Q1 2021 to $114.64 million in Q4 2022.

- AAVE tokens account for more than 80% of the protocol's treasury.

- According to LinkedIn, AAVE employs 117 people and is expected to burn $12-15 million a year.

AAVE: The Dominator of the DeFi Money Market

AAVE is a decentralized finance (DeFi) platform running on the Ethereum blockchain. It enables users to lend and borrow various crypto assets without the need for an intermediary. With AAVE, users maintain full control over their funds at all times and have access to a variety of lending and lending options.

- A unique feature of AAVE is its “Flash Loan,” which allows users to borrow funds without collateral in a very short period of time. This makes it popular among arbitrage traders and developers looking to build new DeFi applications.

AAVE has a native token called AAVE that can be used for governance and to earn passive income. By staking AAVE, token holders can earn 6-7% annual yield to help protect the protocol from any Liquidity crisis. This gain is not without risk. In case of bad debt accumulation , staked AAVE tokens can be cut by up to 30% 🗡️.

Overall, AAVE has become one of the most popular DeFi protocols in the industry, with billions of dollars in total value locked. So far, AAVE has maintained its position as a top 10 DeFi protocol by TVL.

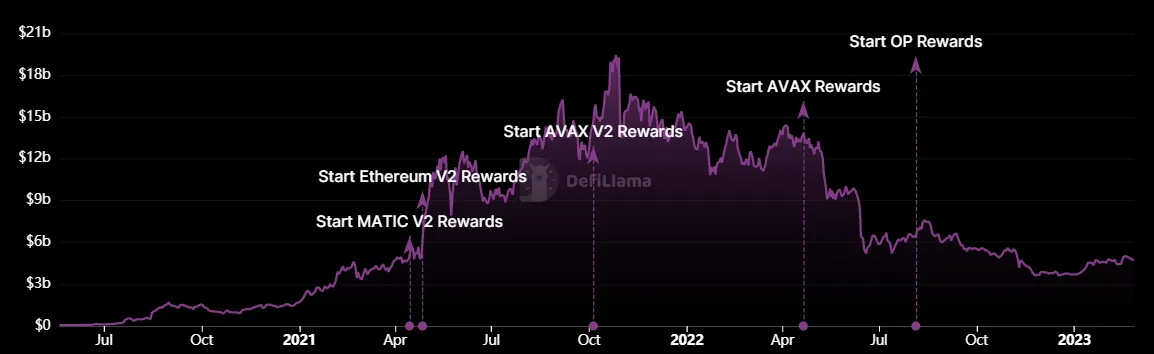

- Its current TVL is $4.7 billion .

- At its peak in October 2021, AAVE had a TVL of $19 billion .

How does AAVE make money?

Like many other DeFi protocols, AAVE generates revenue through various fees it charges on its platform. These fees are paid by users participating in lending activities on the AAVE platform.

The fees charged by AAVE vary depending on the specific activity performed on the platform. It's worth noting that AAVE 's fees are subject to change and may vary based on market conditions and other factors, such as whether a borrower is using a fixed or variable rate.

Here are some examples of what AAVE charges:

- Borrowing Fees: Fees charged to borrowers for loans on the platform, typically ranging from 0.01% to 25%, depending on the asset being borrowed, the loan-to-value ratio, and the term of the loan.

- Flash Loan service fee: Charged to users who use the platform's "Flash Loan" function, allowing them to borrow funds in a short period of time without collateral. The fee is typically 0.09% of the amount borrowed.

- Fees for other features: In V3, AAVE will offer to charge additional fees, such as clearing, instant Liquidity, gateway bridge, etc.

In short, AAVE earns revenue by charging users for its services. These earnings are then deposited into the AAVE community treasury, where AAVE token holders have the power to decide how the funds are spent. These are done through governance voting on various proposals on AAVE 's governance forum.

- As of February 28, 2023, AAVE had $131.9 million in funding.

- 81.7% (or $107.7 million) of AAVE ’s funds are in the form of AAVE tokens, with the remaining 15.3% in USD-denominated Stablecoin.

- At its peak in the second quarter of 2021, AAVE 's coffers stood at $1.03 billion.

If we look at the graph below, AAVE has managed to maintain an average revenue of around $20K per day for the past 6 months.

However, these figures are top earners. Basically, AAVE isn't very useful without understanding how much money Aave burns to pay its employees and service providers or token incentives.

Headcount and capital burn

AAVE has 117 employees, according to LinkedIn. Its first 5 "sectors" are as follows:

- Engineering – 37 people

- Business Development – 22 people

- Finance – 12 people

- Art and Design – 11 people

- Marketing – 9 people

Let's create a scenario to estimate how much AAVE needs to spend on the 5 sectors above:

- Engineering: In the $100,000 to $200,000 range, AAVE pays $3.7 million to $7.4 million per year.

- Business development: In the $80,000 to $120,000 range, AAVE needs $1.76 million to $2.64 million per year.

- Finances: With $80,000 to $120,000, AAVE pays $960,000 to $1.44 million per year.

- Art and Design: In the $60,000 to $90,000 range, AAVE pays $660,000 to $990,000 a year.

- Marketing: In the $50,000 to $80,000 range, AAVE pays $450,000 to $720,000 per year.

In total, AAVE needs to spend between $7.53 million and $13.19 million per year for the five sectors listed above.

This does not include the remaining 26 employees who were not included in the calculation. Assuming an average salary of $80,000, AAVE would need to spend an additional $2.08 million on these individuals. That pushes the final total to $9.53 million – $15.27 million .

Additionally, data from Token Terminal indicates that AAVE spent $124.67 million in token incentives in 2022, adding another indicator of its capital burn.

income

Thanks again Token Terminal for the heavy lifting 👷⛏️

In 2022, AAVE reportedly lost $103.7 million , including spending on token emissions to bootstrap or maintain Liquidity, a key element of its service. If we include the additional $9.53 million – $15.27 million in personnel costs calculated above:

AAVE net loss from operations in 2022 will be $113.23 million – $118.97 million.

While that might look dire considering AAVE only has $120-$130 million in coffer capital left, there may be a silver lining to all of this.

- 👑 AAVE is the de facto leader in the crypto lending space, Compound is the closest competitor.

- ⬆️ AAVE 's business model can still scale exponentially as it gets closer to a decentralized money market fund, especially its upcoming GHO Stablecoin, which will be the cornerstone of more innovative products.

- 👩⚖️ AAVE has barely touched the institutional side of DeFi services, with its AAVE Arc KYC authorization pool failing miserably .

- 🏄 Compared to Q4 2022, AAVE trailing 3-month earnings have shown a positive trend, suggesting that the protocol is treading cautiously in this bear market.

- 💼 AAVE latest round of financing was a $25 million Series B round in October 2020. In a worst-case scenario, they can still raise a Series C round in the next few years.

future plans

AAVE launched Version 3 (Version 3) in January 2023, focusing on improving the capital efficiency of Stablecoin and Liquidity collateralized Derivatives lending. AAVE is also developing a Stablecoin called GHO, a decentralized multi-collateral Stablecoin that is fully backed, transparent and native to the AAVE protocol. Currently, it is only active on the AAVE platform on the testnet and has not yet been deployed to the mainnet.

With GHO and version 3, AAVE is positioning itself as the go-to lending market around Stablecoin and Liquidity collateralized Derivatives.

- Basically, the platform will lift and re-stake users’ assets as the broader cryptocurrency industry moves to Proof-of-stake stake (and thus yield), Liquidity collateralized Derivatives, and Stablecoin.

- By launching its own Stablecoin, AAVE expands the TAM (Total Addressable Market) and further solidifies its position as a DeFi giant.

- Globally, money market funds hold about $3 trillion .

What to do next: AAVE needs to reduce its token incentive payouts while maintaining leadership by creating innovative products through its own Stablecoin and LSD capital efficiency.

- Without token incentives, AAVE is roughly at break-even given its headcount and other operating costs. With just a slight tweak to the top or bottom line, the agreement should be profitable.

We predict that AAVE 's eventual form will be closer to a decentralized money market giant.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal views of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.