Source: DroomDroom

Compilation: BitpushNews Mary Liu

Ethereum will usher in the "Shapella upgrade" (Shanghai upgrade "EIP-4895") on April 12. The previously locked validator tokens will be unlocked, which will greatly increase the Liquidity of Ethereum. In recent months, Liquidity Staking platforms have attracted a lot of attention, with Liquid Staking Derivative (Liquidity Staking: LSD) offering a unique solution to the problems associated with traditional staking.

Liquid Staking Derivatives (LSD) is the latest innovation in the DeFi field, which allows users to earn staking rewards while retaining access to their assets. The LSD platform operates through tokenization and can be used for lending, trading and collateral. Through LSD, users and investors can access their mortgage tokens at any time, receive tokenized assets or derivative tokens; it can also be used for external transactions, maximize potential returns, and at the same time receive rewards related to asset mortgages, creating multiple sources of income .

In this article, we discuss what Liquidity staking/ Derivatives/LSD are, outline some of the advantages and risks of LSD and some of the top LSDs in the crypto market.

To fully understand the mechanics behind LSD, we need to examine two concepts: Liquidity Staking and Derivatives.

Liquidity pledge

Staking is when users lock up their assets for a specific period of time, which means they are likely to miss out on opportunities to profit by trading tokens. However, the development of Liquidity staking allows token holders to earn staking rewards and use their tokens as they wish. This ensures that stakers can earn staking rewards and have the opportunity to use tokens in external transactions, further helping them maximize returns and generate multiple revenue streams.

Liquidity staking is an advanced or updated version of traditional staking that can be used on smart contract protocols. To keep the blockchain secure, stakeholders pledge their funds while still having access to those funds at any time.

Derivatives

A Derivatives is simply defined as a contract between two parties. They are financial instruments backed by underlying assets (collateralized tokens). This underlying asset or pledged token represents the value of your pledged assets. The price of Derivatives is determined by fluctuations in the value of the underlying asset or pledged tokens.

What are Liquidity Staking Derivatives(LSD)?

LSD is the token that confirms and verifies stakers' participation in the staking pool. These tokens can be used for lending, trading, and staking across the DeFi ecosystem. LSD utilizes the concept of tokenization to ensure that participants or stakeholders can benefit from Derivatives, as well as benefits associated with token staking. LSD provides a platform for stakers to pledge any number of tokens, and in return they receive derivative tokens that can be used in other Defi protocols.

Additionally, LSD allows investors to generate returns when using their Collateral asset as collateral in other DeFi protocols. A major advantage of LSDs is that they allow users to earn staking rewards without locking up their tokens for long periods of time; however, due to the volatility of cryptoassets, locking up tokens for long periods of time does not always lead to positive returns.

Finally, stakers can earn staking rewards, retain access to their funds, and take advantage of market price fluctuations.

The LSD mechanism: how does it work?

We already know that when tokens are staked, they are locked for a period of time, so they cannot be traded or withdrawn during this time. However, the development of LSD is changing this narrative, as it allows users to stake any amount of assets and unstake them without any impact on the initial deposit. This is because deposits are locked on a Liquidity staking platform and users are issued a tokenized version of that crypto asset (i.e. a derivative token). These derivative tokens have a value equivalent to user deposits and are pegged one-to-one with the original pledged assets.

However, in order to better identify them, they are given different code names. For example, if you deposit 2ETH into a Liquidity staking service, you will receive one stETH as a derivative token that can be traded, spent or stored elsewhere.

This allows users to earn staking rewards from their initial deposits while profiting from trading derivative tokens.

The following example can understand the mechanism of LSD more clearly:

You currently have $20,000 in your hand, and you decide to bring it to the LSD platform and stake it in the treasury for 3 months; the LSD platform gives you tokens equivalent to your locked $20,000. With these tokens, you can pay your bills, execute transactions—everything you can do with $20,000.

At the end of the 3 months, you will get back the $20,000 and the rewards associated with the lock period, and you will also receive the profits earned during the use of the token as fiat currency. In this case, your locked $20,000 is the pledged token, and the $20,00 of the token is your derivative token.

Advantages of LSD

1. Advocate and encourage staking activities, staking tokens make the network more secure and stable.

There is a direct relationship between the security of a proof-of- Proof-of-stake network, the number of validators on the network, and the amount of funds they have invested. Therefore, the higher the number of validators on the network, the greater the stake capital increase, and the stronger and more secure the network becomes.

However, there is still a limitation that users cannot access their staked tokens during staking, which is where the concept of LSD comes in. LSD offers a unique solution by issuing tokenized versions or Derivatives. This innovation also increases staking activity, as stakers are now confident that whenever they stake their assets, they will receive derivative tokens that can be used for other activities such as lending and trading.

2. Get Multiple Income Streams

With LSD, stakeholders can now lock their funds or assets on a platform and continue to use tokenized versions or derivative tokens as collateral for crypto-backed loans. These loans are deposited at a higher yield to generate more return on investment (ROI).

Risks Associated with LSD

1. Slashing

There is no doubt that Liquidity collateralized Derivatives have many exciting benefits and rewards, but that does not mean that they are risk-free. A common disadvantage is the risk of financial loss from curtailment. Penalty mechanisms regulate and check misbehavior (such as double signing and validator downtime) by validators (someone or network nodes that process and validate transactions on the blockchain). Whenever misconduct is detected, whether intentional or not, a certain percentage of validator tokens are lost.

2. Smart contract risk

Another common risk is smart contract risk. Although blockchain technology is known to be secure, we must admit that sometimes there are loopholes where intruders can exploit users with their funds and assets.

3. If a user loses their tokenized assets/derivative tokens in a transaction or trade, they may lose their staked funds, and the only way to get back the staked funds is to make another equivalent deposit.

Top Liquidity Staking Providers

Below are some of the top Liquidity staking protocols in the crypto space. These LSDs have their own unique mechanisms and methods of generating Liquidity.

1. stETH from Lido Finance

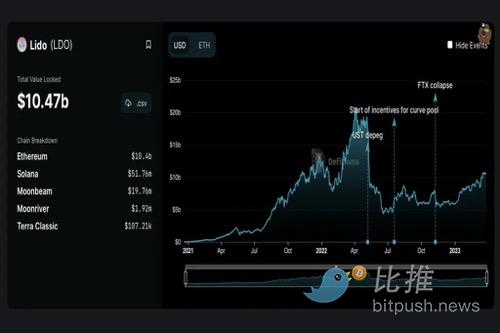

The Derivatives of Lido Finance is stETH (st means staked pledge). Lido Finance is the most popular Liquidity staking protocol. The native token(LDO) is a governance token used to support ETH Liquidity staking. Users can also use LDO digital tokens to vote on network proposals and earn passive income from staking.

Additionally, when users stake their ETH tokens, Lido will issue them stETH in exchange. These Derivatives(stETH) can be withdrawn and spent in over 27 DeFi applications and crypto wallets. Lido charges a 10% fee for Liquidity staking services, which is split equally between the DAO and node operators.

At the time of writing, Lido has 73.34% of the ETH market share, 5.2 million ETH staked, and a total value locked (TVL) of $10.47 billion.

2. Coinbase’s cbETH

At the time of writing, Coinbase has 15.64% of the ETH market share; 1.1 million ETH staked, with a TVL of $2.09 billion. Coinbase's Liquidity derivative token is cbETH. One of the reasons Coinbase launched its LSD was to compete with Lido's dominance and prevent Lido from jeopardizing Ethereum's decentralization. However, the limitation of the Coinbase Derivative Token (cbETH) is that it does not have much utility in DeFi, so they may not attract too many crypto investors. Coinbase charges a 25% fee for Liquidity staking services.

3. Frax Finance’s Sfrx ETH

sfrxETH is a derivative token of Frax. Frax offers the highest yield due to its dual token design. sfrxETH is one of the newly created Liquidity collateralized Derivatives in the crypto market. Frax uses frxCTH/ ETH to provide a liquidity pool on the curve, but if users pledge sfrxETH, they will only get pledge rewards.

At the time of writing, they have 1.44% of the ETH market share; 102,429 ETH staked, with a TVL of $221.6 million.

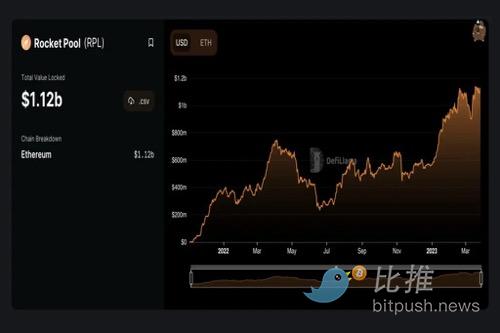

4. rETH from Rocket Pool

rETH is Rocket Pool's decentralized Liquidity staking Derivatives. Rocketpool is probably the most decentralized option of all the Liquidity staking providers listed in this article.

With Rocket Pool, stakers can obtain funds from external sources to run a validator node for as little as 16 ETH instead of the 32 ETH typically required by ETH validators. Also, these validators need to add at least 10% of 16ETH as collateral in case they get slashed.

At the time of writing, Rocket Pool has 5.84% of the ETH market share; 414,312 ETH staked, with a TVL of $1.12 billion.

5. StakeWise’s sETH2

StakeWise operates a secure and stable institutional-grade infrastructure, combined with unique token economics, to provide its users with the highest possible staking returns. StakeWise Ethereum staking consists of a hybrid token system that splits users' own staked ETH into sETH2 tokens and rewards into rETH2 tokens.

At the time of writing, StakeWise had a TVL of $150 million, an APR of 4.79%, and a market share of 1.11%.

next hot story

LSD is very popular in the encryption community, and other large and small encryption companies have also begun to adopt Liquid pledged Derivatives to unlock capital efficiency, increase yields, diversify risks, and support the development of decentralized financial ecosystems. As such, it's hard not to believe that they are the next big story in the DeFi space.

A few weeks ago, Yearn Finance announced that it was now launching a derivative token called yETH. Potential use cases for this new derivative token include: diversifying risk for stakeholders, enhancing yield for stakeholders, and having multiple exposures through a single token.

ChainLink has embraced LSD as an important component in unlocking capital efficiency and supporting DeFi growth. They recently tweeted that with Chainlink Proof of Reserves, anyone can verify that their Liquidity staked tokens are fully backed by staked native token.

The invention of LSD increases the stakers' rewards, and staking participation further strengthens the network and helps build the future of the crypto ecosystem. The crypto community strongly believes that the concept of LSD is here to stay, and we are likely to see more groundbreaking use cases.