Key points:

- Regulatory Impact and Market Adaptation: The SEC’s review of Uniswap highlights the regulatory hurdles facing DEXs, while market events such as the USDC decoupling test the resilience and adaptability of these platforms.

- Volume Growth: DEX volume growth, Uniswap quarterly volume rises to $84 billion in Q1 2024

- Curve’s Challenges: While utilization is rising, Curve Finance’s liquidity and trading volumes are down from their peak.

introduce

Decentralized exchanges (DEXs) form a core part of the infrastructure in the digital asset ecosystem. They act as a gateway to the on-chain economy, facilitating listings, trading, and liquidity provision across markets without the need for intermediaries. Uniswap debuted in 2018, marking a groundbreaking development in the use of liquidity pools and automated market makers (AMMs), a model that has since been widely adopted by many DEXs. As the number and maturity of decentralized exchanges continue to grow, assessing their adoption can provide insight into key components of cryptocurrency infrastructure.

In this episode of Coin Metrics’ State of the Network, we take a data-driven approach to explore activity on Ethereum decentralized exchanges, examining liquidity, trading volumes, and the trends shaping the DEX landscape.

Characteristics of decentralized exchanges and AMMs

In light of the SEC’s recent Wells Notice to Uniswap Labs, it is critical to highlight the unique characteristics of DEXs. While the specific issues have not yet been fully disclosed, the SEC’s potential intent to bring DEXs under regulation mirrors actions taken against major centralized exchanges such as Coinbase and Binance, particularly with regard to the securities classification of traded assets. However, decentralized exchanges are fundamentally different from centralized exchanges.

At the core of most DEXs are automated market makers (AMMs). Unlike traditional exchanges that rely on centralized order books and market makers to match counterparties, AMMs use pricing algorithms to manage the price and liquidity of tokens in pools. These pools are funded by liquidity providers (LPs), who earn trading fees based on their contributions, creating an environment where users maintain control of their funds. This is in stark contrast to the custodial nature of centralized exchanges (CEXs). As a result, the permissionless, autonomous, and non-custodial nature of DEXs, governed by open-source smart contract code , sets them apart from platforms that are subject to greater regulatory scrutiny.

The following section will take a deep dive into some of the largest DEXs in the Ethereum ecosystem, focusing on their evolution and usage, supported by DEX market data and network data from Coin Metrics.

Trading volume rises

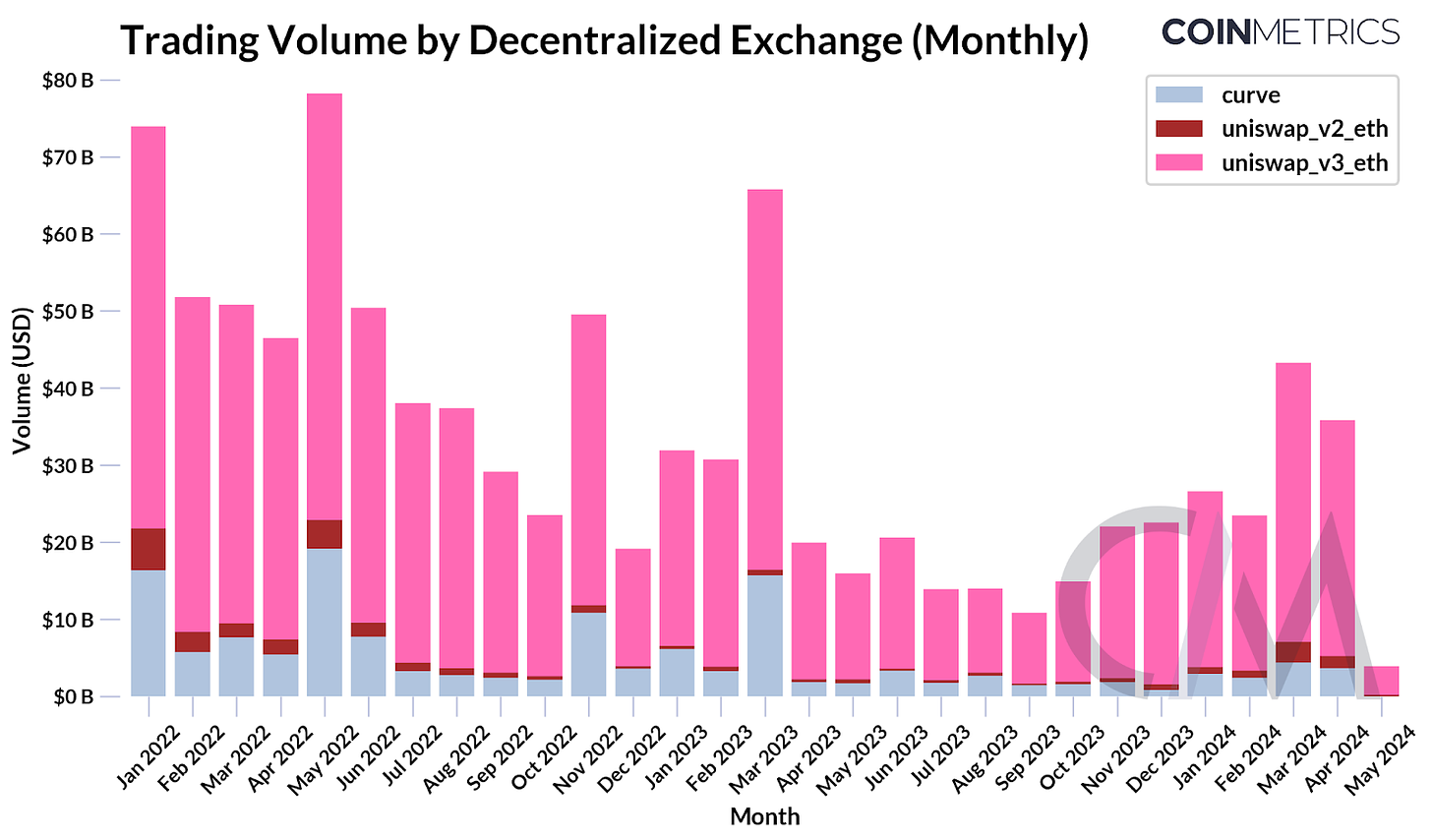

Volumes on major decentralized exchanges (DEXs) are currently trending upward. While market volatility occasionally spurred spikes in activity, volumes remained subdued for much of last year, averaging around $15B per month. However, since October, Uniswap’s quarterly volumes have reached $54B in Q4 2023 and $84B in Q1 2024. Curve Finance’s volumes are also rising, though not yet to the levels seen before USDC’s decoupling in March 2023.

Source: Coin Metrics DEX Market Data and Labs

Uniswap — The largest market and liquidity pool

Today, Uniswap has become the largest decentralized exchange by trading volume, with a cumulative trading volume of more than 2T USD. It is regarded as the cornerstone of the expansion of the entire decentralized finance (DeFi) field. With each iteration of the protocol, Uniswap's liquidity provision model has made some progress.

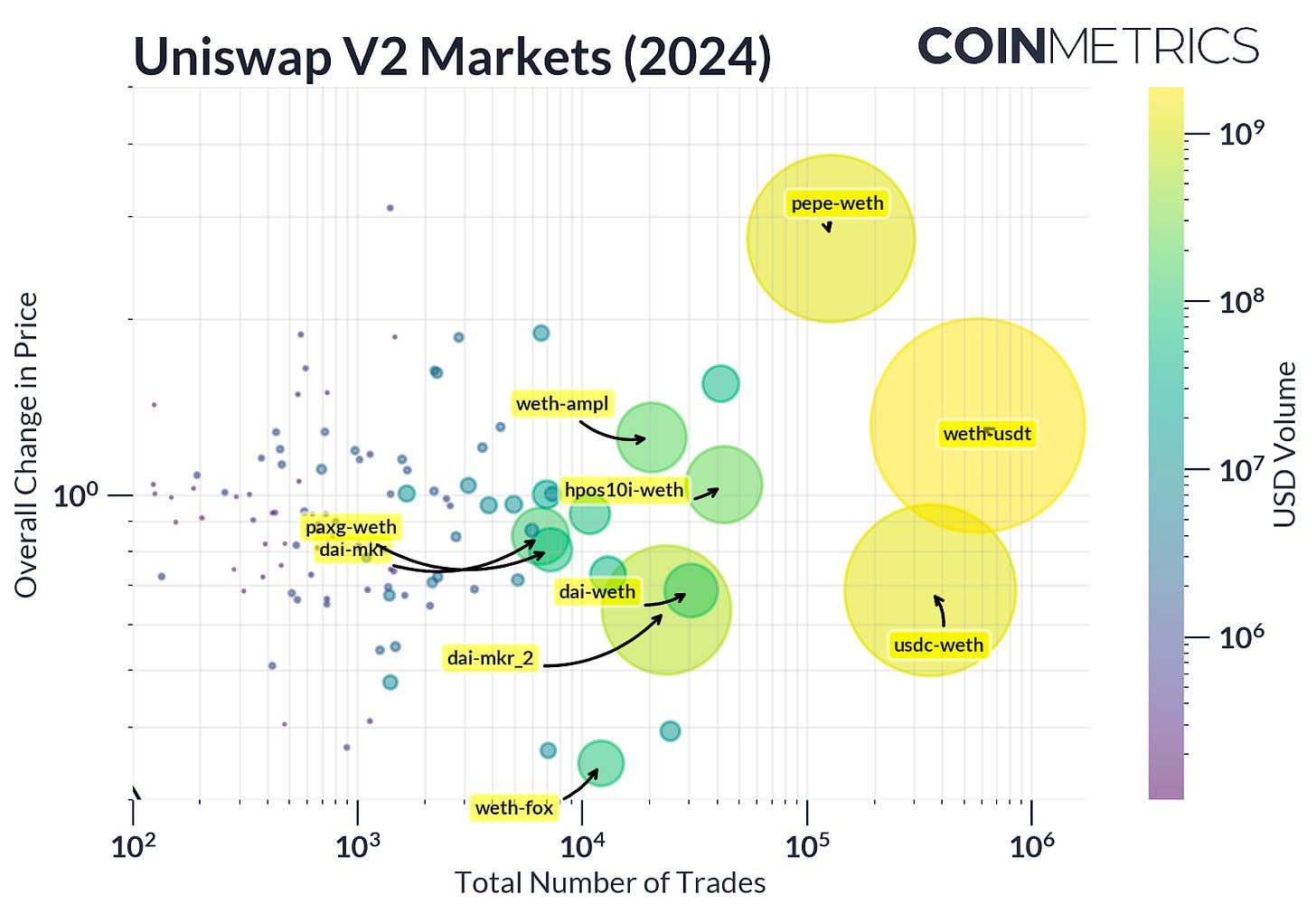

Uniswap v2 , launched in 2020, provides a base AMM platform leveraging a constant product invariant (x * y = k). This version facilitates token swaps by ensuring liquidity even in less active markets, and its permissionless process of creating markets (also known as pools) makes it a breeding ground for a variety of currency pairs ranging from blue chip stocks to memecoins. While trading volumes do not match Uniswap v3, several pools on Uniswap v2 have more trading volume, favoring newly listed tokens and passive liquidity providers. However, this also brings challenges, such as susceptibility to maximum extractable value (MEV) forms , reduced capital efficiency due to having to allocate capital across the entire price range, and potential Impermanent Loss, which reduces returns for liquidity providers.

Source: Coin Metrics DEX market data

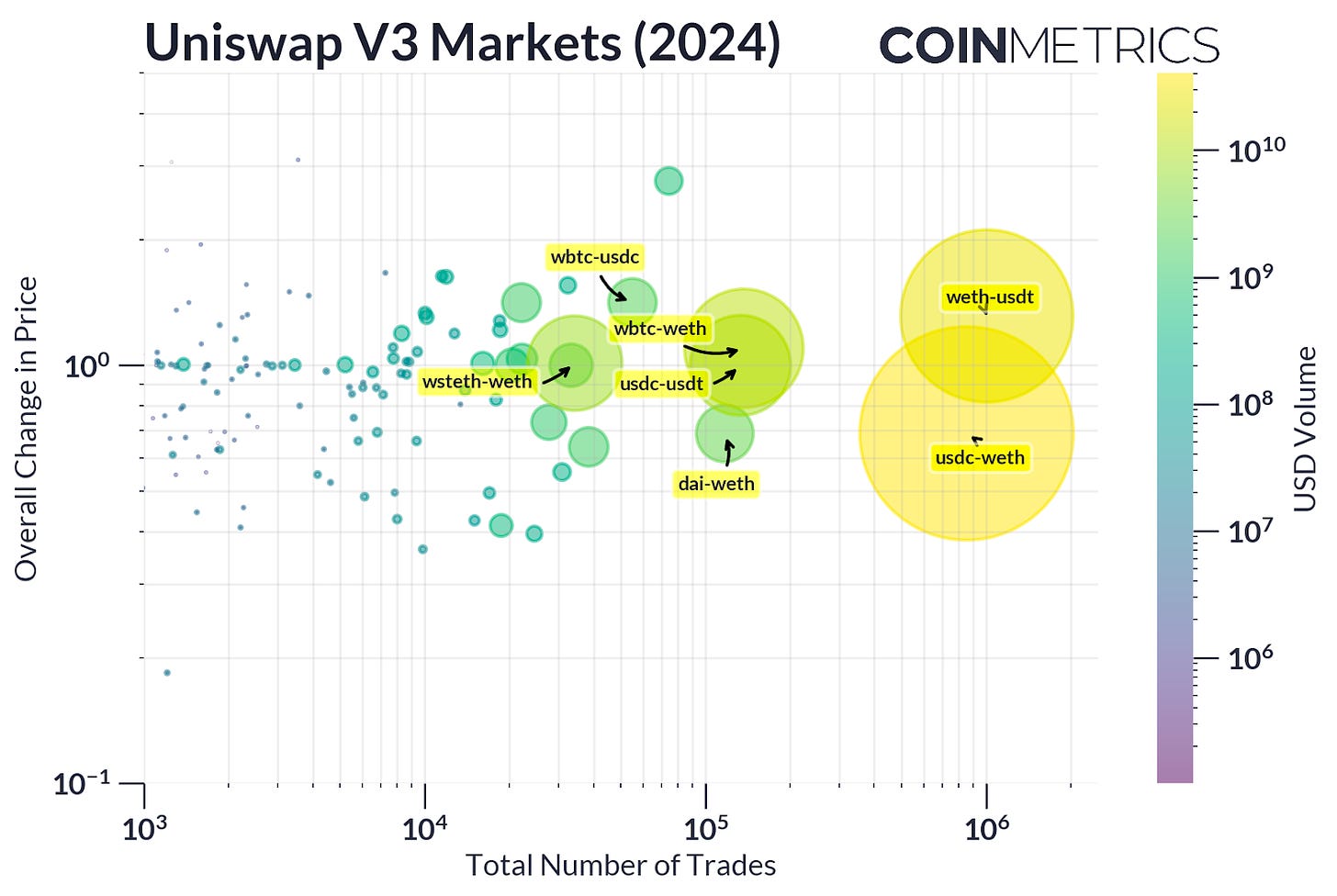

Uniswap v3 addresses these challenges through its centralized liquidity model, allowing LPs to allocate capital within specific price ranges. This enhancement greatly improves capital efficiency and LP returns, as token reserves only need to be maintained within the prescribed price range where liquidity is most needed. As shown in the figure below, this mechanism significantly increases liquidity in the stablecoin market.

Uniswap v3 also introduces fee tiers (0.1%, 0.05%, 0.3%, and 1%), increasing the granularity of the trading experience across pools. This innovation provides LPs and exchangers with the option to manage risk more efficiently, allowing them to adjust their exposure based on market volatility or the nature of an asset pair (either stable or more volatile).

Source: Coin Metrics DEX market data

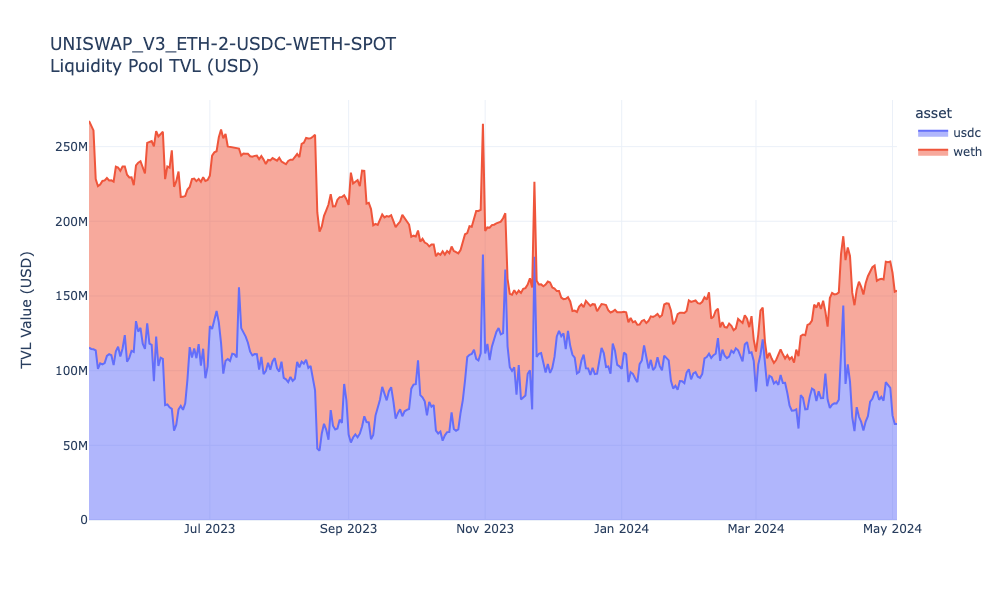

Circle's USDC-WETH pairing (USDC-WETH pool) charges a 0.05% fee and is one of the most liquid and actively traded markets on Uniswap v3. The pair attracts more trades due to low transaction costs, low price volatility, and the popularity of both assets. These factors make it an attractive option for both traders and liquidity providers.

Source: Coin Metrics DEX market data and ATLAS

Curve — Relatively low liquidity, high utilization

Similar to Uniswap, Curve Finance is an automated market maker (AMM)-based DEX that has become a central hub for assets of similar value. Before the launch of Uniswap v3's centralized liquidity mechanism, stablecoins often faced liquidity challenges, with relatively low fees earned by liquidity providers (LPs). Curve, launched in 2020, aims to address these issues by enabling low-slippage swaps between stablecoins through its StableSwap AMM. The system uniquely combines constants and invariants (x + y = k) with the constant product invariant (x * y = k) used by Uniswap. As a result, Curve facilitates a diverse market for stablecoins, wrapped assets, and liquid staking tokens (LSTs), focusing on deep liquidity within a narrow price range.

Source: Coin Metrics DeFi Balance Sheet and Labs

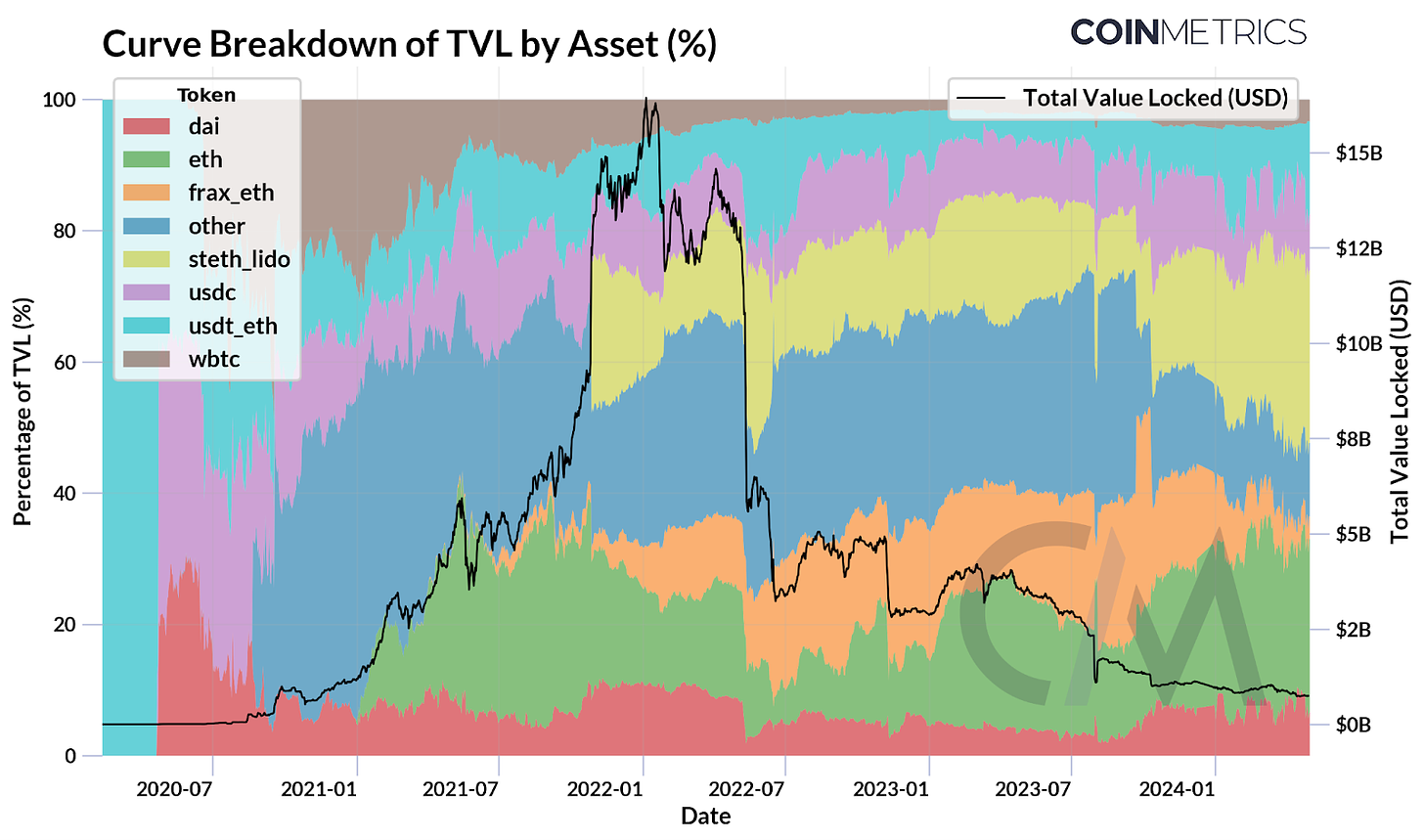

As shown in the figure above, the total value of assets locked in Curve smart contracts (TVL) quickly rose to over $15B in 2021, followed by liquidity outflows due to user loss of confidence in decoupling and vulnerability exploits in 2023. Over time, Curve's liquidity composition has changed, with ETH (26%), stETH (26%), and stablecoins (32%) making up the majority of liquidity, while the dominance of other assets has declined.

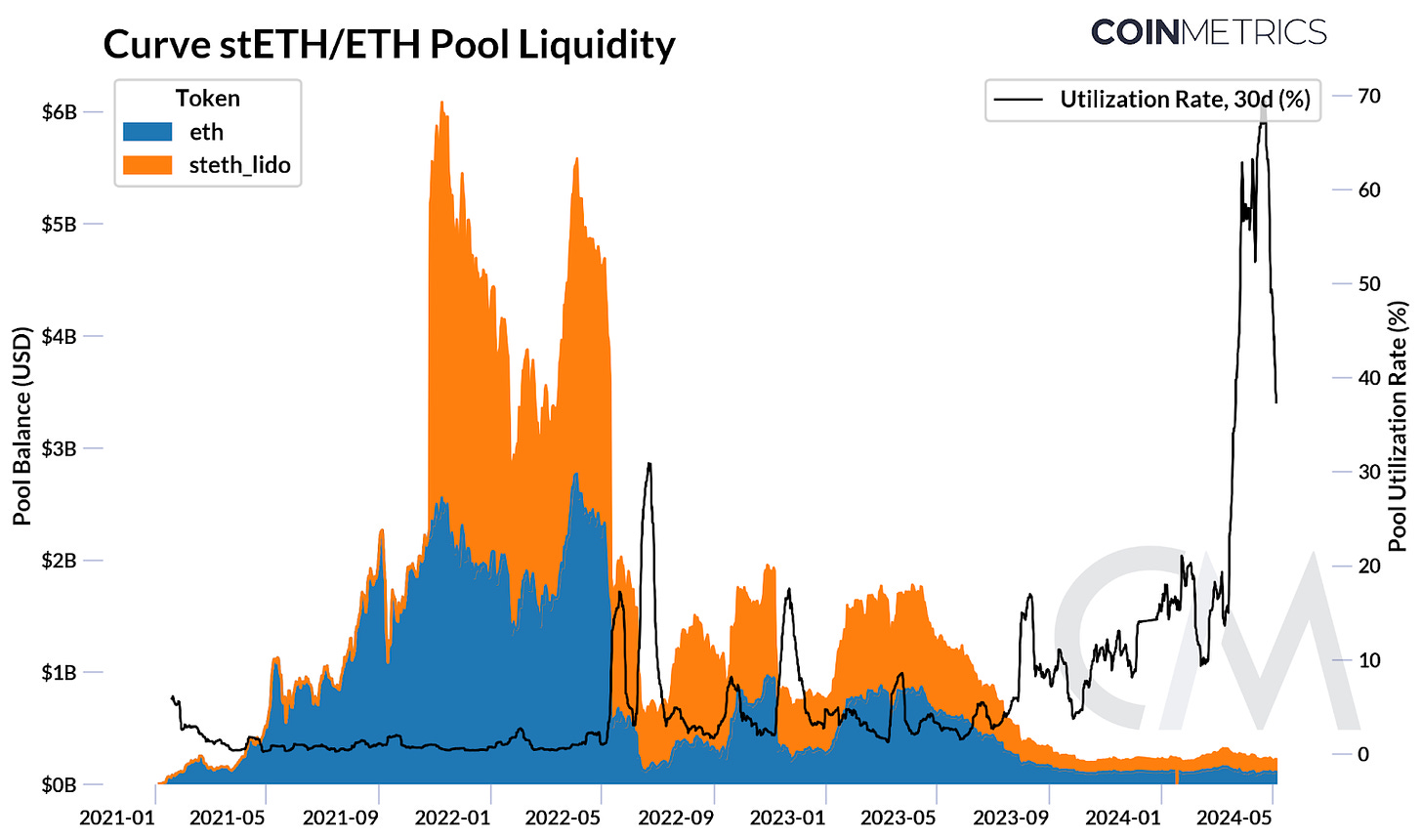

Currently, the stETH/ETH pool is the largest liquidity pool on Curve. Curve is the main hub for stETH, and before the Shapella upgrade , most of the liquidity was concentrated here. However, since the stETH decoupling in May 2022 (when the price of stETH deviated from the underlying ETH by ~6.5%) and the introduction of withdrawals, this has changed. Liquidity has expanded to other AMMs and CEXs, and there is also a primary market for stETH liquidity. Currently, there is ~$220M in liquidity in the pool, significantly lower than the peak of $6B in early 2022.

Source: Coin Metrics Labs

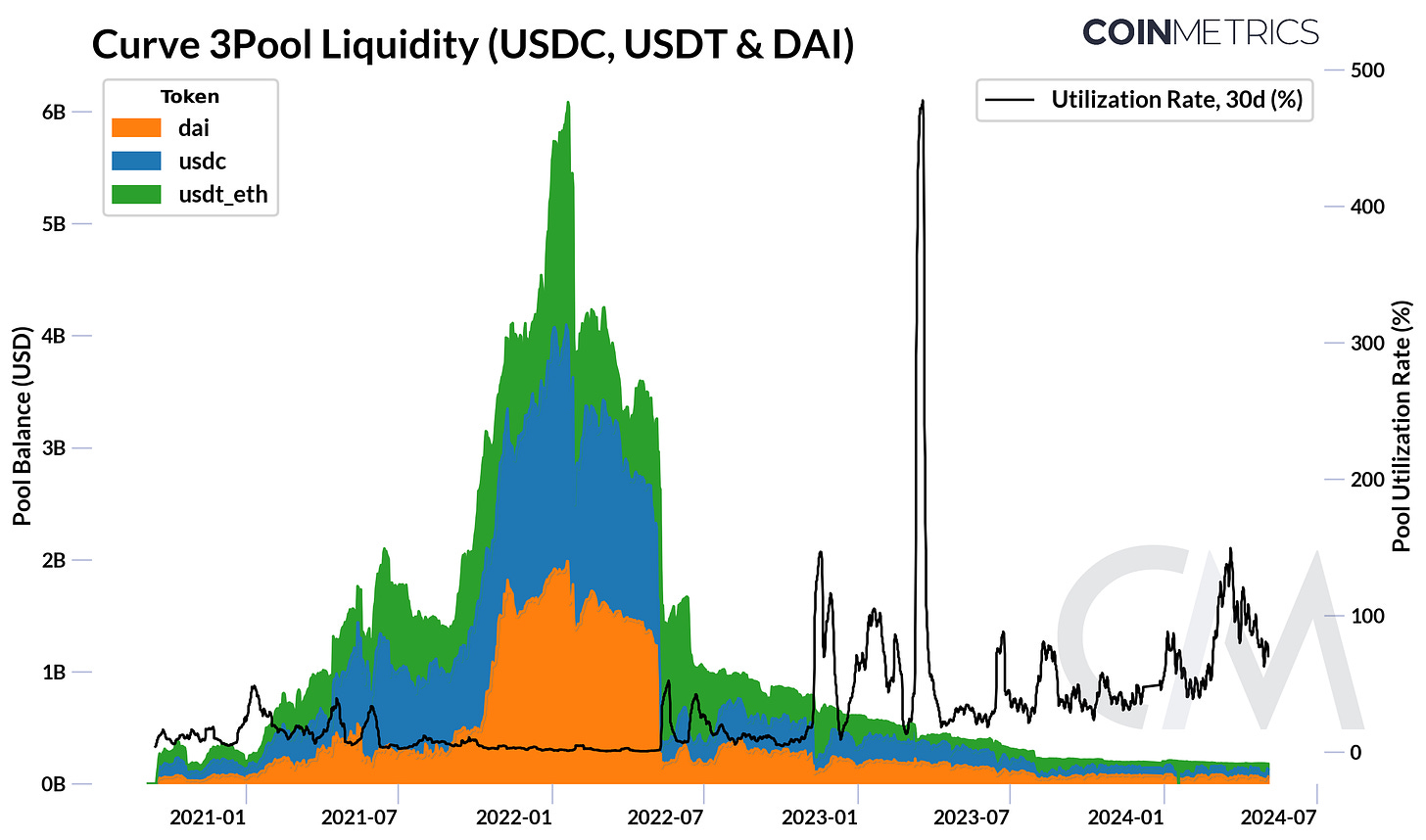

However, liquidity or total value locked (TVL) alone does not tell the whole story. Pool utilization (representing how much deposited liquidity is being actively used/traded) is rising. This metric is available through our DeFi balance sheet endpoint for liquidity pools in money markets like Aave and DEXs like Curve, and can more effectively capture the financial health of these protocols.

Source: Coin Metrics Labs

Due to its focus on pegged assets, stablecoins such as USDC, USDT, and DAI have gained traction on the platform and formed the largest stablecoin pool, known as 3Pool. The decoupling of Terra’s UST and Circle’s USDC led to a loss of investor confidence, causing liquidity to dry up. However, several stablecoins that have recently joined the fray, such as PayPal’s PYUSD, FRAX, and yield products such as MakerDAO’s sDai and Ethena’s USDe, have made progress on the exchange. Curve has also evolved to accommodate volatile assets, with dynamic parameters such as fees and the ability to create multi-asset pools with different volatility characteristics. While volatile assets have not received as much attention as stablecoins, this flexibility has influenced the design of other prominent DEXs such as Balancer.

Impact of protocol and network fees

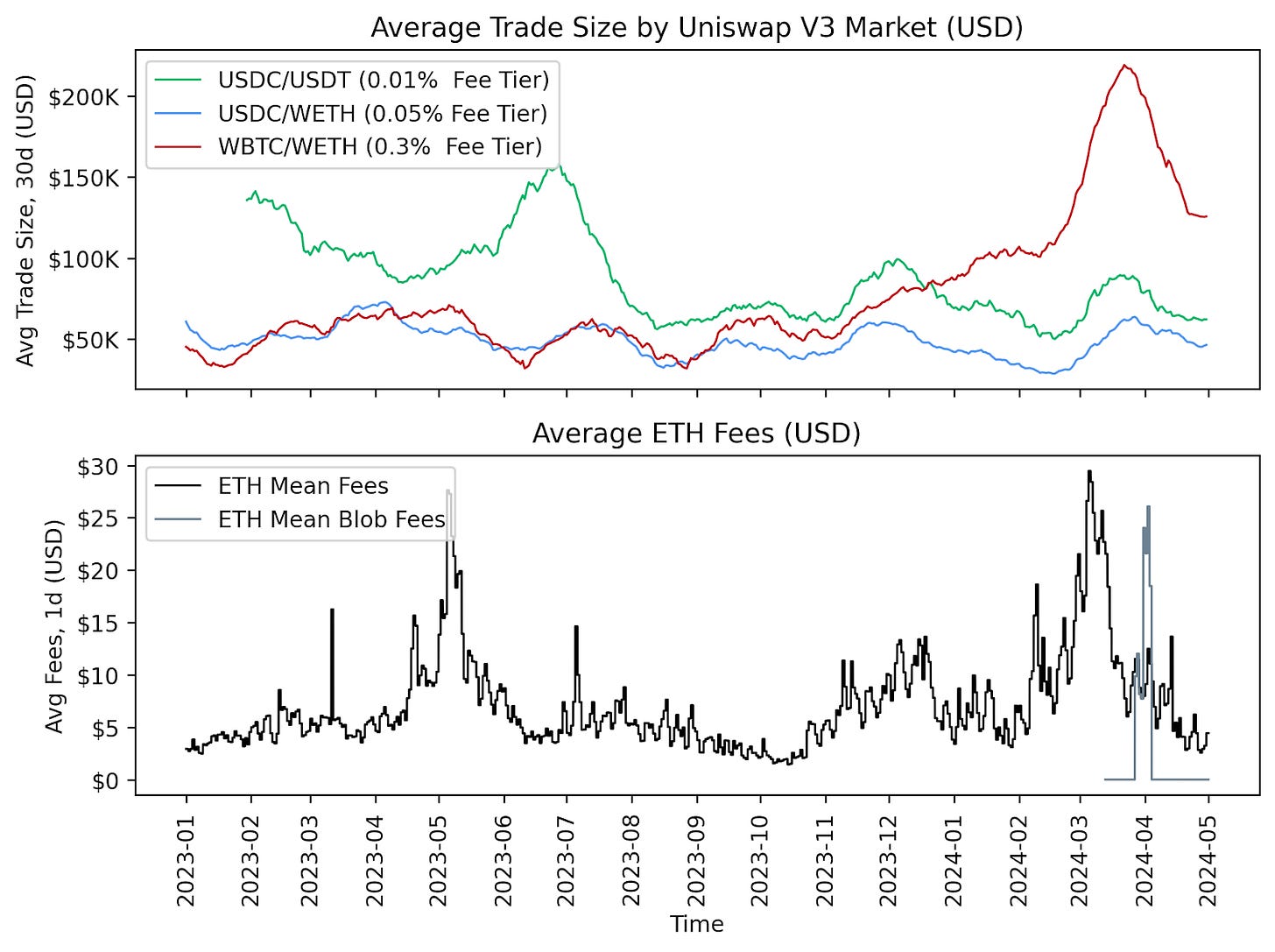

Transaction fees at the protocol level (i.e. Uniswap v3) and at the network level (i.e. Ethereum mainnet or Layer-2) can influence the behavior of traders and liquidity providers on DEXs. In the figure below, we can observe that higher fee tiers (e.g. the 0.3% fee tier for the WBTC/WETH pair on Uniswap v3) tend to have larger average trade sizes than lower fee tiers (e.g. the 0.01% fee tier for USDC/USDT) for the pair. In addition to external market conditions and transaction costs, these fee tiers directly affect the trade-off between risk and reward for swappers and liquidity providers (LPs).

Source: Coin Metrics DEX exchange data and network data

Network transaction fees are an additional expense for DEX users. The high transaction fees on the Ethereum mainnet are more suitable for larger and less frequent transactions, as the fixed costs can be spread over a larger transaction size. On the other hand, the implementation of the Dencun upgrade and the explosion of Layer-2 solutions means that users who prioritize speed and low costs can trade without being priced out, while those who need base layer security can take advantage of Ethereum's L1.

Trends Shaping the DEX Landscape

As a large number of rollups on layer-1 blockchains like Ethereum and Solana lower transaction fees, DEXs are expanding across multiple networks. Uniswap v3 has been deployed on 16 different chains. Some Layer-2s host native DEXs, such as Aerodrome, the largest exchange on the Coinbase Base network, allowing users to traverse the entire ecosystem, while others adopt hybrid AMM or order-book based DEXs, such as Raydium and Hyperliquid, taking advantage of their high throughput and low fees. This diversity caters to users with different risk profiles and preferences in the DeFi space and will continue to develop as Rollups and L1s mature.

Uniswap is also preparing to release its fourth iteration, introducing a "singleton" architecture where all pools are housed in a single smart contract. This will significantly reduce gas costs, as tokens do not need to move between separate pool contracts when making swaps. Uniswap v4 also introduces "hooks" that enable developers to customize pool functionality and execution, extending the flexibility of the protocol to build on-chain limit orders, tools to prevent MEV, or custom logic for tokenized real asset trading (RWA). Overall, the trend shows that DEXs are becoming more prevalent, expanding their influence on the network while meeting the needs of a wider range of traders and liquidity providers.

in conclusion

The development of decentralized exchanges such as Uniswap and Curve Finance highlights significant progress in the DeFi space, especially in improving liquidity management and trading efficiency. These developments not only cater to a wide range of trader preferences and risk profiles, but also indicate a strong future for the decentralized trading environment, where accessibility and efficiency will continue to drive widespread adoption of the crypto ecosystem. As the DeFi ecosystem matures, the regulatory environment around DEXs and their adoption trends will continue to evolve.