Highlights of this issue :

1. Which VC-invested projects have a high probability of airdrops?

2. A new favorite in the AI cloud computing track

01

X Viewpoint

1. Rocky (@Rocky_Bitcoin): Liquidity data doesn’t lie

Global Liquidity Index! Currently, the major central banks in the world are basically in a loose state. Even though the United States is tough on its words, the M2 data has also reached a turning point!

We are rising in a sinusoidal curve, the cycle is mighty, those who follow it will prosper, and those who go against it will perish!

The liquidity index is basically completely positively correlated with the #BTC price, and the peak is likely to be in Q2-Q3 of 25 years!

2. Willy Woo (@woonomic): BTC recovery needs to wait for small miners to exit

I'll break it down in simple terms.

When does #Bitcoin recover? It's when weak miners die and hash rate recovers.

This one is for the record books as it's taking a lot of time for miner capitulation post-halving.

Probably can thank ordinal inscriptions boosting profits.

(Translation: Let me make it clear. When can BTC rebound? It has to wait until small miners withdraw and the hash rate rises again. The current number of Ribbons entanglement days is a record, which requires waiting for miners to surrender after the halving. This is probably caused by the profits brought by the inscription craze.)

3. Dayu (@BTCdayu): MEME will not last, AI sucks blood from the crypto

This article is excerpted from the blogger's article: "Big Problem: Casinos Increase Rapidly, but Gamblers Decrease?!"

(1) The valuations of some projects are not low. Compared with the value targets of US stocks, the valuations of the top value coins BTC and ETH in the crypto are not low.

(2) Ecosystem projects have huge bubbles. Crypto ecosystem projects generally have huge bubbles and huge selling pressure. People are not sober and stop playing with Altcoin, but they are playing with MEME because they are tired of playing with Altcoin. The market value of Altcoin is 10 billion, there are 30 people on the chain, and there is a selling pressure of 500 million every month waiting for you to digest. Where is the value?

(3) MEME is unsustainable. MEME is a consensus and emotion, and PEPE is the most eye-catching representative among them. However, after rising to billions of US dollars, if you want to go up again, the amount of funds required will become larger and larger. Without the massive funds of 21 years and top KOLs like Musk, relying on the community to shout 100 billion to each other - I have seen this too many times in the NFT family group, and every time I get the most cuts from the one who shouts the loudest.

As everyone knows, I love MEME the most, because I am personally most sensitive to emotions, communities, markets and narratives, so I make a lot more money from it than from value coins. But precisely because I understand MEME, I don’t think MEME can carry a round of copycat bulls.

The more speculative the sentiment of MEME is and the more fanatical its participants are, the more devastating the collapse will be. Please believe this; this is the objective law of this world.

(4) AI will continue to suck blood. The AI narrative of the U.S. stock market is attracting big money from all over the world. They are revolutionizing, and all this will continue against the backdrop of low value and high bubbles in the crypto. What if the U.S. stock market collapses? Sorry, the crypto will only collapse even more miserably.

The final sentence summarizes: The approval of ETH ETF will only be a short-term positive. The combined efforts of the above-mentioned parties will most likely force the market to move in the direction of least resistance.

02

On-chain data

Embers: A whale once again increased its holdings by 2,510 BTC

After a whale/institution increased its holdings of 6,570 BTC yesterday, another whale/institution withdrew 2,510 BTC ($163M) from Bitfinex through 3 addresses 6 hours ago at a price of 65,039.

3ADUencNf9zzxMvz7QmJtgU5EsBXg1ScEZ withdrew 1,000 BTC;

3BTSgrNF7MhZEqCWYYK8mSp9YMTz1ZkgRX address withdrew 860 BTC;

3PBRjqe3mdACy2vBzn6o7M1SgWWrh1H7Gr address withdrew 650 BTC.

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are: ZRO, ZK, TRUMP, MAGA, and LISTA. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are: Soccer, Marketing, Moon Knight Labs, e-Commerce, and Discord Bots.

Focus: Ups and downs, a new favorite in the AI cloud computing track

As the AI track is developing rapidly, the AI solution AO (Actor Oriented) proposed by Arweave, a veteran decentralized storage solution, was once very popular in the market. However, after the announcement of AO token economics, AR tokens began to fall sharply, from a high of around $49.5 to a low of $22.6, a drop of 54.3%. AO tokens can still be minted by AR token holders, so why did they plummet?

Overall, although holding AR can also obtain AO tokens, its attractiveness has actually decreased significantly. For example, the cost-effectiveness of holding stETH is high enough. The assets of stETH are more stable than AR. stETH itself can also earn Ethereum staking income. Now holding it can also mint AO, which is much more cost-effective than holding AR. This is also the reason why the hype funds have receded. In addition, the AI track has recently added new favorites, and the attractiveness of AO seems to have decreased a lot.

Recently, the decentralized cloud computing platform Aethir has gained market attention, adding some new atmosphere to AI projects in the crypto market. Aethir essentially integrates idle GPU resources and then aggregates them into a powerful computing resource sharing pool for use by AI high computing demand parties. From an economic structure point of view, Aethir Network is a decentralized economy composed of miners, developers, users, token holders and Aethir DAO. The three key roles to ensure the successful operation of the network are containers, indexers and inspectors.

Although io.net and Aethir look similar, they are also different. Ebunker co-founder 0xTodd said that AI companies do not want to buy a large number of graphics cards themselves, so a decentralized facility is very important, which is also the market demand discovered by the two projects IO and Aethir. In terms of building an ecosystem, the ideas of IO and Aethir are somewhat different. In the early days, IO accumulated a batch of user graphics cards through token subsidies. At its peak, there were hundreds of thousands of graphics cards hanging on IO. Later, IO reached a cooperation with AI companies. Aethir previously sold a virtual mining machine called CheckerNode, and later sold Edge mining machines. This method is very effective in maintaining the basic base of the community. In addition, IO is a SOL ecosystem, while Aethir is mainly in Ethereum and Arbitrum. So from an ecological perspective, the two projects vaguely have a kind of independent governance and divided spheres of influence, but the two projects themselves have cooperated and exchanged tokens.

In addition to the above projects, Bittensor (TAO) is also a project that has been receiving much attention in the market. Bittensor (TAO) is committed to building the world's first blockchain neural network so that network participants can exchange machine learning capabilities and predictions. Dynamic TAO is one of Bittensor's most anticipated proposals, which will introduce crypto incentives in subnets, second only to the launch of subnets last year. Dynamic TAO is currently under testing and is expected to be fully launched soon.

The decentralized infrastructure RNDR is also worth paying attention to. At this year's WWDC conference, Apple released Apple Intelligence, its new AI feature suite for all devices. Among them, OctaneX, a 3D design software supported by Render Network, was demonstrated on the latest iPad Pro. When more users use OctaneX, it means an increase in demand for Render services, which is expected to increase the value of RNDR tokens.

04

Macro Analysis

@10X Research: Three major groups sell off Bitcoin, and hedge fund arbitrage opportunities may have disappeared

While the current market structure is not entirely bullish, we speculated three weeks ago that Bitcoin would attempt a breakout near $70,000 based on the view that new all-time highs usually go parabolic, and when the breakout fails, risk management becomes critical. At the time, we expected lower inflation data to be a catalyst for Bitcoin's price to rise, which it did, but Bitcoin was sold off heavily.

First, contrary to the previous aggressive buying of Bitcoin ETFs driven by inflation changes, Bitcoin ETFs have sold $1 billion in assets in the past eight trading days.

Second, over-the-counter sales by Bitcoin miners grew to their largest daily volume since March, with over 3,200 Bitcoins sold in one day. Publicly traded mining companies account for 3% of the market, but sold a net 8,000 Bitcoins in May (June data is not yet available, but miners' sales have increased significantly). Miners' Bitcoin reserves have fallen from $129 billion on June 5 to $118 billion now.

Finally, another group of sellers were early Bitcoin holders, who sold $1.2 billion.

All three appear to be content to sell Bitcoin above $70,000.

We estimate the average entry price of Bitcoin ETFs to be $60,000 to $61,000, and a return to this level could lead to a wave of liquidations. When Bitcoin fell to $56,500 on May 2, BlackRock issued a statement saying that "sovereign wealth funds and pension funds are about to enter the market." This prevented Bitcoin from falling further to a certain extent, but now BlackRock says that 80% of the purchases of their Bitcoin ETF IBIT come from retail investors rather than institutions.

Currently, the $61,000 price level is consistent with the 21-week moving average, which in previous cycles has been a good risk management indicator when buying (Bitcoin price above the 21-week moving average) or selling. We estimate that 30% of the $14.5 billion in Bitcoin ETFs comes from hedge funds seeking arbitrage, and eight trading days of ETF liquidations indicate that these funds may not be extending arbitrage trades (long ETFs against short CME futures) as the futures expiration date (June 28) approaches, as the arbitrage opportunity has disappeared.

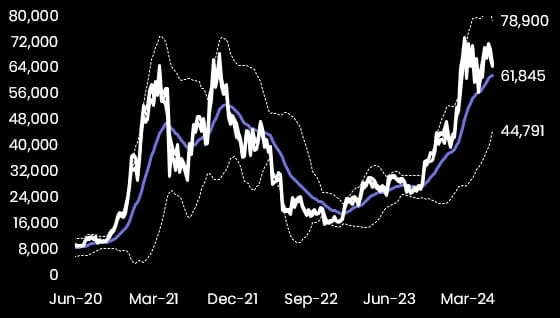

Bitcoin (white) compared to its 21-week moving average (purple)

Arbitrage opportunities exist because high rates allow exchanges to sell futures at a premium, and most crypto traders tend to be bullish (buyers), which drives up funding costs. The average annual funding rate for Bitcoin in 2024 is 16%, and it has only been 8-9% in the past few days. So, these single-digit funding rates may not be able to continue to sustain the arbitrage game, resulting in continued outflows from Bitcoin ETFs. This is the other side of the arbitrage signaling effect we explained in articles such as March 8 (the first cautious statement since Bitcoin reached $40,000) and April 5.

Our market structure analysis breaks down liquidity components, so it sometimes provides a cautious view contrary to the underlying bullish (parabolic) narrative. In fact, despite a significant slowdown in Bitcoin ETF inflows since March 12 (when CPI data rose rapidly), a sharp drop in Altcoin trading volume and a corresponding drop in funding rates, Bitcoin prices have remained in a wide 15% range over the past three months.

Since April 21 (the Bitcoin halving), stablecoin minting has slowed significantly. These factors (Bitcoin ETF inflows and stablecoin minting pauses, Altcoin and funding rate declines) have led us to worry about a Bitcoin price drop to $52,000-55,000, which is only about 3% away from the actual market performance (Bitcoin price fell to as low as $56,500).

On May 15, after the release of lower CPI data, Bitcoin ETFs saw inflows of $3.8 billion over the next 20 days. If growth continues, we expect lower CPI data to drive a market rebound and expect CPI data to be below 3.0% later this year. In July 2019, the Federal Reserve cut interest rates due to lower inflation and weak economic growth, and Bitcoin fell as much as 30% at the time, so the reason for the rate cut is important.

However, this time, Bitcoin ETF purchases failed to grow as the attractiveness of arbitrage (funding rate) weakened. When the US Securities and Exchange Commission (SEC) hinted on May 20 that an Ethereum ETF might be approved, the market structure improved significantly as futures positions increased. In about three weeks, the market bought $4.4 billion in Ethereum futures positions (a 50% increase) and $3 billion in Bitcoin futures. Combined with the CPI data on May 15, this effectively improved the market structure and helped the Bitcoin price to rise back to $70,000, and early holders, miners, and ETFs actively chose to sell their Bitcoin positions.

05

Research Reports

Defizard: Which VC-invested projects have the highest probability of airdrops?

What do L0, zkSync, and Starknet have in common?

The same money invested in them. If these VCs invested in the project – then the project is guaranteed to have an airdrop.

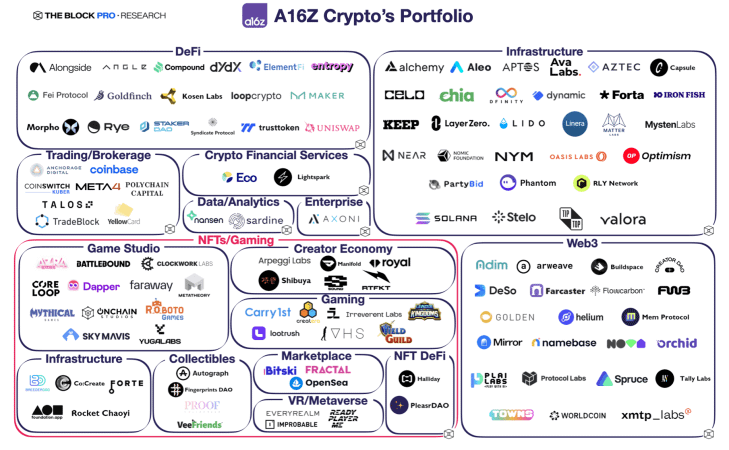

a16z (@a16zcrypto)

Number of investments: 169.

Projects with airdrops: 15.

Farcaster, EigenLayer, Worldcoin, LayerZero, zkSync, Uniswap, Sui, Aptos, Optimism, Goldfinch, Ape, dYdX, Forta, Gitcoin.

Airdrop ratio: 8.87%.

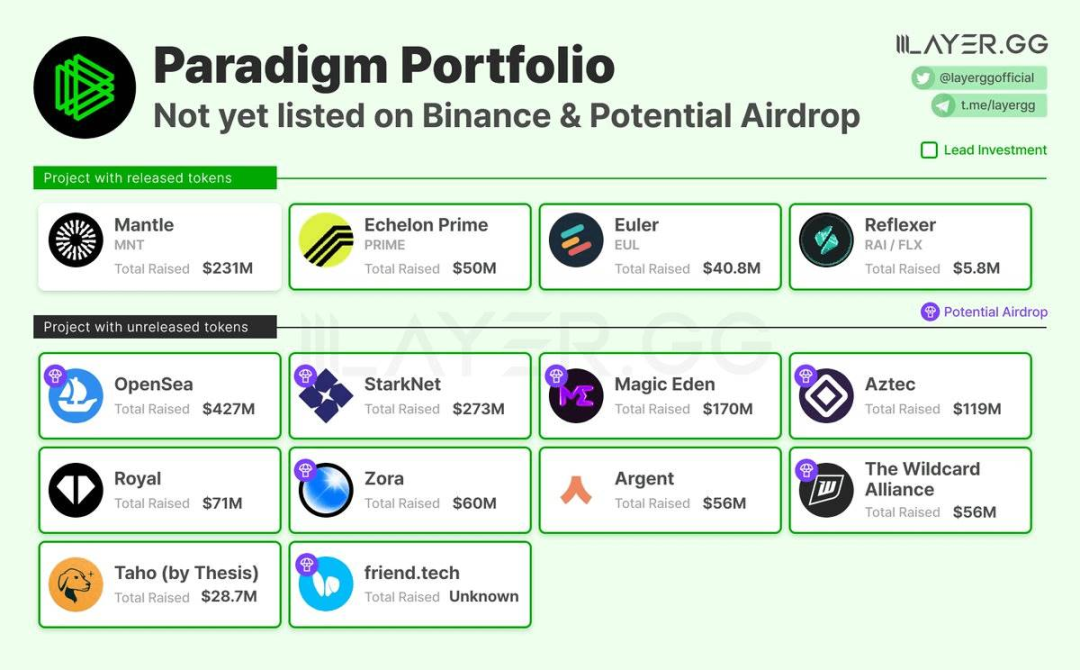

Paradigm (@paradigm)

Number of investments: 92.

Projects with airdrops: 10.

Uniswap, Farcaster, Friend Tech, Optimism, dYdX, Osmosis, Blur, Ribbon Finance, Gitcoin, Starknet.

Airdrop ratio: 10.86%.

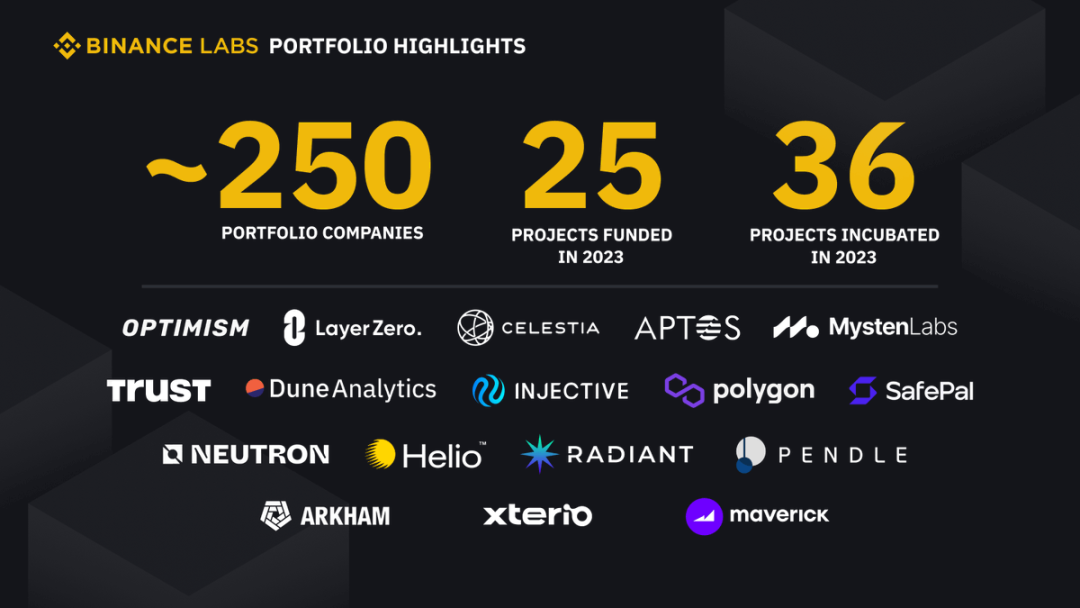

Binance Labs (@BinanceLabs)

Number of investments: 216.

Projects with airdrops: 19.

Aptos, 1inch, Biconomy, Axelar, Space ID, Maverick, Galxe, Mint Club, Aevo, Bounce Bit, Renzo Protocol, Ethena, Arkham, Polyhedra, Sui, Hooked Protocol, Magic Square, Fusionist, Celestia.

Airdrop ratio: 8.79%.

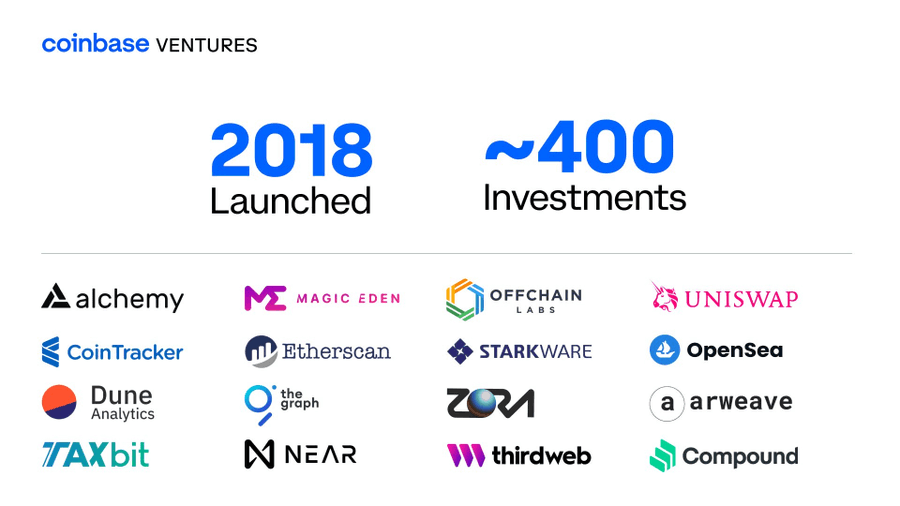

Coinbase Ventures (@coinbase)

Number of investments: 394.

Projects with airdrops: 25.

Uniswap, Aptos, Arbitrum, Optimism, TheGraph, IMX, Sei, Ribbon, Worldcoin, Biconomy, Hashflow, Arkham, Maverick, Galxe, Evmos, Goldfinch, Forta, Umee, Connext, Hop, Axelar, Wormhole, Maverick, Arkham, EigenLayer.

Airdrop ratio: 6.34%

DragonFly Capital (@dragonfly_xyz)

Number of investments: 149.

Projects with airdrops: 25.

Aptos, dYdX, 1inch, Ribbon Finance, Axelar, Hashflow, Galxe, Avail, Ethena, zkSync, Parcl.

Airdrop rate: 7.38%.

HashKey Capital (@HashKey_Capital)

Number of investments: 236.

Projects with airdrops: 8.

dYdX, 1inch, Galxe, Evmos, Avail, Polyhedra, Beoble, Aethir.

Airdrop ratio: 3.38%.

When I started this tweet, I thought statistics would be better. I took all the data from @CryptoRank_io and used the “Number of Investments” category as the overall metric, which is the total number of investments.

Every VC firm mentioned in this thread has invested in a project that I’m sure will do an airdrop, like Monad, Babylon, or Symbiotic.

But we can’t guarantee that if some of these VCs have invested in the project you are promoting, they will do an airdrop.

You should check the token economics, development stage, whitepaper, team, VCs, rumors, etc. to understand if there is an opportunity for an airdrop.

It's not hard, you just need some basic knowledge and some luck.