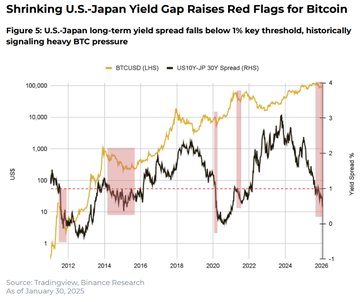

Yield Shifts and Pressure on the USD - The Relationship with Bitcoin - The yield on 10-year US Treasury bonds is approaching 4.19%. Meanwhile, Japanese Treasury bond yields (JGBs) are beginning to cool down after reaching historical highs. This tug-of-war reflects the conflict between extreme policy measures and the need for foreign Capital . - The DXY index no longer holds its dominant position. After falling 9.2% in 2025, it continued to lose another 3.1% in the first month of 2026. Conversely, currencies like the Euro and Japanese Yen are recording strong recovery momentum thanks to the Fed's caution and uncertainties from US trade policy (tariffs). - As the yield spread narrows, the profit from borrowing yen to invest in USD assets disappears. This forces investors to unwind, withdrawing liquidation from risky global assets. - Historical data from 2011, 2014, and 2021 shows that whenever this yield spread narrows and breaks through the 1.0% threshold, the price of Bitcoin $BTC usually faces significant downward pressure. Currently, short positions in the Yen remain significantly lower than their 2024 peak. This implies that there isn't much "dry wood" left to create a liquidation crisis (Yen Panic) like the one in the summer of 2024. => Although BTC is facing resistance from narrowing spreads, the current market structure is more mature than in previous cycles. Downward pressure is real, but its intensity is likely to be mitigated by institutional Capital flows and a shift in confidence as the USD weakens.

This article is machine translated

Show original

Steven | Crypto Research

@Steven_Research

12-19

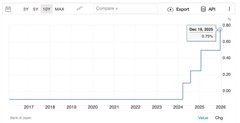

Vậy là BOJ đã tăng 0,25% như các tổ chức lớn dự báo trước đó

Trong suốt hơn 30 năm qua, kinh tế Nhật sống trong môi trường tiền rẻ và giảm phát. BOJ hiểu rất rõ rằng chỉ cần tăng lãi suất quá nhanh, cú sốc sẽ không nằm ở thị trường tài chính, mà nằm ở x.com/Steven_Researc…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share