Those trading futures should carefully review the platform's rules, as these are rarely disclosed beforehand. For example, the "early liquidation system" is something I've never heard of before… What are the details? Under what circumstances is early liquidation implemented? This is crucial. Is the liquidation price calculated based on the market price plus or minus 1%? I don't understand this either, because in 2018, one of my liquidation orders was lower than the lowest market price in the hours before and after the liquidation time 😹… What constitutes abnormal trading? What are the criteria for determining this? Why is a user's account frozen if they don't cooperate with reducing their position? Then, if Bitcoin continues to fall and liquidation occurs, if the account isn't frozen, is there a chance for the user to stop their losses instead of suffering a complete wipeout? Are there other better ways to handle this? For example, if it's not early liquidation, could the account have been stopped out earlier instead of being frozen? The above are just some questions regarding the announcement…

This article is machine translated

Show original

OKX冻结517BTC

@OKX517BTC

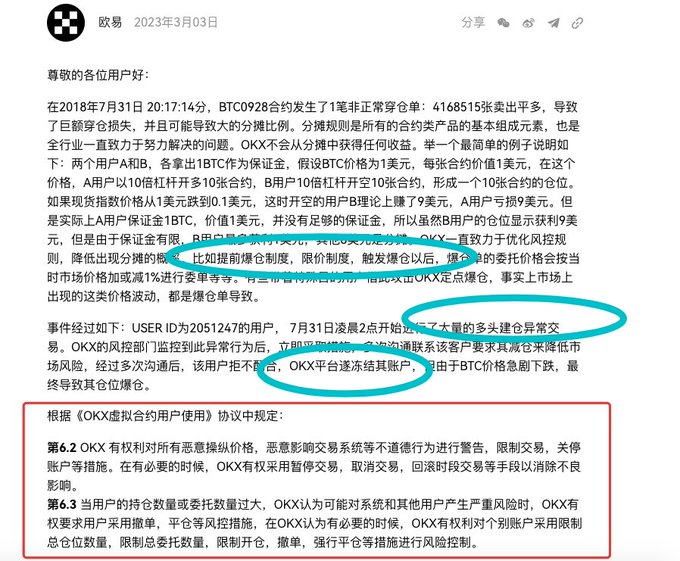

OKex就此次事件发过单方面公告(链接和公告截图)本人对此有几点不同意见。

1. 公告没有提到不予归还我币币钱包和法币钱包内的517.86个比特币,无理由扣下如此数额的比特币理应告知公众,让公众可以知情和判断,不告知是否是心虚的表现

而且公告所示的6.2 6.3条例也没有相关可以克扣客户资产的文字

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share